Why Bitcoin prices might fall further

- BTC’s realized worth of short-term holders was poised to fall beneath market worth.

- Ought to this occur, BTC’s worth may undergo an additional drop in worth.

Within the present market cycle, an unabated drop in Bitcoin’s [BTC] realized worth of its short-term holders put the main cryptocurrency vulnerable to an additional decline in worth, pseudonymous CryptoQuant analyst Crazzyblockk famous in a brand new report.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

BTC’s realized worth refers back to the common worth that every one BTCs have been final transacted on-chain. It’s calculated by dividing the full worth of all BTCs by the variety of cash in circulation.

The metric is commonly deployed towards assessing the general well being of the BTC market.

Rising realized worth signifies that buyers are shopping for bitcoins at the next worth, which is a bullish sign. However, a falling realized worth means that buyers are promoting bitcoins at a lower cost, which is a bearish sign.

Brief-term holders to find out the following worth route?

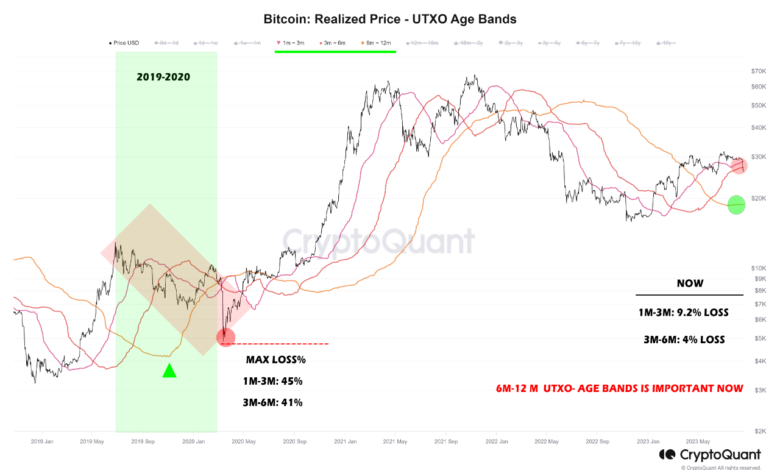

In its report, the analyst in contrast BTC’s realized worth of short-term holders within the 2019-2020 worth cycle and the present worth cycle and located that when the realized worth of short-term holders fell beneath the market worth within the former cycle, the “most loss imposed on short-term holders of 1-6 months was about 40-45%.”

Within the present worth cycle, the realized worth of short-term holders stays above the market worth. Nevertheless it was a lot nearer to the market worth than it was within the 2019 worth cycle.

The analyst famous that this meant short-term holders should not at as a lot of a loss as they have been within the 2019 worth cycle. This was as a result of losses incurred by this investor cohort solely ranged from 4% to 9% at press time.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Nonetheless, whereas present market circumstances will not be as bearish as through the 2019 worth cycle, the continued decline within the realized worth of short-term holders places them vulnerable to additional losses. It additionally places the final market vulnerable to struggling an additional drop within the king coin’s worth.

Based on the analyst:

“For the present market circumstances, it’s crucial that even within the face of an additional drop within the worth of Bitcoin, this realized worth ought to enhance. (This) will point out a double curiosity in holding Bitcoins apart from short-term losses for longer phrases.”

To keep away from any “large worth droop,” the analyst opined additional:

“This common worth, which is now flat, ought to take an upward slope (in) the approaching months in order that the dominance of Bitcoins held within the one 12 months results in assist for sustaining the long-term bullish efficiency of Bitcoin.”