Vitalik Buterin-linked wallet dumps $1.72 mln ETH, What’s Next?

- ETH may attain the $2,900 stage if it closes a day by day candle above the $2,700 stage.

- ETH’s Lengthy/Quick Ratio stood at 0.927, indicating bearish sentiment amongst merchants.

Within the ongoing struggling cryptocurrency market, a pockets linked to Vitalik Buterin, the co-founder of Ethereum [ETH] dumped a major quantity of ETH.

In line with the on-chain analytic agency Spotonchain, on the twenty ninth of September, pockets handle “0x556” linked to Buterin deposited 649 ETH price $1.72 million to Paxos.

Pockets-linked to Buterin dump $1.72M of ETH

The agency additionally famous that, over the previous 11 days, the pockets had deposited a considerable 1,300 ETH price $3.35 million at a median worth of $2,581.

Moreover, the agency added that this pockets acquired 1,300 ETH on the nineteenth of September, from one other pockets that was funded by Vitalik Buterin in 2022.

This large deposit of ETH has the potential to shift the market sentiment to a bearish facet.

Ethereum technical evaluation and key ranges

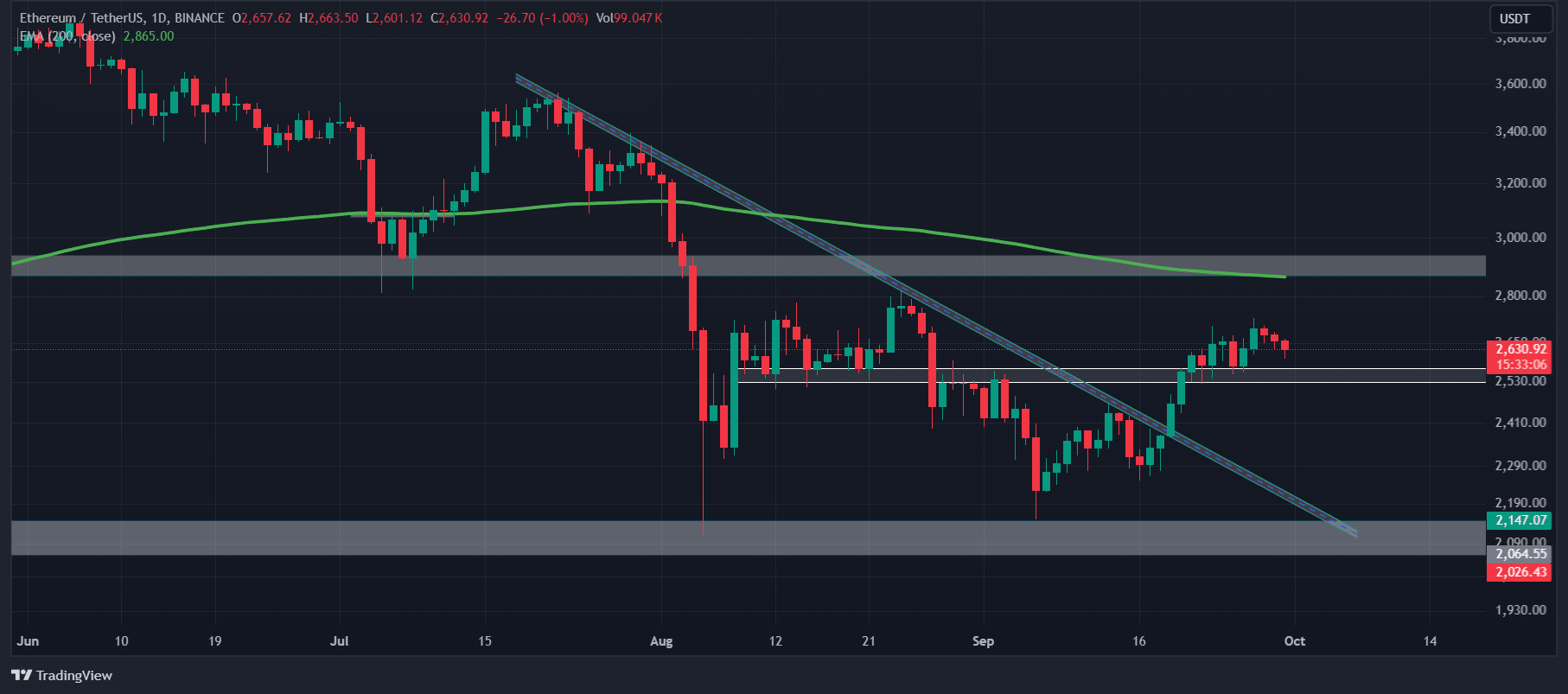

In line with AMBCrypto’s technical evaluation, ETH is consolidating in a good vary following the breakout of a vital resistance stage of $2,590 stage.

If the asset’s worth soars and closes its day by day candle above the $2,700 stage, there’s a robust chance that ETH may attain the $2,900 stage within the coming days.

Supply: TradingView

As of now, ETH is buying and selling beneath the 200 Exponential Transferring Common (EMA) on a day by day timeframe, indicating a downtrend.

The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an uptrend or downtrend.

Combined-sentiment by on-chain metrics

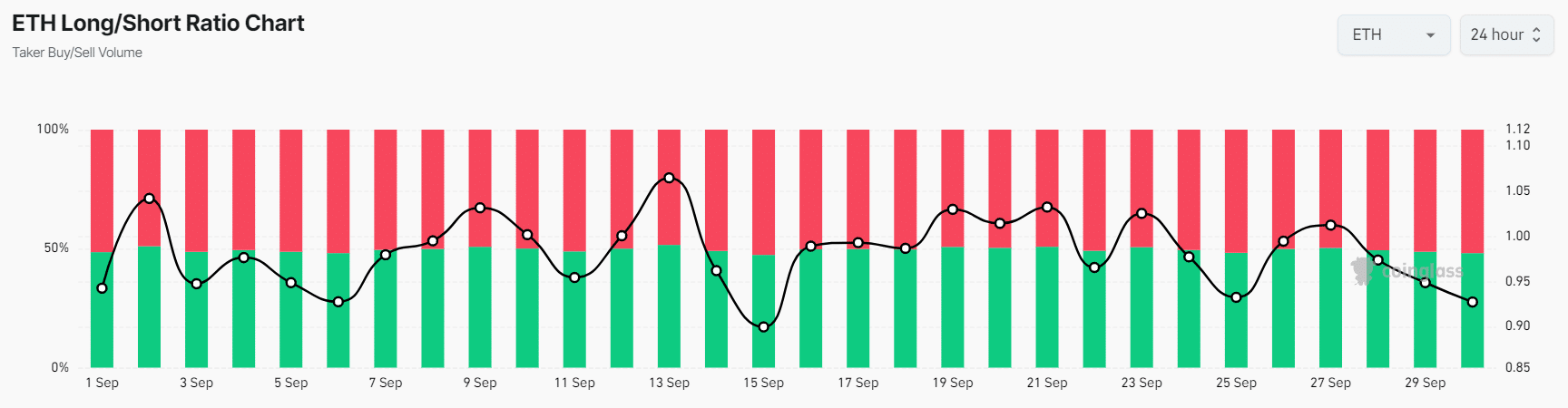

Along with the technical evaluation, on-chain metrics sign combined sentiment.

In line with the on-chain analytics agency Coinglass, ETH’s Lengthy/Quick Ratio was at 0.927, indicating bearish sentiment amongst merchants.

Supply: Coinglass

Moreover, its Futures Open Curiosity has remained unchanged previously 24 hours, indicating merchants are nonetheless holding their positions, whereas new merchants are hesitating in constructing new ones.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

51.89% of high merchants maintain brief positions, whereas 48.11% maintain lengthy positions. At press time, ETH was buying and selling close to $2,635 and has remained unchanged over the previous 24 hours.

Throughout the identical interval, its buying and selling quantity jumped by 22%, indicating increased participation from merchants and traders amid ongoing consolidation, which is doubtlessly a optimistic sign for ETH.