Values Drop 60% After Holiday Frenzy

The short-lived reign of Bitcoin because the main NFT platform got here to an finish this month, with Ethereum reclaiming the highest spot as NFT gross sales on the Bitcoin community plummeted over 60% in comparison with December’s document highs.

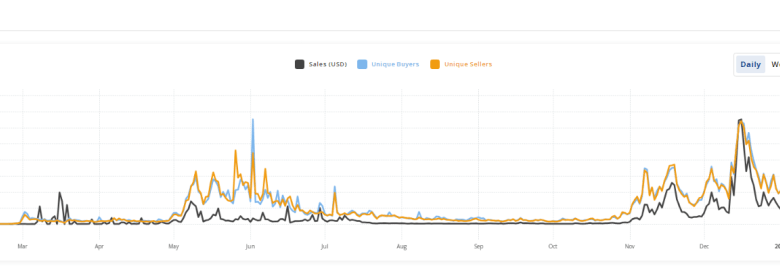

Information from NFT analytics platform CryptoSlam reveals a stark reversal in fortunes. After surpassing Ethereum in December with $881 million value of NFT gross sales, Bitcoin’s January quantity has sunk to $314 million as of two days earlier than month-end. In the meantime, Ethereum has maintained a steadier tempo, registering $328 million in gross sales over the previous 28 days.

Bitcoin NFT Loses Its Enchantment

This shift may be attributed to the fading fervor surrounding Ordinals, a expertise enabling inscriptions and non-fungible tokens straight on the Bitcoin blockchain. The December surge in Bitcoin NFT exercise was largely pushed by Ordinals-related hype, resulting in excessive charges for inscription minting. As an illustration, on December tenth, Bitcoin noticed a single-day excessive payment of $10 million as a consequence of inscription transactions.

Supply: CryptoSlam

Nonetheless, with the broader digital asset market going through turbulence, curiosity in Ordinals has waned considerably. Minting charges have plummeted by 83% since peaking at $5 million on January 14th, now standing at simply $848,000 as of January twenty eighth. This decline displays a drop in demand for blockspace for non-traditional Bitcoin transactions, additional suggesting a diminished urge for food for Ordinals-based NFTs.

Supply: Dune Analytics

Ethereum, then again, advantages from its established ecosystem and various functionalities. Its NFT landscape encompasses a wider vary of tasks and functions in comparison with the nascent Ordinals scene on Bitcoin. This, coupled with the relative stability of the Ethereum community, possible contributed to its potential to retain consumer curiosity and NFT buying and selling quantity all through December and January.

BTC market cap presently at $854 billion. Chart: TradingView.com

NFT Panorama Shifts: Adaptability Essential

The speedy change within the NFT panorama highlights the necessity for adaptability and innovation throughout the trade. Whereas Ordinals introduced a novel use case to Bitcoin, its technical limitations and area of interest enchantment could hamper its long-term sustainability. Conversely, Ethereum’s flexibility and established infrastructure place it properly to adapt to evolving market tendencies and consumer preferences.

Moreover, the broader decline in digital asset class curiosity possible impacted each Bitcoin and Ethereum NFTs. Nonetheless, Ethereum’s bigger and extra various consumer base, together with its established NFT ecosystem, recommend it could be higher geared up to climate the present market downturn.

The way forward for the NFT market stays unsure, however one factor is obvious: the panorama is continually shifting, and gamers should be capable of adapt to remain forward of the curve.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site totally at your individual threat.