Why Does Bitcoin Have Value?

You’ll be able to’t contact it. You’ll be able to’t see it. It’s not backed by any governments, gold requirements, or something bodily. However then, why is Bitcoin worthwhile? Good query! If it’s only a string of code working on a blockchain community, why do individuals pay hundreds of {dollars} for a single coin? And right here’s the loopy half: it isn’t simply costly, it works. Bitcoin doesn’t depend on central banks or middlemen like fiat currencies. It’s a decentralized digital foreign money with a restricted provide, coded and constructed utilizing cryptography and blockchain expertise. On this information, you’ll study what makes it price one thing—and why it would simply be a very powerful digital asset ever.

Why Conventional Currencies Have Worth

Each day, you switch {dollars}, euros, or yen with out even fascinated with it. However have you ever ever considered why they’re truly price one thing? It’s as a result of central banks say so—and the individuals agree.

These are fiat currencies. ‘Fiat’ means they don’t have any intrinsic worth. Their worth comes from belief. You belief the federal government received’t let the foreign money collapse. You belief the cash you’ve obtained saved in your account will nonetheless be good to purchase some espresso tomorrow.

That belief is enforced by financial coverage, taxes, and authorized tender legal guidelines. Everybody accepts it, so that you do too. However when that belief breaks—like in international locations with unstable currencies—issues crumble quick.

Conventional currencies are worthwhile due to one factor: perception. When that perception fades, so does their buying energy.

What Is the Level of Bitcoin?

That is the issue: conventional monetary techniques depend on middlemen like banks and governments. These establishments resolve who will get entry, what charges they cost, and the way a lot cash they print. This kind of system works—till it doesn’t.

Bitcoin gives a substitute for the system. It’s a decentralized foreign money you should use freely. No financial institution accounts. No gatekeepers. All you want is an web connection and a pockets. It offers your funds freedom. You management your belongings, and you may ship them throughout the community with no need anybody’s permission. And that’s the purpose. It challenges the concept a single entity should oversee and approve how you employ your cash.

And it’s not nearly comfort, both. It’s about shifting energy. From establishments to people. From inflation to sound cash. Bitcoin operates on guidelines written in code—not modified behind your again.

Why Is Bitcoin Useful?

Bitcoin isn’t backed by something bodily. It’s not issued by any authorities. It has no intrinsic worth. So why do thousands and thousands of individuals see it as worthwhile? Brief reply: as a result of it solves actual issues. It’s scarce, safe, and outdoors the management of central authorities. Let’s break down the important thing elements behind the worth of BTC. Collectively, they make it one thing no conventional foreign money or crypto token can match.

Shortage and the 21 Million Restricted Provide Cap

You’ll be able to’t print extra BTC. Ever. Its code limits the whole circulating provide to 21 million. No overrides. No emergency bailouts.

Learn extra: What’s Circulating Provide?

This built-in shortage mimics valuable metals like gold. However Bitcoin is much more clear. You’ll be able to examine its actual provide at any time—no have to guess or do any sophisticated analysis.

Central banks can print as a lot fiat foreign money as they like. However the variety of Bitcoin in the marketplace is capped. That makes it a possible retailer of worth, particularly if fiat currencies lose their belief. If demand will increase, the provision continues to be fastened, and the worth of a single Bitcoin can go means up in worth. It’s simply provide and demand.

Decentralization and the Absence of Central Management

There are not any CEOs. No boardrooms. No swap to show the entire thing off. Bitcoin runs on a decentralized community of nodes and miners all around the globe. No single person, company, or country controls it. That’s the way it was designed.

Due to this decentralization, Bitcoin is way tougher to censor, shut down, or manipulate. In contrast to conventional currencies, it has no central authority pulling its strings. Choices are made by code, consensus, and math—not politics or panic.

This independence offers it a degree of resilience most different related techniques can’t match.

Safety and Immutability Via the Blockchain

Bitcoin doesn’t depend on belief. It depends on math.

Each single transaction on the community is recorded on a public ledger that’s known as a blockchain. As soon as the transaction’s there, it’s locked in. You’ll be able to’t change or erase it. It’s immutable—and that’s a giant deal.

Bitcoin secures its community by means of computing energy. Hundreds of miners resolve cryptographic puzzles so as to add new blocks to the community. That is known as proof-of-work consensus, the mechanism that retains the community sincere and immune to assault. Over a decade later, the Bitcoin blockchain has nonetheless never been hacked. That monitor document is a part of what makes it a dependable retailer of worth.

Learn extra: What’s Proof-of-Work?

Bitcoin as a Retailer of Worth (“Digital Gold”)

Gold—the asset—has been round for hundreds of years. And Bitcoin? Simply over a decade. However evaluating the 2 is definitely fairly widespread, and for good cause.

Each Bitcoin and gold are scarce. They’re sturdy. They’re onerous to pretend. That’s why many name Bitcoin “digital gold.” You’ll be able to’t simply print extra, like with fiat currencies. It has restricted provide. However you don’t want a vault to retailer it such as you do with gold. Only a safe pockets and a backup phrase.

Folks can use Bitcoin to safeguard their belongings after they don’t belief banks or fiat currencies. It’s extra enticing to some buyers, since inflation could make conventional monetary techniques wobble. That’s the way it’s earned its place as a contemporary hedge in opposition to chaos.

Bitcoin as a Medium of Trade

Bitcoin’s now not simply an funding alternative. These days, you may truly spend it, too. Because it turns into extra extensively accepted, it’s proving itself as an actual medium of change—not only a retailer of worth.

You should use it to purchase flights, laptops, VPN companies, espresso, and so much more. Main retailers and fee processors are beginning to assist crypto funds straight or by means of third-party apps.

Positive, value fluctuations make some retailers cautious. However the quantity of companies which might be accepting Bitcoin is rising and rising. In any case, there are not any banks, and no foreign money conversions essential—simply digital cash that works throughout borders, by yourself phrases.

International Accessibility and Permissionless Nature

There’s no want for a checking account, or a financial institution, for that matter. You simply want an web connection and a pockets to make use of Bitcoin. It’s open to anybody, anyplace. Whether or not you’re in New York or Nairobi, you may ship and obtain BTC. No gatekeepers. No varieties to fill. No approvals.

That’s a giant deal in locations with damaged monetary techniques. Billions of individuals internationally are underbanked. Bitcoin offers them entry to international worth switch and opens the door to decentralized finance, immediately and freely.

Nobody can block your account. Nobody can freeze your funds. That’s the facility of a really open monetary instrument.

Transparency and Belief Via Code

You don’t have to belief a financial institution once you use Bitcoin. You’ll be able to see all the things for your self. Each single transaction is recorded, immutably, on a public ledger. Anybody can confirm it. There are not any backdoors. No humorous enterprise. Simply uncooked information, and cryptographic algorithms doing their factor.

The principles are open-source. The code is public. You’ll be able to examine how Bitcoin works for your self, anytime. That sort of transparency creates belief, all with no need a government.

You don’t must marvel if somebody’s printing further cash. You’ll be able to go examine for your self, and show that they’re not.

Who Gave Bitcoin Worth?

Bitcoin barely price something when it first appeared. So who precisely made it so worthwhile in the present day? The reply: individuals began utilizing it, and it acquired worth within the course of.

In 2010, the primary actual Bitcoin transaction occurred when developer Laszlo Hanyecz paid 10,000 BTC for 2 pizzas. After this second, it was now not simply an web plaything, however one thing with price in the actual world.

From there, increasingly more early adopters started steadily utilizing and selling Bitcoin in enterprise. For instance, Overstock.com became one of many first main retailers to simply accept BTC in 2014, proving the digital foreign money might work at bigger scales.

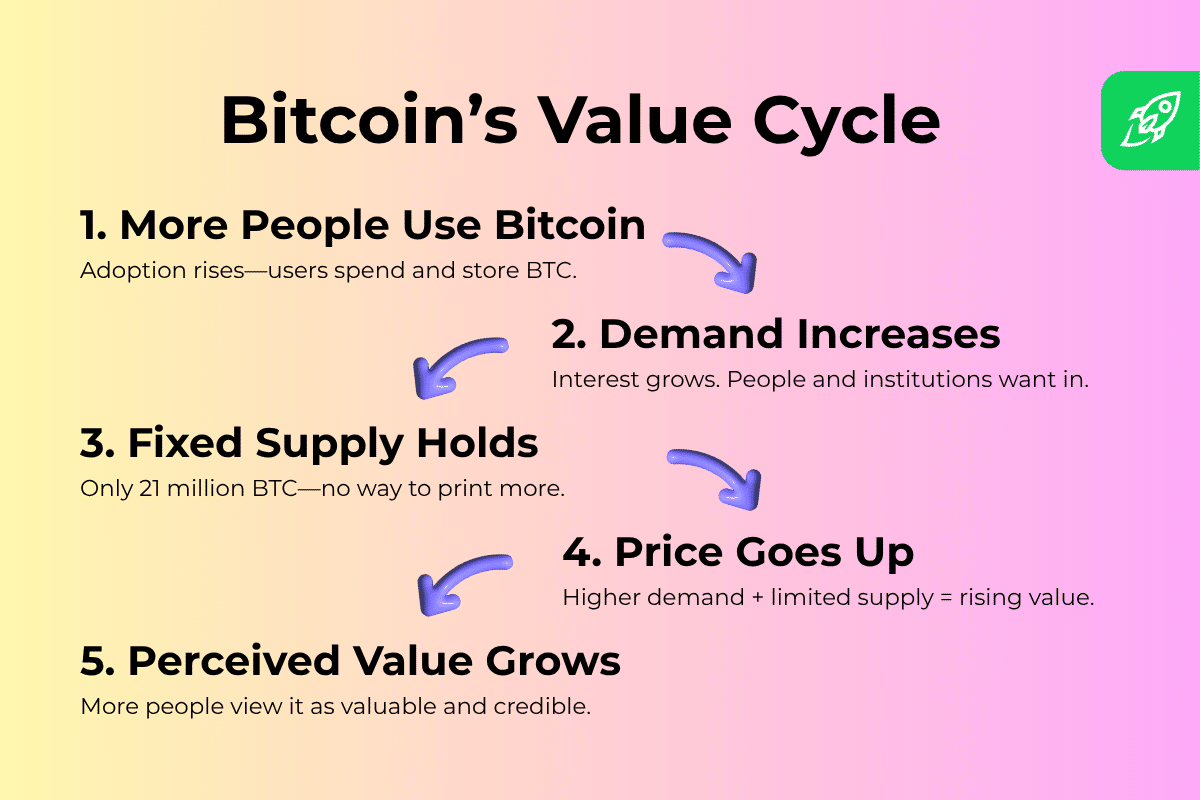

As increasingly more individuals began shopping for and spending BTC, demand rose—whereas the provision stayed fastened. This imbalance of restricted provide and growing demand pushed up its value. The extra individuals and firms used it, the extra of it others wished. This stored driving up its worth.

So BTC’s present value wasn’t assigned by decree. It was earned—by the individuals, companies, and networks who’ve put it to work.

Why Bitcoin Has an Benefit Over Different Cryptocurrencies

However Bitcoin isn’t the one digital asset in the marketplace anymore. Hundreds of cryptocurrency tokens exist in the present day. Nonetheless, it manages to steer the pack—and never simply because it’s the oldest.

Its benefit is down to numerous elements, together with belief, its monitor document, and its underlying expertise. New cash may supply fancier options, however most haven’t stood the take a look at of time like Bitcoin has. Let’s break down why this coin nonetheless holds the crypto crown.

The First-Mover Benefit and Community Safety

Bitcoin was the primary—and that’s a critical benefit. It constructed the most important, most safe decentralized community within the historical past of crypto. Extra customers. Extra miners. Extra nodes. That scale makes it onerous to assault or manipulate.

Different cash try to catch up, however Bitcoin’s headstart means deeper liquidity, broader adoption, and stronger infrastructure.

The Lindy Impact: The Longer Bitcoin Exists, the Stronger It Turns into

The Lindy Effect claims that the longer one thing’s already existed, the longer it’s more likely to preserve going. Properly, Bitcoin’s already been working since 2009, by means of loads of crashes, bans, and fixed media cycles. And every passing yr it survives, belief grows. That monitor document offers it a sort of monetary gravity. Buyers, establishments, and even critics deal with it in a different way than newer crypto tokens.

Why Bitcoin Is Extra Proof against Manipulation Than Altcoins

There’s some sort of face behind most altcoin tasks—a founder, a basis, an organization. Bitcoin doesn’t have that. There’s no CEO. No board. Which means it’s extra impartial. With no central level of failure and a large circulating provide, it’s extremely immune to pump-and-dump schemes and backroom dealings.

It’s gradual to alter, and that’s by design. That’s what retains it sincere.

Criticisms of Bitcoin’s Worth

Bitcoin’s obtained followers, however loads of critics, too. Some name it risky. Others name it wasteful. And lots of extra declare that, these days, different cryptocurrencies can do its job higher.

These points aren’t simply noise—they’re price listening to out if you’d like the entire image. So let’s take a more in-depth have a look at what the skeptics say.

Volatility and hypothesis

Bitcoin’s value chart over the previous 5 years is sort of a rollercoaster. It’s climbing one month and crashing the following. That kind of value motion scares off a number of buyers. It additionally feeds the concept the coin’s worth is pushed extra by hypothesis than precise utility.

On high of that, the cryptocurrency market continues to be younger. Information, altering laws, and web hype can set off huge swings. Which means the worth of BTC isn’t all the time tied to fundamentals. As an alternative, it may well react shortly, and generally irrationally.

It’s true that the long-term tendencies are pointing up. However within the short-term, it’s usually chaotic.

Environmental issues

Mining Bitcoin takes vitality. A variety of it. It’s because the Bitcoin community depends on Proof-of-Work consensus, the place miners compete utilizing increasingly more highly effective machines to validate transactions, securing the chain. All that computation burns electrical energy.

Critics argue that this kind of growing energy utilization is unhealthy for the surroundings, and extremely wasteful. Some governments, comparable to China, have even banned mining attributable to this excessive vitality consumption, whereas others are pushing for greener options. Both means, the environmental debate is complicated, and isn’t going away anytime quickly.

Comparisons to different cryptocurrencies

Bitcoin isn’t the quickest crypto, and it’s undoubtedly not the most cost effective. It doesn’t assist good contracts, both, like Ethereum or different chains. So why keep it up?

Critics declare that newer digital currencies already supply higher tech, decrease charges, and extra flexibility. Some cash course of hundreds of transactions per second. Bitcoin can course of round seven.

However Bitcoin wasn’t constructed for bells and whistles. It was constructed as sound cash—easy, safe, and gradual to alter. Whereas different cryptocurrencies evolve shortly, they usually commerce stability for his or her velocity. Bitcoin’s power is that it doesn’t attempt to do all the things. It simply tries to do one factor nicely. And for a lot of, that’s ok.

What Drives the Worth of Bitcoin?

The worth of BTC isn’t magic. Like all asset, its worth comes down to produce and demand. The availability is fastened—solely 21 million will ever exist. So when there’s a rise in demand, rising costs often observe.

However there’s extra. Information, regulation, media protection, and institutional buyers all play their roles. Then there’s sentiment. When individuals really feel bullish, they purchase. Once they panic, they promote. It’s half emotion, half economics—and all the time in movement.

Will Bitcoin Maintain Its Worth?

That’s the billion-dollar query.

Supporters say sure—due to its restricted provide, rising adoption, and rising belief. They see it as sound cash in a world the place governments preserve printing increasingly more.

Skeptics aren’t so positive. They level to cost fluctuations, the dangers of blockchain expertise, and doable regulation as causes the coin may lose steam. It’s not backed by any authority, and that makes some buyers nervous.

However right here’s the factor: Bitcoin has already outlived dozens of doomsday predictions over time. It’s been by means of bubbles, bans, crashes—and it simply retains bouncing again. Will it maintain its worth ceaselessly? Nobody is aware of. However it’s held robust for over a decade, and there’s greater than luck behind that.

Conclusion: Why Bitcoin’s Worth Is Right here to Keep

Bitcoin isn’t simply worthwhile as a result of somebody mentioned it needs to be. It’s worthwhile as a result of it really works—and retains working. It’s scarce. It’s safe. It runs with no need banks, borders, or permissions. It offers you complete management over your belongings in a means fiat currencies can’t.

Sure, it’s risky, and has its critics. However it’s additionally obtained critical endurance. Folks have used Bitcoin to save lots of, spend, and survive in failing economies for greater than a decade now. Establishments have poured in. Nations have taken discover.

Bitcoin’s worth wasn’t a straightforward success. It’s an earned victory. One block, one use case, one believer at a time. And so long as individuals preserve selecting it, that worth isn’t going anyplace.

FAQ

Can Bitcoin lose all its worth?

It’s extremely unlikely. So long as individuals use and belief it, BTC will nonetheless maintain some worth. Complete collapse would require international, everlasting lack of market demand.

Is Bitcoin too costly to purchase?

Truly, no! You should buy fractions of Bitcoin, known as “satoshis,” all the way down to 0.00000001 BTC. You don’t have to afford a complete coin. Most exchanges allow you to begin with $10 or much less.

Can Bitcoin be hacked?

The Bitcoin community has by no means been hacked. It’s secured by computational energy and cryptographic algorithms. Most hacks goal exchanges or customers, not the blockchain itself.

Why is Bitcoin in comparison with gold?

It’s as a result of it shares a number of key traits with the valuable metallic. Bitcoin’s shortage, sturdiness, and use as a retailer of worth are why it’s known as “digital gold”. However Bitcoin beats gold in velocity, divisibility, and portability.

Will Bitcoin ever change conventional cash?

It’s not going. However Bitcoin doesn’t want to interchange it to matter—it may well act as a substitute or backup, particularly in locations with unstable currencies or restricted monetary entry.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.