What Ethereum’s rising demand says about ETH’s price action

- Demand for ETH grew as put-to-call ratios declined

- ETH’s worth motion remained stagnant as costs fluctuated

Ethereum [ETH] has remained stagnant across the $3500-mark for fairly a while now. Regardless of its sideways motion, nevertheless, bullish sentiment round ETH has been rising.

Ethereum demand surges

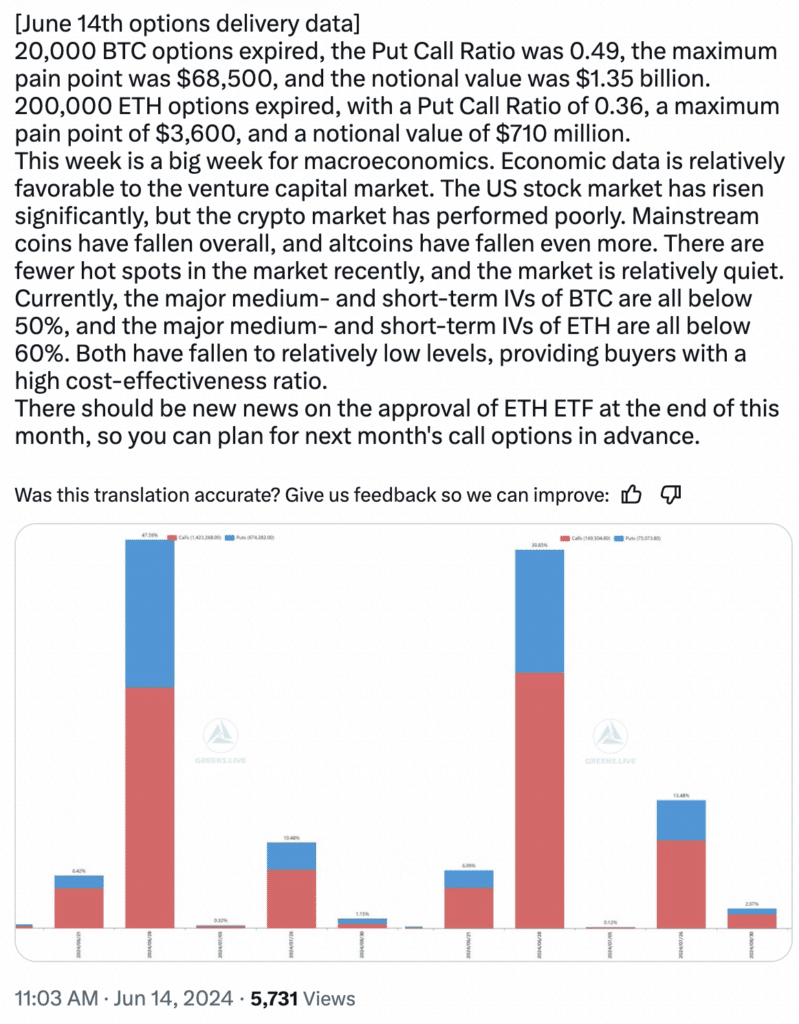

In response to latest information, 200,000 Ethereum choices contracts lately expired, and the info surrounding this occasion hinted at a surge of bullish sentiment within the Ethereum market. The Put-Name Ratio, a key indicator of market bias, sat at a low 0.36 at press time.

This implies there was considerably much less shopping for of put choices in comparison with name choices – An indication that almost all choices merchants anticipate Ethereum’s worth to rise. Additional including to the optimism is the utmost ache level of $3,600. This worth degree signifies the purpose the place most choices contracts expire nugatory.

If Ethereum surpasses $3,600 at expiry, most name choices will likely be worthwhile, once more reflecting a bullish bias.

Lastly, low implied volatility (IV) under 60% throughout all short-term ETH choices contracts additional fueled the bullish outlook. Right here, implied volatility displays anticipated worth motion, and decrease IV suggests buyers anticipate Ethereum’s worth to stay secure or hike within the close to time period.

Supply: X

Trying on the worth motion

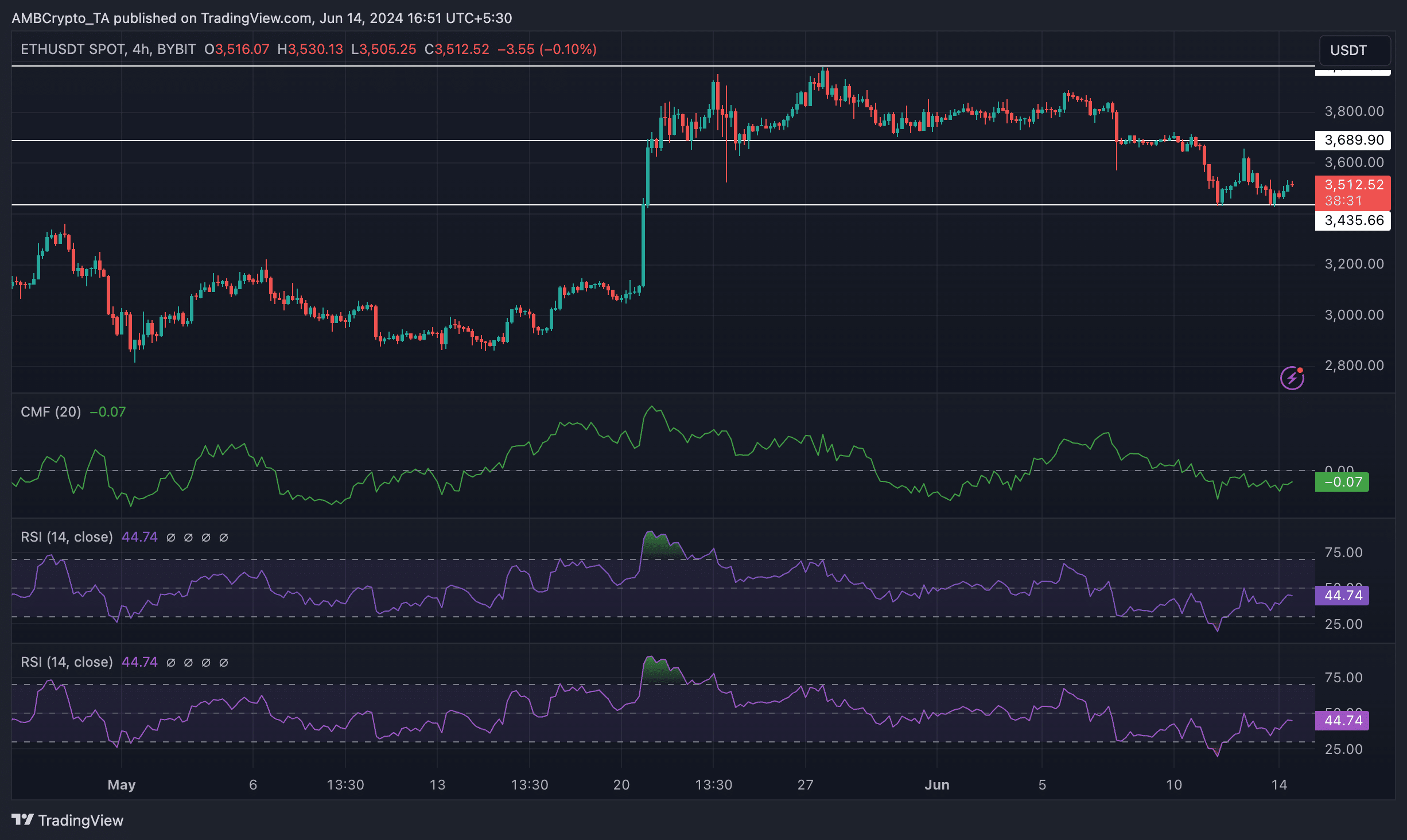

At press time, ETH was buying and selling at $3,512.52. Whereas the value of ETH has appreciated considerably after 20 Could, as time went on, the bullish sentiment round ETH depleted itself. In reality, because the altcoin’s worth fell once more after 27 Could, its market pattern reversed itself too.

If bearish sentiment persists, the value of ETH might go all the way down to the $3,000-level. The CMF (Chaikin Cash Stream) for ETH fell considerably throughout this era as nicely.

This indicated that the cash movement for ETH fell materially. The RSI (Relative Energy Index) for ETH was additionally comparatively low. The declining RSI could possibly be an indication of ETH’s bullish momentum waning on the charts.

Supply: Buying and selling View

How will new addresses adapt?

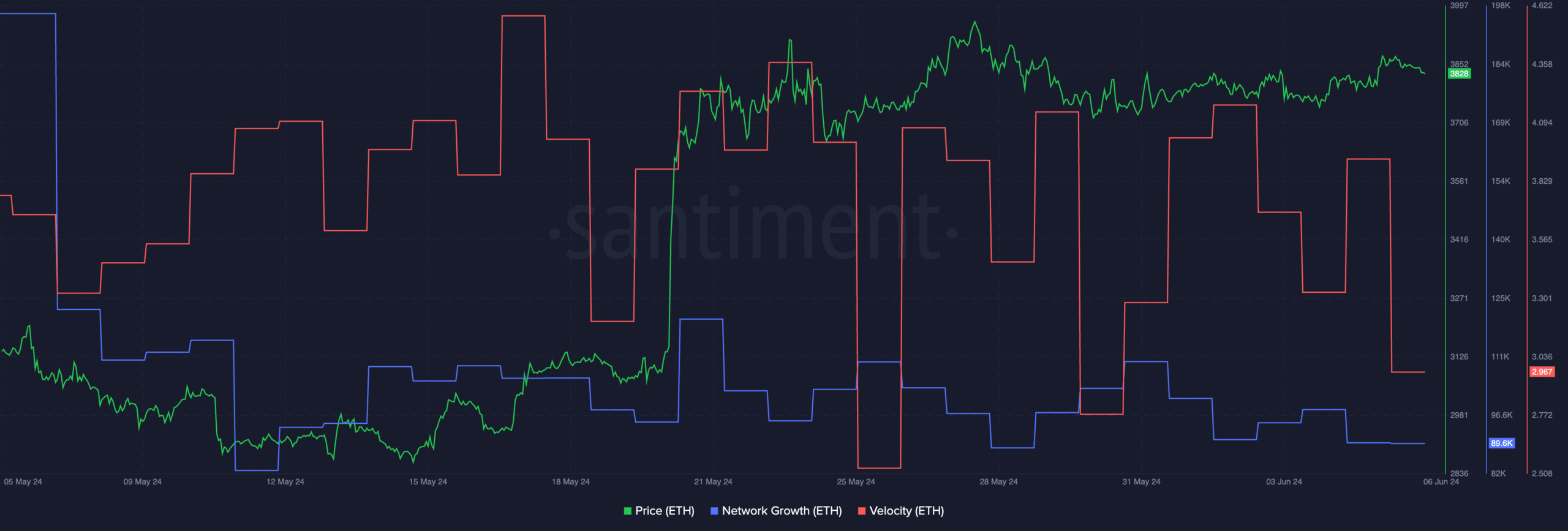

AMBCrypto’s evaluation of Santiment’s information revealed that the community development for ETH additionally fell materially as the value of declined. The falling community development implied that new addresses have been shedding curiosity in ETH and weren’t keen to purchase the altcoin on the latest low cost.

Learn Ethereum (ETH) Worth Prediction 2024-25

If this pattern continues and addresses the refusal to purchase extra ETH, it might additional impression the value of ETH negatively.

Furthermore, the speed of ETH additionally plummeted throughout this era, implying that the frequency at which the trades had been occurring had additionally fallen considerably over the previous few days.

Supply: Santiment

Nonetheless, if the recognition of ETFs continues to rise, the general curiosity in ETH may even develop considerably as Wall Avenue cash flows in.