Users move Ethereum out of exchanges in favor of…

- ETH’s staked provide was near flipping ETH’s change provide.

- The convergence underlined that individuals have been taking ETH out of the market to make use of it as yield-earning investments.

A researcher from blockchain analytics agency Nansen took to Twitter to attract consideration to a captivating development growing within the Ethereum [ETH] ecosystem.

Supply: Nansen

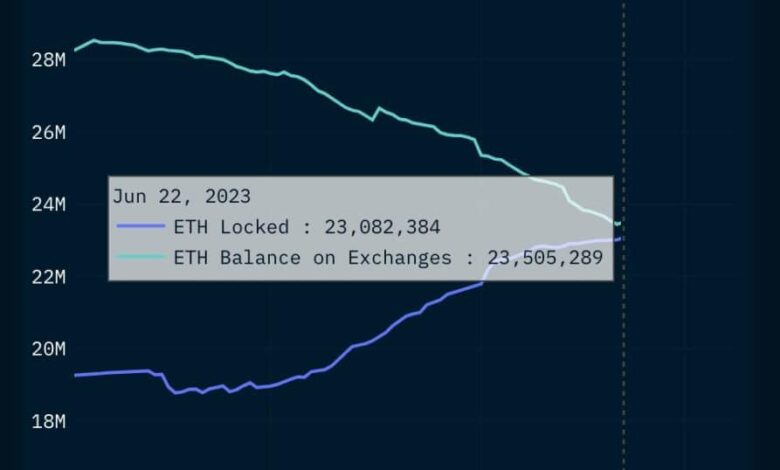

The snippet connected within the tweet dated 22 June revealed an attention-grabbing convergence of the quantity of ETH staked on the community and ETH’s provide, which was out there on exchanges for getting and promoting.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Staking turns into profitable

Customers have proven important curiosity in ETH staking for the reason that Shapella Improve went stay on the mainnet in April. As the anomaly surrounding withdrawals was put to relaxation, folks obtained extra confidence in restaking their ETH.

This resulted in a pointy spike within the variety of ETH staked with deposits persistently outpacing withdrawals during the last two months. On the time of publication, the entire quantity locked accounted for 16.7% of ETH’s complete circulating provide, as per a Nansen dashboard.

Then again, the provision on exchanges, i.e. liquid provide, has steadily dropped in the identical time interval. As per the data supplied within the aforementioned tweet, the change provide fell to 23.5 million from about 28 million at first of April.

This equated to 19% of the ETH’s complete circulating provide of 120.2 million, in keeping with CoinMarketCap.

The convergence underlined that individuals have been taking ETH out of the market and utilizing it as an funding to earn yields. And although staking rewards have progressively lowered over the previous two years, folks have most popular using ETH as a financial savings choice, as per a current report by CoinShares.

Supply: Coinshares

ETH slips beneath $1900 after rally

ETH failed to carry its positive aspects because it slipped beneath $1900 to commerce at $1,885.59 on the time of writing, in keeping with knowledge from Santiment. It remained to be seen how sustainable the rally of 21 June would show to be.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Nonetheless, the spike boosted the general profitability of the community. The 30-Day MVRV Ratio stormed into the optimistic territory after a spot of two weeks, suggesting that ETH holders, on common, would make income in the event that they have been to promote their holdings.

And whereas the long-term holders reacted to the value rise as indicated by the hike within the Age Consumed metric on 21 June, the next decline dampened their enthusiasm.

Supply: Santiment