What does Ethereum’s latest revisit to key historical levels mean for you?

- A surge in demand has been noticed amongst U.S. traders, who seem wanting to accumulate ETH

- Analysts predict the following potential worth goal may exceed $10,000, fueled by an anticipated rally

Ethereum [ETH], the world’s largest altcoin, gained by nearly 10% in just below every week to commerce at underneath $3,900 at press time – An indication of renewed curiosity within the cryptocurrency. That’s not all although.

Owing to rising curiosity from U.S. traders and declining alternate reserves, ETH may register a big upward transfer on the charts quickly.

ETH attracts extra curiosity from U.S. traders

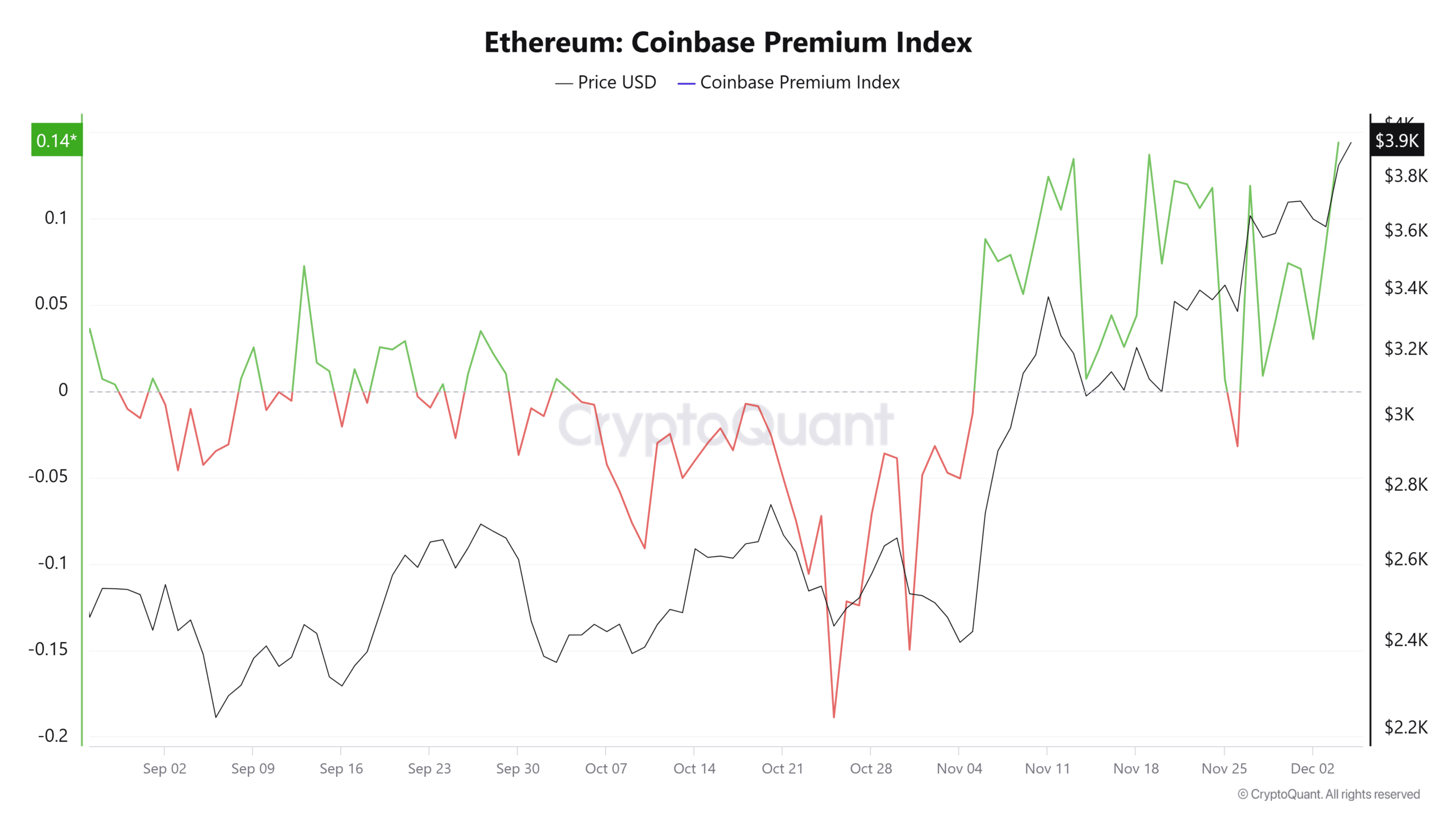

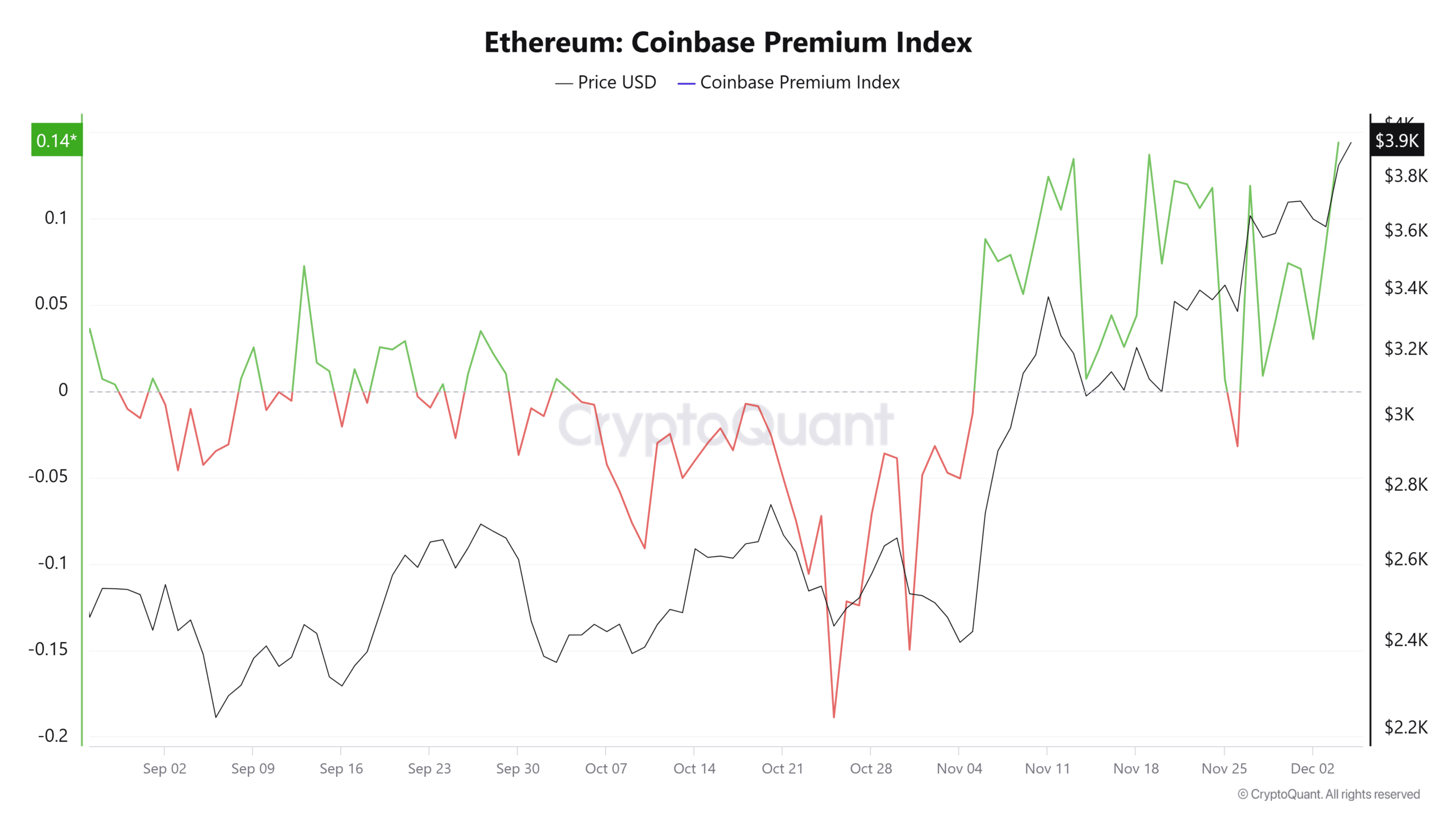

Curiosity in ETH amongst U.S. traders has risen sharply, as evidenced by the Coinbase Premium Index on CryptoQuant.

On the time of writing, the index had a worth of 0.1440 – Its highest stage since April 2024. Right here, it’s price noting that this was a interval throughout which ETH’s worth was notably increased.

The Coinbase Premium Index tracks the value distinction between ETH on Coinbase, a significant U.S-based cryptocurrency alternate, and different international platforms like Binance.

Supply: Cryptoquant

A better studying signifies higher demand for ETH amongst U.S traders, relative to worldwide markets.

The aforementioned surge within the index could be interpreted to imply rising curiosity within the asset, which may result in additional upward momentum for ETH.

What’s subsequent for ETH?

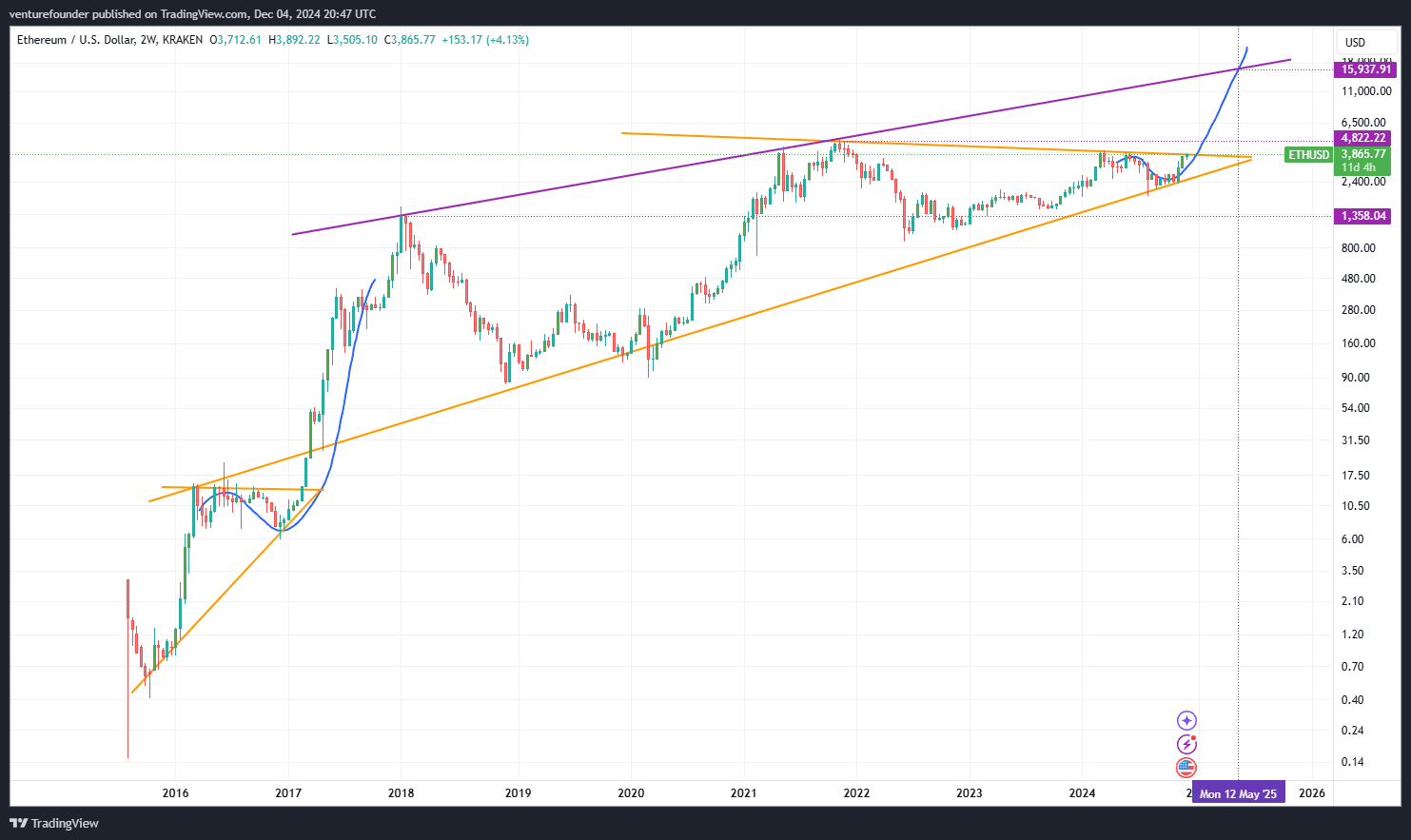

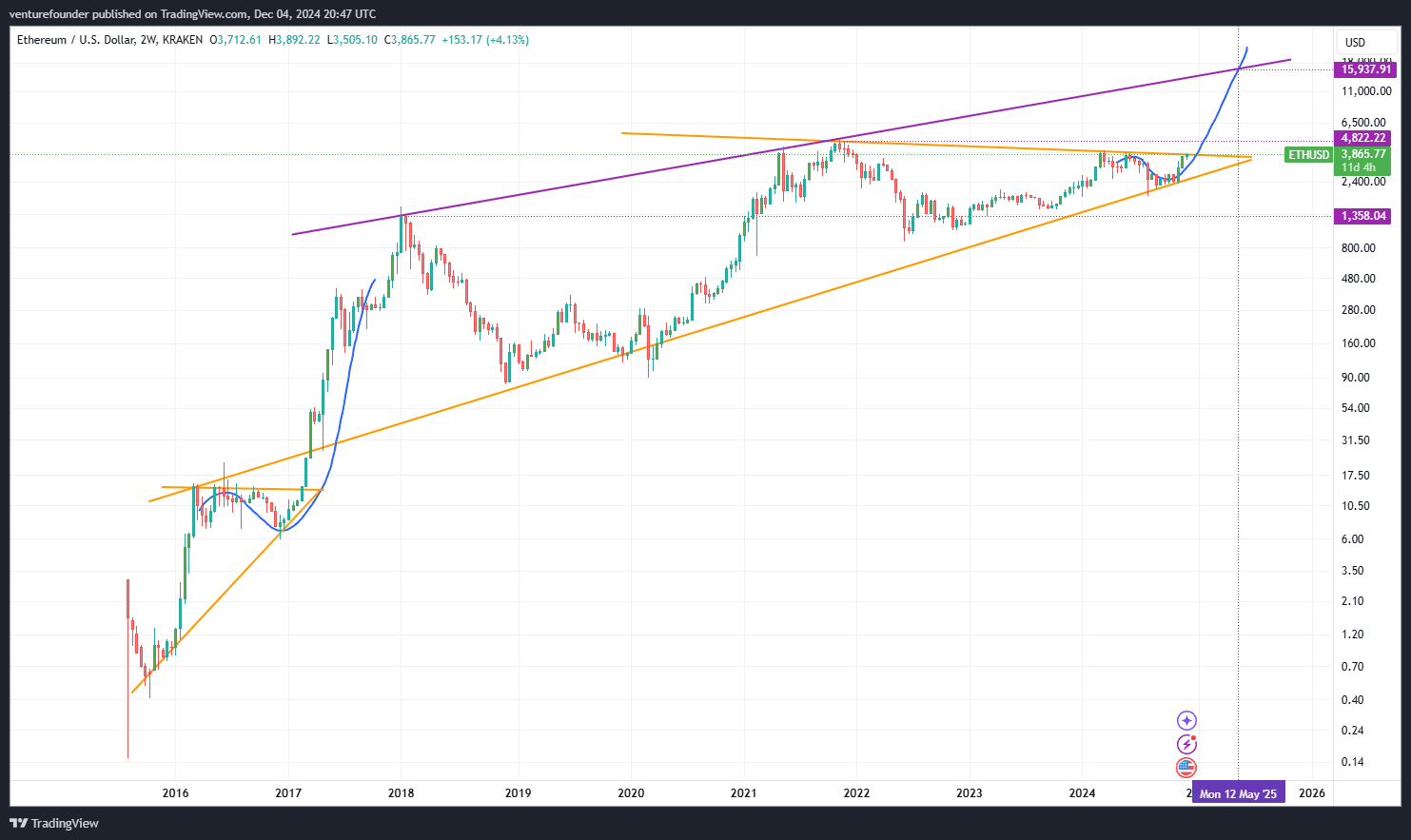

In accordance with analyst Enterprise Founder, ETH could also be getting ready to breaking out from a three-year consolidation triangle sample. This usually alerts the beginning of a rally.

As soon as this breakout happens, pushed by important shopping for momentum—possible from U.S. traders and different market contributors—ETH may see its worth run up. There could also be potential targets ranging between $11,000 and $15,000 too, as indicated by the hooked up chart.

Supply: X

The favored analyst added,

“[ETH] worth goal: $15,937.”

Value declaring although that the asset’s skill to succeed in these ranges is determined by whether or not ETH can replicate the “impulsive” worth transfer it noticed between 2016 and 2017. The identical is marked by the blue line on the chart.

If this sample holds, ETH may proceed its upward trajectory in direction of the expected worth ranges.

Market gears up for upswing

Moreover, latest information revealed a constant decline in ETH Trade Reserves, with the identical standing at 19.3 million ETH at press time.

A fall in Trade Reserves usually alerts a discount within the circulating provide of ETH on exchanges. When mixed with rising demand, this typically results in upward worth motion.

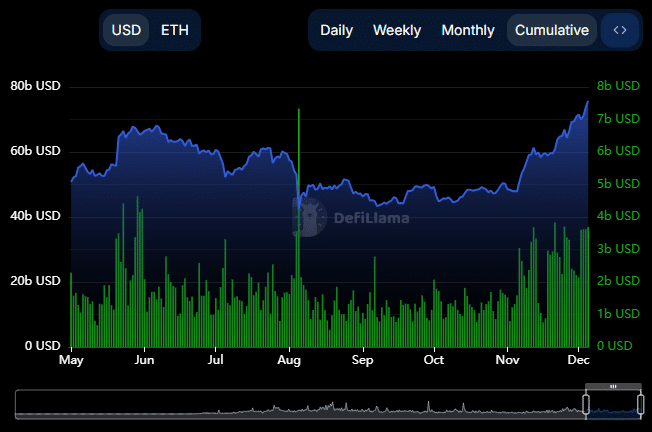

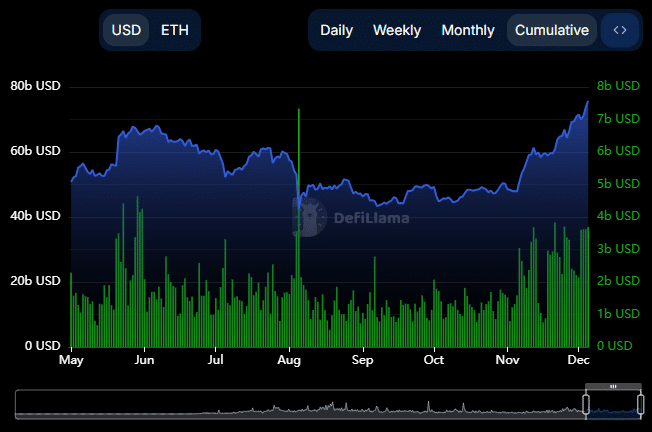

Moreover, Ethereum’s Whole Worth Locked (TVL)—which measures the quantity of ETH invested throughout varied protocols—surged to $71.08 billion. It is a stage that was final seen in 2022.

Supply: DeFiLlama

All these tendencies cumulatively recommend a constructive outlook for ETH, reflecting sturdy market confidence and the potential for sustained progress as demand rises.