Why did Binance ditch Ordinals — and will the market survive?

Information reveals Binance’s NFT market wasn’t actually a preferred vacation spot for Ordinals anyway — with merchants now fixated on Runes as a substitute.

Binance’s resolution to scrap assist for Ordinals in April raised eyebrows amongst Bitcoin fans.

The embattled change, which has been combating authorized battles on a number of fronts in latest months, mentioned the transfer was designed to “streamline” its product providing.

It went on to warn anybody who holds Bitcoin NFTs to maneuver them someplace else so they might proceed to be eligible for airdrops.

This marks fairly a sudden U-turn from Binance, which is the largest crypto platform when it comes to buying and selling quantity.

Ordinals solely grew to become technologically attainable early final 12 months and permit inscriptions to be made on a single satoshi — the equal to 1 100-millionth of a Bitcoin.

Photos, movies, and different types of information can now be hooked up to sats consequently, however critics declare this solely serves to clog up Bitcoin’s blockchain.

Solely final Might, Binance’s head of product Mayur Kamat mentioned:

“Bitcoin is the OG of crypto. We consider issues are simply getting began right here and may’t wait to see what the long run holds on this area.”

Mayur Kamat

So why the dramatic reversal — and can this function a crushing blow to the way forward for Ordinals?

How are Ordinals holding up?

Binance formally ended assist for Ordinals on April 18, which means they might now not be traded via the platform’s NFT market.

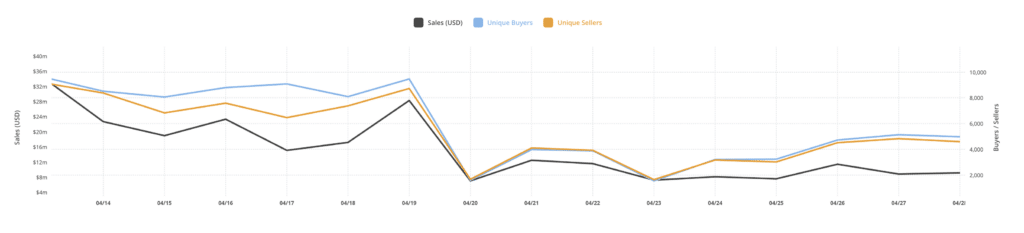

Information from CryptoSlam! does present that there was a marked fall in Ordinals gross sales volumes — in addition to the variety of distinctive consumers and sellers — since.

Ordinals gross sales, distinctive consumers and sellers | Supply: CryptoSlam!

Gross sales volumes stood at $28.2 million on April 19, with 9,469 distinctive consumers and 9,728 distinctive sellers general.

Quick ahead one week to April 26, and revenues had slumped to $11.4 million. In the meantime, the variety of consumers and sellers had greater than halved to 4,722 and 4,515 respectively.

Nevertheless, it’s vital to emphasize that correlation doesn’t suggest causation, and there are different components at play right here.

For one, April 19 formally marked the newest Bitcoin halving, which noticed block rewards tumble from 6.25 to three.125 BTC. Merchants have been preoccupied with different issues.

However second, the halving additionally led to the launch of Runes — a brand new normal that enables fungible tokens (like ERC-20 on Ethereum) to be rolled out extra effectively on Bitcoin.

Information from Dune Analytics powerfully explains what occurred in the course of the second half of April:

Supply: Dune Analytics

On April 19, Ordinals had a 6.5% share of transactions on the Bitcoin blockchain.

A day later — when Runes made their debut — Ordinals represented simply 0.4% share as frenzied demand for memecoins shot up.

The recent pink within the chart above represents the proportion of every day Runes transactions, which hit a staggering share of 73.5% on launch day.

Put one other approach, Binance isn’t solely accountable for dwindling demand for Ordinals — Runes are stealing their lunch cash.

What subsequent for Ordinals?

It’s unlikely that Ordinals collectors will lose a lot sleep over Binance exiting the market — particularly contemplating the change has been banned or severely restricted in 20 nations worldwide. They embrace Canada, China, Japan, Italy, Australia, the U.Okay. and the U.S.

Additional Dune Analytics dashboards present Binance’s NFT platform wasn’t actually a preferred vacation spot for Ordinals anyway.

On April 29, two marketplaces — OKX and Magic Eden — dealt with 94% of transactions between them.

Supply: Dune Analytics

You can argue that this quantities to Binance inserting its assets into areas the place it might really achieve a bigger market share.

The larger query now could be this: will Binance be rolling out assist for Runes any time quickly?

Binance teases itemizing Runes

They did not checklist BRC-20 till many months after it launched

However once they did, there was lots of of tens of millions of {dollars} in quantity and it led $ORDI to hit $1B valuation pic.twitter.com/ut7hVx3B7t

— trevor.btc (@TO) April 22, 2024

As buying and selling volumes proceed to surge for newly launched memecoins on the Bitcoin community, it appears inevitable that Binance will need a slice of the pie.

With exchanges partaking in a brutal worth warfare to remain aggressive on transaction charges, buying and selling platforms are all the time seeking to diversify their income streams.

Demand for Ordinals could have dipped in latest weeks, however Bitcoin stays the second-largest blockchain for NFT gross sales quantity — streets forward of Solana, with Ethereum not too long ago returning to the highest spot.

If urge for food for Bitcoin NFTs recovers, Binance’s resolution to bow out of providing Ordinals via its market could show short-sighted.

Learn extra: Binance’s CZ in talks with Sam Altman to discover AI investments