Why Bitcoin can hit $160K in the next bull run

- Bitcoin’s newest prediction positioned the height of the following bull run above $160,000.

- The S2F timeline for the following rally peak is predicted to happen between 2024 and 2025.

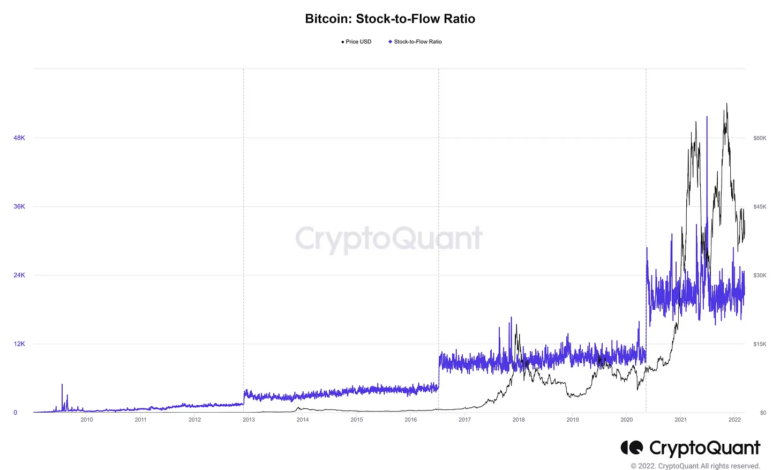

Many have tried to precisely predict Bitcoin’s [BTC] cycle peaks and bottoms with little to no accuracy. PlanB’s inventory to circulation mannequin (S2F) is maybe one of many traditional examples of a extremely publicized technique.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Sadly, PlanB’s S2F mannequin didn’t precisely predict the market prime in 2021. However might there be a extra correct model of the inventory to circulation mannequin?

Nicely, CryptoQuant analyst Gigi Sulivan lately carried out an S2F evaluation of Bitcoin. It would supply some readability about what to anticipate earlier than, throughout and after the following Bitcoin halving.

Supply: CryptoQuant

Based on Gigi Sulivan’s evaluation, BTC’s S2F chart registers a spike throughout every halving. A bull run has traditionally taken place after every halving, resulting in a brand new peak, adopted by a bear market.

The following Bitcoin halving is scheduled to happen in Could 2024. A bull run is perhaps on the playing cards if it maintains traits just like these noticed throughout earlier halving occasions.

Attainable or too formidable?

Sulivan’s evaluation anticipates that Bitcoin will peak between $160,288 and $206,824 throughout the fourth halving’s bullish cycle. Apparently, S2F predictions throughout the earlier two halvings had been notably decrease than the precise peaks.

This implies Bitcoin might rally properly above $260,000 throughout the subsequent bullish cycle.

Supply: CryptoQuant

However is the anticipated value for the following cycle actually attainable? Nicely, some previous predictions have a lot increased expectations relating to Bitcoin’s value sooner or later.

For instance, some imagine that Bitcoin is perhaps value over $1 million sooner or later. This implies the prediction based mostly on this S2F evaluation is a little more attainable, particularly within the close to time period.

Bitcoin will want a number of liquidity to push into the anticipated costs. Thankfully, this prediction aligned with some fascinating market observations.

For instance, institutional demand for BTC has recovered considerably in the previous couple of months. As well as, a number of Bitcoin ETFs had been pending approval at press time. They could supercharge BTC’s ascent within the months resulting in the halving subsequent yr.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Whereas Bitcoin merchants ought to be aware of these predictions, it is usually essential to notice that they’re speculative. This implies they don’t assure that costs will soar to these ranges.

The market is thought to be fairly unpredictable and therefore there’s a vital likelihood that issues may not prove as anticipated. However, a rally previous the anticipated ranges can also be attainable.