Vitalik Buterin on why Ethereum centralization is a problem: ‘Higher risk of…’

- Vitalik Buterin marked block creation and staking as key centralization dangers.

- The workforce was exploring some options to handle these danger components.

Vitalik Buterin, co-founder of Ethereum [ETH], has explored the community’s centralization dangers and potential options the workforce was exploring.

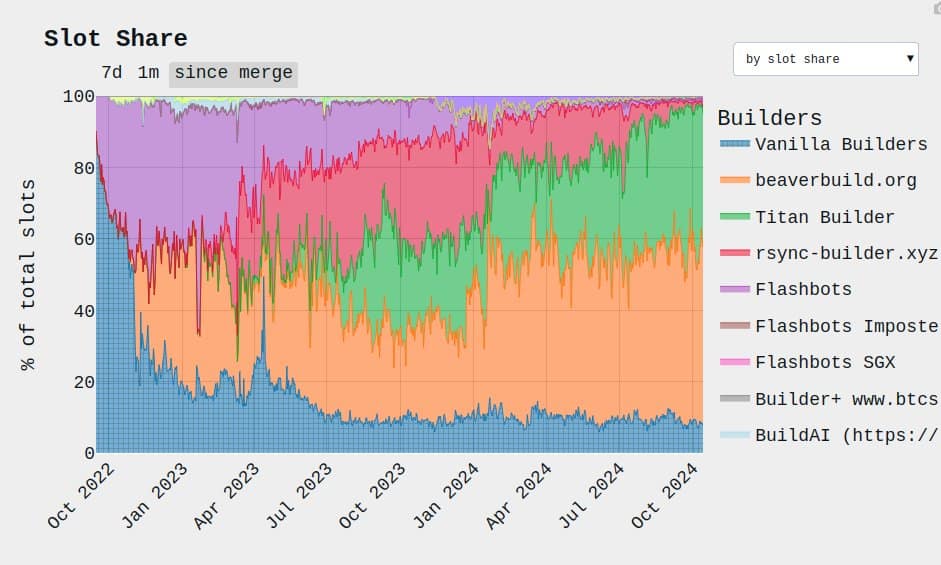

Buterin marked block creation and staking as key centralization danger components. To place the dire state of affairs in perspective, two entities (Beaver and Titan) created almost 90% of ETH blocks in October.

What may presumably go incorrect with such a degree of centralization?

Supply: Buterin

Buterin additionally highlighted that enormous stakers’ dominance may elevate community assaults and censorship dangers. He stated,

“This (massive stakers dominance) results in increased danger of 51% assaults, transaction censorship, and different crises. Along with the centralization danger, there are additionally dangers of worth extraction: a small group capturing worth that might in any other case go to Ethereum’s customers.”

Doable options

Since final yr, the dangers talked about above have hiked amid an increase in the usage of specialised algorithms (MEV, most extraction worth) by block proposers to maximise income.

“Bigger actors can afford to run extra subtle algorithms (“MEV extraction”) to generate blocks, giving them a better income per block.”

For the block creation situation, Buterin cited the inclusion lists method as a possible answer, wherein proposers and builders share the duty.

“The main answer is to interrupt down the block manufacturing process additional: we give the duty of selecting transactions again to the proposer (i.e. a staker), and the builder can solely select the ordering and insert some transactions of their very own. That is what inclusion lists search to do.”

The workforce was exploring varied nuances of inclusion lists with completely different trade-offs and was to choose a single method.

On staking danger, 34M of 120M circulating provide is staked, which is sort of 30% of ETH in supply.

In response to Buterin, the continued staking progress may doubtlessly make one liquid staking token (LST) extra dominant and cut back liquidity.

To unravel this, the workforce explored decreasing staking rewards and capping the quantity of ETH that might be staked.

Total, Buterin reiterated the intention to stop worth extraction from customers on the expense of centralized management and preserve limiting the community from going the centralization route.

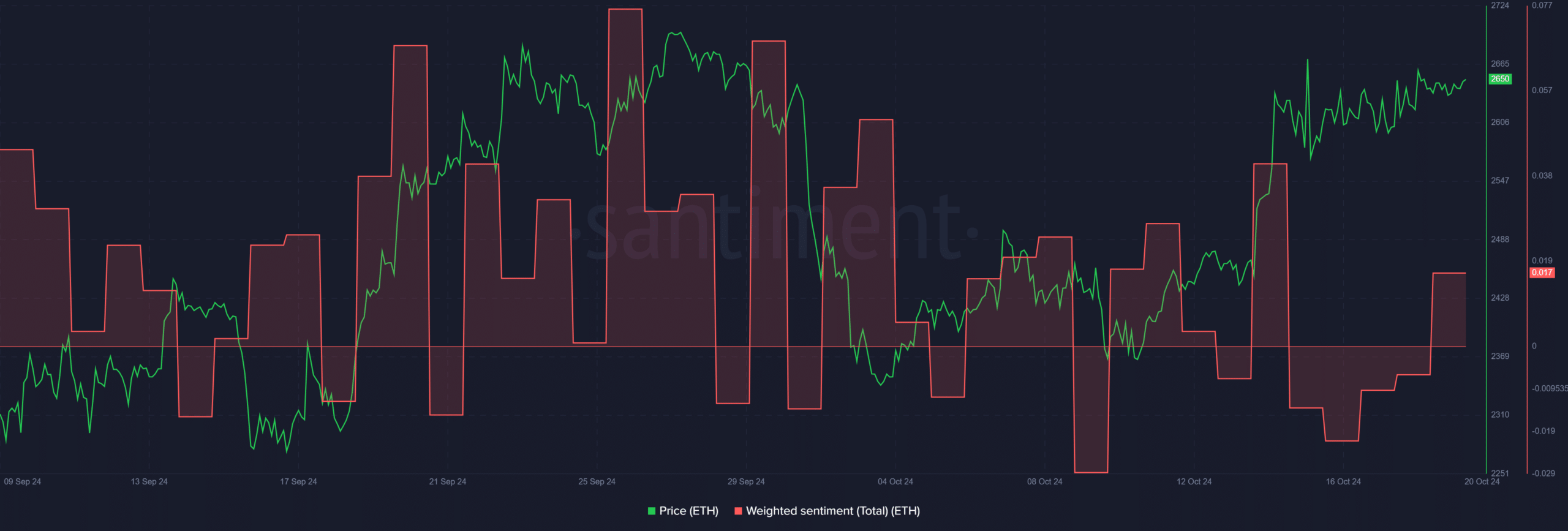

A number of hours after the replace, ETH’s sentiment positively surged, suggesting that market contributors have been hopeful concerning the altcoin’s value prospects.

Supply: Santiment

Though it stays to be seen which options the workforce will choose to handle the problems raised, the transfer may bolster ETH worth in the long term.

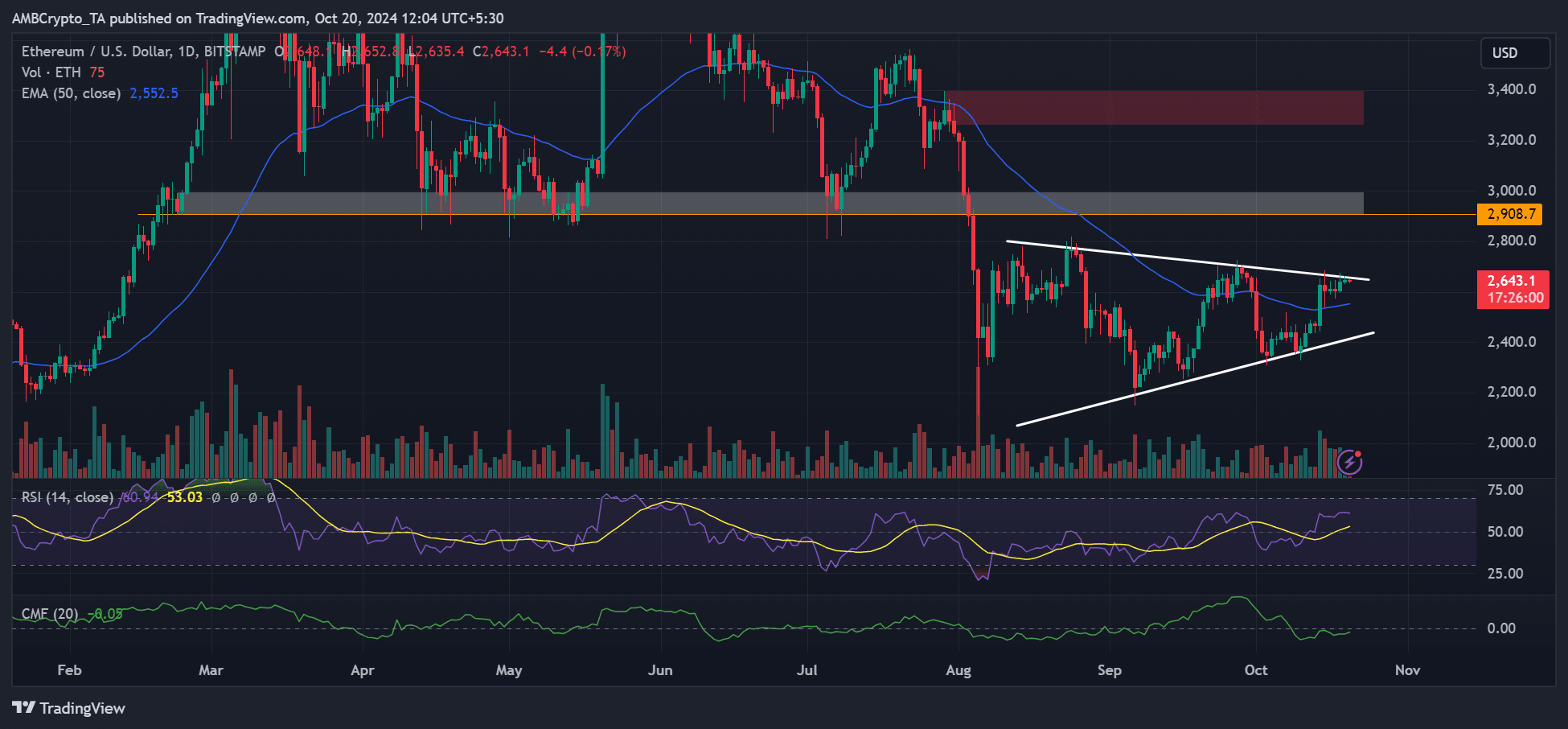

At press time, ETH’s value was $2.6K, under a key roadblock away from its $2.9k bullish goal.

Supply: ETH/USD, TradingView