VanEck Advisor Observes Recent Shifts in Blockchain Narrative

Gabor Gurbacs, an advisor at VanEck, commented the evolving narrative of the blockchain trade in 2024, noting vital modifications ensuing from latest developments within the crypto house.

“I consider efforts as we speak are meaningfully differentiated from previous “blockchain this blockchain that” tales,” he famous.

VanEck’s Gurbac Highlights Underestimation of the Blockchain

On X (previously Twitter), Gabor Gurbacs argues that people generally underestimate the crypto trade’s potential and investments, drawing parallels to previous misguided doubts.

“Individuals additionally laughed at ETFs. Now it’s a $9 Trillion trade.”

Launched in 1993, the primary exchange-traded fund (ETF), SPY, made historical past because the inaugural ETF listed on a nationwide inventory alternate. At the moment, it stays one of many world’s most actively traded ETFs.

Nonetheless, he argues that is what it’s beginning to seem like for the crypto trade going ahead, particularly with the latest approval of 11 spot Bitcoin ETF functions by the US Securities and Change Fee.

“Critical efforts and capital are beginning to stream on this house. It’s much less so about blockchains than rethinking and remaking capital markets,” he states. He signifies that the information protection has developed from merely pointing to tales in regards to the functionality of the blockchain:

“I consider efforts as we speak are meaningfully differentiated from previous “blockchain this blockchain that” tales.”

It’s solely the start for companies seeking to introduce Bitcoin merchandise to the market. On January 12, BeInCrypto reported that Grayscale Investments shall be submitting for a coated name Bitcoin ETF, which is able to permit traders to generate earnings from choices on its Grayscale Bitcoin Belief (GBTC).

Nonetheless, Gurbacs additional argues in opposition to those that challenged latest statements by BlackRock CEO Larry Fink concerning tokenization.

“97% of people that snicker at Larry Fink, & his feedback on tokenization being his subsequent focus space, don’t perceive how damaged capital markets are.”

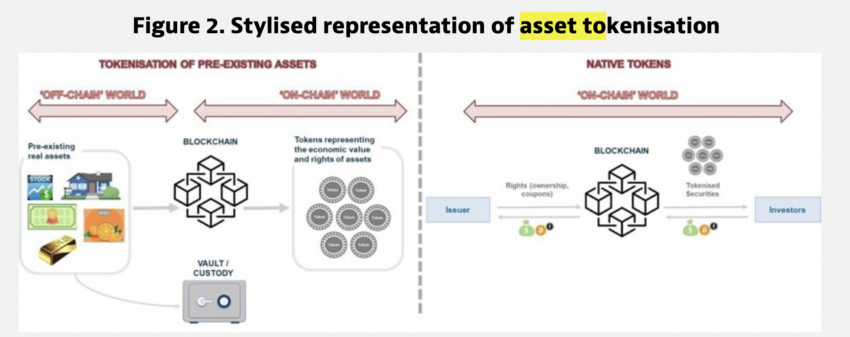

The tokenisation of belongings is the digital illustration of bodily belongings on the blockchain. It affords benefits like enhanced elevated transparency. Moreover, a simplified entry to fractionalized belongings by enabling possession splitting on the blockchain.

Determine 2. Stylised illustration of asset tokenisation. Supply: OECD Going Digital Toolkit

This follows BeInCrypto’s latest reporting that Fink’s imaginative and prescient extends to the concept that ETFs will ultimately rework each asset class. Moreover, the last word step being the tokenization of belongings.

Learn extra: What’s a Layer-1 Blockchain?

Gurbacs Highlights Ignored Trendy Capital Markets Imaginative and prescient

But, Gurbacs argues that latest contentment with capital markets could also be disrupted by the evolution of spot Bitcoin ETFs and the potential for others sooner or later.

“Individuals haven’t given a critical thought on what fashionable capital markets ought to seem like for many years,” he states.

Many within the trade speculate over which narrative shall be subsequent within the crypto world.

Till final yr, AI-focused crypto didn’t obtain a lot consideration. Nonetheless, in 2023, the highlight shifted, particularly with the emergence of generative AI chatbots like OpenAI’s ChatGPT and Google’s Bard.