Why Bitcoin is in a speculative bubble

- Bitcoin’s blocks have been reaching most capability.

- Miner income declined whereas hash fee elevated.

Since reaching the $30,000 worth threshold, the worth of Bitcoin [BTC] has been the topic of intense hypothesis. Whereas many holders stay optimistic concerning the king coin’s future, there have been rising issues relating to its stability.

From blocks to bubbles

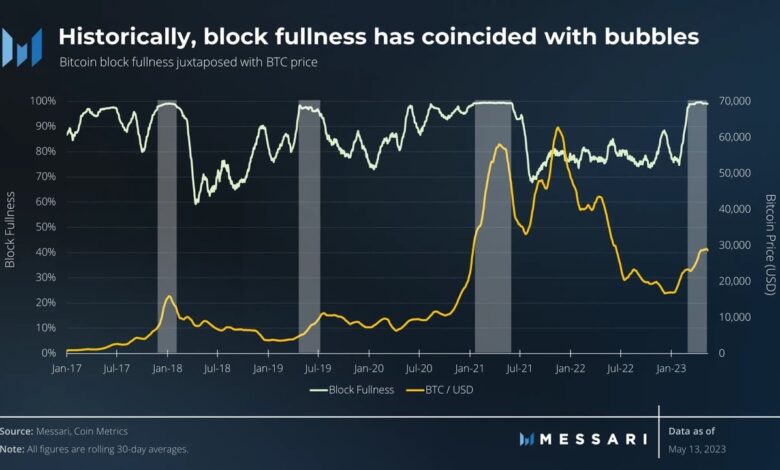

Based on Messari, Bitcoin’s blocks have been reaching their most capability at press time, inflicting congestion and an incapacity to accommodate further transactions.

This congestion has traditionally been noticed throughout speculative bubbles within the Bitcoin market, the place heightened transaction demand has overwhelmed the community.

Supply: Messari

Nevertheless, a major change has occurred within the composition of those blocks. Prior to now, blocks have been primarily stuffed with transaction exercise. However the blocks have been stuffed with Inscriptions ever because the NFT’s introduction.

The impression of this shift on the longer term worth of BTC stays unsure.

In current observations, the quantity of Ordinals being traded throughout exchanges had declined, as reported by Dune Analytics. This will likely have repercussions for miner income.

Notably, Blockchain.com’s information revealed that miner income decreased from $41.744 million to $26.178 million over the previous month.

Supply: Dune Analytics

In parallel, the hashrate of Bitcoin witnessed an upward pattern throughout this era. The rising hashrate positively influences the community’s safety and effectivity.

Nevertheless, it additionally results in elevated competitors amongst miners, probably impacting particular person profitability and centralization issues.

Supply: Blockchain.com

What are Bitcoin holders as much as?

The conduct of Bitcoin holders confirmed attention-grabbing patterns. The variety of holders on numerous exchanges rose, suggesting an growing curiosity in buying and holding BTC.

Glassnode performed an in depth analysis of cumulative Bitcoin holdings on the three main cryptocurrency exchanges over the previous three years.

The findings reveal vital progress in Bitcoin balances held by Binance and Bitfinex, with notable will increase of 421,000 BTC and 250,000 BTC, respectively.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

In distinction, Coinbase skilled a decline in its reserves, observing a discount of 558,000 BTC.

Supply: Glassnode

These shifts in holder conduct and the distribution of BTC amongst exchanges can have consequential results on the general Bitcoin ecosystem.