Solana rallies against Ethereum: What it means for you

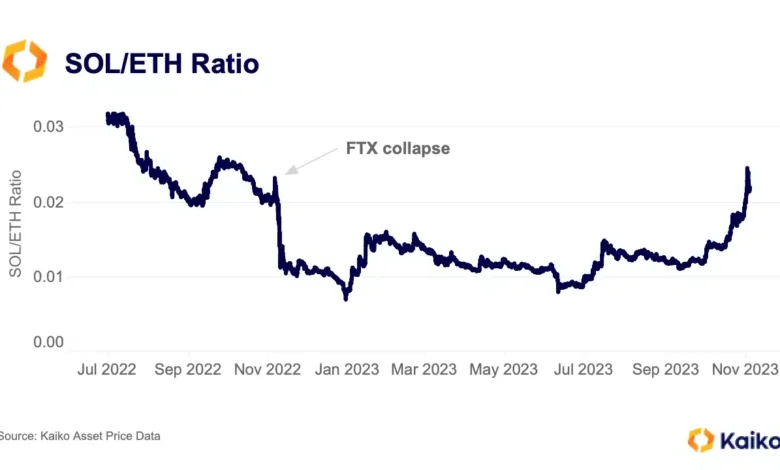

- The Solana to Ethereum ratio returned to its stage previous to FTX’s collapse in 2022.

- Regardless of the sideways market motion, coin accumulation continued to thrive.

The Solana [SOL] to Ethereum [ETH] ratio has rallied steadily since September and has returned to its stage previous to the collapse of crypto alternate FTX in November 2022, Kaiko Analysis present in a brand new report.

This ratio is a measure of SOL’s efficiency towards ETH. It’s calculated by dividing the worth of SOL by the worth of ETH.

A rising SOL/ETH ratio signifies that SOL is outperforming ETH, whereas a falling SOL/ETH ratio signifies that SOL is underperforming ETH.

In keeping with the on-chain information supplier:

“Since September, SOL has been the clear outperformer, with the ratio between the 2 leaping from 0.011 to almost 0.025, breaking the ratio from simply earlier than FTX’s collapse.”

Supply: Kaiko Analysis

SOL and its story of success

At press time, SOL traded at $41.47, based on information from CoinMarketCap. Since 1 September, the altcoin’s worth has climbed by over 100%. At its press time value, the coin exchanged fingers at a value stage final recorded in August 2022.

Supply: CoinMarketCap

Though SOL has spent the previous few days oscillating inside a good vary, the bulls remained accountable for the spot market on the time of publication.

An Common Directional Index (ADX) studying of 68.47 at press time prompt that SOL’s present uptrend was a powerful one. Usually, ADX values above 50 point out that the market development is powerful and has been sustained over a time frame.

With the constructive directional index (inexperienced) resting above the adverse directional index (purple), shopping for momentum outpaced SOL’s distribution. This, coupled with an ADX studying of 68.47, indicated that the bears would discover it laborious to displace the bulls within the brief time period.

Additional, key momentum indicators have been noticed above their respective highs as of this writing. For instance, SOL’s Relative Energy Index (MFI) and Cash Movement Index (MFI) rested at 73.75 and 57.95, respectively.

Sensible or not, right here’s SOL’s market cap in ETH phrases

This signaled that regardless of the worth consolidation prior to now few days, shopping for exercise continued to outpace promoting exercise amongst spot market members.

Supply: SOL/USDT on TradingView

Furthermore, SOL’s Open Curiosity has risen steadily since 14 October. At $514 million at press time, it has since elevated by over 80%. The OI sat at its highest stage since March, based on Coinglass.

Supply: Coinglass