What’s going on with Ethereum’s addresses? Taking a closer look

- Ethereum’s each day lively addresses have decreased to round 395,000.

- An handle moved over 19,500 ETH to Binance within the final 48 hours.

Ethereum [ETH] has skilled vital progress in its each day lively addresses over the yr, indicating elevated use and engagement inside its community.

Nevertheless, current traits have confirmed a decline in these lively addresses, suggesting a attainable slowdown in exercise.

Alongside this lower, there was a noticeable shift in market dynamics, with sellers starting to dominate buying and selling actions.

Ethereum’s unstable lively addresses

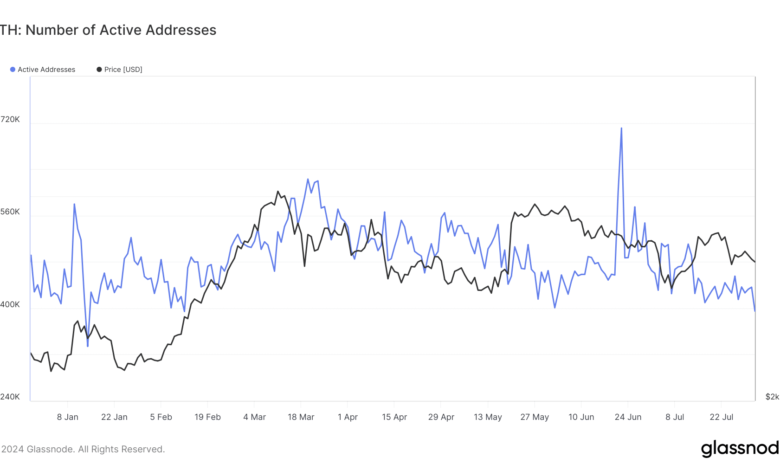

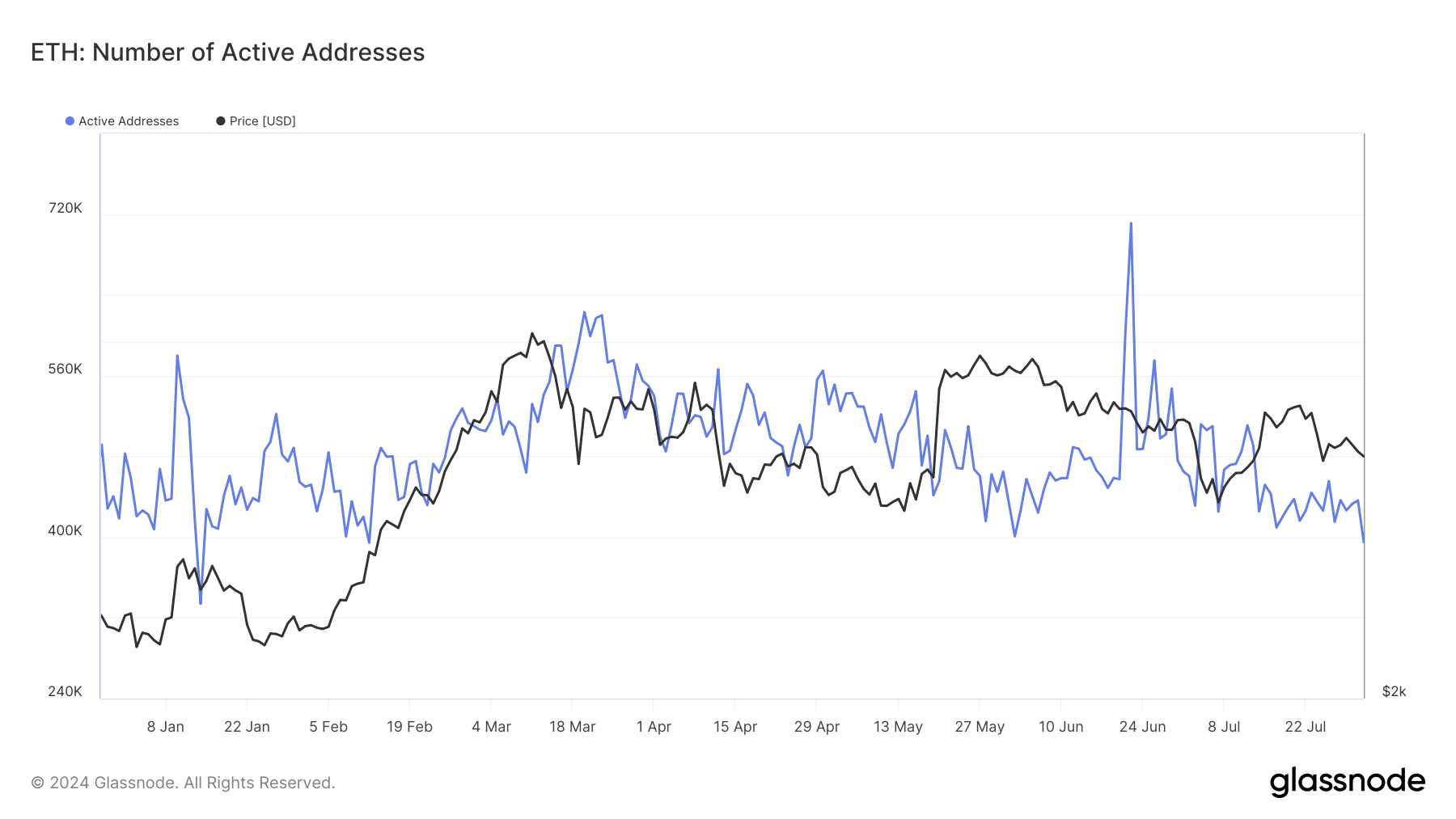

In response to information from Glassnode, Ethereum’s each day lively handle metric has skilled a outstanding improve all year long, surging by 127%.

This substantial progress has primarily been pushed by heightened exercise on Layer 2 (L2) platforms, per the report.

An in-depth evaluation of the lively addresses metric on Glassnode highlighted a peak in each day lively addresses, reaching over 700,000 in June.

Nevertheless, current weeks have witnessed a downward development on this metric. After a major rise to over 510,000 in July, the variety of lively addresses started to taper off.

Supply: Glassnode

By the tip of July, this determine had decreased to roughly 436,000. As of the most recent information, it has additional decreased to round 395,000.

Ethereum sellers seem extra lively

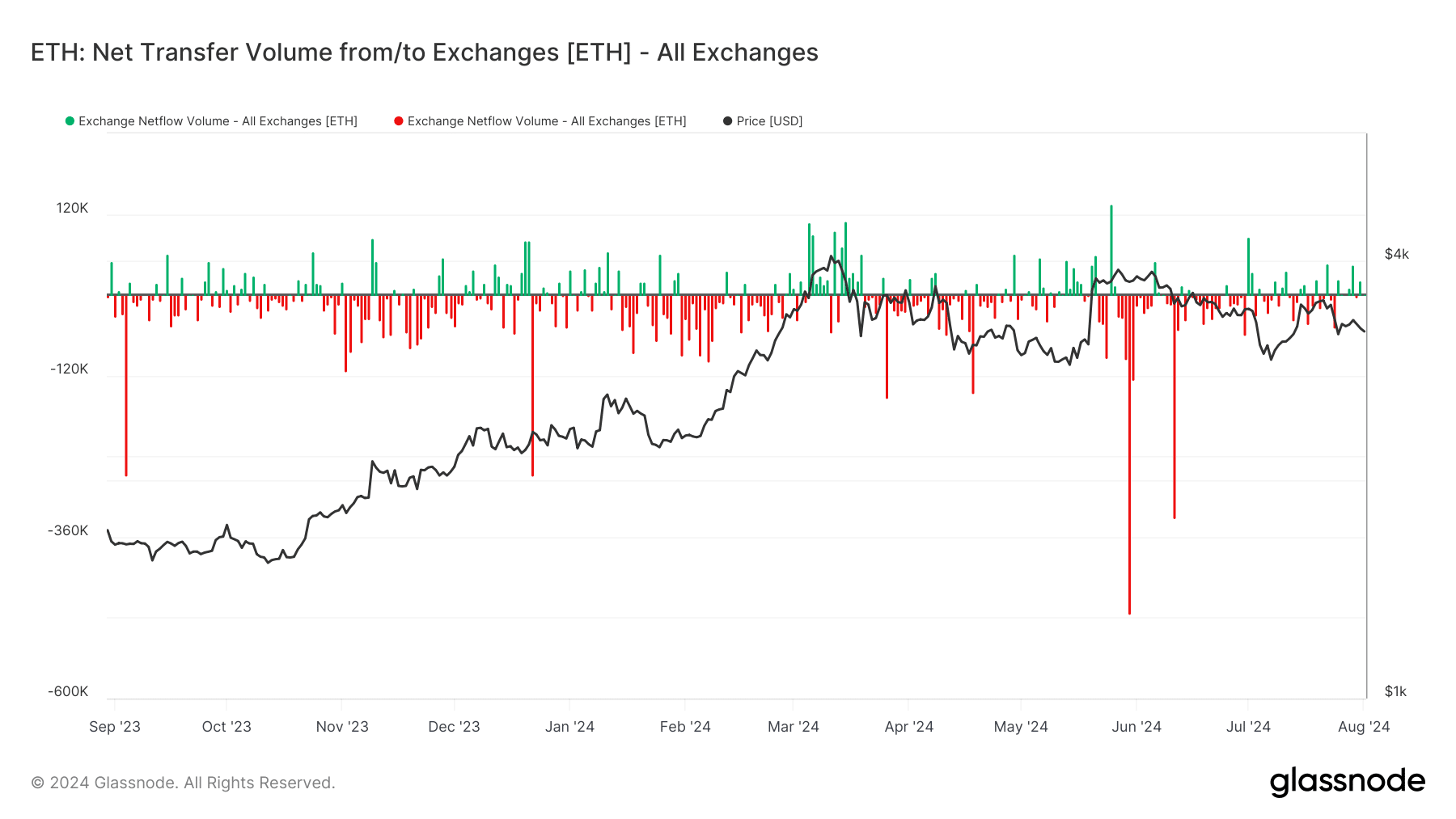

The current evaluation of Ethereum’s netflow on Glassnode has highlighted a notable development. It confirmed extra ETH was being moved into exchanges than was being withdrawn.

The transfer instructed a predominance of promoting exercise amongst holders. Over the previous month, this development culminated with a major inflow of over 22,000 ETH into exchanges.

Additional intensifying this development, information from Lookonchain revealed that particular accounts have been significantly lively in transferring ETH to exchanges.

Within the final 48 hours alone, these accounts despatched a complete of 19,500 ETH, valued at practically $64 million, to the Binance alternate.

Such large-scale actions to exchanges typically point out a readiness to promote, contributing to elevated provide available on the market.

Supply: Galssnode

This inflow of ETH to exchanges has coincided with and certain contributed to the current decline in Ethereum’s value.

As extra ETH turns into accessible available on the market via these exchanges, the elevated promoting stress can result in a downward development in value, particularly if demand doesn’t maintain tempo with the brand new provide.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

RSI exhibits rising bear development

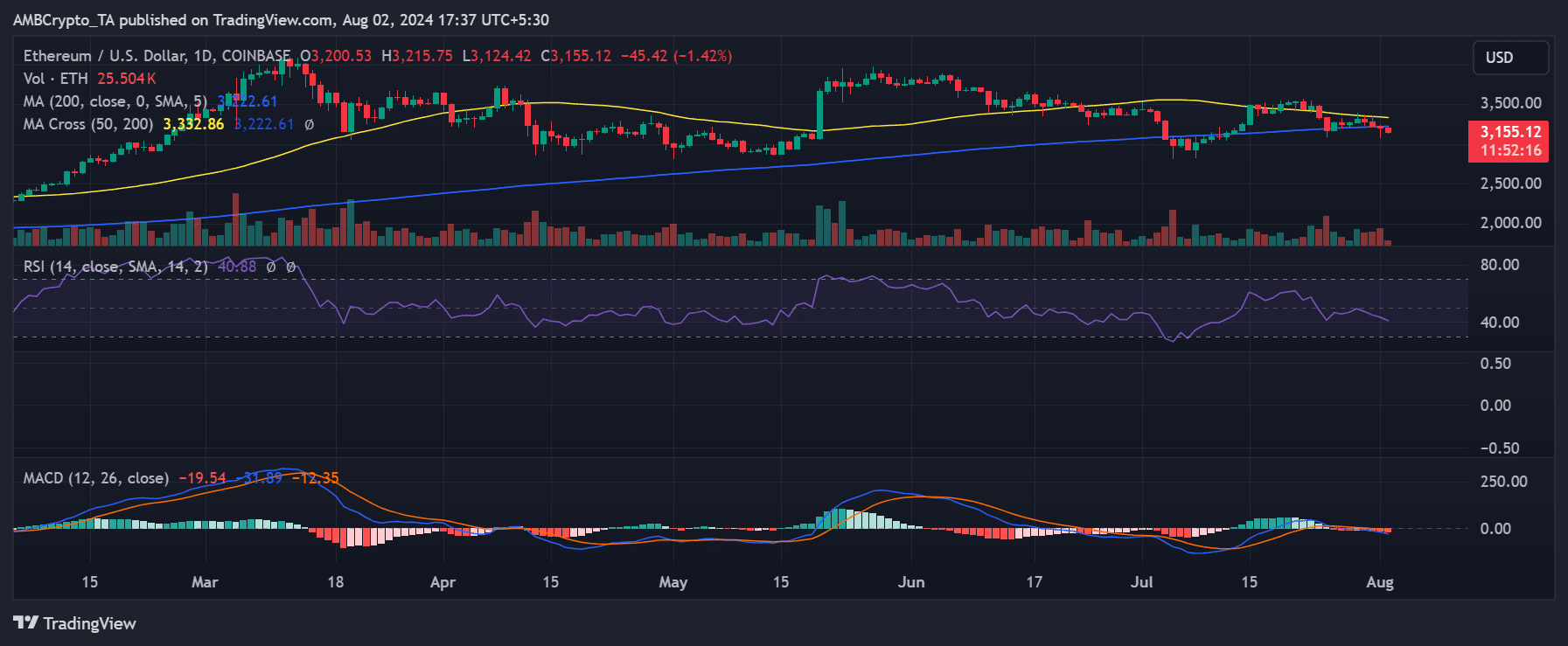

An evaluation of Ethereum’s each day value development revealed a decline of over 1.4% on the time of writing. The worth was roughly $3,154, marking the fourth consecutive day of decreases.

In response to AMBCrypto, the decline started across the thirtieth of July, and Ethereum has been on a downward development ever since. The Relative Power Index (RSI) is about 41, indicating a strengthening bearish development.

Supply: TradingView