‘Wen spot ETH ETF?’ – Why this exec has predicted a date of July 15th

- Nate Geraci predicted that Ethereum ETFs could possibly be accredited on the fifteenth of July.

- Regardless of the rising anticipation round ETH ETFs, the worth of the altcoin dropped 2.54%.

The long-awaited approval of the spot Ethereum [ETH] ETF might have obtained a brand new date.

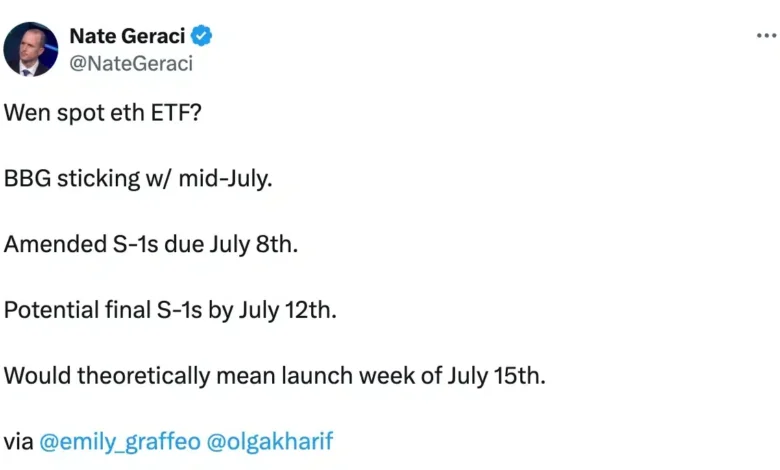

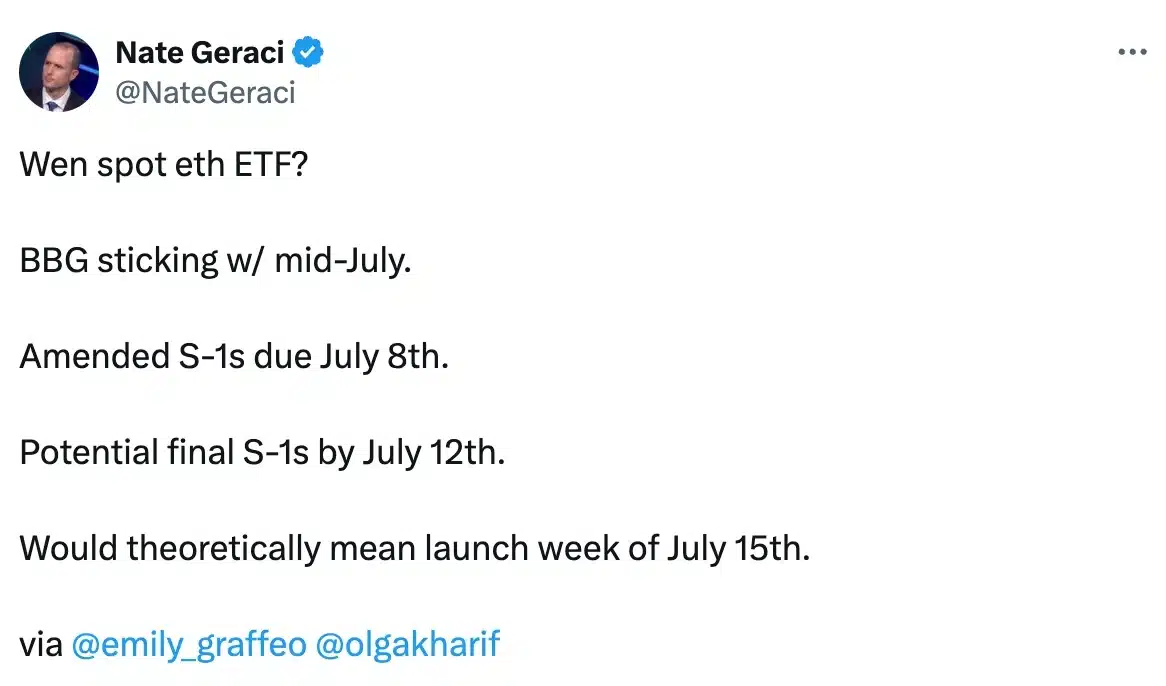

In keeping with Nate Geraci, president of ETF Retailer, it’s extremely possible that the spot ETH ETF will obtain approval on the fifteenth of July.

Supply: Nate Geraci/X

In his publish, Geraci indicated that following a revised S-1 submission for Ethereum ETFs, anticipated in July, remaining approval from the SEC could possibly be granted by the twelfth of July.

Subsequently, based on Geraci, there is no such thing as a purpose why the SEC wouldn’t approve ETH ETFs on the fifteenth of July.

It’s vital to notice that the continuing delay has stems from the SEC’s request on twenty eighth Might for issuers to handle minor queries of their S-1 filings.

The rationale behind the delay

Sources near the state of affairs report that issuers are presently engaged in resolving these issues.

Nevertheless, with the SEC’s prior approval of 19b-4 filings in Might, issues may quickly work in favor of the issuers.

Offering additional readability on the matter, Galaxy Digital’s head of asset administration, Steve Kurz, in a latest interview with Bloomberg TV mentioned,

“Look, we’ve performed this earlier than. That is methodical, that is window dressing, the SEC is engaged. We did it for the Bitcoin ETF, the merchandise are considerably related — we all know the plumbing, we all know the method.”

Bitcoin ETF vs. Ethereum ETF

With the Ethereum ETF approval going through delays, business executives at the moment are drawing comparisons to the Bitcoin [BTC] ETF approvals.

The journey of BTC ETF started in July 2013 when Cameron and Tyler Winklevoss, co-founders of Gemini crypto change, initially filed their utility with the SEC for a spot Bitcoin ETF.

Quick-forward to January 2024, almost a decade later, and after quite a few purposes and rigorous regulatory scrutiny, the SEC lastly granted approval for 11 Bitcoin ETFs.

Nevertheless, some argue that regardless of delays, BTC had a comparatively simple path to approval however the course of for ETH’s ETF approval has been caught up in far more regulatory complexities.

This has led to many believing that ETH ETF won’t be competitors to BTC ETF.

Will ETH match the BTC ETF hype?

Remarking on the identical, Matt Hougan, CIO at Bitwise, throughout a latest episode of the “Bankless” podcast mentioned,

“I don’t assume Ethereum ETFs will match Bitcoin ETFs however I do assume will probably be measured by way of many billions of {dollars}.”

Moreover, regardless of expectations of a constructive influence from the ETH ETF approval date, Ethereum’s worth didn’t rally.

At press time, ETH was buying and selling at $3,351, marking a 2.54% drop within the final 24 hours, based on CoinMarketCap.