Bitcoin ETF approval could take BTC ‘as high as $180k’: Analyst

- Hedge fund founder Tom Lee opined that BTC would cross its ATH shortly after the ETF approval.

- One other huge participant out there predicted a surge in liquidity.

The anticipation surrounding a possible Bitcoin [BTC] spot Change-Traded Fund (ETF) approval has been a serious matter of debate throughout the cryptocurrency group currently. For a lot of buyers, regulatory acceptance would affect the BTC worth positively.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Nonetheless, a couple of skeptics don’t consider {that a} go-ahead by a centralized entity would do something nice for the value motion. One notable person who has commented on the matter is Tom Lee.

$150,000 or nothing

Lee, who has been repeatedly bullish on BTC, stated he was not shocked that August has been a weak month for the coin. In his interview with CNBC, he based mostly his opinion on BTC’s historic efficiency. He famous that traditionally, a powerful July for BTC equals an unimpressive August.

On the ETF utility, the founding father of Fundstrat International Advisors, a market analysis agency, stated,

“If the Bitcoin spot ETF will get authorized, I feel the demand would outweigh the each day provide. And the clear worth might be as excessive as $150,000 or $180,000.”

However Lee additionally clarified that the spot ETF must be authorized within the U.S. for the value to hit that prime. Though on 14 August, CNBC reported that the U.S. SEC has delayed the approvals of ARKInvest and 21Shares.

Additionally, the regulatory company pushed the deadline to early 2024. Nonetheless, AMBCrypto had a brief dialog with Ruslan Lienkha on the matter.

Extra ETFs, extra liquidity

Lienkha, who’s the Chief Markets Officer at YouHolder, opined that the ETF approval may set off a worldwide adoption of crypto belongings. He additionally talked about that extra corporations would desire a share of the market.

Moreover, Lienkha admitted that Jacobi’s ETF approval in Europe didn’t have a major affect on BTC. However it’s not sufficient motive to imagine that approval within the U.S. wouldn’t result in an uptrend.

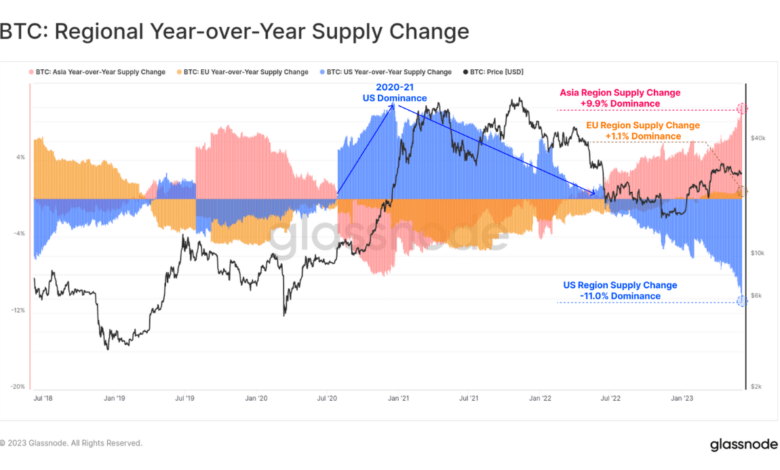

In explaining this, Lienkha used the BTC regional Yr-on-Yr (YoY) provide as a rationale for the opinion. From the chart shared beneath, choices from the U.S. and Asia have had extra affect on BTC as Europe was nonetheless a impartial floor.

Supply: Glassnode

How a lot are 1,10,100 BTCs price right this moment?

In conclusion, Lienkha stated {that a} Bitcoin spot ETF approval within the U.S. would convey in additional liquidity for the market and encourage diversification. He stated,

“Principally, extra ETFs will convey extra liquidity to the crypto market and can stimulate market development. Additionally, crypto shall be higher built-in into the monetary system.”

In the meantime, the U.S. SEC should approve the Bitcoin spot ETFs this yr contemplating latest developments. These days, Coinbase disclosed that the CTFC authorized its utility for a Bitcoin and Ethereum [ETH] futures ETF. Due to this fact, all hope will not be misplaced for the previous.