What is Macro/Crypto Summer? Don’t Miss Out, Says Expert

In a thread on X (previously Twitter), Raoul Pal, a famend buying and selling guru and the founder/CEO of World Macro Investor and Actual Imaginative and prescient, has illuminated the crypto group in regards to the creation of what he phrases because the “Macro/Crypto Summer time.” This era, based on Pal, is not only a fleeting season however a major part within the monetary and cryptocurrency markets, deeply rooted within the cyclical nature of the worldwide economic system.

Why The Macro/Crypto Summer time Issues

Pal elaborates on the idea of the “Macro Summer time,” explaining it as a pivotal part in “The All the things Code” cycle, carefully following the Monetary Circumstances Index, which traditionally precedes the cycle by roughly ten months. The ISM (Institute for Provide Administration) index, a key indicator of financial well being, typically bottoms out throughout this era, marking the beginning of GDP progress.

Associated Studying

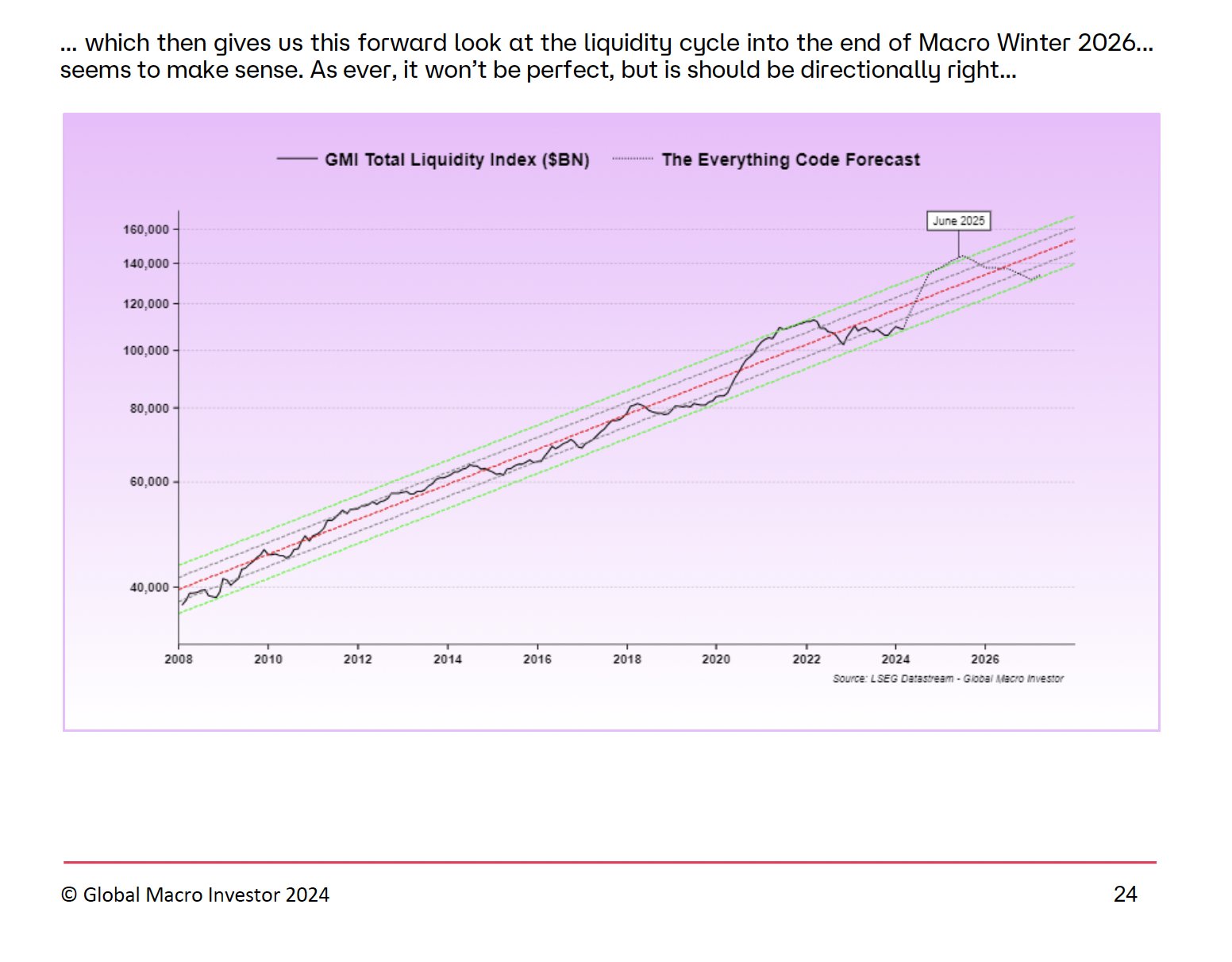

Pal’s thesis attracts consideration to the “near-perfect 3 1/2 yr cyclicality” within the ISM enterprise cycle, propelled by liquidity dynamics and the debt refinancing cycle at its core. He underscores the importance of liquidity: “And that’s pushed by liquidity, which bottomed on the finish of 2022… macro summer time and fall are all about liquidity rising and is a core a part of The All the things Code thesis.”

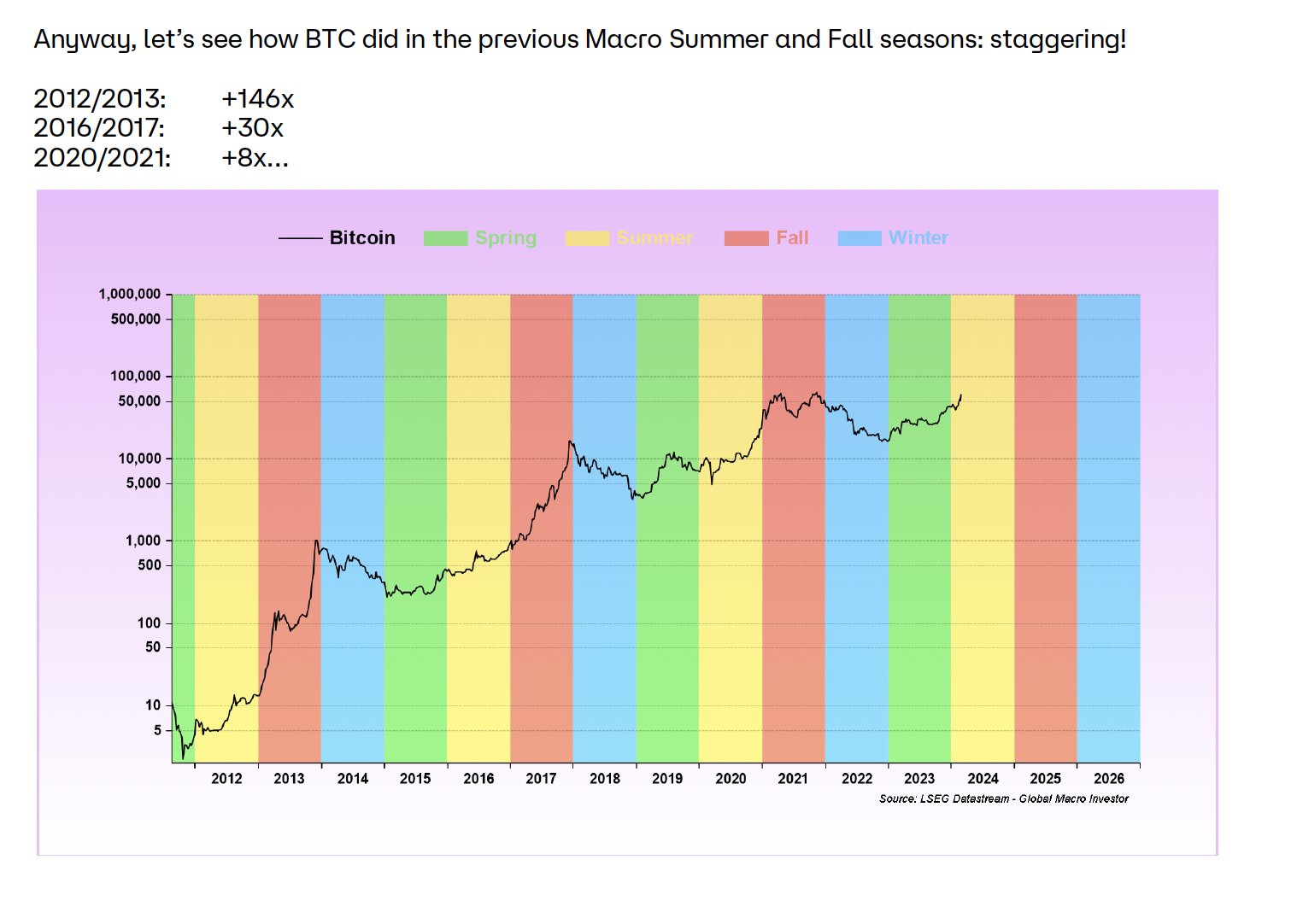

This inflow of liquidity is essential for tech shares, which traditionally thrive throughout these phases. But, it’s Bitcoin and, extra broadly, the cryptocurrency market that exhibit probably the most dramatic responses. Pal presents staggering progress figures from previous Macro Summer time and Fall seasons to underscore his level:

- Bitcoin: Noticed will increase of “2012/2013: +146x, 2016/2017: +30x, 2020/2021: +8x…”

- Ethereum: As an altcoin through the 2016/2017 and 2020/2021 cycles, it achieved “2016/2017: +1,770x, 2020/2021: +41x.”

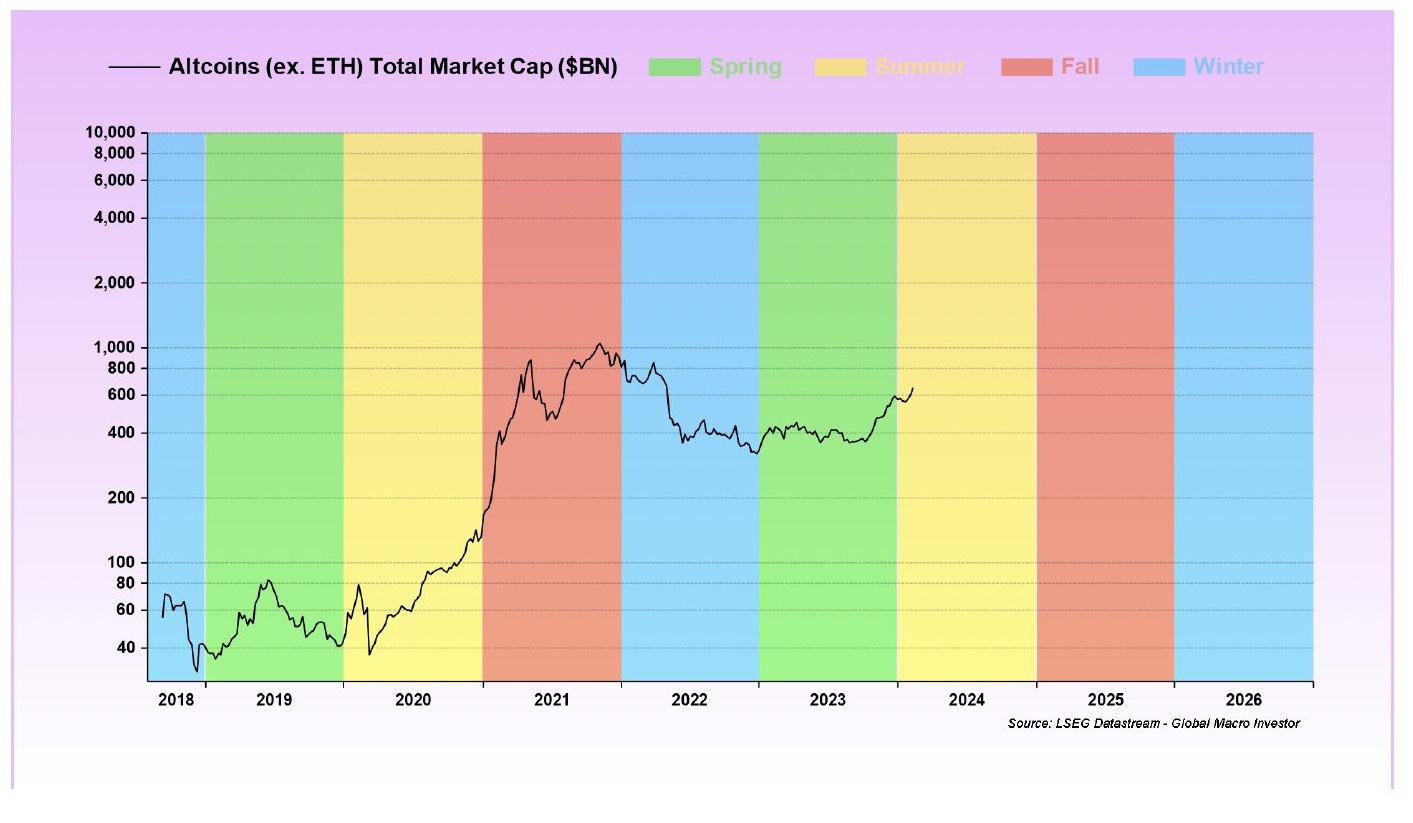

- Altcoins (excluding ETH): Witnessed an mixture market cap rise of “+24x” within the final cycle.

“Wild! After we simply have a look at Altcoins ex-ETH (we solely have shorter knowledge for the final cycle), your entire market cap rose +24x! And that features 1000’s of nugatory tokens that didn’t rise, so I’m not simply cherry-picking winners right here,” Pal remarked.

DOGE, a well-liked meme coin, is talked about by the knowledgeable as one other prime instance of the “energy of Crypto Summer time and Fall,” with its worth experiencing important multipliers – “2016/2017: +136x, 2020/2021: +370x” – within the aforementioned cycles.

These figures underline the numerous affect of macroeconomic cycles on crypto valuations, with Pal mentioning the alignment of those cycles with Bitcoin’s halving occasions. “Crypto summer time has began and totally develops post-halving,” he states, highlighting the interconnectedness of those cycles with the broader monetary panorama.

Associated Studying

Notably, Pal’s evaluation doesn’t cease on the previous; it seems to be ahead, suggesting that liquidity is predicted to rise all the best way into the tip of 2025. This anticipation is rooted in a posh interaction of world monetary mechanisms, together with the potential for elevated US cash printing in response to an enormous ramp-up in curiosity funds and adjustments in Fed Internet Liquidity and the Treasury Common Account (TGA).

“Will the US be a part of the summer time occasion? […] I do know it appears unattainable now, however the US is on the verge of an enormous ramp-up in curiosity funds. […] in some unspecified time in the future – the steadiness sheet will cease shrinking, which is sufficient to unleash liquidity into the system. […] I can not see how they don’t massively broaden liquidity, a method or one other.

In the meantime, Pal predicts that it gained’t be simply the US injecting liquidity into the monetary techniques within the coming months. “I’ve no thought whether or not it’s China, the EU, Japan or the US that drives this or possibly a little bit of all. Time will inform,” he remarked.

Pal attributes his funding methods, particularly in tech and crypto, to the insights gained from The All the things Code. This strategy has ready him for the unfolding Macro Summer time, with a eager eye on the altcoin market and the so-called “Banana Zone.” He concludes:

However the larger recreation is but to be performed out as Alt season arrives and we totally enter the Banana Zone. The Banana Zone cometh, and it’s a big wealth-generating machine. Persistence can be rewarded. Within the meantime, don’t fuck this up. #DFTU

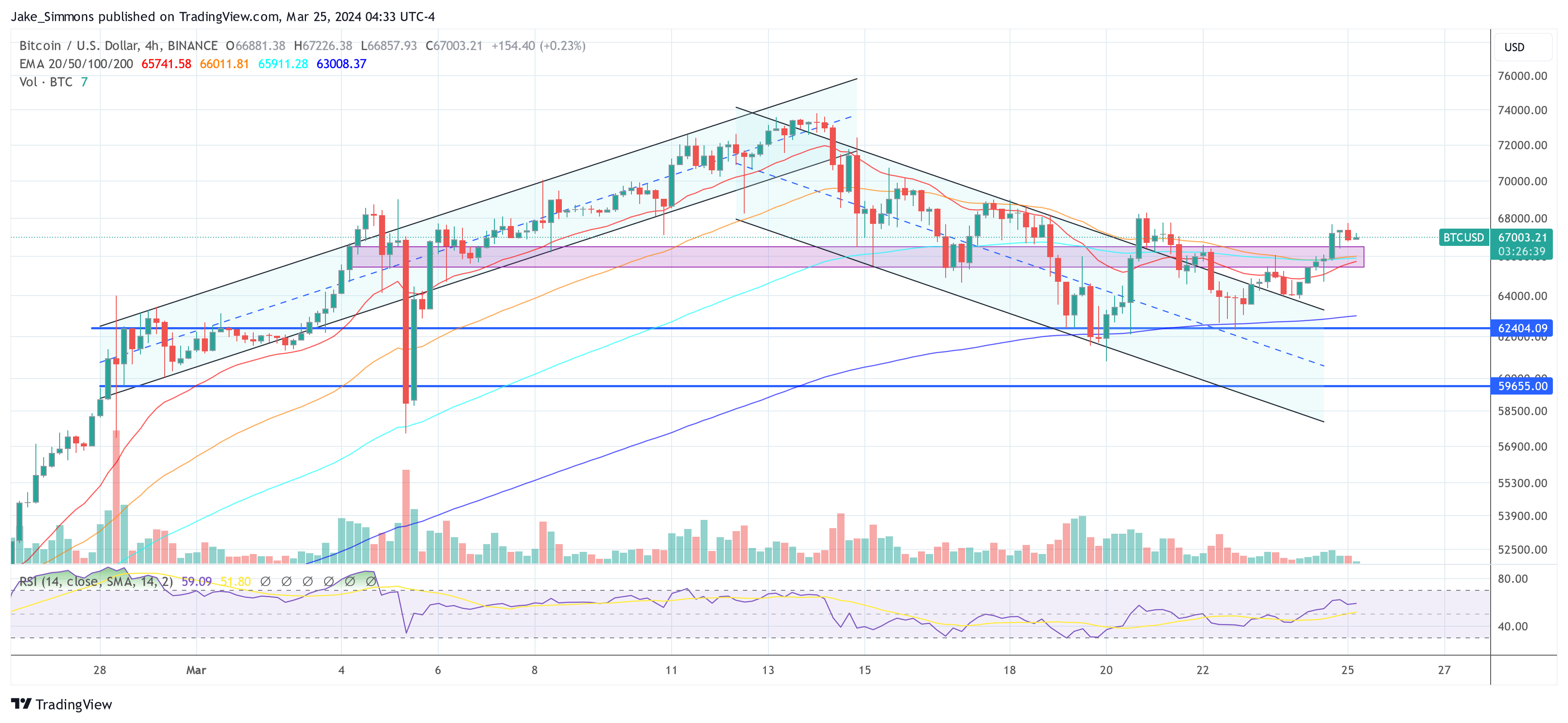

At press time, BTC traded at $67,003.

Featured picture from Shutterstock, chart from TradingView.com