What’s Next For Bitcoin? Bulls Aren’t Running Out Of Steam Yet

After Bitcoin reached a brand new yearly excessive at $31,413, the purchase facet has thus far did not provoke a trend-following transfer north. Though the bulls fended off a sell-off final Friday within the wake of the SEC’s perceived issues over a Bitcoin spot ETF approval, the momentum appears to be more and more flattening, or isn’t it?

What’s Subsequent For The Bitcoin Value?

Because the market awaits an approval from the Safety and Change Fee (SEC) relating to a spot Bitcoin exchange-traded fund (ETF), traders are seemingly exercising warning. Whereas open curiosity within the Bitcoin futures market continues to rise, exercise within the spot market has lately declined.

This shift signifies that worth motion in current days has been primarily influenced by futures merchants. Analyst @52Skew noted on Twitter, “$BTC Spot CVDs & Delta: Fairly a little bit of spot nonetheless being dumped in the marketplace + no restrict chasing at present from coinbase patrons. Spot bid liquidity $30.5K.”

This remark underscores the reluctance of traders within the spot market who could also be ready for a decisive transfer by the SEC. Nevertheless, it must be famous that US markets have been closed yesterday for the 4th of July vacation. Most lately, big spot shopping for quantity got here from Coinbase, pushing the market up. So at present might be fascinating to look at if yesterday’s retracement is purchased at present by US traders.

Bitcoin dominance, which had risen to resistance at 52.15%, has now consolidated considerably, dropping to 51.25%. This consolidation, mixed with the entry of traders into the altcoin sector, reinforces the prevailing wait-and-see perspective amongst traders.

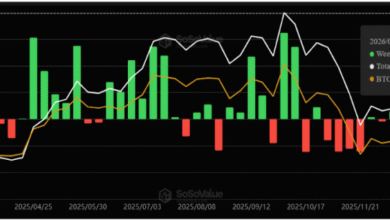

Analyzing the Bitcoin worth, it’s clear that the market is presently going through sturdy resistance within the $31,300 to $31,416 vary. The help space at $30,700 is presently proving to be a crucial mark to look at. Holding above this help may give patrons the chance to launch a renewed offense.

If the Bitcoin worth can escape dynamically above the year-to-date excessive, the following main chart hurdle awaits at $32,500. But, a short lived retracement to the help space at $29,800 might be acceptable to achieve momentum for the following breakout try.

To this point, the bears have lacked follow-through. The promote facet additionally failed in its try to dump the BTC worth within the increased time frames again beneath the psychologically essential $30,000 degree in current days. The aim of the bears have to be to push Bitcoin completely beneath $29,800.

Consultants Stay Bullish For Now

Famend analyst Josh Rager believes the pullbacks gained’t be as deep as many consultants count on, suggesting that ETF approval, notably from BlackRock, is an actual chance. He says, “Solely an ETF rejection may cause ache, however I feel BlackRock might be accepted this time,” adding:

The $24k, then up sentiment appears to be fairly widespread. I feel persons are overthinking it. Comparable was stated about Bitcoin needing to comb $20k first. IMO, pullbacks gained’t be this deep now and if we handle to see $25k once more it gained’t be till afterward within the yr after extra upside earlier than so.

Equally, NewsBTC lead analyst Tony “The Bull” believes within the bullish case for BTC within the close to time period. Nevertheless, he stresses the significance of Bitcoin’s Relative Power Index (RSI) coming into overbought territory, as a failure to take action may indicate an absence of sturdy upside momentum:

I need to see Bitcoin RSI push into overbought circumstances by week finish, or else I fear that this isn’t an impulse but. Now we have a doji on the weekly, which indicators indecision. We have to see observe by this week, or extra correction turns into extra possible w/ potential bear div.

Featured picture from iStock, chart from TradingView.com