WazirX hackers move $6.54 mln ETH: What does this mean for Ethereum?

- There’s a excessive risk that ETH might fall 4% to the $2,400 degree.

- ETH’s reserve on the exchanges has been rising, indicating greater promoting strain from buyers.

On this bearish market sentiment, a current transaction of Ethereum [ETH] by WazirX exploiters has created an alarming state of affairs, elevating considerations of an enormous sell-off.

On the third of September, on-chain analytic agency Spot On Chain made a put up on X (previously Twitter) that exploiters had transferred 2,600 ETH value $6.54 million to Twister Money.

Nonetheless, the exploiters nonetheless held a major quantity of 59,156 ETH value $148.8 million, throughout 9 completely different cryptocurrency pockets addresses, at press time.

In the event that they dump their holdings, ETH could witness a major value decline within the coming days.

Ethereum value motion

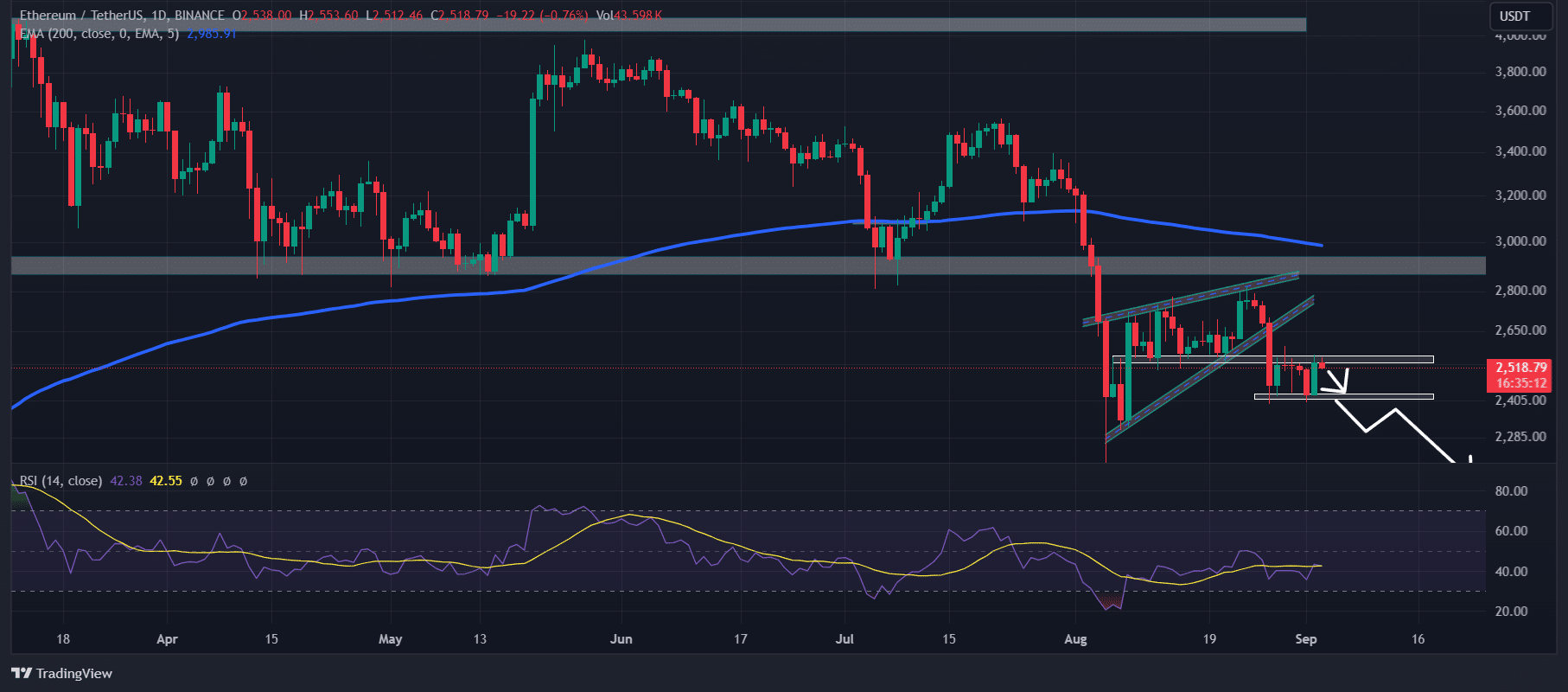

In keeping with AMBCrypto’s take a look at TradingView information, following the breakdown of a bearish rising wedge value motion sample, ETH appeared to consolidated inside a good vary between the $2,400 and $2,555 ranges.

If ETH breaks down this consolidation zone and closes a each day candle beneath the $2,400 degree, there’s a excessive risk it might fall to the $2,200 degree within the coming days.

Supply: TradingView

Moreover, on a four-hour timeframe, ETH regarded extra bearish because it was at an higher degree of the consolidation zone, suggesting a possible 4% value drop to the $2,400 degree.

In the meantime, the altcoin’s Relative Power Index (RSI) was in an oversold territory, which might probably sign a value reversal.

Bearish indicators forward?

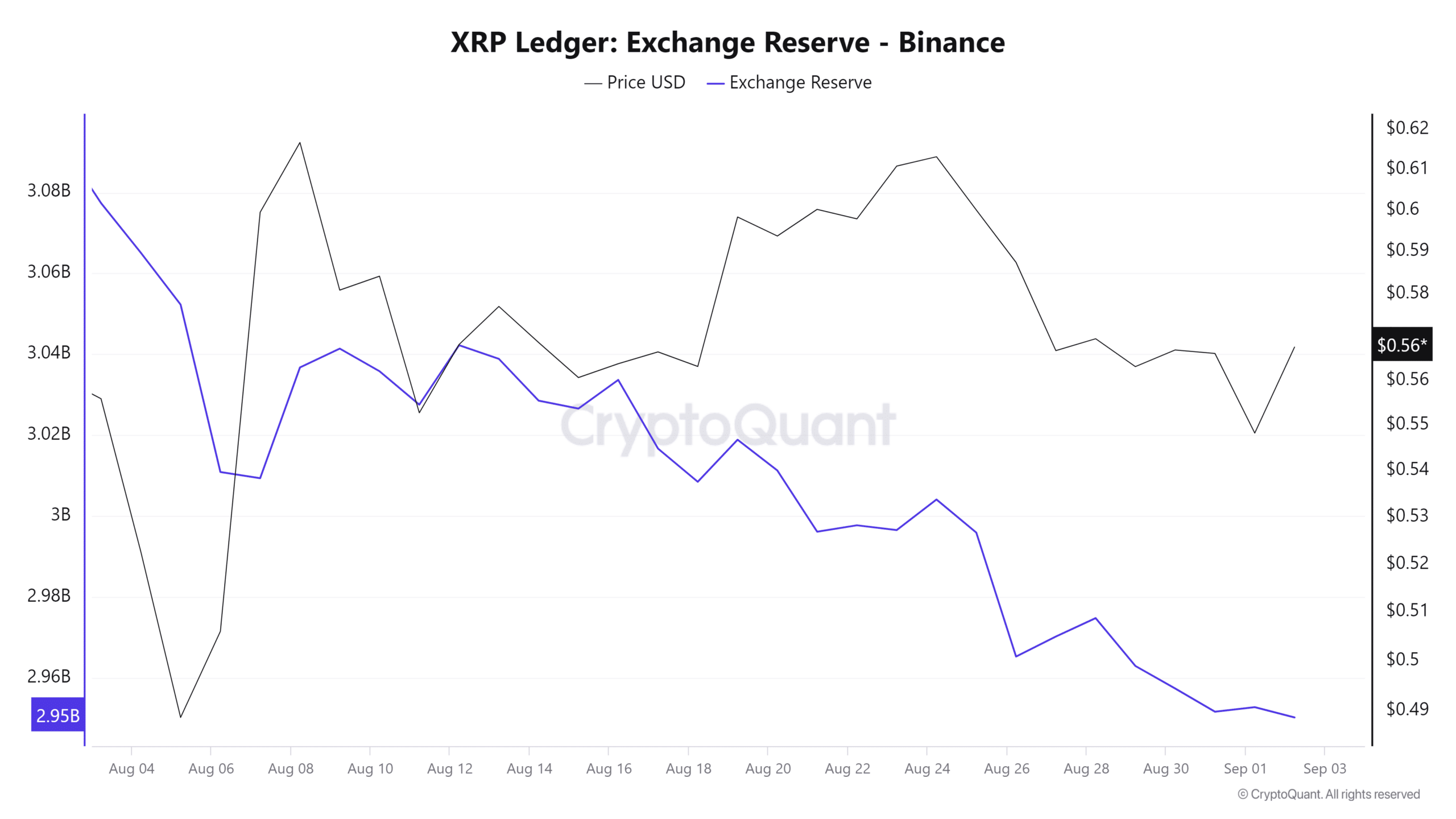

AMBCrypto’s take a look at the Ethereum change reserve through CryptoQuant supported the present bearish outlook, suggesting that ETH could expertise a value decline.

Because the twenty ninth of August, ETH’s reserve on the exchanges has been repeatedly rising, indicating greater promoting strain from buyers and establishments.

The change reserve usually rises when buyers or establishments are making ready to dump their belongings, prompting them to switch their holdings from wallets to exchanges.

Supply: CryptoQuant

As of press time, the key liquidation ranges have been close to $2,490 on the decrease aspect and $2,550 degree on the higher aspect, as intraday merchants have been over-leveraged at these ranges, in response to Coinglass.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

At press time, ETH was buying and selling close to the two,510 degree, having skilled a value surge of over 2.7% within the final 24 hours.

Its Open Curiosity elevated by 3.5% throughout the identical interval, indicating heightened curiosity from buyers regardless of the current value decline.