USDT supply hits $190B: Investors fleeing to Bitcoin or hoarding for safety?

- USDT typically presents conflicting demand and provide alerts, making it essential to maintain a detailed eye on.

- With the market within the crimson, stablecoins may be changing into an more and more engaging various.

If Bitcoin [BTC] is digital gold, Tether [USDT] is the digital greenback, firmly holding its $1 peg.

As soon as a distinct segment asset, USDT has seen an enormous surge in demand, changing into the go-to device for seamless transactions – whether or not for on a regular basis purchases or big cross-border transfers.

This surge is obvious, with the worldwide stablecoin provide hitting a file $190 billion, including over $60 billion for the reason that begin of 2024.

Nevertheless, within the crypto world, the demand/provide dynamic takes on a complete new that means.

Exploring the 2 sides of the coin

USDT, probably the most broadly used stablecoin within the crypto market, has lengthy acted as a security internet throughout occasions of shaky market sentiment. Proper now, we’re seeing that development once more.

December kicked off sturdy, with Bitcoin not solely surpassing $100K but additionally hitting a brand new all-time excessive of $104K throughout the first 5 days. Because of this, USDT dominance slipped to a 6-month low of three.80%.

Nevertheless, with Bitcoin’s subsequent market prime nonetheless unsure, volatility is ramping up. If this development holds, extra traders might flock to the steadiness of USDT, particularly with a bearish MACD crossover additional supporting this shift.

Moreover, from an financial standpoint, provide will increase to fulfill rising demand.

With the stablecoin supply reaching $190 billion – $60 billion of which got here this 12 months – it’s clear that demand for USDT is rising quickly, significantly among the many huge gamers.

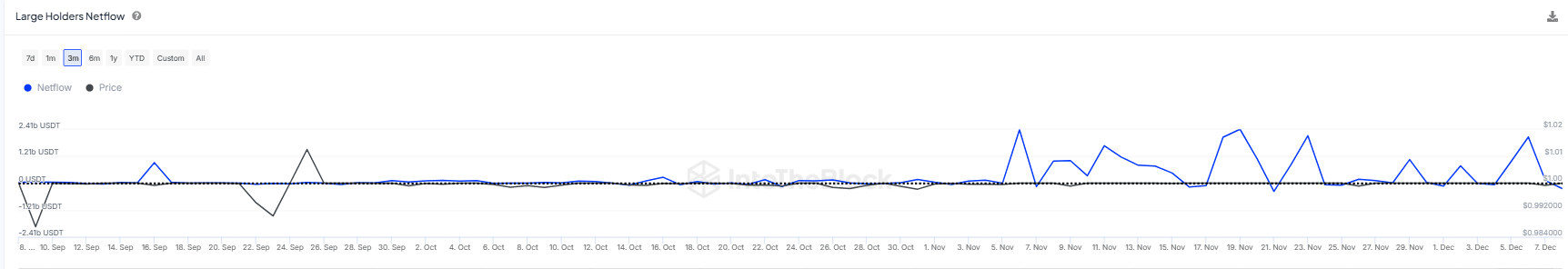

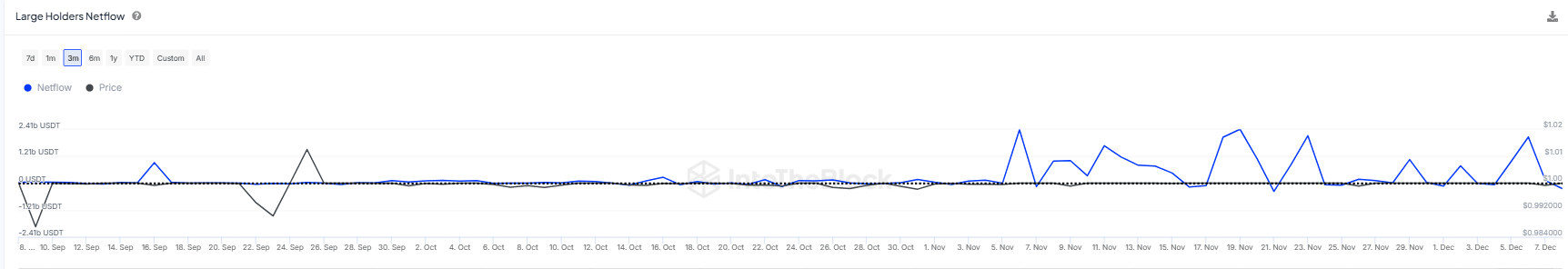

Supply : IntoTheBlock

In November alone, whales ramped up their USDT accumulation, scooping up over $2 billion throughout 4 separate time durations, additional solidifying the stablecoin’s rising position as a hedge towards higher-risk belongings.

Nevertheless, this will likely solely signify one aspect of the coin. Rising USDT demand doesn’t essentially spell doom for the market. In truth, it might imply the other.

Identical to after the election outcomes, when huge whales snatched up over $2.5 billion in USDT, positioning themselves to swap for Bitcoin, this development might be the precursor to a significant rally.

So, does excessive USDT demand sign correction or rally?

Clearly, two dynamics are at play. Both market contributors are unloading USDT in anticipation of an enormous bull run, driving its provide to new highs, or concern of a correction is sparking a rush to hoard USDT as a secure haven.

Wanting on the chart above, whales have considerably diminished their USDT holdings prior to now two days—from over $2 billion to a -$240 million place—exhibiting sturdy conviction in upcoming positive aspects.

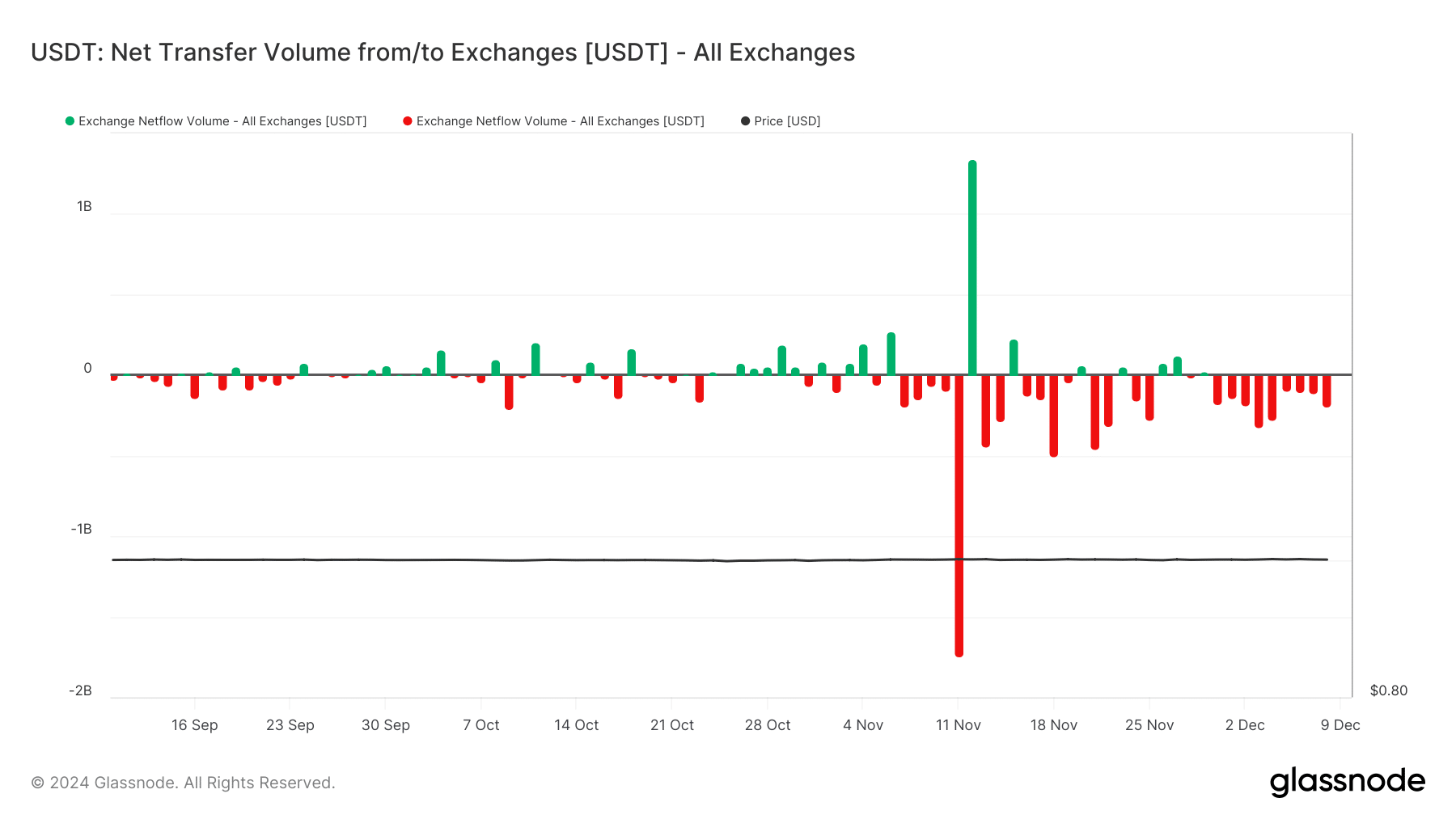

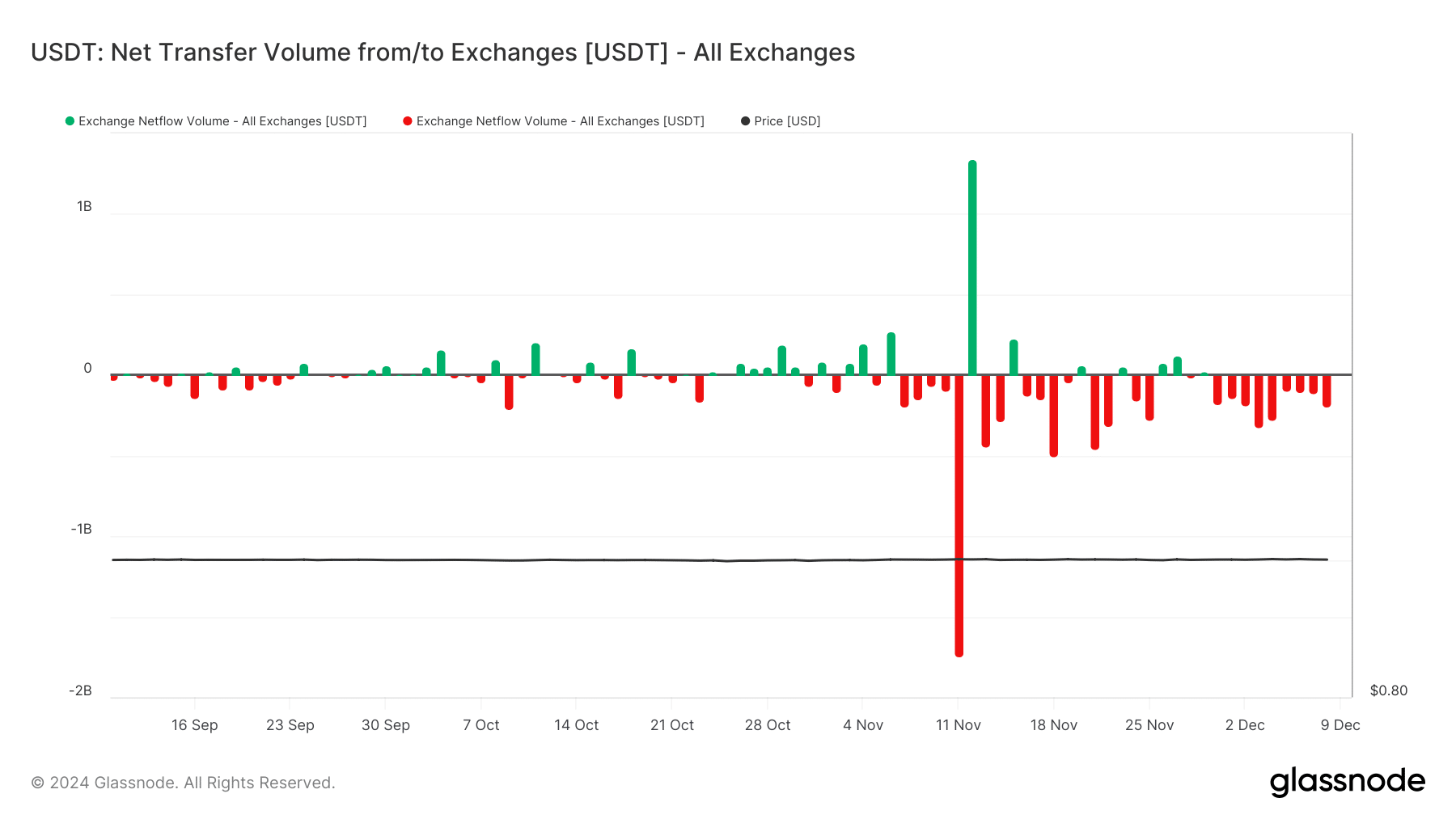

Nevertheless, the retail sector seems to be taking a unique route. Because the begin of December, there have been consecutive crimson bars, indicating an rising withdrawal of USDT from exchanges.

Supply : Glassnode

In contrast to earlier than, when USDT accumulation signaled Bitcoin’s bullish outlook, traders could now be turning to stablecoins for security. Why?

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin’s 4 failed makes an attempt to interrupt $100K, concern over its overvaluation, and a scarcity of FOMO are making traders extra cautious.

So, with volatility spiking, merchants are both chasing fast, huge positive aspects in mid and low-cap tokens or searching for stablecoins as a safer wager.