Whales dump Ethereum – should you be concerned?

- Ethereum whale liquidation amidst market volatility raised issues about dwindling engagement.

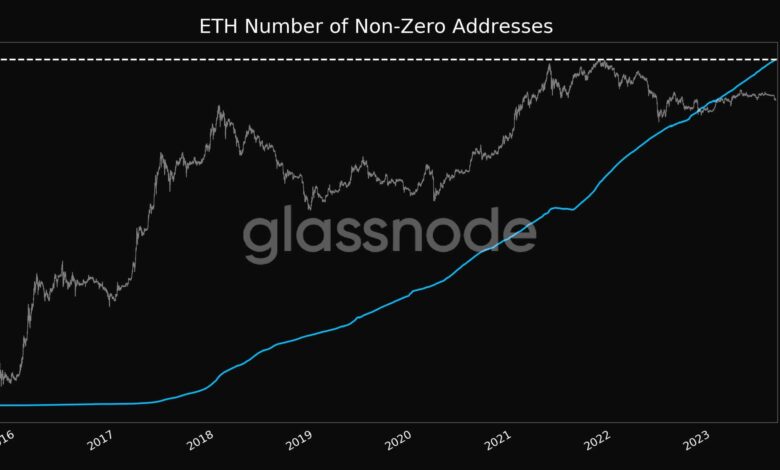

- Regardless of whale disinterest, Ethereum noticed a surge in non-zero addresses, indicating retail traders’ continued curiosity.

Within the wake of a big Bitcoin correction that reverberated by the cryptocurrency market over the previous few days, inflicting value fluctuations throughout numerous cash, Ethereum [ETH] additionally skilled notable impacts.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Resulting from these components, whales began to promote giant parts of their ETH.

In keeping with Lookonchain, a sizeable whale liquidated a ten,600 ETH valued at $17.2 million, at a value level of $1,622. This transaction incurred a lack of $2.9 million for the whale.

A whale dumped 10,600 $ETH($17.2M) at a value of $1,622 7 hrs in the past, with a lack of $2.9M.

The whale traded a complete of 18 tokens, and solely 4 tokens had been worthwhile, with a win price of twenty-two%.

He at the moment has a revenue of $10.8M on $ETH, however misplaced $3.6M on $PDT and $1.3M on $MPL. pic.twitter.com/GzPl8WyHx6

— Lookonchain (@lookonchain) August 23, 2023

A extra complete examination of the transaction information painted a broader image. The mentioned whale ventured into 18 completely different token trades, with solely 4 of them turning out to be worthwhile. This translated to a comparatively modest success price of twenty-two%.

Though the whale managed to build up a revenue of $10.8 million from its Ethereum holdings, the scenario just isn’t solely favorable. It additionally incurred a $3.6 million loss on PDT trades and a further 1.3 million loss on $MPL trades.

As whale curiosity in Ethereum appears to wane, retail engagement tells a special story. Illustrated by information from Glassnode, the variety of non-zero addresses skyrocketed to an all-time excessive of 104,794,621.

This instructed sustained curiosity amongst particular person customers regardless of the continued market volatility.

Supply: Glassnode

Ethereum’s market exercise took middle stage because the Change Influx Quantity surged to a 1-month peak of 9,630.147 ETH. This surge in inflows into exchanges might doubtlessly replicate evolving market sentiment and spotlight potential promoting pressures.

Supply: Glassnode

However, regardless of the rise in alternate inflows, Ethereum’s community exercise exhibited a divergent trajectory. Low fuel utilization indicated a discount usually community exercise, significantly when it comes to good contract interactions.

In distinction, the NFT sector appeared to keep up comparatively secure exercise ranges.

Supply: Santiment

Ethereum’s present panorama

As a result of habits of whales and different components, Ethereum’s value shifted from $1820 to $1627 during the last week, indicating a noticeable decline. Community progress additionally skilled a slowdown, suggesting a potential lower in new consumer onboarding.

Lifelike or not, right here’s ETH’s market cap in BTC’s phrases

Moreover, Ethereum’s transaction velocity exhibited a decline, hinting at much less frequent buying and selling actions.

The MVRV ratio, a metric used to gauge whether or not holders are experiencing earnings or losses at a given time, provided a combined perspective for Ethereum. The damaging MVRV ratio implied that a good portion of Ethereum holders weren’t realizing earnings at press time.

Supply: Santiment