What this whale’s latest dump means for ETH, AAVE, and UNI’s prices

The latest replace on Spot Ethereum ETFs (Change Traded Fund) by Nate Geraci, the President of ETF Retailer, has gained large consideration from traders and establishments. In accordance with his put up on X, america Securities and Change Fee (SEC), which was prone to greenlight the launch of those merchandise by 2 July, has postponed the choice to mid-July.

Following this replace from Geraci, an enormous sell-off was seen throughout a number of Ethereum-based tokens.

Whales dump LDO, AAVE, and UNI tokens at a loss

On 3 July, on-chain analytics agency Lookonchain revealed {that a} single whales/establishment bought tens of millions price of Ethereum-based tokens together with Lido DAO (LDO), Aave (AAVE), UniSwap (UNI), and Frax Share (FXS). In accordance with the info, they bought 3.13 million LDO price $5.77 million, 49,771 AAVE price $4.54 million, 269,177 UNI price $2.41 million, and 250,969 FXS price $708K – All at a loss.

Following this market dump, the tokens’ value plunged considerably. In accordance with CoinMarketCap, for example, LDO registered a 14% value drop, AAVE depreciated by 9%, UNI declined by 5%, and FXS misplaced 12% of its worth.

Right here, it’s price declaring that the whale initially spent over $73 million to purchase Ethereum (ETH) and associated tokens, following the approval of the spot Ether ETF kind 19b-4 in Could 2024. In addition to this large dump, the whale nonetheless holds a 3.33 million LDO price $5.83 million and 31,191 AAVE price $2.8 million.

Ethereum’s (ETH) value following ETF replace

This large dump is an indication that if the U.S SEC delays or postpones spot Ether ETFs as soon as once more, we might even see one other large sell-off in ETH and associated tokens within the coming days. Actually, following the ETF replace, the Head of Asset Administration large Galaxy Digital, Steve Kurz, advised Bloomberg that the U.S SEC may probably approve spot Ether ETF throughout the subsequent couple of weeks.

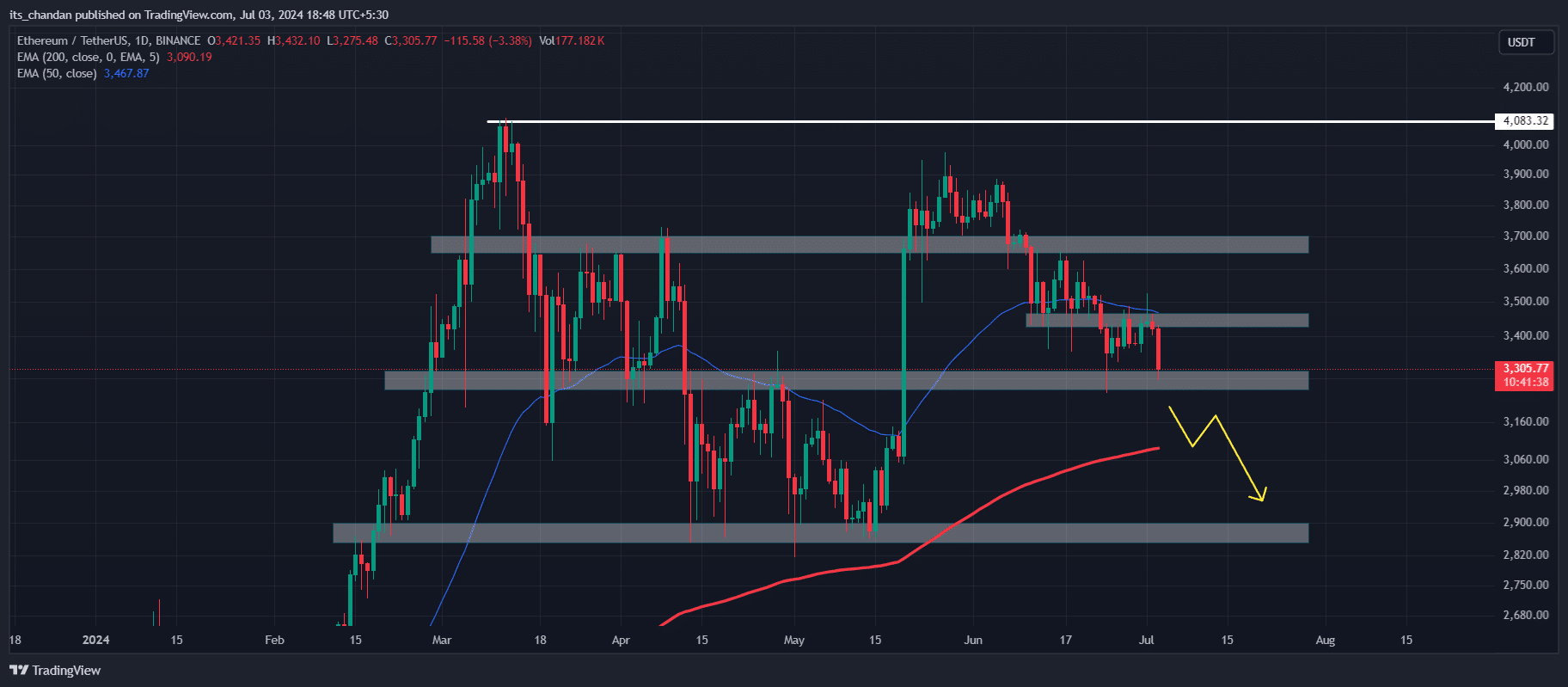

On the worth charts, ETH appeared to be near its essential help degree of $3,250 and beneath the 50 EMA (Exponential Transferring Common). If ETH fails to maintain this degree, we may see an enormous draw back transfer to the $2,870 degree within the coming days.

Supply: ETH/USDT, TradingView

Regardless of the optimism round Spot Ether ETFs, together with different Ether-based tokens, ETH additionally recorded a value drop of 5% within the final 24 hours.