What caused Bitcoin miners to dump their coins in October

- Miners’ earnings from transaction charges elevated within the final week.

- Miners liquidate their BTC stashes to satisfy their operational prices.

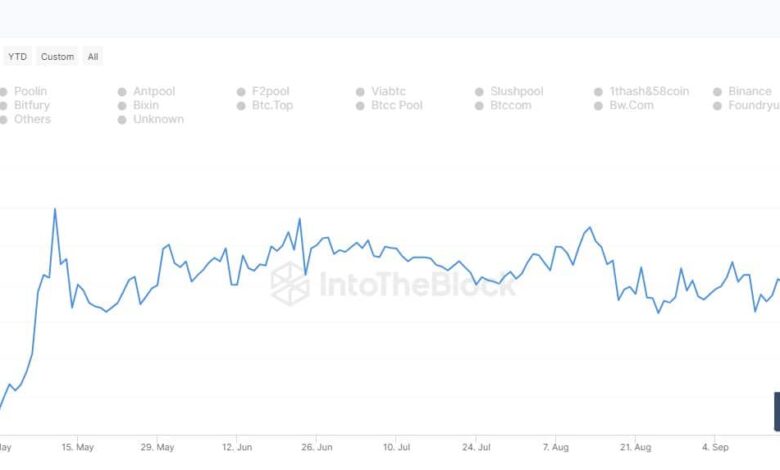

Bitcoin [BTC] miners shunned hoarding mentality and liquidated a major chunk of their holdings in the previous couple of days. In line with on-chain analytics agency IntoTheBlock, miner reserves tanked by greater than 20,000 because the begin of the week, marking probably the most intense wave of promoting since April.

Supply: IntoTheBlock

Learn BTC’s Worth Prediction 2023-24

Significance of miner sell-offs

Promote-offs are usually seen as bearish occurrences since they swamp the market with extra cash. Nevertheless, miner liquidations happen regularly and shouldn’t be seen as an anomaly.

Miners are liable for bringing new BTC cash into circulation. This occurs within the type of mounted rewards, presently at 6.25 BTC, for each block they validate and add to the Bitcoin community.

Whereas miners are rewarded in BTC for his or her efforts, money is required to cowl their typically excessive mining expenditures resembling equipment, energy, and leases. Therefore, they continuously dump their Bitcoins.

Sometimes, miners watch for a significant rise within the worth of BTC earlier than promoting them off. Nevertheless, this didn’t maintain true within the present state of affairs. The king coin fell greater than 2% from the start of the week till press time, knowledge from CoinMarketCap revealed.

Supply: CoinMarketCap

Miners capitalizing on final week’s positive factors?

A more in-depth inspection revealed that the proportion of miners’ whole earnings from transaction charges witnessed a noteworthy spike final week. Curiously, this was additionally the time when BTC rallied previous $28,000 for the primary time in six weeks.

These developments may have crammed miners’ coffers sufficiently. Therefore, fearing additional worth drops that will have impacted their income, these gamers shortly offloaded their luggage.

Supply: Glassnode

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Whereas miner income noticed a transparent improve in latest days, it was necessary to place it within the broader perspective. For the reason that unprecedented bounce within the first week of Could, transaction charges collected by miners have been on a downward spiral.

The bearish nature of the market restricted the complete utilization of the blockchain that used to occur earlier. In consequence, transactions fell drastically and in flip the cash which miners made by validating transactions.