VIRTUAL price prediction Here’s what the data says

- Information reveals that VIRTUAL’s Open Curiosity has dropped by 18% prior to now 24 hours.

- Exchanges have witnessed an outflow of $4.80 million price of VIRTUAL.

Digital Protocol [VIRTUAL] has been making waves amidst the continued market uncertainty as a result of its spectacular efficiency.

Nevertheless, on the thirtieth of December, VIRTUAL, together with Bitcoin [BTC], Ethereum [ETH], and XRP, appears to be struggling to achieve momentum, elevating considerations a few potential worth correction.

Trying on the present market outlook, it seems that long-term holders are reserving their income after a notable 42% upside momentum prior to now week, throughout which the value surged from $2.44 to $3.47.

It is essential for traders to find out whether or not the value will stabilize at this degree or if a possible decline might happen within the coming days.

VIRTUAL worth prediction

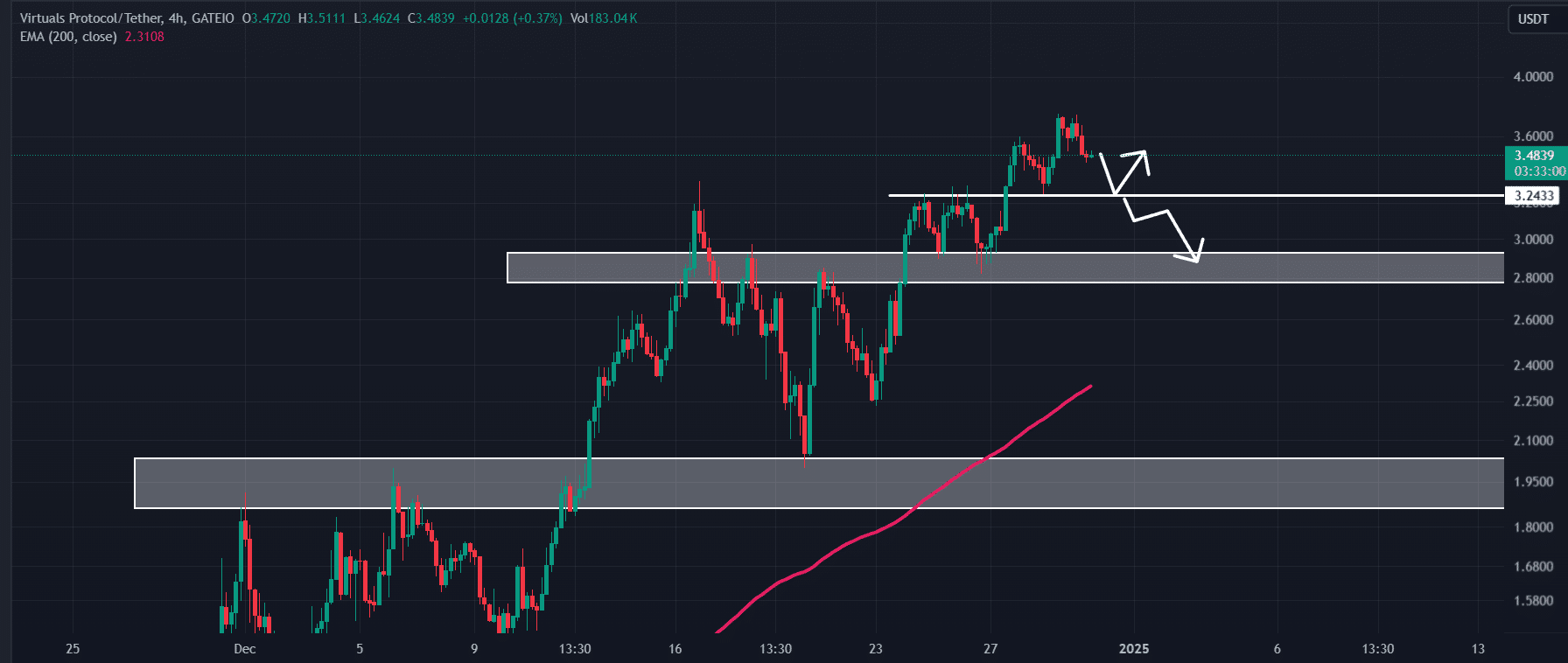

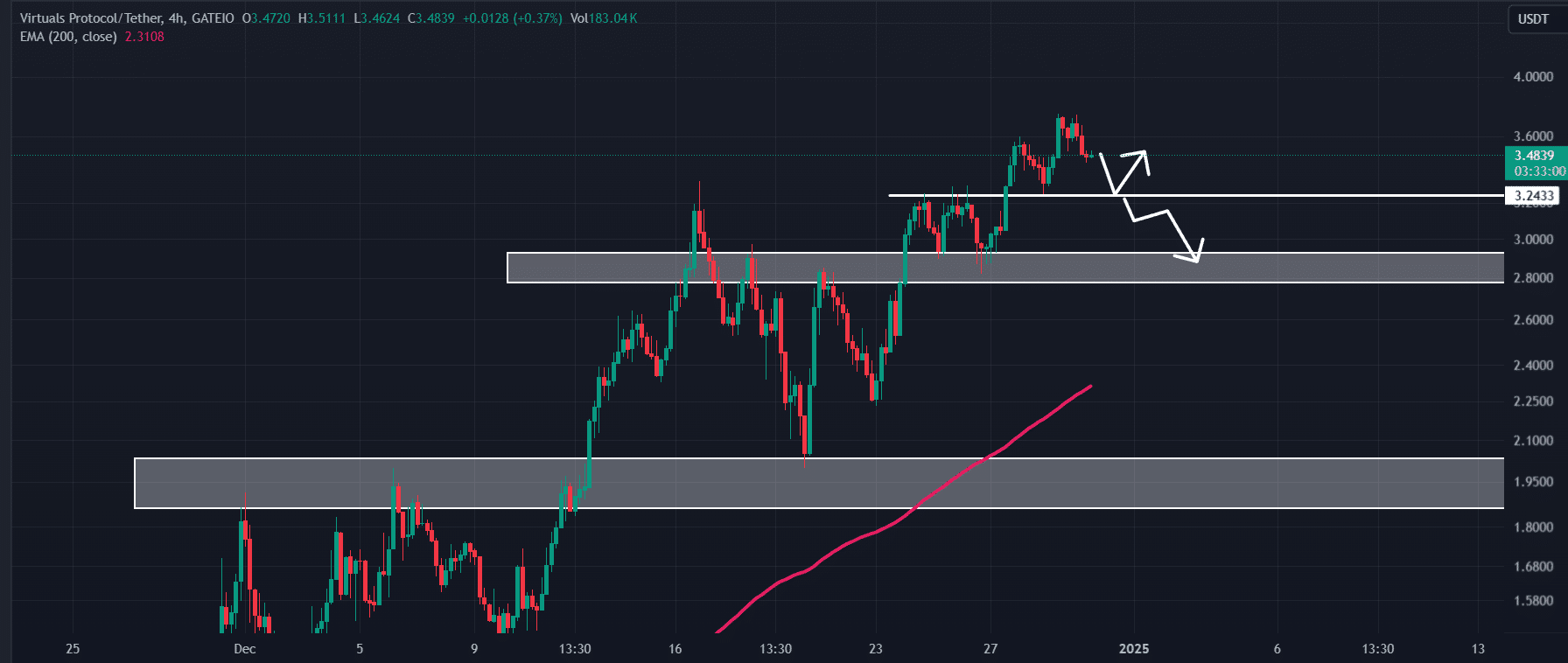

In line with AMBCrypto’s technical evaluation, VIRTUAL has not too long ago damaged out of a small four-hour consolidation zone, which it shaped close to the $3.70 mark.

Supply: TradingView

Following this breakdown, the asset has misplaced one in all its robust liquidation areas, which might help bears in driving the asset’s worth down by one other 7%, reaching the subsequent help degree on the $3.24 mark.

If VIRTUAL holds that degree, a possible worth rebound might happen. In any other case, merchants and traders might witness an extra worth decline to the $2.90 degree sooner or later.

Blended sentiments, on-chain

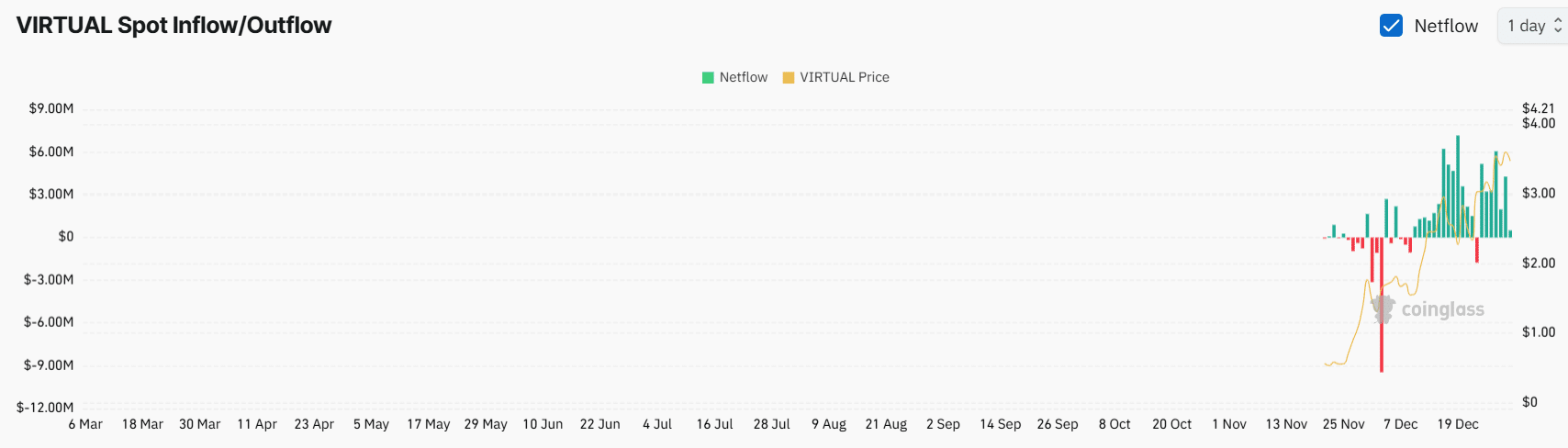

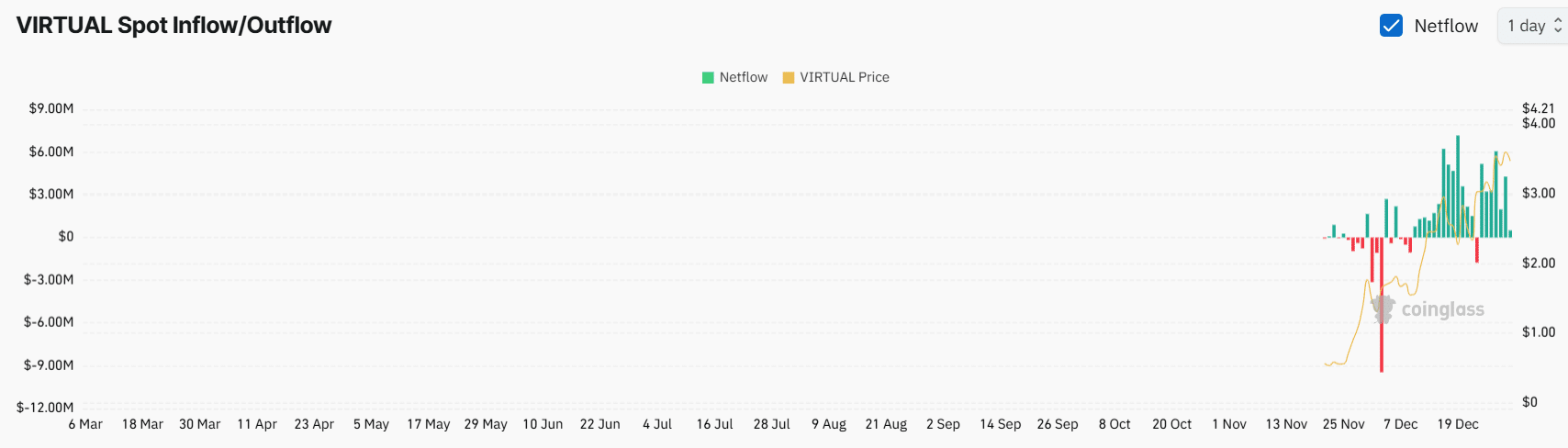

With this potential worth decline and up to date worth drop, merchants appeared hesitant to construct new positions, as reported by the on-chain analytics agency Coinglass.

Information confirmed that VIRTUAL’s Open Curiosity has dropped by 18% prior to now 24 hours.

Supply: Coinglass

In the meantime, long-term holders have been accumulating the asset, reflecting their confidence and curiosity.

Information from VIRTUAL’s spot influx/outflow revealed that exchanges witnessed a modest outflow of $4.80 million price of VIRTUAL throughout the identical interval.

In cryptocurrency, “outflow” refers back to the motion of belongings from exchanges to long-term holders’ wallets, indicating potential accumulation and elevated shopping for stress.

When combining all these on-chain metrics with the technical evaluation, it seems that the asset is bearish on the shorter timeframe, and a possible worth correction might happen.

Nevertheless, on the longer timeframe, traders stay bullish on the asset, which might drive the value greater sooner or later after a profitable worth correction.

Learn Virtuals Protocol’s [VIRTUAL] Value Prediction 2025–2026

At press time, VIRTUAL was buying and selling close to $3.46, after a worth decline of over 6.45% prior to now 24 hours.

Throughout the identical interval, its buying and selling quantity elevated by 3.5%, indicating rising participation from merchants and traders in comparison with the day past.