What is Realized Extractable Value (REV)?

There are various methods to worth a blockchain, from whole worth locked to discounted money circulate. One other common methodology — Realized Extractable Worth — has been the topic of debate amongst crypto communities in 2025. This information covers what Realized Extractable Worth (REV) is, how it’s measured, and whether or not it’s a good valuation metric for blockchains.

In This Information:

- What’s Realized Extractable Worth?

- REV vs. MEV

- Why is Realized Extractable Worth controversial?

- Ought to we use REV to worth blockchains?

- REV, however with context

What’s Realized Extractable Worth?

Realized Extractable Worth (REV) is a metric used to quantify the whole quantity of worth that customers pay to a blockchain. It’s the precise worth extracted from MEV alternatives, versus the worth extracted by a MEV alternative alone.

REV consists of the real-world components that impression the profitability of MEV methods. These embody:

- Community situations

- Precedence charges to validators/miners

- Transaction prices

- Fuel prices

If this sounds complicated, don’t fear; the idea, in actuality, is definitely actually easy.

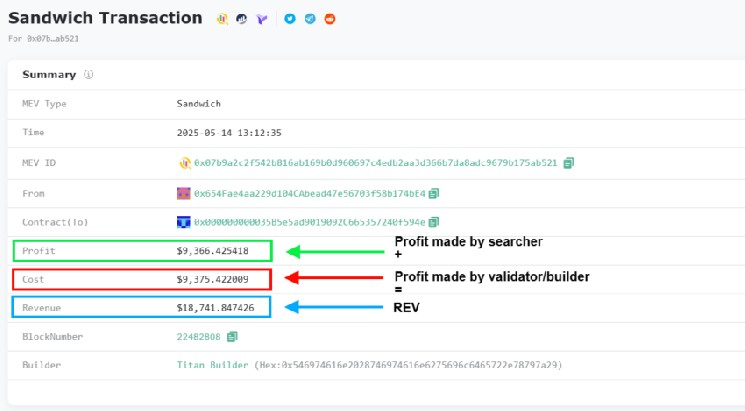

Let’s take a MEV sandwich assault for example. In a sandwich assault, “searcher A” inserts a transaction earlier than and after another person’s transaction to make a revenue. That is the MEV alternative.

Hypothetically talking, let’s say a number of searchers are competing for this identical alternative. The validator should resolve who wins this chance.

Subsequently, searcher A will ship extra worth to the validator than is definitely required, in an effort to execute the transaction by fuel charges alone. That is form of like a bribe from searcher A to make sure the validators consists of their transaction right into a block earlier than the opposite transactions. If searcher A wins the bid, they make the MEV revenue.

MEV sandwich assault: eignephi.io

REV vs. MEV

Maximal extractable worth (MEV) is any revenue alternative that somebody extracts by reordering, inserting, or censoring transactions or blocks, with out hacking or breaking the foundations of the protocol or software.

Searchers create these alternatives by intelligent methods. They aren’t simply restricted to traditional examples like arbitrage or sandwiching, however doubtlessly new strategies that emerge from the construction of the system itself.

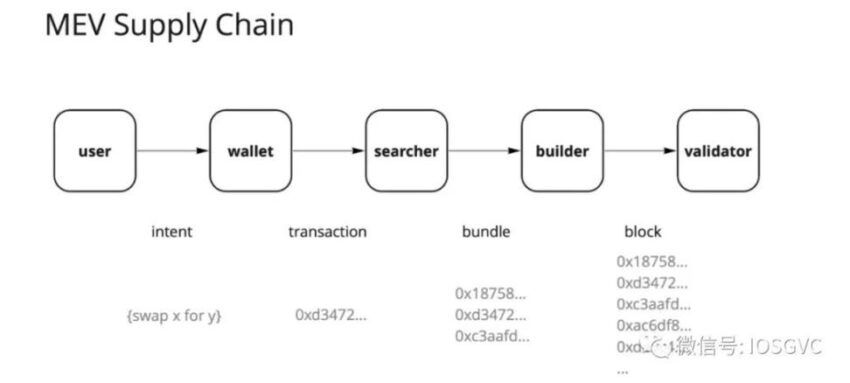

To correctly perceive REV, it is very important pay attention to the life cycle of a MEV transaction on a blockchain. A searcher is somebody (normally a bot) that captures worthwhile MEV alternatives (e.g., arbitrage, liquidations, sandwich assaults).

Transaction life cycle (on Ethereum): www.odaily.information through Flashbots

As soon as the searcher generates a transaction to seize this chance, they need to get it included in a block on the blockchain. A validator picks up this transaction for a price. On this situation, there are two charges: the fee for truly executing the transaction and the fee for together with the transaction in a block.

REV consists of the revenue produced from the MEV alternative, plus the prices they paid to the validator to execute the transaction. Many individuals extrapolate this to imply the prices borne by customers, as MEV sometimes comes on the expense of customers, and the searchers are technically customers themselves (paying for block area).

Why is Realized Extractable Worth controversial?

The article “Quantifying Realized Extractable Worth” by Flashbots, printed on Might 15, 2021, is the earliest complete and formal account of the idea of REV. The subject has gained traction in recent times and has sparked debate on X (previously Twitter) — technically and politically.

Many query whether or not:

- REV is a worth driver for the layer-1 (L1)?

- Is it the easiest way to measure worth accrual to an L1 token?

- Is it the blockchain equal of discounted money circulate (DCF)?

REV is now not only a technical metric — it’s develop into a battleground for competing narratives about what makes a blockchain useful.

These in favor of utilizing REV as a valuation software argue that it displays the financial depth of a blockchain — the actual, dollar-denominated money circulate generated by exercise like buying and selling, liquidations, and arbitrage.

Nevertheless, critics argue that REV is a poor proxy for long-term worth, because it typically spikes in periods of hypothesis (like meme coin bubbles) or volatility (wealth impact of the L1 coin/volatility of belongings on the chain). Some additionally observe that chains like Bitcoin (with zero REV by design) are nonetheless thought of extraordinarily useful.

Ought to we use REV to worth blockchains?

In actuality, valuation is a controversial matter, not only for blockchains. As defined by Professor of Finance, Aswath Damodaran:

“Valuation is straightforward; we select to make it complicated. The second is that each valuation — despite the fact that it’s about numbers — has a narrative, a story behind it. A very good valuation is extra concerning the story than concerning the numbers. And third, when valuations go dangerous, it’s not due to the numbers; it’s due to three huge issues I see in valuation.”

When evaluating REV as a valuation metric, a number of concerns have to be saved in thoughts:

- Mature MEV infrastructure — together with order circulate auctions (OFA) and app-specific sequencing (ASS) — can compress extractable worth and drive charges towards zero. In such environments, excessive REV may point out inefficiency, not financial power.

- Internalized MEV on the software layer (through ASS) could make blockchain-level REV seem decrease even when financial exercise is powerful.

- Most MEV alternatives are extremely aggressive. In actuality, a number of searchers typically compete for a similar alternative through precedence fuel auctions (PGAs) or spamming backrun makes an attempt. In these instances, miners or validators should revenue from fuel charges, even when no MEV is definitely extracted. Moreover, searchers typically run preflights (on-chain checks) that will fail.

REV, however with context

REV is a option to extra precisely measure MEV exercise on a blockchain. Earlier than you leap right into a venture primarily based on its REV, take a minute to grasp how we calculate the metric and the way it’s acceptable to use it to fundamentals. As a result of, whereas REV isn’t essentially ineffective, there are a lot of methods to worth a blockchain, every of which can present crucial data relying on the context.