What Binance’s record-high stablecoin reserves mean for Bitcoin prices

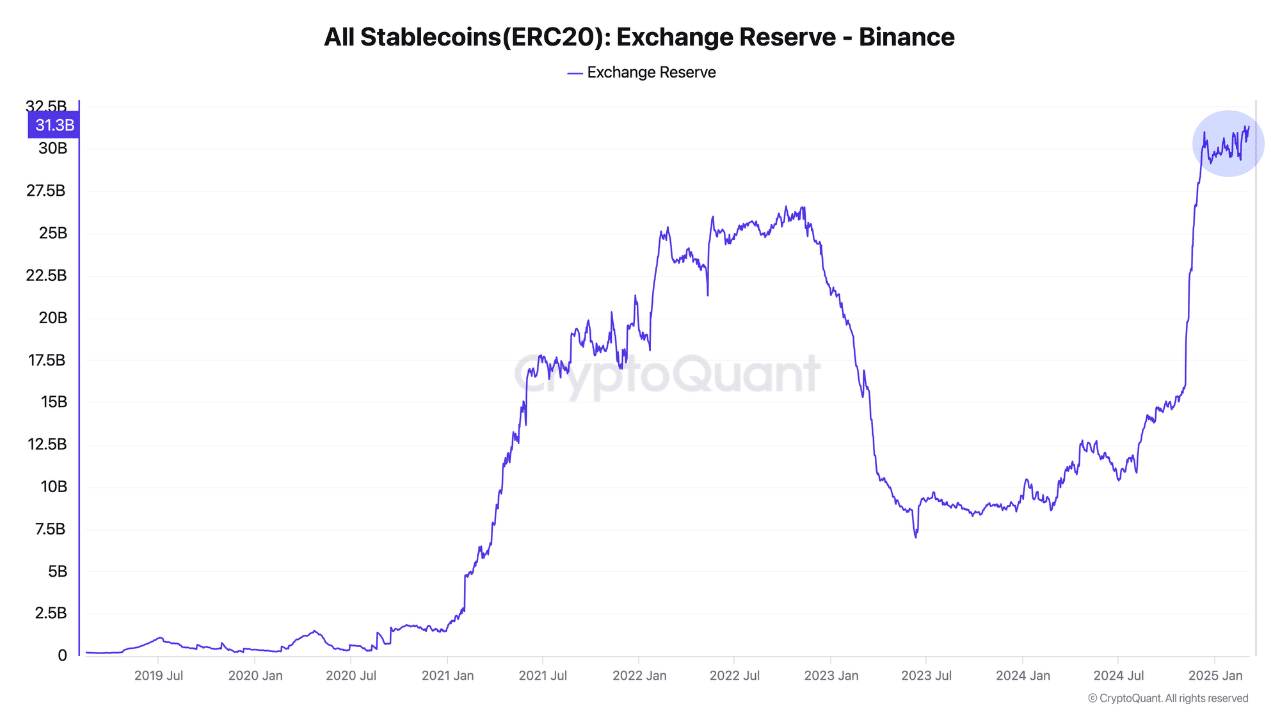

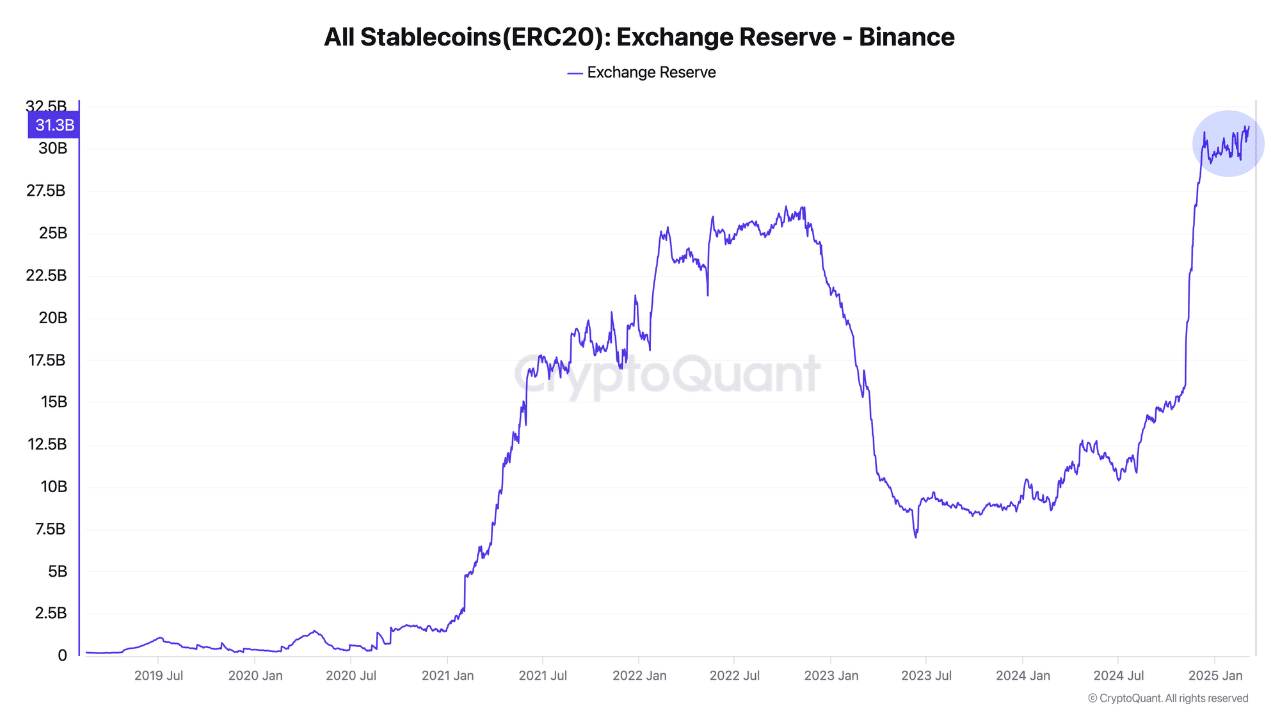

- Binance stablecoins reserve surged to document highs above $31B.

- BTC value was muted regardless of President Trump’s creation of a strategic BTC reserve.

Binance [BNB] stablecoins have hit a document excessive of $31.5B, prompting a CryptoQuant analyst to challenge {that a} Bitcoin upside could possibly be possible. In accordance with pseudonymous analyst Darkish Fost, the stablecoin improve could possibly be attributable to;

“Traders are channeling liquidity into Binance in preparation for market entry, reflecting confidence in each the market and the change.”

Supply: CryptoQuant

Fost added that previous stablecoin spikes boosted BTC.

“Traditionally, durations of rising stablecoin reserves on Binance have typically coincided with, and even preceded, a rise in BTC costs and a broader upswing within the crypto market.”

Liquidity situations eased

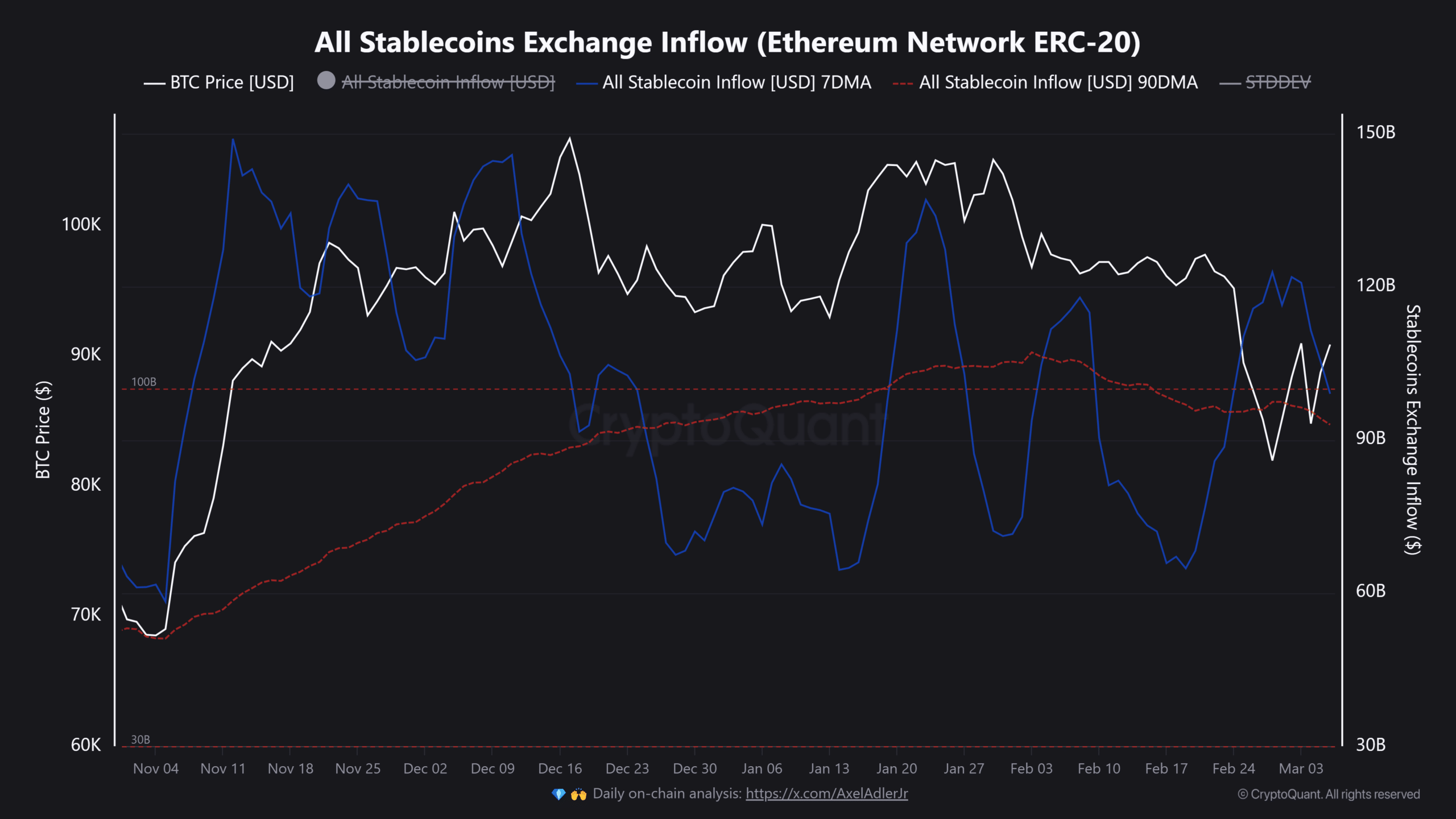

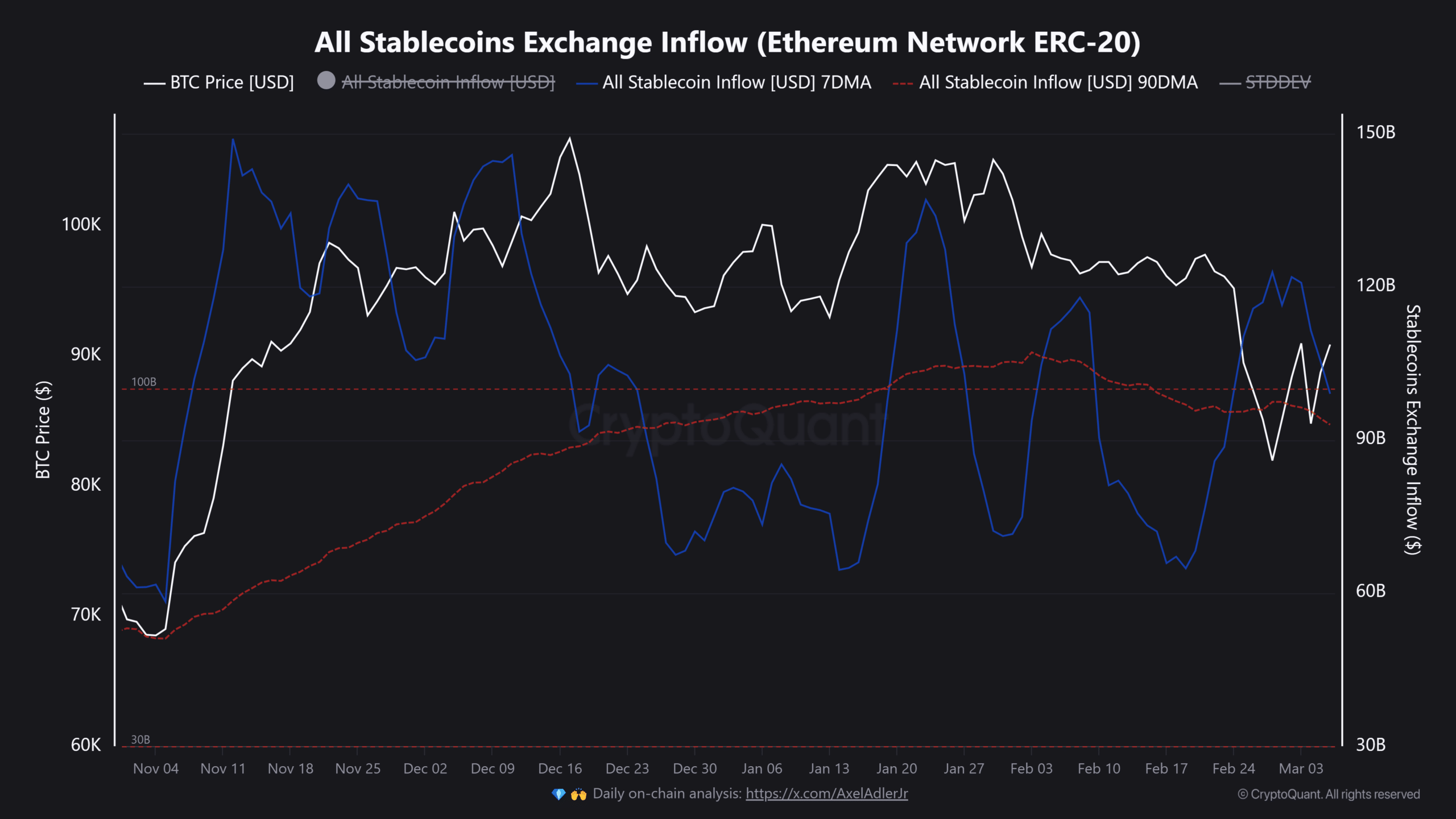

Regardless of the bullish potential from the Binance stablecoins stash, the general liquidity situations have eased barely.

In accordance with CryptoQuant, stablecoins change influx (which tracks on-chain liquidity) declined from $121B to $99B in early March.

Supply: CryptoQuant

Liquidity declines have restricted BTC’s upward motion, whereas liquidity surges have triggered bounces, as noticed final November and January.

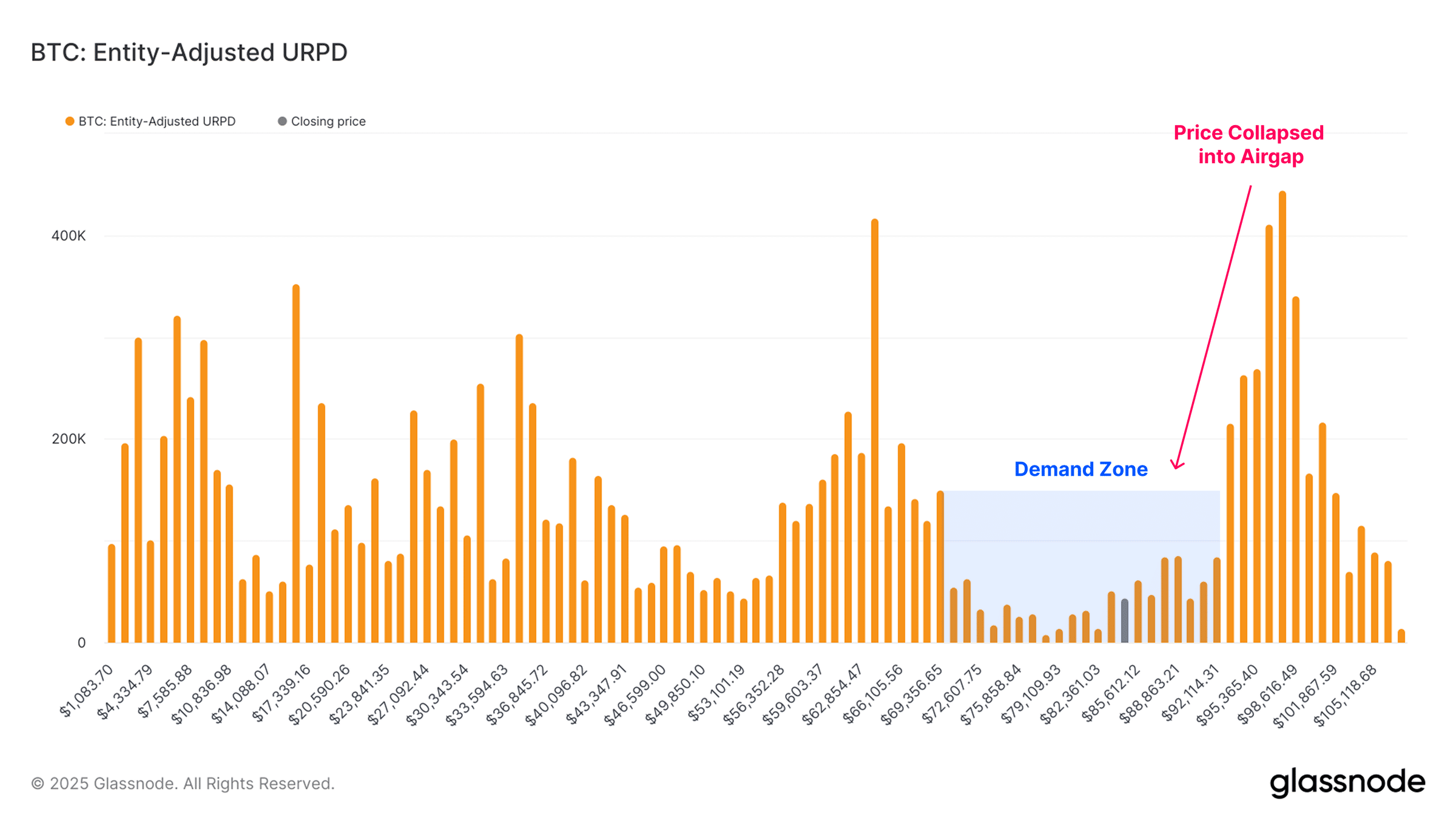

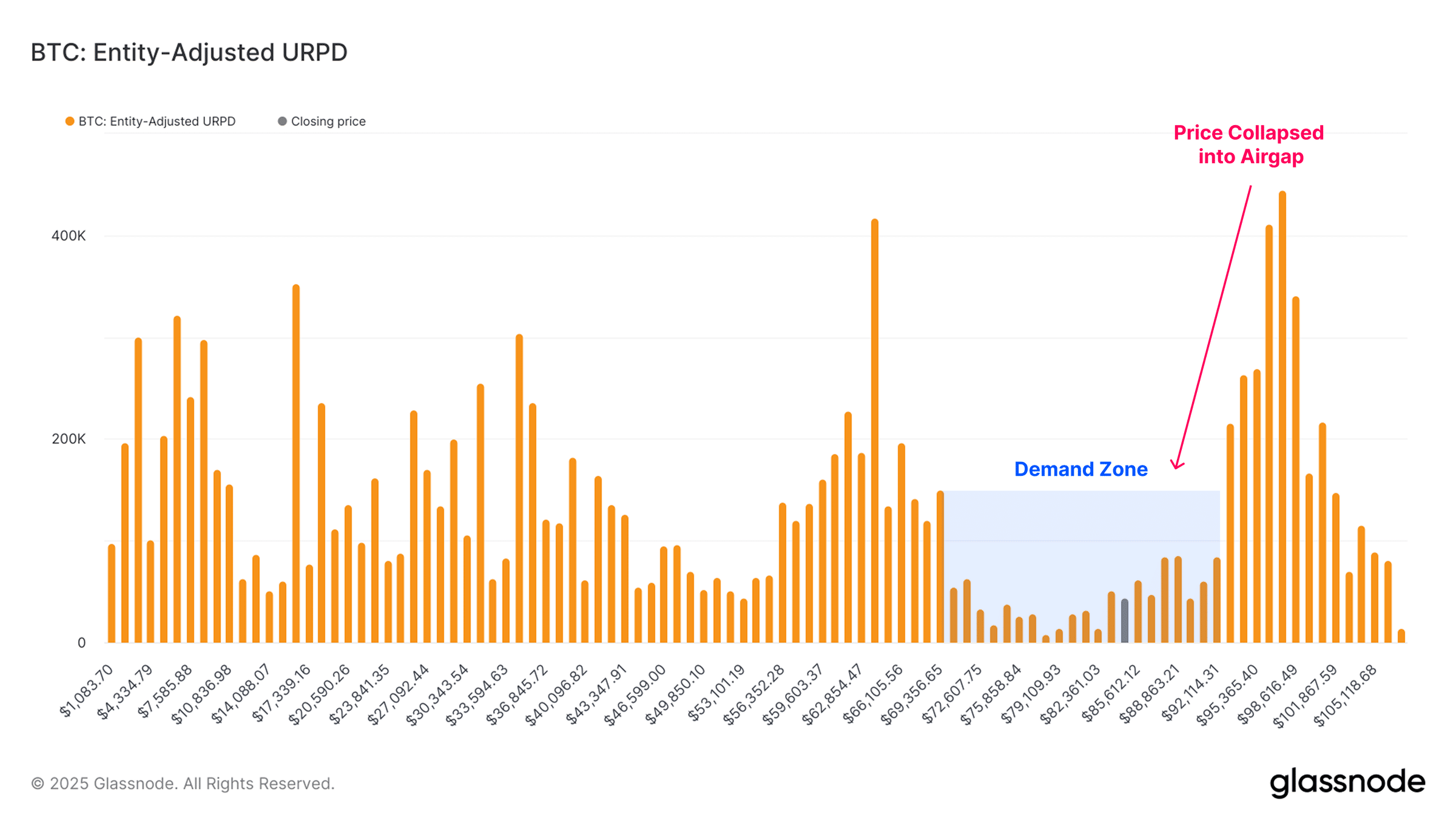

In 2025, liquidity situations have fluctuated between $60 billion and $120 billion, reflecting market volatility. Glassnode highlights that native upside momentum can solely kind above $92K, the common value foundation for short-term holders.

Nonetheless, a sustained draw back threat might power bulls to defend the $70K-$71KK as the following key assist. The agency stated,

“Sturdy confluence between value construction and key on-chain metrics point out that the $92k stays a essential degree for Bitcoin to re-establish upwards momentum, while the ~$70k degree seems to be a key zone for the bulls to construct assist if reached.”

Supply: Glassnode

The blockchain evaluation agency reported that over $14 billion price of BTC was bought when costs fell under $86K, marking this as a requirement zone.

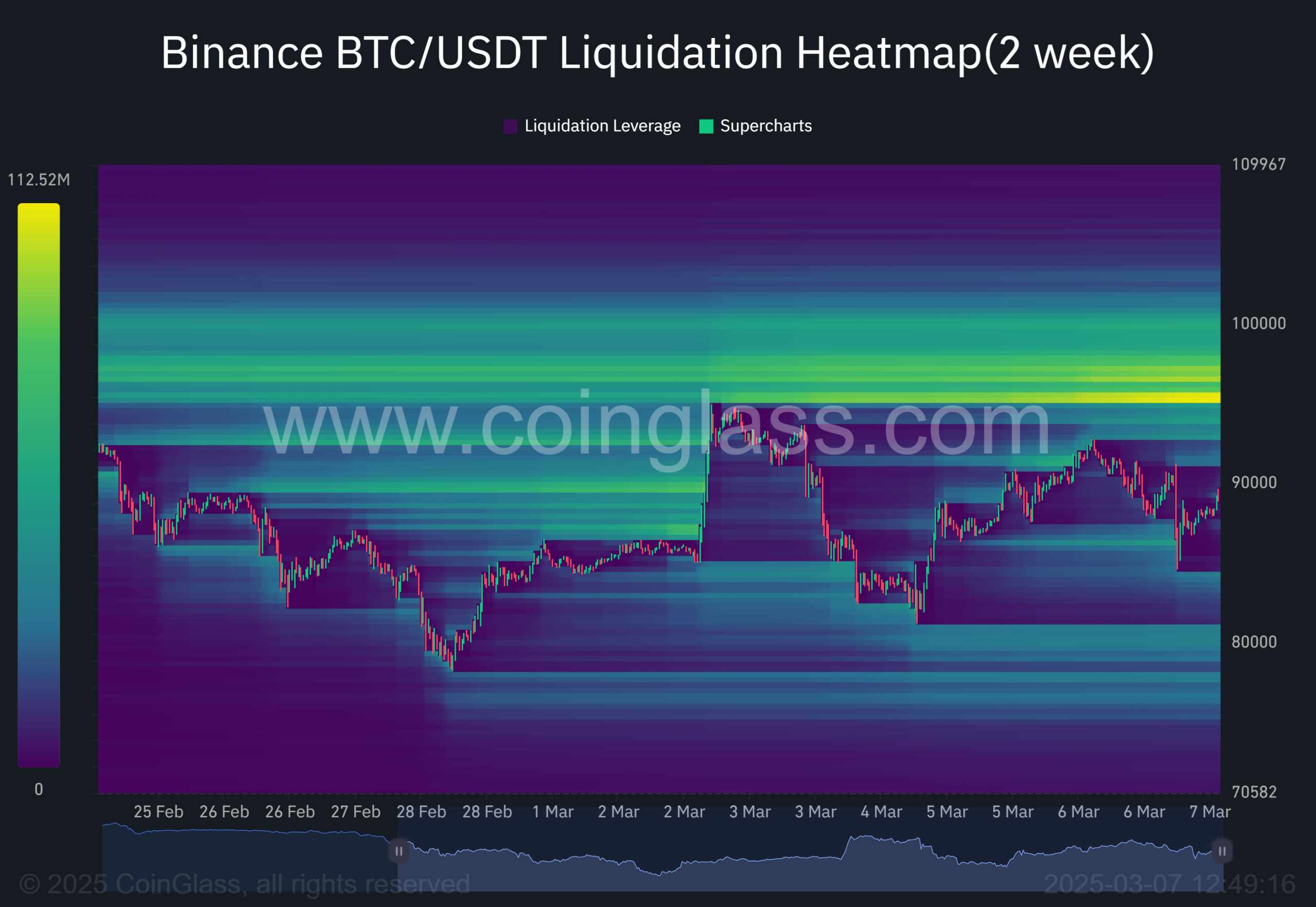

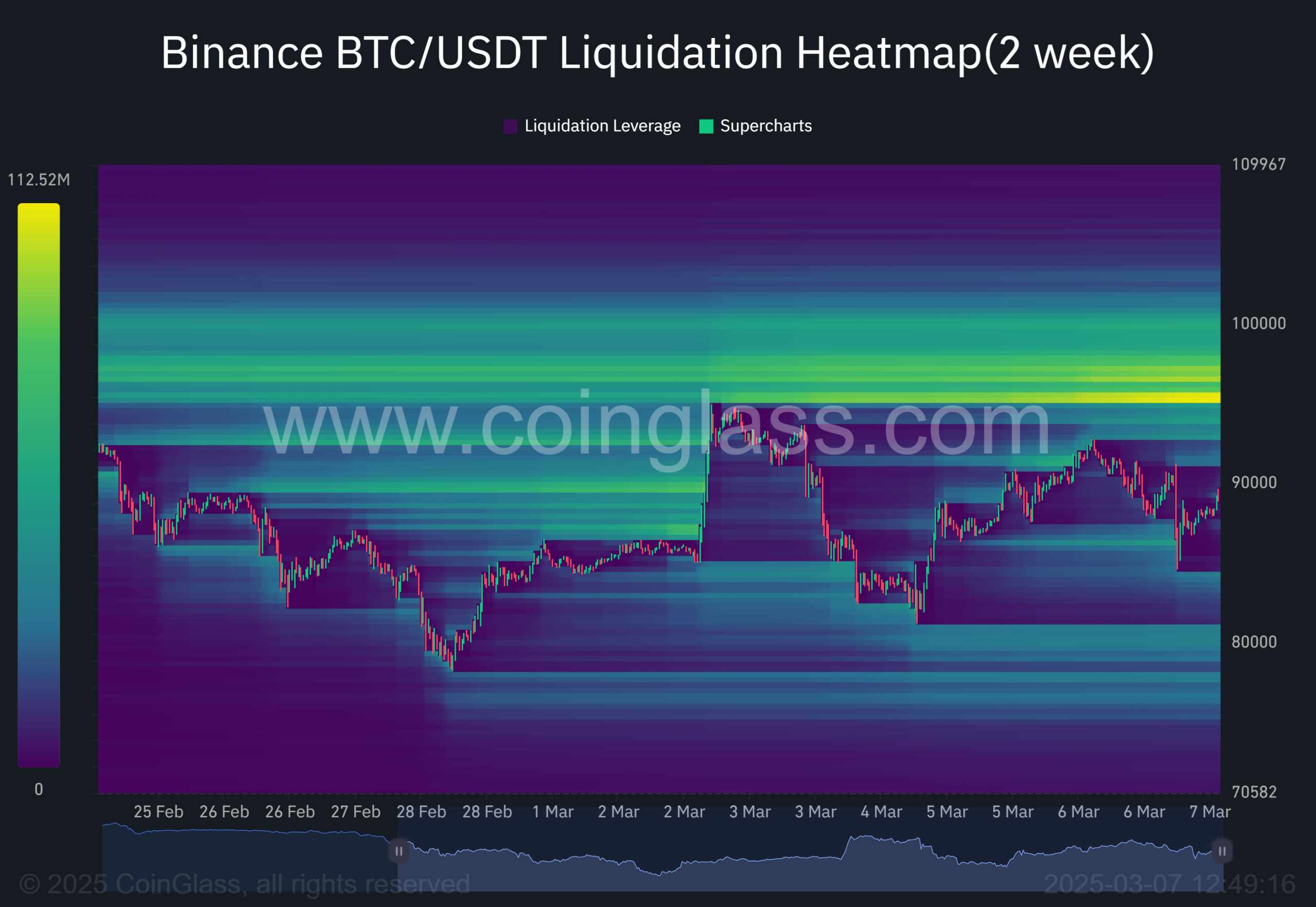

This means that the realm above $70K might act as a robust assist degree. From a liquidation heatmap perspective, vital liquidity was noticed at $95K on the two-week chart.

Moreover, lengthy liquidation ranges gathered within the $75K-$77K vary, reinforcing Glassnode’s evaluation of potential assist above $70K.

Supply: Coinglass

In the meantime, the most important crypto was valued at $89K, at press time, regardless of President Trump’s perceived bullish creation of a strategic BTC reserve.