VIRTUAL price prediction – Will the pullback extend beyond 30%?

- VIRTUAL dropped over 30% after a formidable November rally.

- What are the chances of worth restoration for the AI token?

The AI agent narrative made Digital Protocols [VIRTUAL] an instantaneous hit in November, with over 400% positive factors.

Nonetheless, December started on a tough patch as Bitcoin [BTC] struggled to carry above $98K, triggering an enormous sell-off that hit the AI section the toughest.

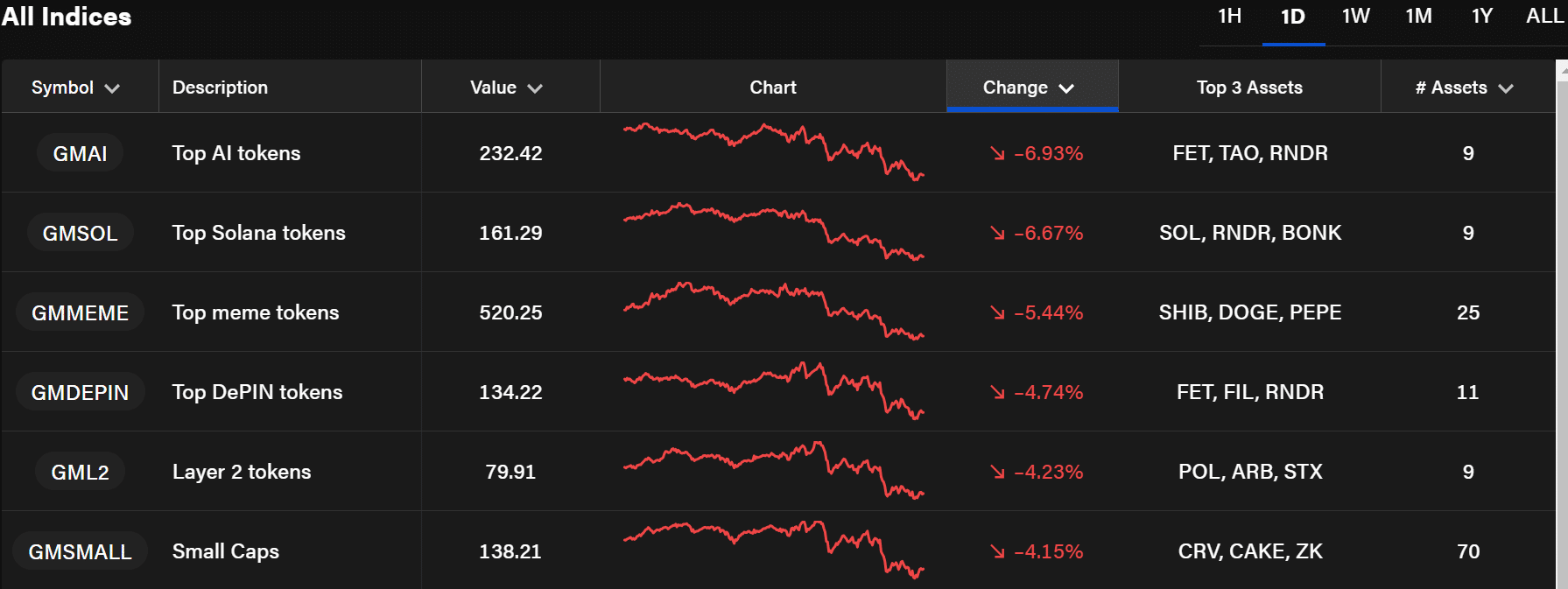

The broader AI sub-sector was down practically 7% on the day by day charts, per The Block’s AI token index, GMAI. VIRTUAL wasn’t spared.

Supply: The Block

VIRTUAL worth prediction

Regardless of main as an AI agent incubation and distribution platform on Base, the Digital protocol’s utility token, VIRTUAL, prolonged its weekend decline.

This is also attributed to capital rotation between sectors after AI brokers dominated the section for the previous two weeks. However what’s subsequent for the AI agent unicorn?

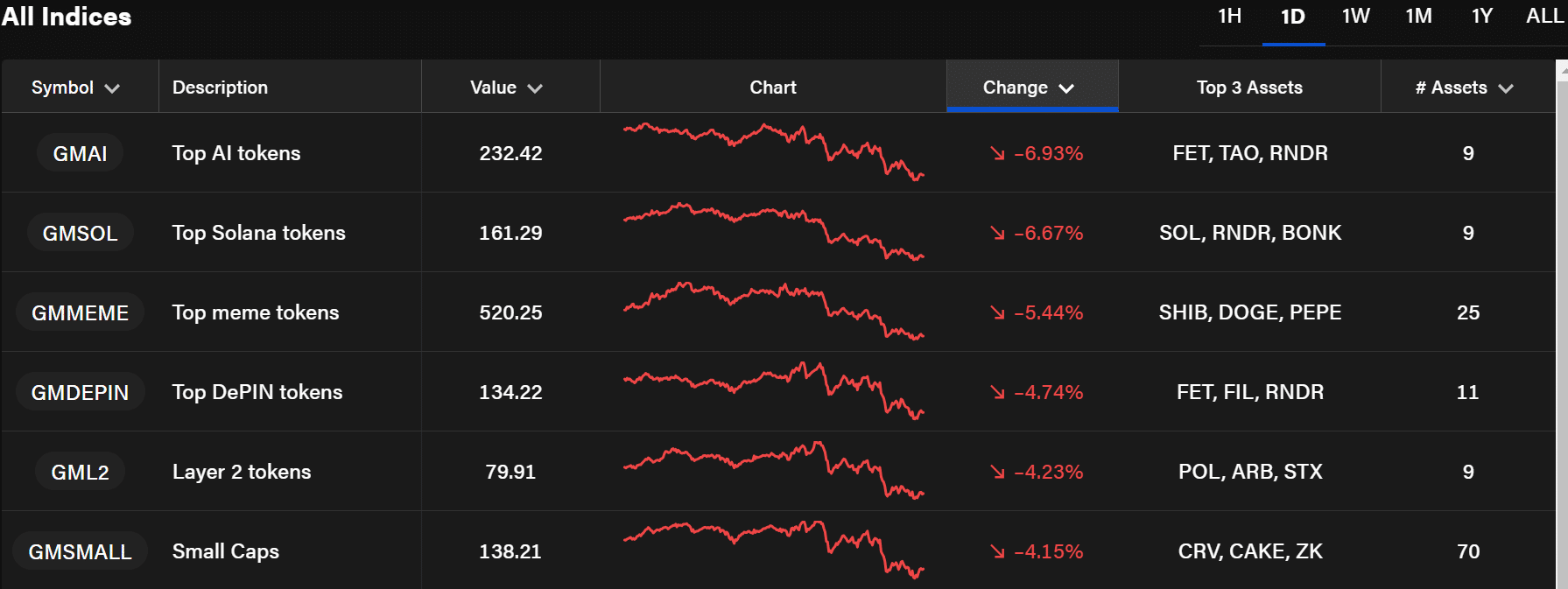

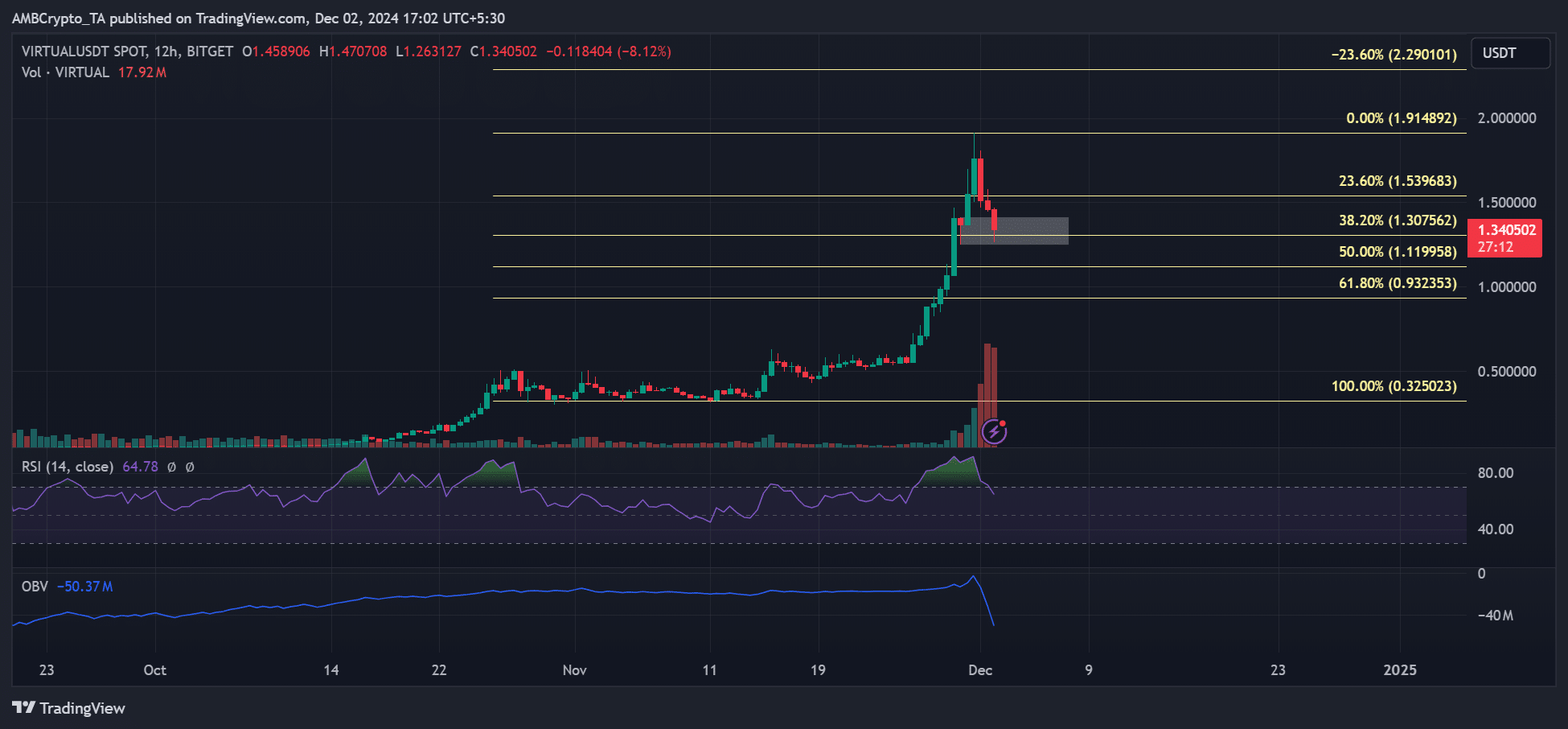

Supply: VIRTUAL/USDT, TradingView

On the 12-hour worth chart, VIRTUAL’s 11% decline hit the bullish order block (OB), white at $1.3. Normally, the bullish OBs act as help and will assist set off a restoration.

In VIRTUAL’s case, the chances of holding $1.3 have been slim, given the sharp drop in OBV (On Steadiness Quantity). It meant the buying and selling quantity (spot demand) had declined massively and will undermine a robust worth restoration prospect.

If that’s the case, even the RSI might retreat in direction of the median stage earlier than making an attempt a reversal. In such a situation, a worth restoration might be confirmed by reversal of RSI on the 50-mark.

In brief, VIRTUAL might prolong its decline to the golden zone of 61.8% Fib stage ($0.93-$1.11), particularly if BTC drops under $95K once more.

Given the sturdy AI narrative, each dip might provide a reduced scoop for VIRTUAL buyers and an extended place entry for merchants.

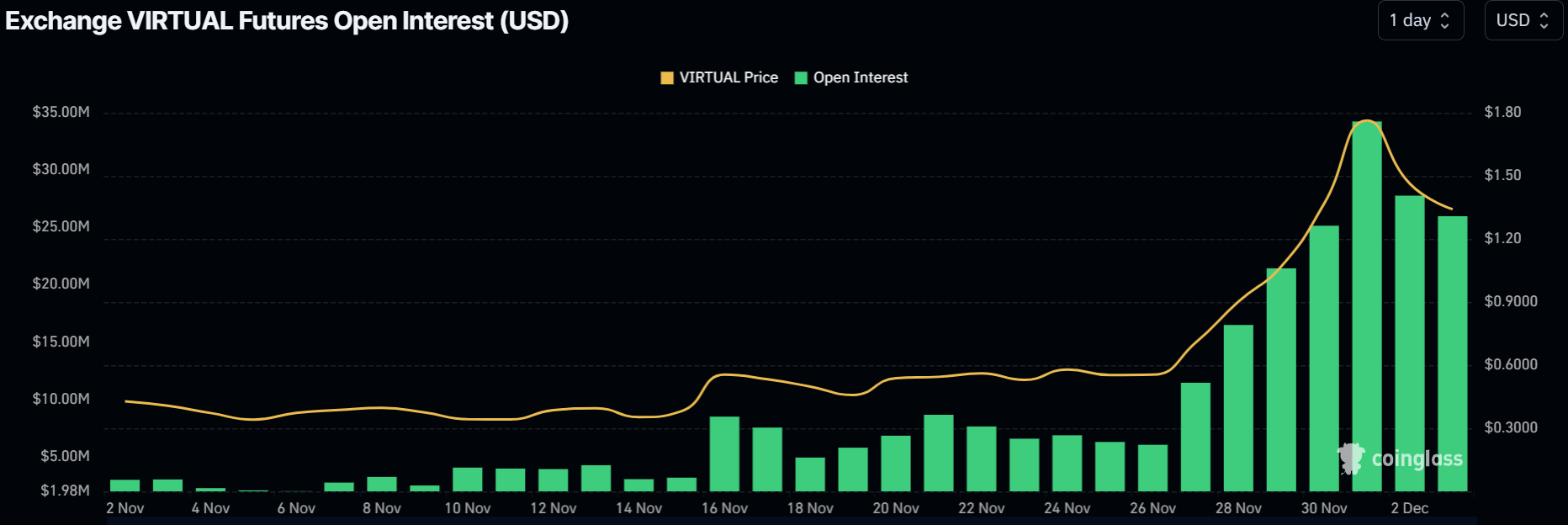

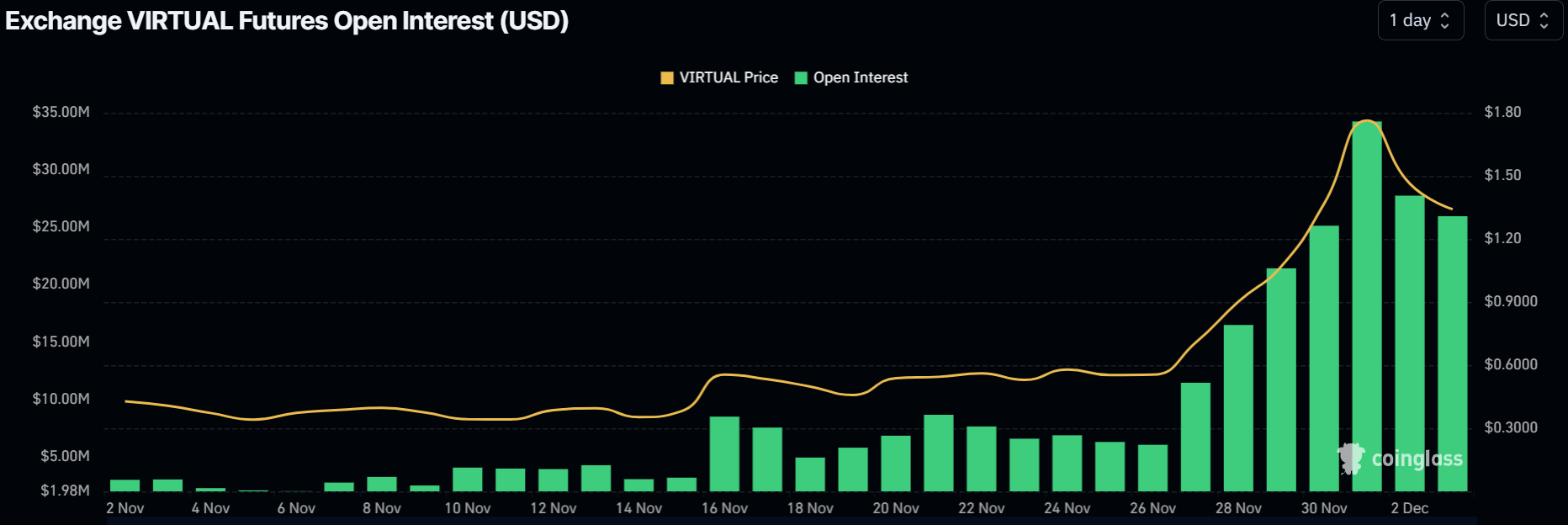

Open Curiosity slides

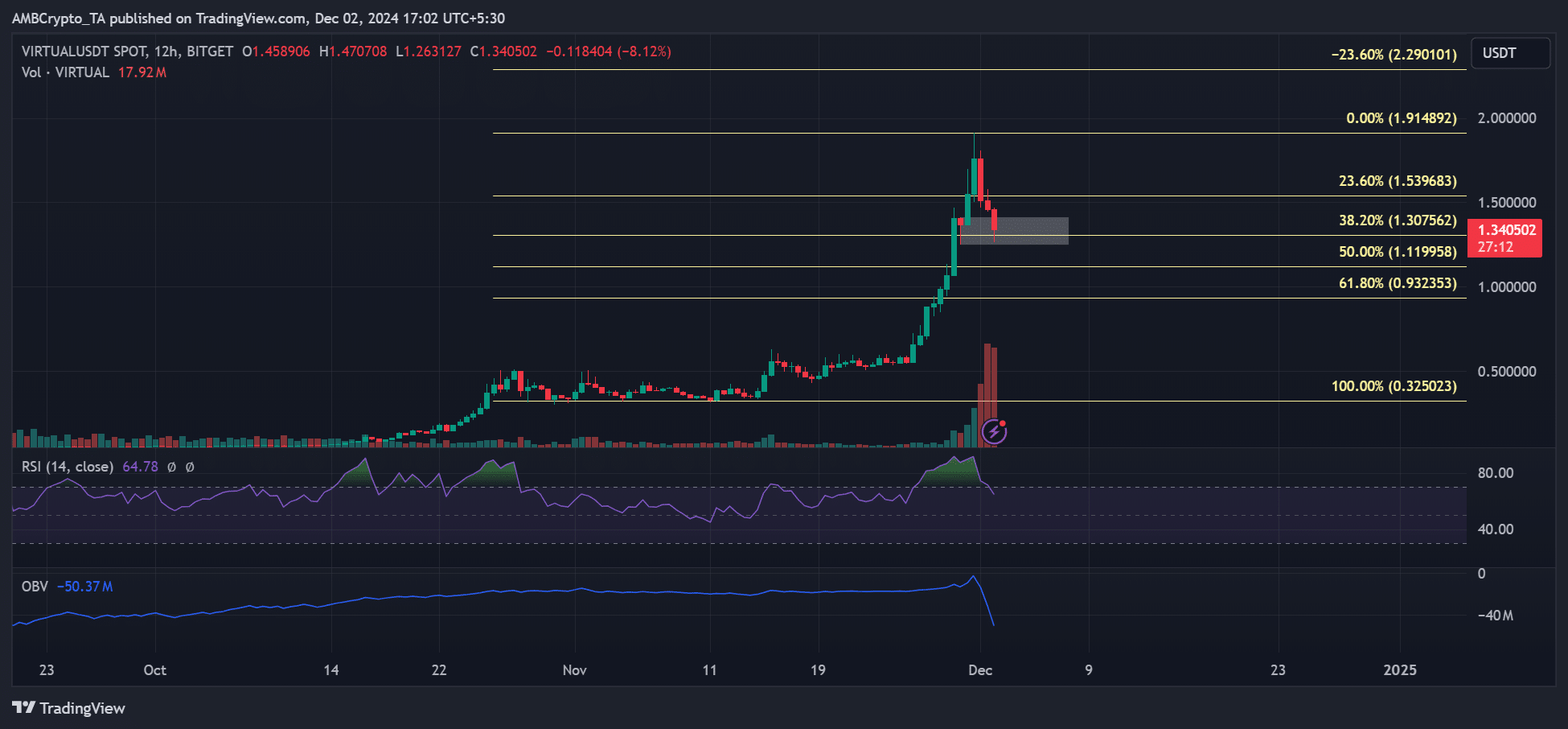

Supply: Coinglass

Learn Digital Protocol [VIRTUAL] Worth Prediction 2024-2025

VIRTUAL’s worth pullback was additionally marked by decreased market curiosity within the Futures section.

The Open Curiosity (OI) charges dropped from $34M to $25M, a virtually $10M decline in two days. This strengthened a bearish sentiment that would change if BTC eyes $100K once more.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion