USDC Market Cap Drops As Redemptions Climb To $1.4 Billion

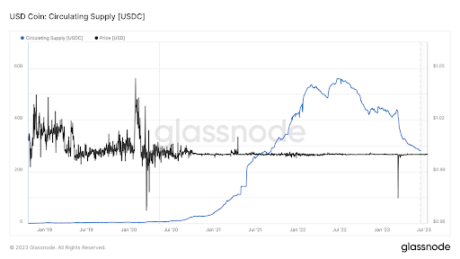

As one of many largest stablecoins, USDC is among the main gamers within the crypto business. Nevertheless, the stablecoins have seen higher days, because the stablecoin has seen its market cap drop drastically over the previous few months.

The second-largest stablecoin has seen its market cap drop by over $1.4 billion in simply the previous few days due to a surge in redemptions.

$1.4 Billion Redeemed In One Week

The stablecoin market was rocked this week by a large redemption of USDC. In accordance with Circle and knowledge obtained from Coinmarketcap, the availability of USDC decreased by $1.4 billion in simply seven days as Circle’s fee of token burning outnumbered the speed of recent token creations. This led to a market cap drop from $27.4 billion to $26.9 billion in a 7-day timeframe.

This comes as the general provide of USDC has been on a steep decline because the starting of the 12 months, plummeting from $45 billion to its current stage of $26 billion. The worst drop in USDC’s market cap this 12 months got here throughout the top of Silicon Valley Financial institution’s shutdown.

USDC market cap plunges | Supply: Glassnode

In accordance with Nansen, Circle burned $1.6 billion in USDC in a single day. Throughout this era, Circle’s market cap fell by greater than $10 billion. This got here as buyers rushed to redeem USDC as a consequence of Circle having money reserves within the failed financial institution.

What Does This Imply For USDC?

The push to redeem USDC over the course of the previous 12 months has prompted doubts concerning the reserves underpinning the stablecoin. However the stablecoin market seems to be doing simply superb when it comes to sustaining its peg to the US greenback. Circle additionally maintains that the USDC cryptocurrency is backed 1:1 by money and different financial equivalents.

USDC market cap sitting at $27.25 billion | Supply: Market Cap USDC on Tradingview.com

In March of this 12 months, Circle switched to short-term maturity bonds. Because of this the USDC reserve is now held 80% in short-dated US treasuries and 20% in money deposits throughout the US banking system. Given this, there are worries amongst buyers as redemptions at this scale may pressure the reserves in the event that they’re invested in much less liquid belongings. This may clarify the excessive quantity of redemptions over this time.

The cryptocurrency market is understood for its volatility, however stablecoins have develop into one of many backbones of the business as a consequence of their skill to supply extra stability. Total, a lot of the stablecoin market stays break up between USDT and USDC, making up greater than 83% of the whole stablecoin market cap.

For now, USDT has the upper momentum. Whereas USDC’s market cap has slipped all year long, knowledge exhibits USDT has added over $15 billion to its market cap.

Featured picture from Cryptonomist, chart from Tradingview.com