US Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling

A fierce winter storm that swept a lot of the US over the weekend compelled massive elements of the Bitcoin mining fleet to chop energy, leaving the community a lot weaker for a short while.

Associated Studying

Reports say energy outages and excessive climate pushed some operators to pause or gradual their rigs so native grids might breathe. The end result was a dramatic, although short-term, fall within the whole mining energy securing the blockchain.

Miners Alter Energy Use

In accordance with mining operators on the bottom, the pause was intentional. Many farms turned down machines to scale back pressure on regional utilities when demand spiked and technology dropped.

Plentiful Mines, a crypto mining agency headquartered in Oregon, stated roughly 40% of worldwide mining capability went offline in a 24-hour window. That form of fast scaling again is feasible as a result of miners can shut down and restart {hardware} quickly, which in some areas acts like a giant, versatile electrical load that may be trimmed when wanted.

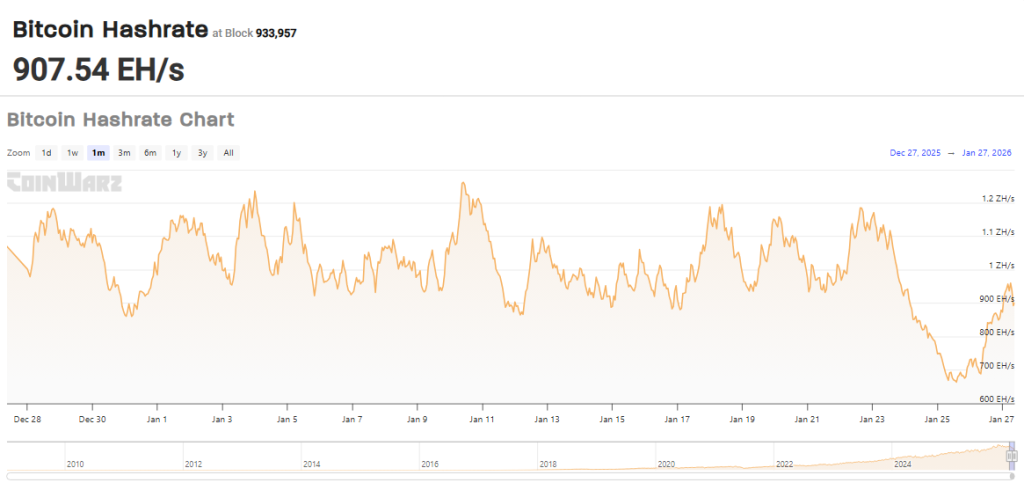

Bitcoin Hashrate Simply Dropped Under 700 EH/s

The seemingly trigger: the winter storm impacting Texas & the southeast, the place a big share of US mining occurs. Energy outages and voluntary grid-stabilization measures have taken miners offline.

What this implies:

– Fewer miners on-line… pic.twitter.com/j0lv7bU9JN— Plentiful Mines (@AbundantMines) January 25, 2026

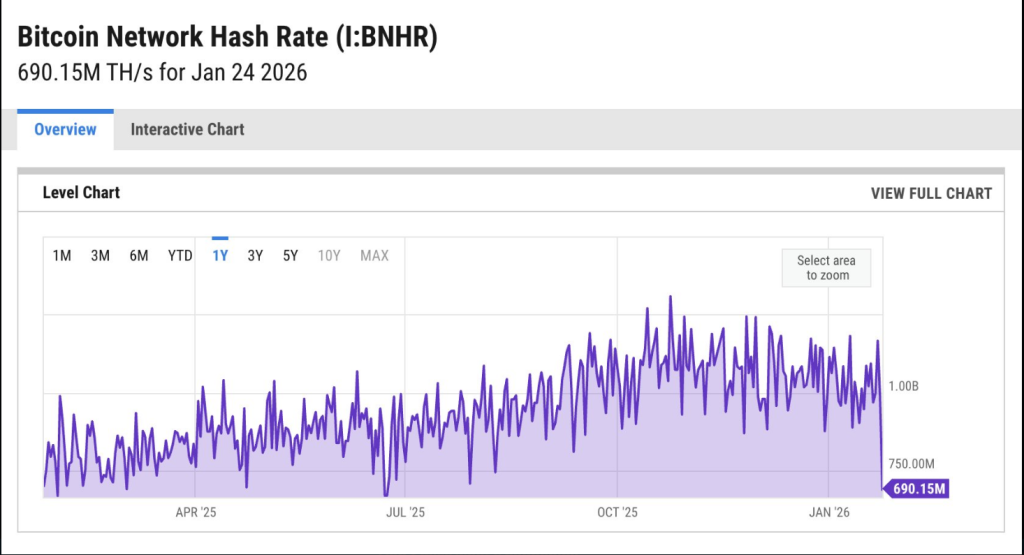

Hashrate Drop And Fast Restoration

Based mostly on experiences from mining trackers, community hashrate fell sharply beginning Friday and hit a low not seen in seven months by Sunday, dropping to about 663 EH/s. Inside a day or so, as crews labored and climate methods moved on, the determine climbed again towards 854 EH/s.

Hashrate Index estimates the US provides practically 38% of worldwide mining energy, so disruptions within the nation present up quick in world totals.

A federal Power Data Administration report famous there are greater than 130 devoted crypto mining websites throughout the US, which means storms that have an effect on broad areas can hit mining provide in a giant approach.

Bitcoin Value Motion

Value moved with the headlines however not in a straight line. Based mostly on experiences, Bitcoin traded round $88,300 by means of the volatility, with swings linked to each climate and wider geopolitical strains.

BTCUSD now buying and selling at 87,866. Chart: TradingView

The market had earlier seen lifts up close to $96,000 throughout episodes of geopolitical pressure, whereas different stretches introduced softer costs as macro dangers grew.

Merchants watched fastidiously; the short-term hashrate dip raised questions on short-term miner income, but it didn’t set off a significant crash in market worth.

Because the winter storm hits the US, Bitcoin mining corporations curtail operations to assist the ability grid.

Their day by day Bitcoin manufacturing was hit considerably in the previous couple of days.

CLSK: 22 bitcoin –> 12 Bitcoin

RIOT: 16 –> 3

MARA: 45 –> 7 (extra risky because it mines “solo”)… pic.twitter.com/SzgcbtgQ5V— Julio Moreno (@jjcmoreno) January 26, 2026

Huge Miners Felt The Influence

Analytics companies famous output from some huge US miners fell sharply. Marathon Digital’s day by day manufacturing was down from 45 cash to seven in in the future, and IREN moved from 18 to 6, information compiled by market trackers confirmed.

Associated Studying

CryptoQuant flagged slower day by day digs from a number of main operators because the storm hit. In Texas, experiences say miners labored with grid managers to assist stability provide and demand, utilizing their machines to absorb additional energy when out there and to step again when the grid was underneath pressure.

Featured picture from Pexels, chart from TradingView