Why Bitcoin’s run to $28K could only be the beginning

- About $1.17 billion BTC was accrued in September, driving the king coin as much as $28,000.

- On-chain metrics together with Bitcoin’s circulation and change stream supported a possible rise to $30,000.

Bitcoin [BTC] started October in scintillating vogue, because the king coin broke previous $28,0000. Its worth enhance additionally triggered a hike within the values of different cryptocurrencies, main the broader market cap to achieve $1.12 trillion.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Nevertheless, BTC’s enhance was not with out trigger, and Santiment did nicely to focus on the underlying influences. Based on the on-chain analytic platform, addresses holding 10 to 10,000 BTC accrued a mixed $1.17 billion price of the coin in September.

Going sturdy regardless

Usually, elevated accumulation by each the retail and whale cohorts has a optimistic impression on most cryptocurrencies. This time, it wasn’t completely different, with the outcome beginning to present on 1 October.

🐳 #Bitcoin has blasted again above $28K for the primary time since August seventeenth. With 10-10K $BTC wallets accumulating a mixed $1.17B since September 1st, a return to a $30K market worth seems to be increasingly seemingly until these wallets now begin dumping. https://t.co/sdcPWGiBMg pic.twitter.com/zN741HmDqh

— Santiment (@santimentfeed) October 2, 2023

However Santiment didn’t cease there. Based on its put up on X (previously Twitter) proven above, Bitcoin had extra potential to achieve $30,000 than to expertise a notable drawdown. Apparently, this projection might be potential, as different on-chain metrics appear to help it.

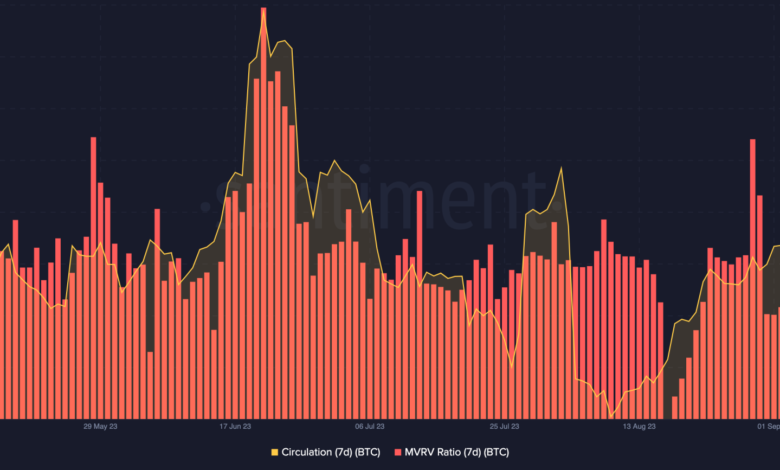

For a begin, let’s check out Bitcoin’s circulation. Up till 29 September, Bitcoin’s circulation was 343,000. At press time, the metric had fallen to 302,000. Circulation exhibits the variety of distinctive cash used throughout a interval.

Spikes on this metric could indicate an increase in short-term promote stress. So, since BTC’s seven-day circulation dropped, it signifies that the coin could not expertise vital promote stress quickly. Therefore, a continuation of the value enhance is feasible.

Bitcoin’s Market Worth to Realized Worth (MVRV) ratio additionally elevated. The MVRV ratio helps to judge the tops and bottoms of the Bitcoin market. It additionally offers an thought if a cryptocurrency is at a good worth, undervalued, or if it’s overpriced.

On the time of writing, the seven-day MVRV ratio was 5.328%, indicating that the market has made some earnings. Regardless of the rise, the metric confirmed that BTC nonetheless has a very good potential to maneuver towards $30,000 for the reason that MVRV ratio was not even but at a ten% enhance.

Supply: Santiment

Optimistic conviction neutralizes pessimism

Another metric to verify for Bitcoin’s potential is the change stream. At press time, Bitcoin’s change influx was 1588. This metric measures the variety of cash transferred from non-exchange wallets to change addresses.

Alternatively, the change outflow was 2044. As the other of the influx, the change outflow is the variety of cash transferred from change wallets to exterior addresses. So, the distinction between the metrics is a sign that extra individuals had been prepared to HODL than promote.

Supply: Santiment

How a lot are 1,10,100 BTCs price at the moment?

Therefore, it’s unlikely for Bitcoin to lose maintain of $28,000. In the meantime, bears haven’t given up on BTC regardless of the value enhance. Based on analysis and knowledge analyst, Axel Adler, bearish merchants had been trying to push down the market worth. So, bulls could have to be careful for that.

An try with $77M of bears 🐻 to push the market down. pic.twitter.com/1M0uB7qRqF

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 2, 2023

On the opposite finish, one other analyst, Michaël van de Poppe opined that Bitcoin might hit $40,000 within the final quarter (This fall). He primarily based his projection on the potential ETF approval, and the historic pre-halving rally.

Welcome to Uptober.

Welcome to This fall, which is main in the direction of an awesome quarter, doubtlessly fueled by ETF approvals and the pre-halving rally.

Doubtlessly #Bitcoin to $40,000 is affordable.

— Michaël van de Poppe (@CryptoMichNL) October 1, 2023