Why Bitcoin’s pullback looks riskier after a $2.24B stablecoin exit

Because the market shifts into risk-off mode, threat administration naturally takes middle stage. Traditionally, this has meant both exiting positions or transferring to the sidelines, ready to re-enter as soon as circumstances flip again to risk-on.

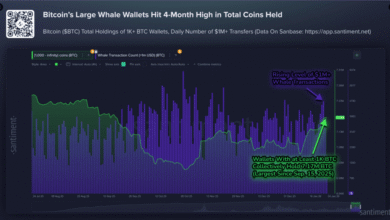

Notably, how traders are positioning round this shift is prone to form Bitcoin’s [BTC] subsequent transfer.

On the speculative facet, the BTC market is deleveraging, with Open Interest down almost $10 billion in beneath ten days.

Put merely, merchants are flushing extra leverage. Nevertheless, they’re not heading to the sidelines. Because the chart exhibits, the mixed market cap of the highest 12 stablecoins has fallen by $2.24 billion over the identical interval.

Supply: Santiment

Based mostly on CoinMarketCap data, these 12 stablecoins account for 90% of the $315 billion stablecoin market. So any outflows right here naturally translate right into a broader liquidity drain and lowered threat urge for food throughout the market.

Technically, this implies traders are exiting, dumping stables as an alternative of parking them as dry powder to rotate again into Bitcoin. Outcome? Thinner liquidity, since there’s much less stablecoin capital to soak up promoting strain.

Notably, that places the entire “purchase the dip” play for Bitcoin beneath the microscope. And in a risk-off market, with capital already flowing into belongings like gold, this setup may make any draw back strikes hit tougher.

Bitcoin losses sign rising threat amid stablecoin drain

Within the present market, conviction is the whole lot.

However stablecoin flows present traders are exiting. In the meantime, CryptoQuant studies important USDT outflows, displaying capital transferring to the sidelines. With dip‑shopping for nonetheless weak, the general affect is prone to stay restricted.

Trying forward, if outflows choose up, the stablecoin market may face a deeper correction, pushing its mixed market cap decrease. Notably, the latest $2.24 billion outflow coincided with Bitcoin’s 8% dip to $87k.

Supply: TradingView (BTC/USDT)

That stated, this wasn’t only a “coincidence.”

As an alternative, gold hit a document of $5k, whereas the Altcoin Season Index slid additional. Collectively, these developments help AMBCrypto’s view: Relatively than rotating into Bitcoin or altcoins, sideline capital is transferring into different belongings.

On high of that, Lookonchain flagged a Bitcoin OG pulling 20 million USDC from Hyperliquid and transferring it to Binance after taking a web lack of $2 million on his BTC place, a transparent sign of capitulation out there.

In essence, traders’ threat administration round BTC is leaning extra towards capitulation than conviction. With cash transferring into protected havens and stablecoin outflows nonetheless rolling, a deeper sell-off is quietly constructing.

Remaining Ideas

- High 12 stablecoins misplaced $2.24 billion, with traders exiting somewhat than holding dry powder, limiting dip-buying and rising draw back strain on Bitcoin.

- Gold hits $5k, altcoins slide, and BTC whales are offloading positions, signaling risk-off sentiment and a possible deeper sell-off.