What’s next for BTC as Bitcoin miners cash in over $27 mln?

- Bitcoin miners liquidate over $27 million, sparking considerations about BTC’s skill to maintain its worth momentum.

- BTC faces key resistance at $87K whereas miner promoting stress grows—can bulls take in the impression?

Bitcoin [BTC] miners have been offloading vital holdings, cashing in over $27 million in realized earnings. This got here at a time when BTC gave the impression to be adjusting inside a key worth vary.

With miners promoting aggressively, questions come up relating to the potential impression on BTC’s subsequent transfer. Will this promote stress cap Bitcoin’s upside, or is the market absorbing these liquidations?

Bitcoin miners’ earnings spike

In accordance with recent data, early Bitcoin miners have realized over $27.2 million in earnings as BTC hovered across the $83,000-$84,000 vary.

This marked a major liquidation section, particularly after Bitcoin’s current pullback from its highs above $90,000.

Supply: CryptoQuant

Traditionally, such profit-taking by miners can point out a short-term cooling interval for Bitcoin’s rally, resulting in both consolidation or a possible retracement.

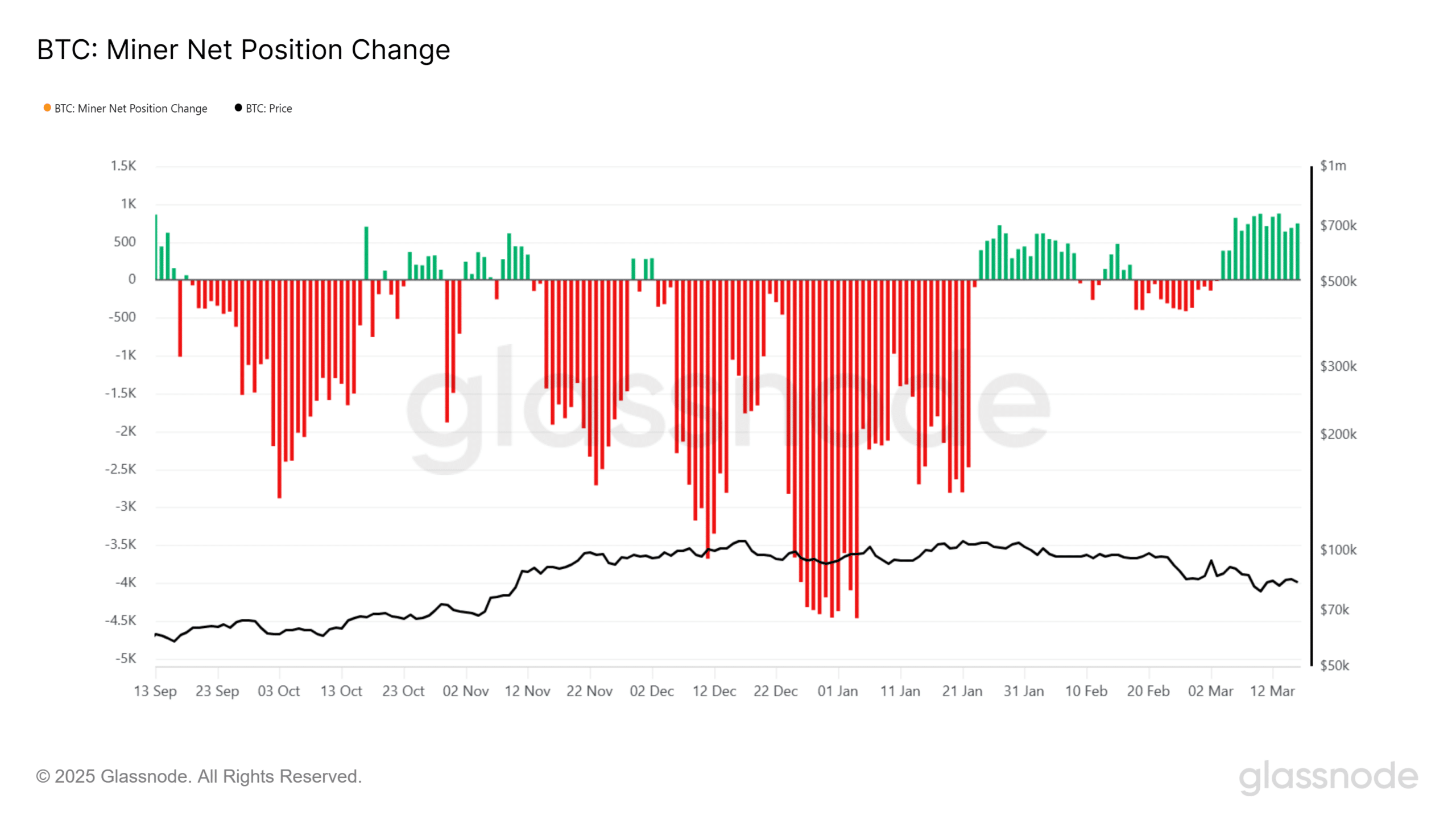

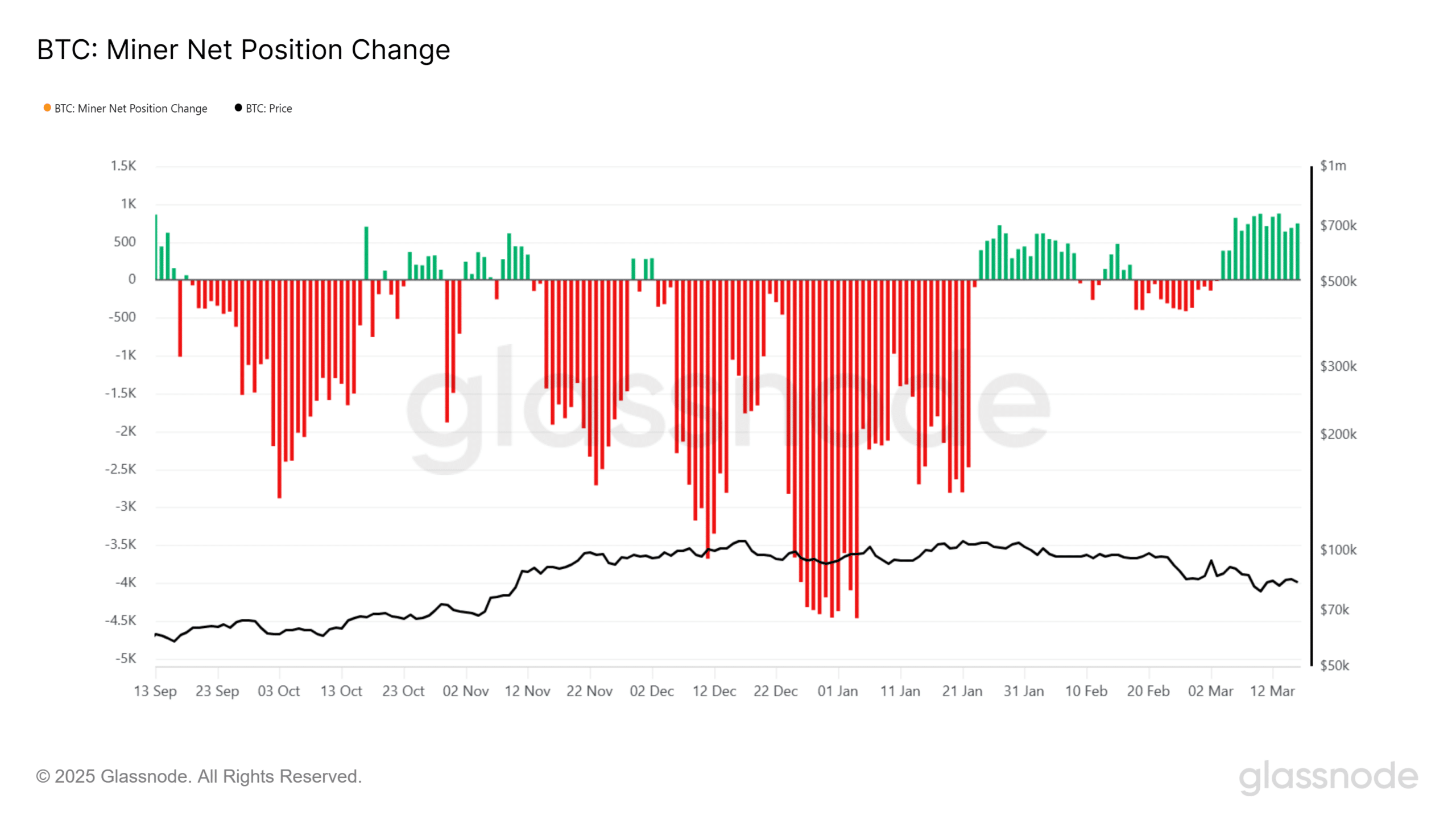

Glassnode’s miner web place change chart exhibits continued promoting stress, with outflows surpassing inflows.

Miners gave the impression to be lowering their holdings reasonably than accumulating, reinforcing the opportunity of near-term worth weak spot.

How a lot BTC are miners nonetheless holding?

Regardless of the promoting spree, Bitcoin miners nonetheless retain a considerable quantity of BTC. Nonetheless, the speed at which holdings decline indicators their outlook on worth actions.

The info means that whereas some miners are securing earnings, others could also be holding onto BTC in anticipation of one other bullish leg.

Supply: Glassnode

If BTC maintains its present assist ranges, a resurgence in shopping for curiosity may stabilize costs.

Alternatively, if miners proceed liquidating, Bitcoin would possibly wrestle to interrupt previous key resistance ranges, significantly close to $87,000-$90,000.

Key ranges to look at

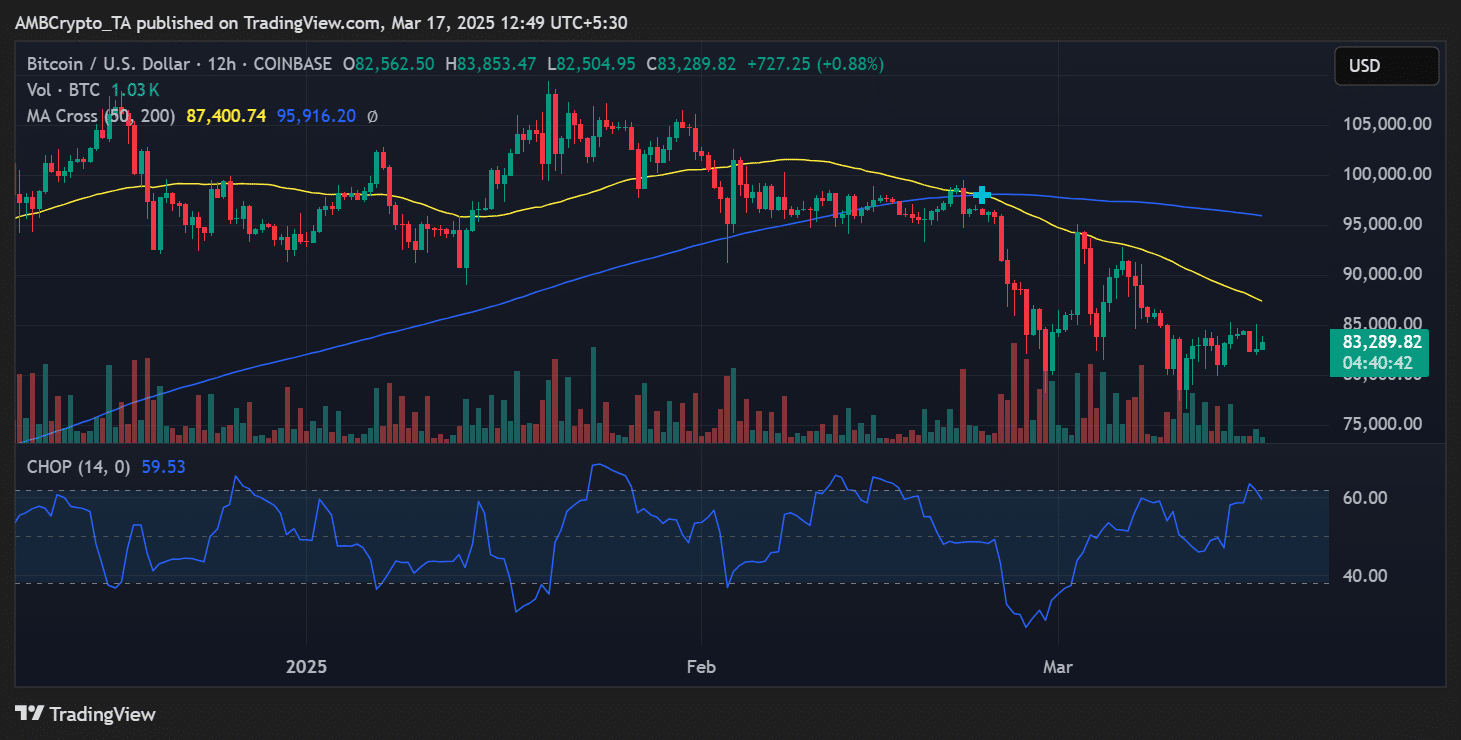

Bitcoin was buying and selling round $83,289 at press time, with the 50-day transferring common positioned at $87,400 and the 200-day transferring common close to $95,916.

These ranges function important resistance factors that BTC must surpass to reclaim bullish momentum.

Rapid assist was at $82,500. A breakdown beneath this stage may open the doorways to additional declines towards $80,000.

Key resistance stood at $87,000. A decisive transfer above this mark may set off renewed bullish momentum.

Supply: TradingView

With miner promoting ramping up, BTC’s skill to carry its floor can be essential in figuring out its subsequent transfer.

Merchants ought to look ahead to shifts in miner conduct, as continued sell-offs may stall Bitcoin’s upside, whereas stabilization would possibly pave the way in which for a rebound.