What USDT’s YoY growth means for other stablecoins

- Demand for stablecoin elevated, whereas USDT’s provide reached its ATH.

- The coin’s Social Dominance jumped, indicating early indicators of the bull market.

The battle for the stablecoin king could also be accomplished and dusted as Tether [USDT] continues to show that no different venture within the sector could possibly match the authority it has. On plenty of events, AMBCrypto has disclosed how USDT has maintained the highest spot.

Real looking or not, right here’s USDC’s market cap in USDT’s phrases

This time, it was no completely different, based mostly on a brand new revelation by IntoTheBlock. In response to the blockchain perception platform, USDT’s provide crossed 84 billion on 5 November.

New milestone for USDT: Provide surpassed 84 billion, setting an all-time excessive simply final week! This represents a 22% year-over-year development.

🔗https://t.co/vSgB5HA3qC pic.twitter.com/F6qZv2AHTg— IntoTheBlock (@intotheblock) November 5, 2023

Usually, when a cryptocurrency provide outweighs demand, its worth could drop. However within the case of stablecoins, it isn’t the identical. Right here, the higher the provision, the extra the demand and adoption.

No different match for the king stablecoin

The bounce represents an All-Time Excessive (ATH) and a 22% Yr-on-Yr (YoY) enhance. After IntoTheBlock disclosed the information, the AMBCrypto group regarded into the explanations for the hike. From our analysis, there have been a number of causes for USDT’s dominance.

One purpose for this enhance may very well be linked to the market restoration. For instance, Bitcoin [BTC], which began the 12 months round $16,000 was now buying and selling at $35,000. This enhance is a testomony that the bear market was virtually at its finish, and the bull market was incoming.

Normally, when indicators like this come up, market members take it as a possibility to arm themselves with stablecoins. It’s also not stunning that USDT is the popular choice for the broader market.

In contrast to different stablecoins, the variety of occasions USDT has depegged from the U.S. greenback has been fewer. The noteworthy interval was in the course of the Terra Luna [LUNA] collapse and FTX contagion.

Different causes for the hike within the provide may very well be linked to the lower in belief towards Circle [USDC]. This was largely due to the venture’s hyperlinks with some banks’ collapse earlier within the 12 months.

The bull could already be right here

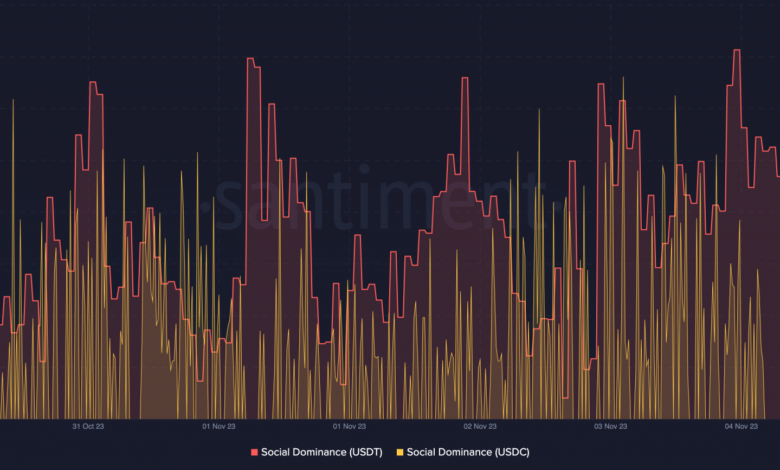

One other metric proving USDT’s dominance is Social Dominance. In response to knowledge assessed from Santiment, USDT’s social dominance had elevated to five.95% at press time. USDC, alternatively, had a dominance of a paltry 0.33%.

Supply: Santiment

The hike within the metric signifies that USDT was getting numerous hype in comparison with different cryptocurrencies within the prime 100. A fast refresher may very well be linked to 2 completely different durations when social dominance is at its highest.

How a lot are 1,10,100 USDTs price in the present day?

One is the U.S. in a single day buying and selling hours. One other is when the bull market is at its peak or is beginning to choose up. So, USDT’s enhance on this regard means that the market could proceed to desire it over different choices.

Additionally, it may not be out of order to say that the bull market is beginning to achieve momentum.