What Is Slippage in Crypto Trading – And How to Avoid It

Whereas it may be extremely profitable, cryptocurrency buying and selling can also be fraught with quite a lot of dangers and challenges. Even skilled merchants can lose cash in the event that they’re not cautious. One such hazard that buyers must be looking out for is one thing referred to as slippage. On this article, we’ll outline what slippage in crypto is, have a look at the way it can have an effect on merchants, and provide some recommendations on learn how to keep away from it. Keep secure on the market!

What Is Slippage?

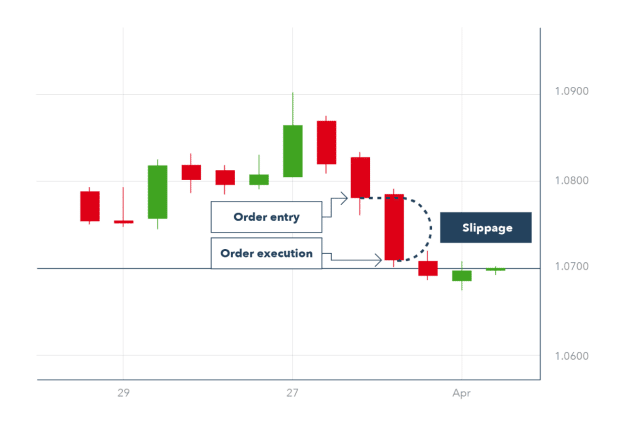

Slippage is the distinction between the anticipated worth of the commerce and the precise worth at which the commerce is executed. It typically happens when there’s a sudden change in market situations, reminiscent of a pointy enhance in rates of interest. Whereas all forms of transactions are susceptible to slippage, it’s most typical in fast-moving markets. For instance, in case you are shopping for an asset for $100 and its market worth instantly jumps to $105, you’ll expertise slippage. Whereas slippage could be pricey, it’s normally not an indication of fraud or poor-quality securities. As an alternative, it’s merely a mirrored image of the truth that costs can change shortly in risky markets.

What Is Slippage in Crypto?

Okay, we’ve obtained the conventional slippage lined, however what’s slippage in crypto? Merely put, crypto slippage refers back to the distinction between the anticipated worth of a cryptocurrency transaction and the precise worth at which it’s executed. This may occur when buying and selling on decentralized exchanges, the place fast adjustments in worth attributable to risky buying and selling exercise can result in vital discrepancies between the meant transaction worth and the ultimate settled worth. Slippage is especially pronounced in crypto markets attributable to their excessive volatility and generally decrease liquidity in comparison with conventional monetary markets.

The impression of slippage within the crypto world can fluctuate; it would work in favor of the dealer if the asset’s worth improves between the time of order placement and execution, an occasion referred to as constructive slippage. Nevertheless, extra typically, merchants expertise detrimental slippage, particularly in periods of excessive volatility when the value strikes in opposition to the dealer’s curiosity. This may enhance the price of entry right into a place or scale back the earnings when promoting. Crypto merchants can reduce slippage by buying and selling on extra liquid markets or setting limits on their trades to manage the worst worth at which they’re keen to commerce, thereby managing the potential monetary impression associated to the present market worth and anticipated worth slippage.

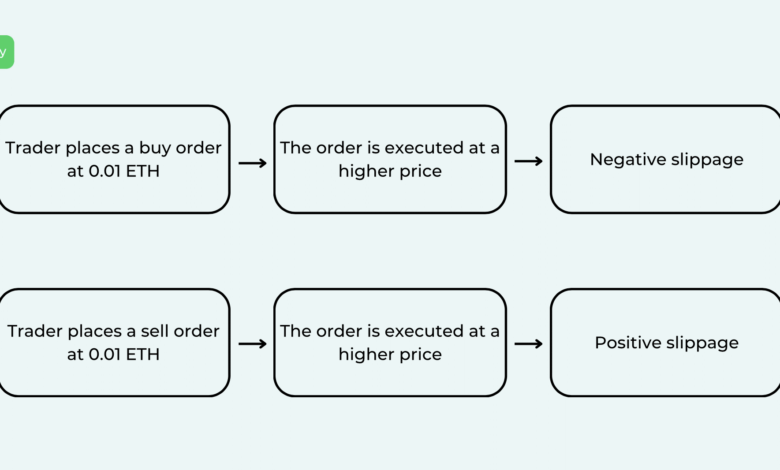

Constructive vs. Unfavorable Slippage

Slippage can occur in each rising and falling markets and could be constructive or detrimental. Constructive slippage happens when the order is executed at a worth higher than anticipated, whereas detrimental slippage occurs when the order is stuffed at a worse worth. Whereas each forms of slippage can have an effect on buying and selling outcomes, constructive slippage is mostly thought-about extra advantageous for merchants. That’s as a result of constructive slippage represents a chance to purchase or promote at a greater worth than anticipated, whereas detrimental slippage merely represents a loss. As such, most crypto merchants attempt to attenuate detrimental slippage whereas maximizing constructive slippage.

Examples of Slippage

Let’s say you need to buy the cryptocurrency listed on a crypto buying and selling platform for $10.00. After putting your market order, you uncover that it was really filed for the next worth of $10.50.

This case illustrates detrimental slippage since you bought an order at the next value than anticipated, decreasing the general buying energy of your funds.

Constructive slippage, however, happens if you place a purchase order at $10.00 however shut it at solely $9.50. Your buying energy rises on account of the decreased worth.

How Does Slippage Work?

An asset is bought or offered at the absolute best worth when an order is executed on an change. Slippage can occur between the time when a commerce is initiated and when it’s accomplished since a cryptocurrency’s market worth may fluctuate swiftly.

How you can Calculate Slippage in Crypto

Right here’s how one can calculate slippage in crypto:

- Determine the Anticipated Value: That is the value you hope to purchase or promote a crypto asset at if you place an order.

- Decide the Precise Execution Value: That is the value at which your commerce is definitely executed on the change.

- Calculate the Distinction: Subtract the anticipated worth from the precise execution worth.

- Convert to Proportion: Divide the distinction by the anticipated worth after which multiply by 100 to get the share of slippage.

Right here’s the system for calculating slippage in crypto:

Slippage % = ((Precise Execution Value – Anticipated Value) / Anticipated Value) * 100

Calculating slippage is essential for understanding how market situations, reminiscent of liquidity and volatility, can have an effect on your buying and selling final result, particularly on decentralized exchanges the place worth adjustments could be swift and sizable. This perception helps in setting more practical commerce methods, reminiscent of utilizing restrict orders to cap potential slippage.

What Causes Slippage?

A sure variety of consumers and an equal variety of sellers are required to execute the right order. If there’s an imbalance, costs will fluctuate, and slippage will comply with.

As talked about earlier, slippage can happen in each rising and falling markets. It’s normally brought on by a scarcity of liquidity within the crypto market or excessive worth volatility.

Low Market Liquidity

In a low liquidity market, there is probably not sufficient consumers or sellers to fill all orders on the requested worth, which results in slippage.

Value Volatility

Excessive worth volatility could cause slippage as costs can transfer instantly and unexpectedly. Since massive market orders are inclined to impression the market worth considerably, slippage also can happen once they’re positioned. For instance, if a big purchase order is positioned for an asset that’s not continuously traded, its worth might sharply enhance as consumers compete for the accessible shares. This may trigger slippage for subsequent purchase orders as a result of the asset might commerce at the next worth than anticipated.

Would you prefer to get extra helpful recommendations on crypto buying and selling? Subscribe to our weekly e-newsletter to remain up to date on the most recent crypto developments!

What Is Slippage Tolerance?

Slippage tolerance is a setting that enables merchants to specify the utmost quantity of slippage they’re keen to just accept for his or her order. It’s constructed into restrict orders as a option to account for instability or volatility available in the market.

For instance, for those who place a purchase order for a inventory at $10 with a slippage tolerance of 5%, your order won’t fill until you should purchase the shares for not more than $10.50 — that can be your minimal worth. Slippage tolerance is often expressed as a share however may also be represented by a sure variety of ticks or pips. For some merchants, slippage is an accepted value of buying and selling; for others, it’s thought-about unacceptable and must be minimized.

There are just a few other ways to cope with slippage. A method is to easily settle for it as a price of buying and selling and issue it into your general technique. One other means is to attempt to keep away from it by utilizing restrict orders as an alternative of market orders and/or by buying and selling when the market is most steady. This manner merchants guarantee they’ll buy the belongings on the precise worth they need.

Some merchants even attempt to reap the benefits of slippage by putting restrict orders exterior of the present bid-ask unfold; if their order fills, they pocket the distinction between the execution worth and the present bid or ask worth. Merchants who function in unpredictable markets or on crypto initiatives with little liquidity and excessive commerce quantity, reminiscent of coin launch initiatives, usually profit from having a low slippage tolerance.

How you can Keep away from Slippage

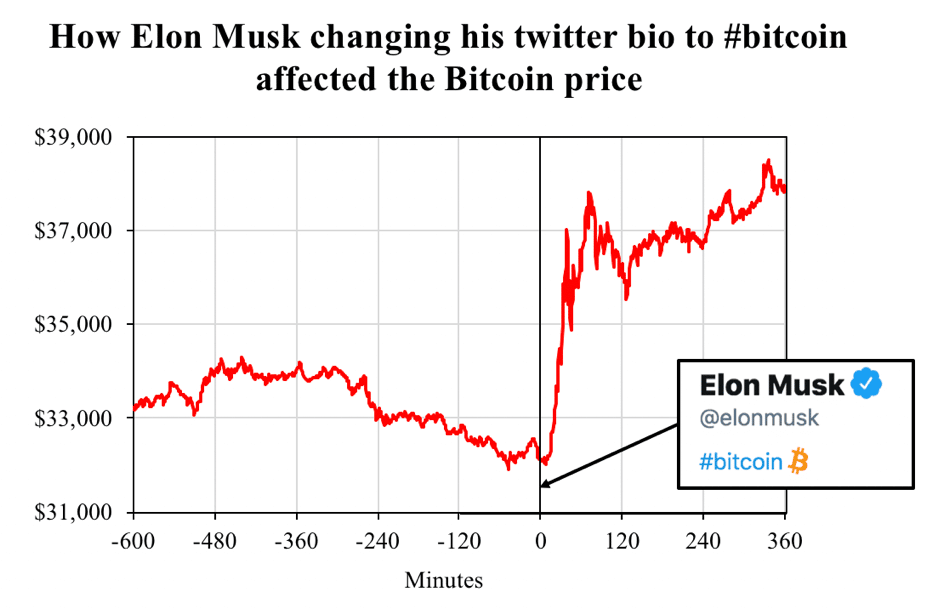

There may be now a option to absolutely remove slippage. Due to the dearth of construction and stability within the cryptocurrency market in comparison with the inventory or futures markets, the value of a token can shortly shift attributable to influencers’ social media exercise. Consequently, it may be difficult to foretell when sure occasions that enhance market volatility will happen. Nevertheless, there are particular actions you possibly can think about to attenuate slippage whereas buying and selling cryptocurrencies.

How you can Management and Reduce Slippage

- Place restrict worth orders as an alternative of market orders.

This ensures you’ll solely purchase or promote on the worth you need.

- Use a buying and selling platform with excessive liquidity.

This manner, there’s a greater probability that your order can be stuffed at a good worth.

- Keep away from buying and selling throughout high-volatility intervals and attempt to commerce throughout off-peak hours.

The markets are usually much less risky throughout these occasions, which will help stop massive deviations between the anticipated and precise commerce costs.

- Keep watch over information and main occasions.

The market is particularly turbulent throughout necessary bulletins.

- Know the place your entrance and exit factors are.

This will even tremendously help in lowering threat as a lot as attainable.

Whilst you can’t all the time management when slippage occurs, following the following tips will help reduce its occurrences.

FAQ

What’s regular slippage?

The slippage share represents the quantity of worth motion for a sure asset. It’s essential to remember that the slippage measurement is usually small. The slippage between 0.05% and 0.10% is typical. The slippage of 0.50% to 1% might occur in significantly turbulent circumstances. Buyers ought to pay attention to what this implies in precise cash phrases.

What’s a 2% slippage?

2% slippage and better is taken into account extraordinarily harmful.

Does slippage matter in crypto?

Sure, slippage is a vital issue to think about in each crypto buying and selling and investing. Earlier than coming into any transactions, merchants ought to all the time attempt to scale back slippage and make a slippage calculation.

Is excessive slippage good?

Excessive slippage is taken into account a foul signal for buying and selling because it characterizes an especially risky market.

Do you lose cash on slippage?

It depends upon the kind of slippage you’re experiencing, detrimental or constructive.

What’s a detrimental slippage?

Unfavorable slippage means the value distinction works in opposition to you.

Is slippage a payment?

No, it’s the distinction between the meant worth and the executed worth.

What is an efficient slippage tolerance?

It depends upon your buying and selling targets, and you must arrange a slippage tolerance share accordingly.

Why is slippage so excessive?

Excessive slippage usually happens throughout high-volatility market situations when a dealer’s order can’t be instantly matched by accessible liquidity available in the market.

How do you commerce with low slippage?

Low slippage really creates a great atmosphere for merchants.

Last Ideas

In the end, slippage is one thing that each dealer has to cope with in a technique or one other. By understanding what slippage is and the way it works, you possibly can ensure that it doesn’t impression your buying and selling technique in a detrimental means. Whereas it might probably typically be troublesome to keep away from utterly, merchants can reduce its results by utilizing restrict orders and monitoring market situations carefully. By doing so, they will help make sure that their trades are executed at costs which are as near their expectations as attainable.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.