Was November kind to Ethereum NFTs? Here’s what the data says

- There was a hike in NFT and DeFi exercise on Ethereum.

- Regardless of the excessive demand for ETH, its provide continues to fall.

The Ethereum [ETH] community has skilled a surge in exercise round non-fungible tokens (NFTs) and decentralized finance (DeFi) in latest weeks, on-chain knowledge reveals.

This development in community exercise follows an prolonged interval of decline when NFT gross sales quantity and DeFi whole worth locked (TVL) plummeted to new lows.

Ethereum’s NFT and DeFi ecosystems

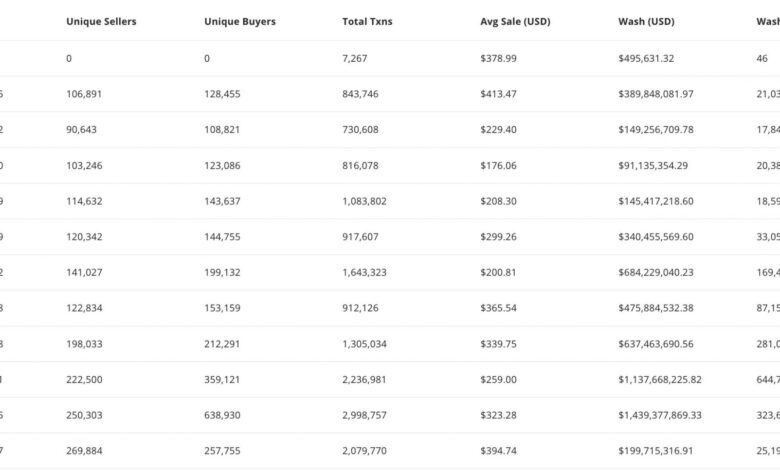

In November, Ethereum-minted NFTs recorded a gross sales quantity of $348.61 million, in accordance with knowledge from CryptoSlam.

AMBCrypto discovered that this marked the primary time since February that the chain would file a month-over-month (MoM) uptick in gross sales quantity.

For context, Ethereum registered an NFT gross sales quantity of $949.49 million in February. Nevertheless, as bearish sentiments ravaged your complete crypto market within the first and second quarters of the 12 months, NFT buying and selling exercise declined severely.

Knowledge from NFTGo confirmed that basic NFT market capitalization peaked at $10 billion on twentieth February and has since trended downward.

Between February and October, NFT gross sales quantity on Ethereum fell by 82%. Nevertheless, basic market sentiments improved in November, resulting in a resurgence in NFT buying and selling exercise.

Final month, basic NFT market capitalization grew by 39%. Mirroring the expansion within the basic market, Ethereum’s MoM gross sales quantity climbed by 108%.

Concerning its DeFi vertical, it additionally skilled development in TVL. Knowledge from DefiLlama confirmed that between 1st and thirtieth November, the chain’s TVL rose by 15%.

The community’s TVL was $26.64 billion at press time, its highest since July.

However there’s a catch…

Whereas the expansion in NFT and DeFi exercise is sweet for the chain, it’d lead to a possible hike in ETH’s provide because of the present elevated demand for the altcoin.

Pseudonymous CryptoQuant analyst Nino found that the resurgence in NFT and DeFi exercise on the Ethereum community has led to development in the usual deviation (SD) of ETH withdrawal transactions from exchanges.

Which means that ETH’s common withdrawal transaction dimension is turning into extra variable. In different phrases, there are extra giant and small withdrawal transactions than there was.

How a lot are 1,10,100 ETHs worth today?

Taking a cue from ETH’s historic efficiency, Nino stated:

“Like throughout previous bubble durations, if there’s a surge in demand for DeFi and NFTs, it will necessitate an elevated provide of ETH. This might result in larger volatility in its worth.”

Apparently, regardless of final month’s NFT and DeFi exercise hike, its provide continues to say no. Knowledge from Ultrasound.money confirmed that 32,012 ETH tokens value round $66.95 million have been faraway from circulation within the final month.