What next for Bitcoin, Ethereum as $9.3B options expiry looms

- A lot of the bets predicted a bullish shut for BTC and ETH.

- ETH may drop under the max ache level whereas BTC may finish the week above it.

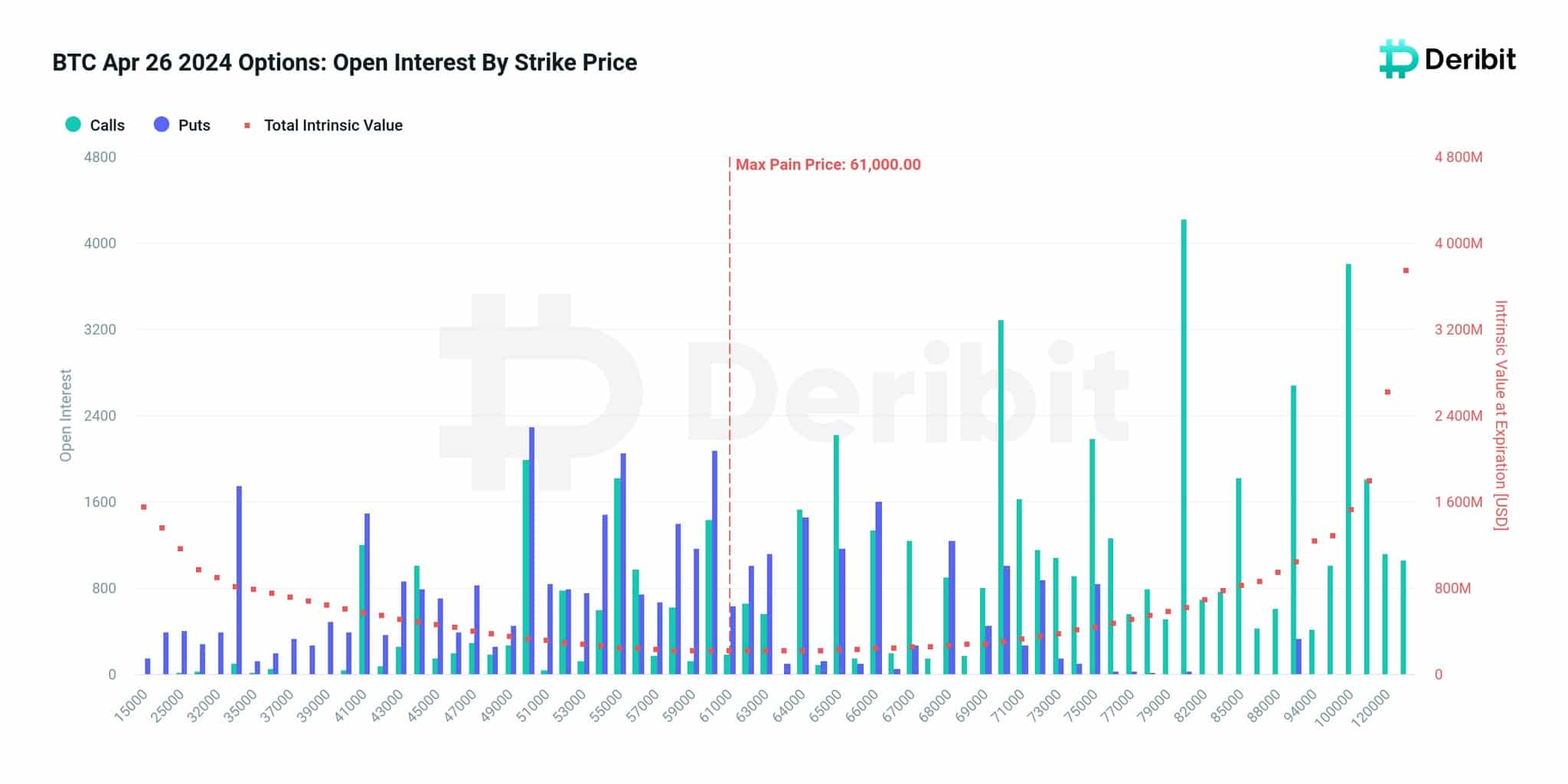

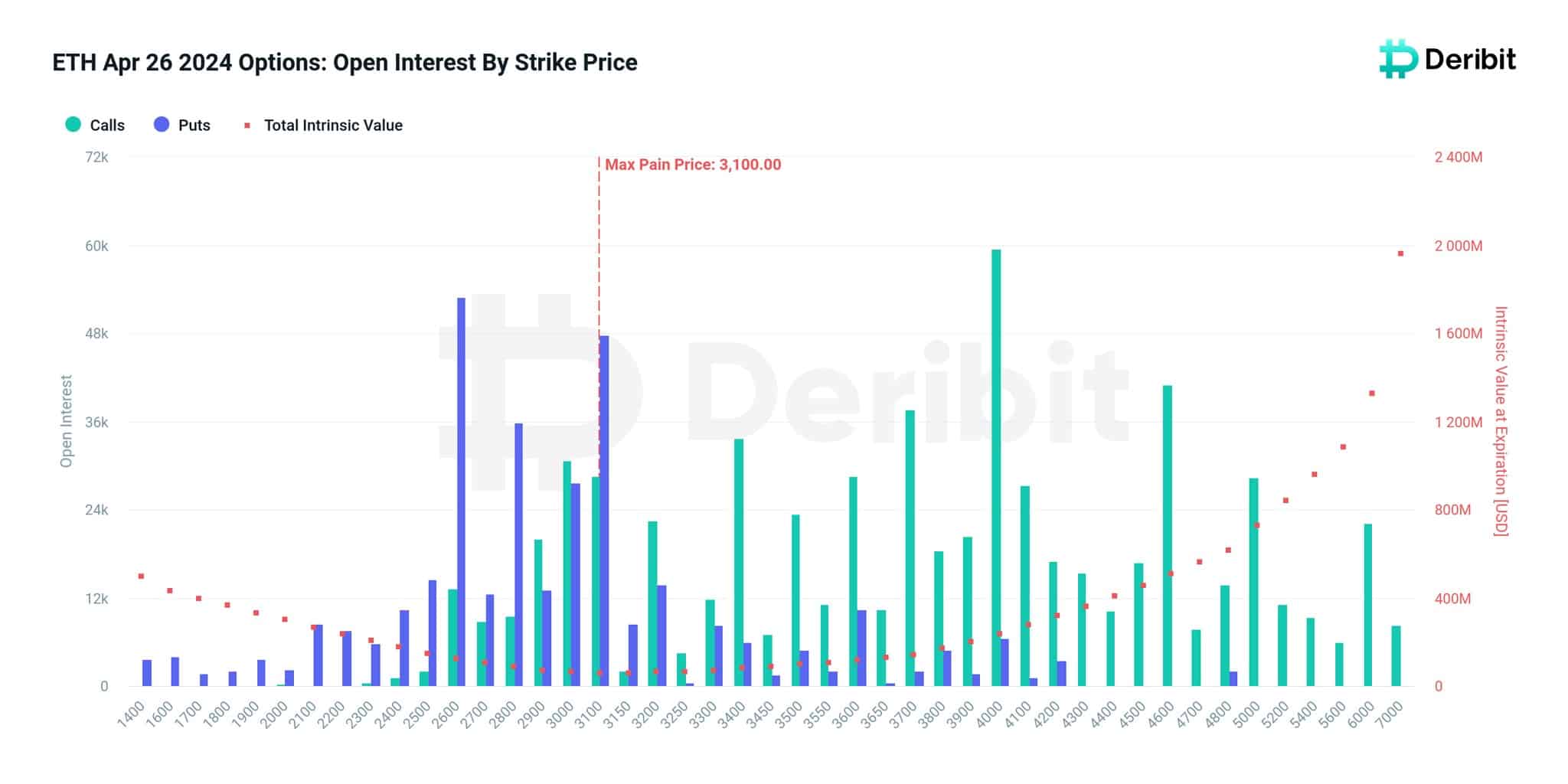

Greater than 96,000 possibility contracts of Bitcoin [BTC] and 978,000 for Ethereum [ETH] are set to run out on Friday, twenty sixth April.

In line with derivatives trade Deribit, the BTC contracts have been valued at $6.2 billion whereas ETH contracts have been value $3.1 billion, bringing the full to a mind-blowing $9.3 billion.

With choices, merchants should purchase contracts that permit them to purchase or promote a cryptocurrency at a predetermined worth. As choices close to expiry, merchants should resolve if to purchase, promote, or shut the contract.

Supply: Deribit

Optimism rises regardless of the decline

Particulars AMBCrypto bought from Deribit confirmed that the BTC put-call ratio was unfavorable. This means that a lot of the bets have been calls and merchants have been bullish on the coin worth.

It was the same case for ETH. For these unfamiliar, shopping for a name possibility implies that a dealer will generate income if the value goes up. Then again, a put possibility is a bearish wager, which means a dealer will make income if the value declines.

Supply: Deribit

Relying on the place BTC and ETH costs shut, the trade noted that sellers may achieve essentially the most if BTC hits $61,000. In ETH’s case, patrons may lose some huge cash if the worth of the altcoin reaches $3,100.

“Bitcoin choices and the elimination of a 61k max ache worth level, along with the expiring open curiosity of almost $3 billion in Ethereum choices and the elimination of a $3.1k max ache worth level.”

At press time, BTC’s worth was $64,140, representing an 8.52% lower within the final 30 days. ETH, alternatively, modified fingers at $3,129— a 12.46% 30-day lower.

Totally different patterns for the highest two

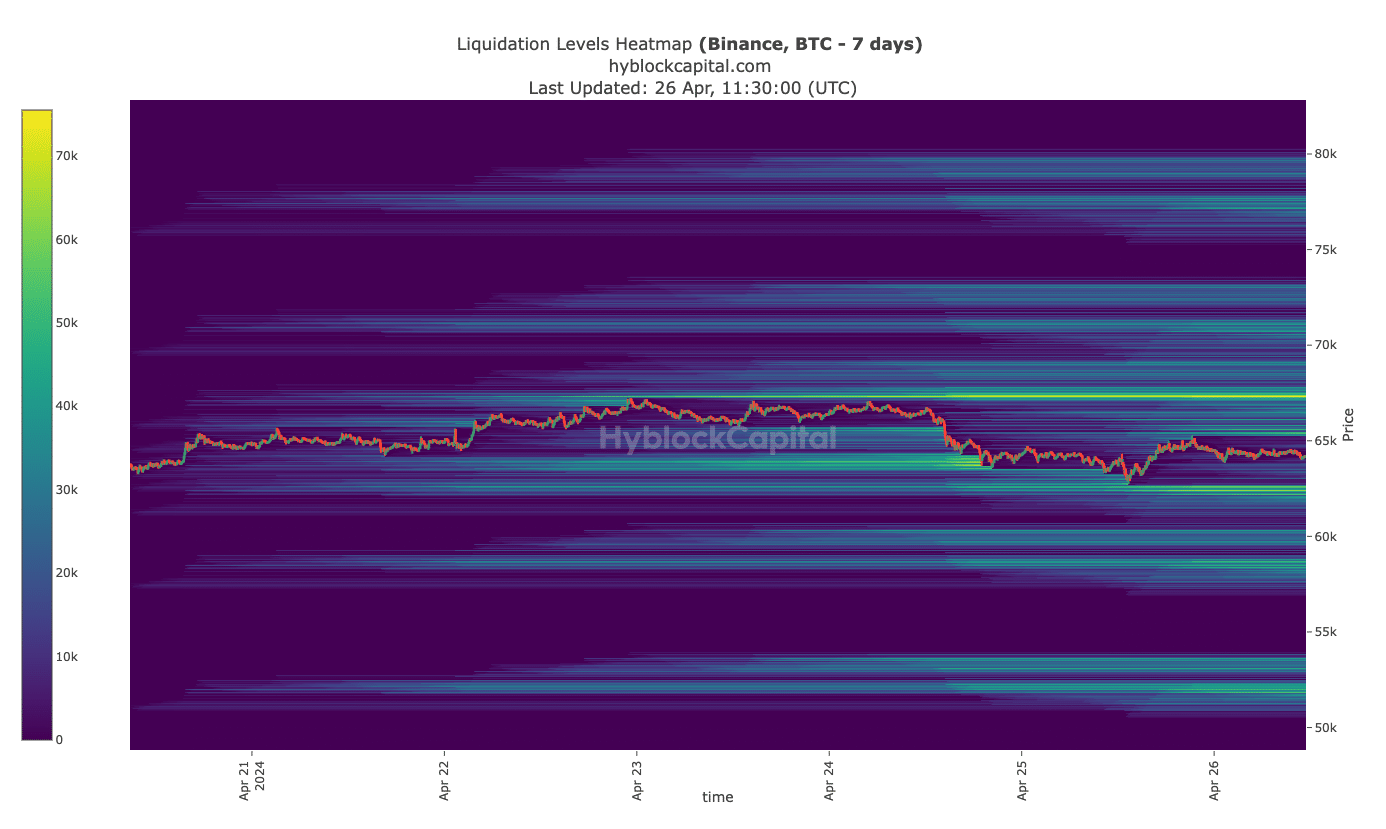

To determine the place the value may shut this week, AMBCrypto regarded on the liquidation heatmap. Liquidation heatmap exhibits merchants excessive areas of liquidity (magnetic zone).

This helps to establish potential massive liquidation factors, and the potential for costs transferring towards sure areas. In line with information obtained from Hyblock, a magnetic zone (coloured yellow) appeared on the BTC liquidation heatmap at $67,250.

To the draw back, one other magnetic space was at $62,600. If Bitcoin’s worth strikes towards $67,250, then most possibility contracts will find yourself being profitable from their bets.

Supply: Hyblock

Then again, a decline towards $62,600 might trigger losses. Nonetheless, the ache is likely to be minimal so long as the value doesn’t hit $61,000.

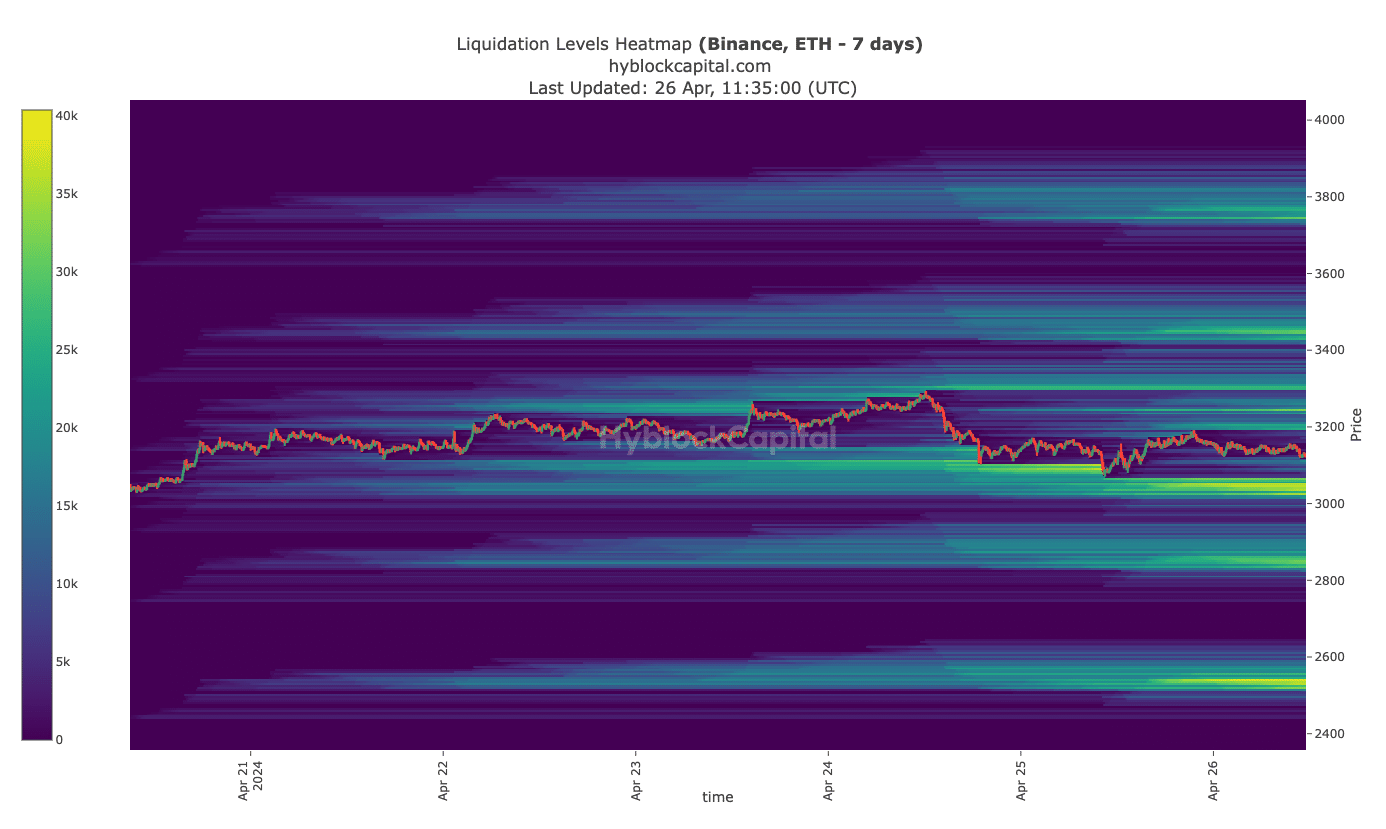

Nonetheless, it won’t be the identical case for merchants who went with the ETH name possibility.

Supply: Hyblock

Life like or not, right here’s ETH’s market cap in BTC phrases

At press time, the excessive space of liquidity was round $3,025, indicating that the value may decline under the $3,100 max ache threshold.

If this occurs, a big a part of the $3.1 billion set to run out may very well be worn out. Nonetheless, if ETH stays above $3,100, places won’t be the one ones to realize from the value motion.