Why another 10% drop for LINK’s price is likely in the short-term

- Following LINK’s newest drop, solely 24.96% of holders have been in revenue, whereas 74.74% have been dealing with losses

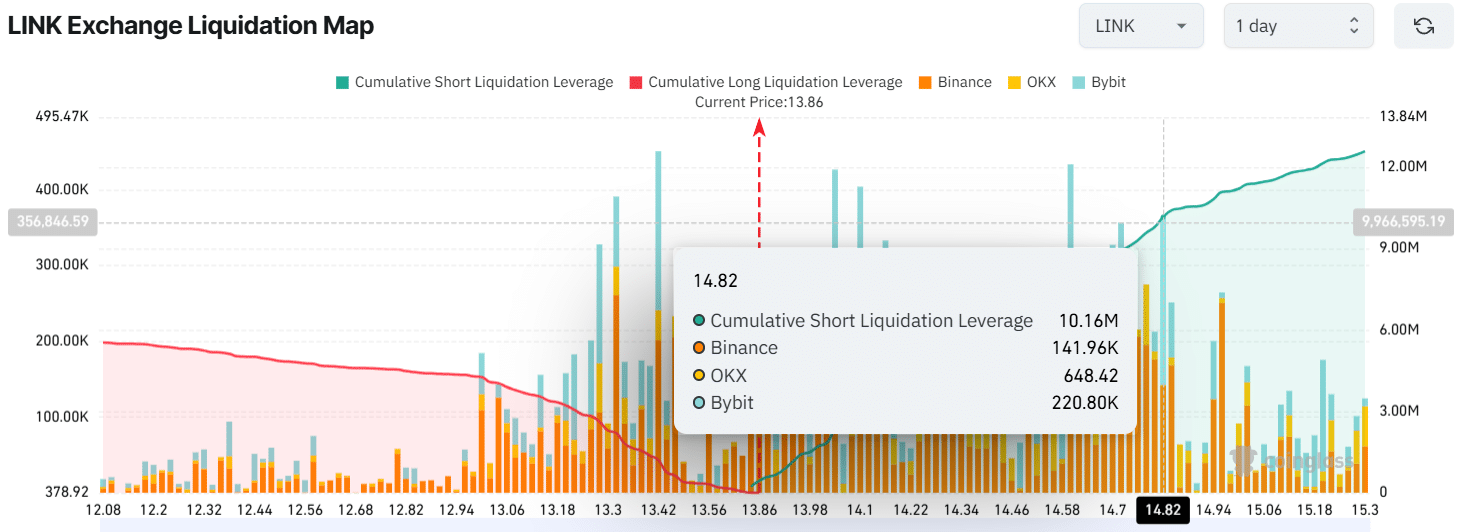

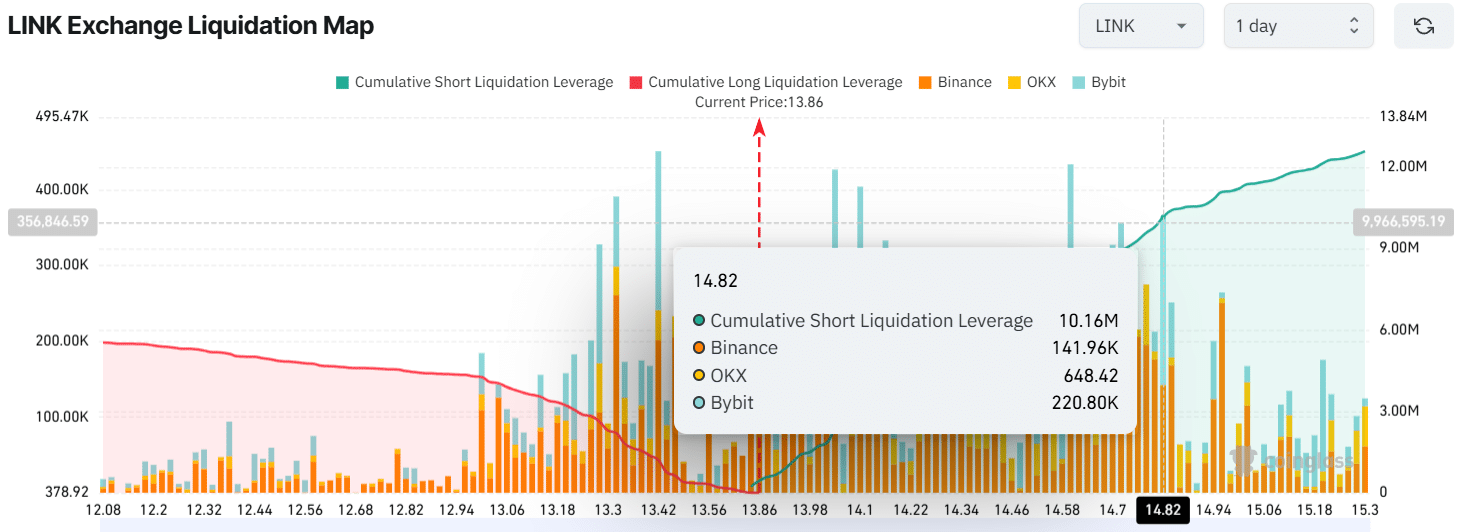

- Intraday merchants is likely to be over-leveraged at $13 on the decrease aspect and $14.82 on the higher aspect

Following a 12% value drop, Chainlink’s native token misplaced an important help degree at $14.85. This degree was the place 17,000 traders and long-term holders accrued 73.5 million LINK tokens.

Now, their holdings have turned purple, in line with the on-chain analytics agency IntoTheBlock.

75% of LINK traders see purple

After the lack of the $14.85-level, LINK has paved the best way for an additional value drop on the charts. Actually, at press time, the crypto was buying and selling close to $13.80, having declined by 12% within the final 24 hours.

Nevertheless, throughout the identical interval, its buying and selling quantity dropped by 15% – An indication of decrease participation from traders and merchants in comparison with the day past.

Owing to the aforementioned updates, solely 24.96% of LINK holders at the moment are within the cash. Quite the opposite, the share of traders within the purple and dealing with losses has surged to 74.74%.

Supply: IntoTheBlock

Chainlink (LINK) value motion and key ranges

Based on AMBCrypto’s technical evaluation, LINK could also be poised for additional draw back momentum after breaking out of its three-day-long consolidation between $15.85 and $14.85.

Based mostly on its latest value motion and historic patterns, if the asset closes a every day candle under the $13.80-mark, there’s a robust risk it might drop by one other 10% to hit the $12.20-level within the close to future.

Supply: TradingView

Due to its sustained value drop, LINK could also be unable to maneuver above the 200 Exponential Shifting Common (EMA) on the every day timeframe. This indicated that the asset could also be on a downtrend.

Right here, it’s value noting that the 200 EMA is a technical indicator used to find out whether or not an asset is on an uptrend or a downtrend.

Intraday merchants’ bearish nature

The most important proof of the altcoin’s bearish outlook is the truth that intraday merchants betting on quick positions are at the moment dominant. Their numbers are rising considerably too, particularly since extra of them consider the crypto’s value gained’t soar or get well quickly.

Based on the on-chain analytics agency Coinglass, $14.82 is the extent the place merchants holding quick positions are over-leveraged, having constructed practically $10.16 million value of quick positions. In the meantime, merchants betting on lengthy positions is likely to be exhausted, with over-leveraging at $13, the place they’ve constructed solely $4.26 million value of lengthy positions.

Supply: Coinglass

These over-leveraged positions replicate the true nature of market sentiment. Therefore, there’s a robust risk that quick merchants might simply push the worth to $13 and even decrease by liquidating lengthy positions.