What’s behind the surge in liquid staking demand for cryptocurrency Solana?

Solana (SOL) Liquid Staking

Demand for the liquid staking token (LST) of the crypto asset (digital forex) Solana (SOL) has elevated quickly since June this 12 months.

Liquid staking is a staking service that acts as a “validator” accountable for transaction verification within the PoS (Proof of Stake) blockchain. It’s a part of DeFi (decentralized finance) that unlocks the liquidity of tokens which might be usually entrenched.

“Marinade Finance (MNDE)”, the highest protocol of Solana’s liquid staking market, gives customers with SOL staking swimming pools, and customers can obtain mSOL, a liquid staking token, by depositing SOL. . Whereas incomes staking rewards, this mSOL will generate further income by way of operations similar to within the rental market.

Marinade’s whole belongings below custody (TVL) have reached $178 million, up almost 80% over the previous month. This quantity accounts for almost all of Solana’s total TVL ($314 million).

Equally, the TVL of Solana’s second-largest LST protocol, Jito, has greater than doubled prior to now month, reaching about $26 million.

These actions have additionally not directly affected the value of SOL, which in keeping with Coingecko climbed 27.8% week-on-week, rating second among the many prime 10 cryptocurrencies when it comes to value enhance.

connection:Solana Labs co-founder: Ethereum might function L2 for Solana

MarginFi can be a scorching subject

The loyalty factors program launched on July 3 by decentralized finance (DeFi) rental platform MarginFi is believed to be enjoying a job behind this surge. This system is designed to encourage customers to spend extra time on loans and borrows, in addition to to encourage new consumer referrals, permitting each lenders and debtors to earn factors.

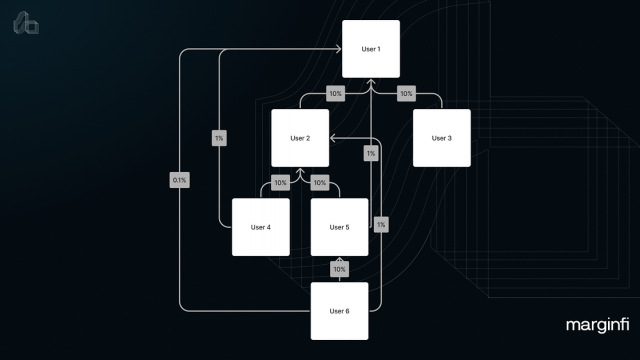

Moreover, customers earn further factors by way of a particular referral system. When a consumer refers one other consumer, you’ll obtain 10% of the factors earned by the referred consumer. As well as, 10% of that 10% could be obtained from second and third era referral customers.

MarginFi including new customers like 🤯🔥🔥🔥 pic.twitter.com/yRw7Ac1Vbk

— Hey Moon 🥷 (@HelloMoon_io) July 14, 2023

Since MarginFi’s introduction of this system, the corporate’s energetic customers have greater than tripled and whole belongings below deposit (TVL) have almost quadrupled to over $10 million.

Specifically, in MarginFi, the deposit share of liquid staking tokens, together with “jitoSOL” and “mSOL”, accounts for greater than 50% of TVL. By depositing these tokens, Solana buyers can earn round 7% annual curiosity.

The final word use of those factors has but to be formally introduced. In an official assertion, these factors quantify exercise inside the ‘mrgn financial system’ and encourage customers to actively take part within the act of lending and borrowing. Nevertheless, many customers appear to count on these factors to result in governance token airdrops sooner or later.

solana summer time https://t.co/3uG9mNy6cE

— Ansem 🎒 (@blknoiz06) July 7, 2023

Different tasks, such because the buying and selling protocol Cypher, which is partnering with MarginFi, are additionally introducing their very own factors system to develop and contribute to the ecosystem as a complete. Some business observers who took discover of such a transfer known as it the “second Solana Summer season” and hoped that the Solana ecosystem would come to life once more.

connection:The market dimension of DeFi “LSDfi” for liquid staking has doubled from the earlier month