Were Bitcoin Miners Behind The BTC Price Crash Below $60,000?

The worth of Bitcoin fell drastically in the direction of the $60,000 mark within the days main as much as the simply concluded halving. On-chain information has make clear what may very properly be the rationale for this value dip in the course of all of the excitement around the halving.

Significantly, information has revealed that some miners have been promoting their holdings within the days main as much as the halving occasion, with the complete BTC holdings of miners hitting a 12-year low.

Miners’ Bitcoin Holdings Hit 12-12 months Low

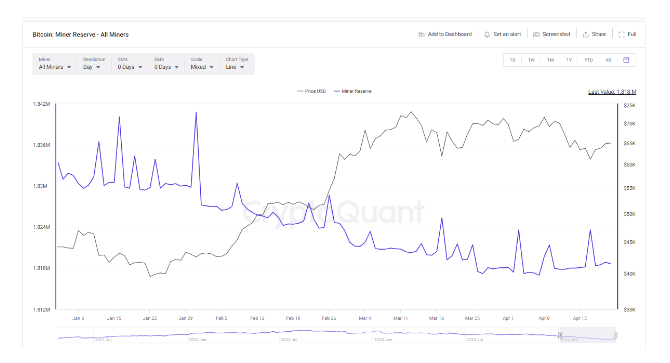

On-chain analytics platform IntoTheBlock famous this fascinating development amongst Bitcoin miners. In keeping with the platform’s “Miners’ Bitcoin Holdings,” the collective BTC reserve throughout numerous miners has now dropped under 1.9 million BTC, its lowest in over 12 years.

Curiously, the metric exhibits that miner reserves have been on a continued development of outflows because the starting of the 12 months, simply after the approval of Spot Bitcoin ETFs. This implies the outflow from miner wallets might be linked to elevated demand from the varied Bitcoin ETF wallets, with the latter now controlling over 4.27% of the full circulating wallets.

As Bitcoin goes into the halving, miners’ BTC holdings hit 12 12 months low. This means that miners have been web sellers main as much as the halving. pic.twitter.com/WNi74RkluG

— IntoTheBlock (@intotheblock) April 19, 2024

On the time of writing, CryptoQuant information places the full variety of miner reserves at 1.818 million BTC, a lower of twenty-two,000 BTC from 1.84 million on January 3. Moreover, this outflow from the miner reserves was exacerbated within the days main as much as the halving, as famous by IntoTheBlock.

“This means that miners have been web sellers main as much as the halving,” IntoTheBlock mentioned in a social media put up.

The persistent promoting stress exerted by miners might have been a contributing consider Bitcoin’s stagnant tempo between $65,000 and $70,000 over the previous weeks. This outflow of BTC from miner wallets into the market appears to have flooded the market with greater than sufficient BTC, which in flip contributed to a crash to $60,000 throughout the week.

Bitcoin is now buying and selling at $64.906. Chart: TradingView

What’s Subsequent For Bitcoin?

The observe of Bitcoin miners promoting their holdings within the days main as much as the halving shouldn’t be uncommon, as demonstrated by their actions in previous halving occasions. On the time of writing, Bitcoin is buying and selling at $64,978, up 8% after rebounding up at $60,000. The a lot anticipated fourth Bitcoin halving has now been accomplished and the trade appears ahead to its impact over the following few months.

The halving is finally a balancing act for miners. Though miners’ revenues are lower in half, the diminished Bitcoin provide and potential value improve might help offset a few of the losses over time. According to a report, Bitcoin miners may promote as much as $5 billion price of BTC after the halving, with the value of the cryptocurrency doubtlessly falling to $52,000.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site fully at your personal danger.