Uniswap’s $38B milestone – Here’s what that means for UNI’s price action

- UNI confirmed sturdy on-chain indicators with important development in giant transactions and community exercise

- UNI, at press time, was testing its key resistance at $13, with potential for additional positive factors if breakout happens

Uniswap [UNI] has been gaining important momentum these days, fueled by an enormous $38 billion in month-to-month quantity throughout Ethereum Layer-2 networks like Base, Arbitrum, Polygon, and Optimism. This surge in exercise has translated into sturdy bullish sentiment, with UNI buying and selling at $12.95 at press time – Up 2.16% within the final 24 hours.

As liquidity and utilization proceed to rise, UNI finds itself at a essential juncture. Can it keep this momentum and push previous key resistance ranges, or will it face a pullback within the close to future?

Are the on-chain indicators signaling extra bullish motion?

Uniswap’s on-chain knowledge revealed a variety of bullish indicators. Internet community development noticed a average hike of 0.34%, suggesting that extra customers are adopting the platform. Equally, into the cash transactions rose by 1.56%, implying that extra traders are actually in worthwhile positions.

Moreover, focus grew by 0.04%, indicating a shift in the direction of greater confidence amongst holders.

Essentially the most noteworthy metric, nevertheless, appeared to be the spike in giant transactions, which surged by 6.92%. This leap highlighted the rising involvement of institutional traders and enormous merchants – An indication that large gamers are positioning themselves for potential upside in UNI’s worth.

Supply: IntoTheBlock

What does UNI’s worth motion say concerning the future?

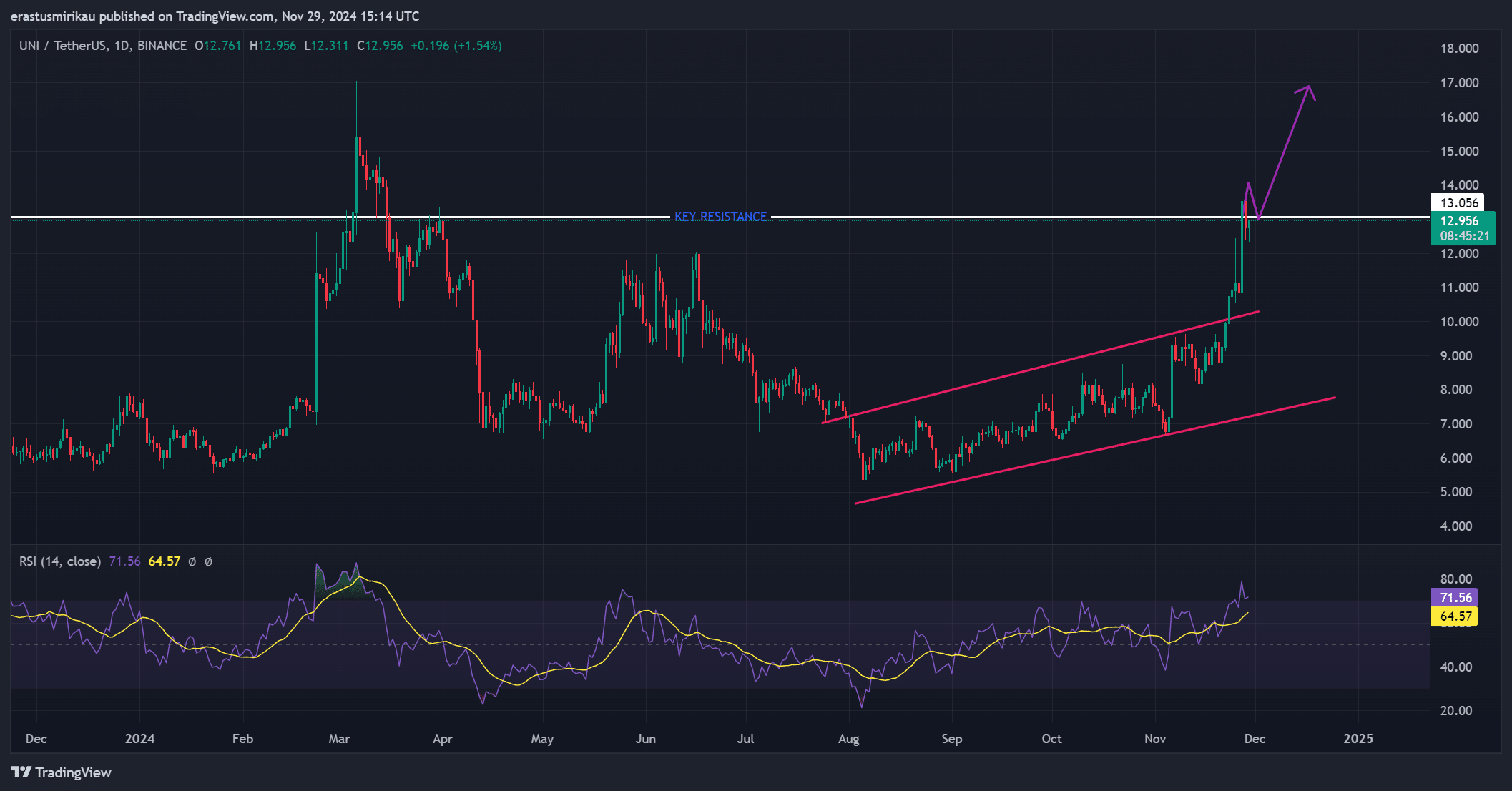

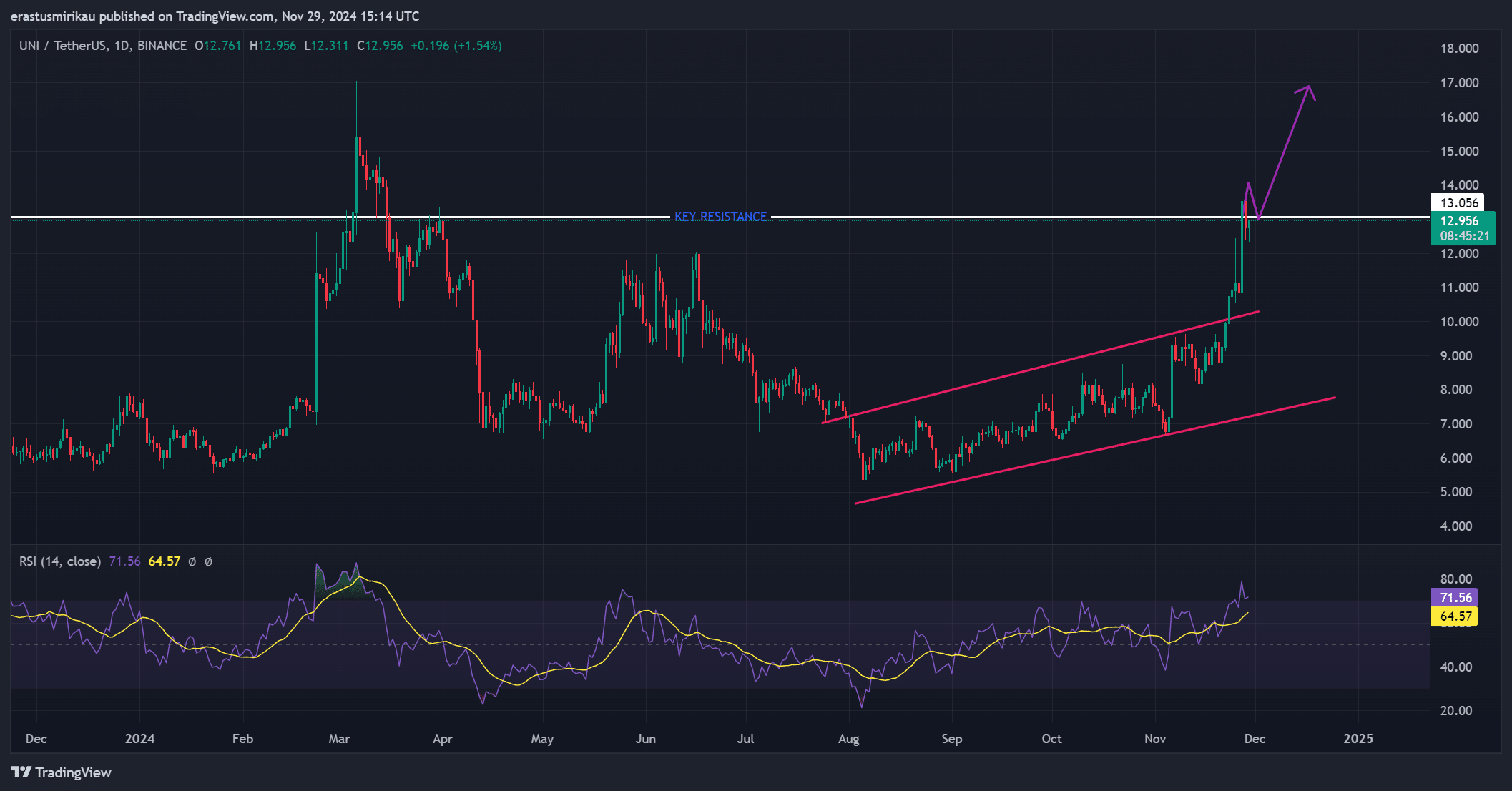

Testing the $13 resistance degree at press time, Uniswap’s worth motion was at a pivotal level. A breakout above this degree might propel UNI to as excessive as $17, the place the subsequent resistance appeared to be.

Nevertheless, RSI had a studying of 71.56, which urged that UNI was nearing overbought situations.

Consequently, whereas the bullish development stays intact, traders must be cautious of potential pullbacks or consolidation earlier than any breakout.

Supply: TradingView

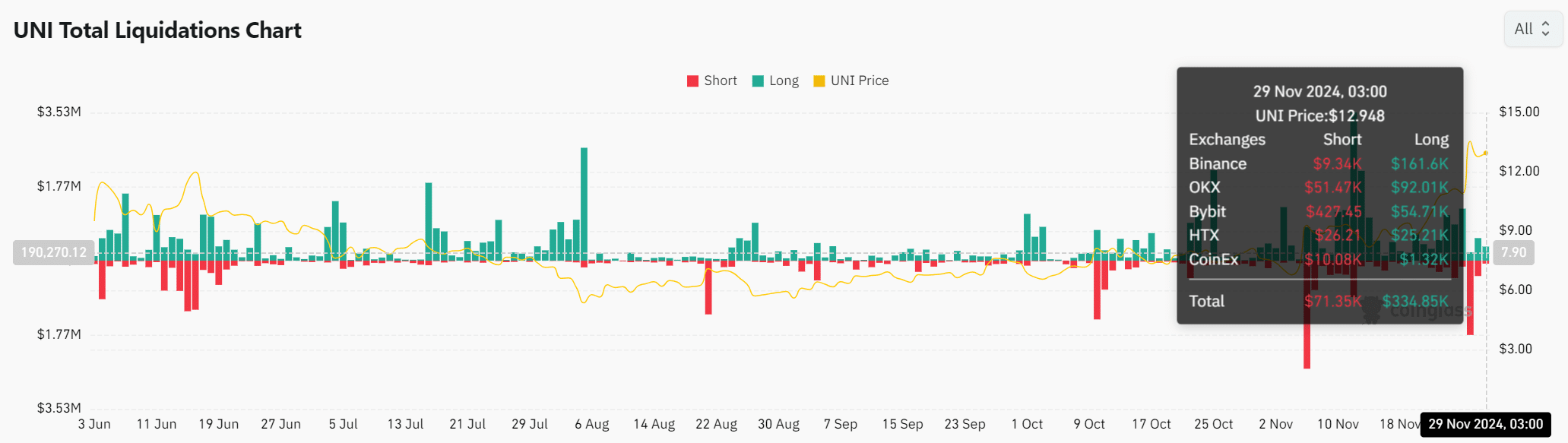

Trade reserves and liquidations – Blended indicators forward?

Trade Reserves noticed a modest hike of 0.12% within the final 24 hours, bringing the full to 68 million UNI tokens. This uptick urged that traders could also be holding onto their tokens or making ready to promote, relying on their outlook for the market.

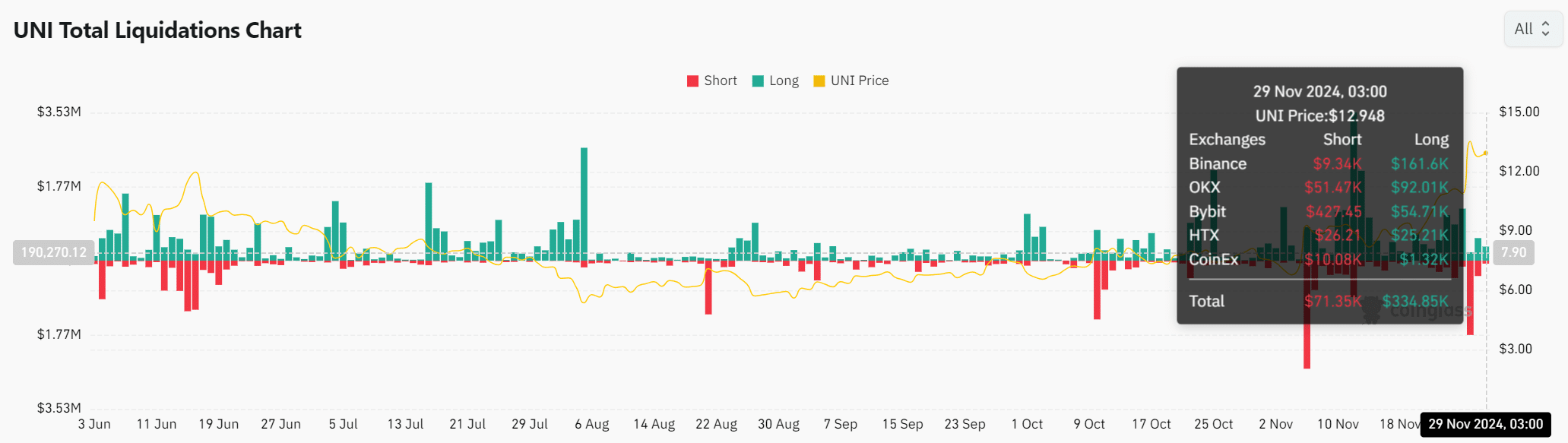

In the meantime, the full liquidations revealed the next focus of lengthy positions – $71.35k in brief positions and $334.85k in lengthy positions. This disparity indicated that almost all of merchants are betting on sustained bullish momentum.

Nevertheless, it additionally leaves UNI weak to brief squeezes if the market strikes in opposition to the lengthy crowd.

Supply: Coinglass

Reasonable or not, right here’s UNI’s market cap in BTC’s phrases

Will UNI proceed its upward development?

Uniswap’s current worth hike, mixed with sturdy on-chain indicators and an hike in giant transactions, pointed to a bullish outlook for the token. Nevertheless, with the RSI approaching overbought territory and the change reserves displaying blended indicators, merchants ought to proceed with warning.

A breakout above $13 may lead UNI greater, however the danger of a pullback stays current. Due to this fact, if UNI can keep its press time momentum and break by way of resistance, additional positive factors could also be seemingly.