Why Ethereum and AI tokens could be your best bet in Q3

- Ethereum poised to have a constructive quarter forward in keeping with new analysis.

- AI tokens dominated within the social area and carried out positively YTD.

Ethereum [ETH] and AI tokens have had a constructive run over the previous few months.

Apparently, Grayscale Analysis believes the upcoming quarter shall be closely influenced by the current approval of spot Ether exchange-traded merchandise (ETPs) within the U.S. market.

This can be a important growth because the Securities and Alternate Fee (SEC) greenlit Type 19b-4 filings in late Could, permitting a number of issuers to checklist these Ether ETPs on U.S. exchanges.

ETPs to assist ETH

Grayscale’s market evaluation assumes ETPs will start buying and selling in Q3 2024.

Much like the profitable launch of spot Bitcoin ETPs in January, Grayscale Analysis anticipates these Ether merchandise will appeal to important internet inflows, albeit more likely to a lesser extent than their Bitcoin counterparts.

This might probably translate to cost assist for Ethereum itself and tokens inside its ecosystem.

The launch of spot Ether ETPs is anticipated to deliver further focus to the distinctive options of the Ethereum community. In contrast to different blockchains, Ethereum makes use of a modular design strategy, the place totally different infrastructure elements work collectively to optimize person expertise and cut back prices.

Moreover, Ethereum boasts the most important decentralized finance (DeFi) ecosystem within the crypto area and is a hub for tokenization initiatives.

Elevated curiosity and adoption of Ethereum fueled by ETP approval might result in rising exercise and valuation assist for particular Layer 2 tokens corresponding to Mantle, distinguished DeFi protocols like Uniswap, Maker, Aave, and different essential property throughout the Ethereum community corresponding to Lido, a staking protocol.

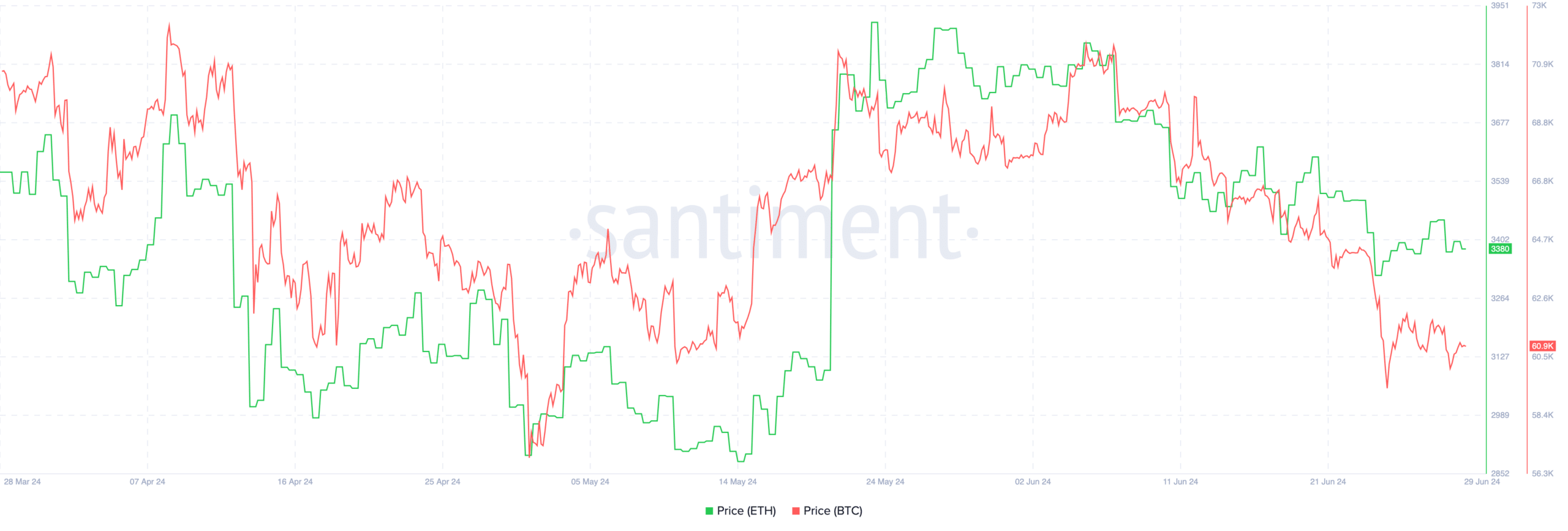

One key issue that might showcase how curiosity in Ethereum has been rising may very well be how ETH’s value has remained resilient whereas BTC’s costs have plummeted.

Regardless of each ETH and BTC being closely correlated, current market drawdowns haven’t impacted ETH as harshly as BTC.

Supply: Santiment

Whereas spot Ether ETPs symbolize a significant growth, Grayscale Analysis anticipates different ongoing market themes to stay related within the coming quarter.

A key space of focus would be the potential for blockchain know-how to intersect with the sphere of Synthetic Intelligence (AI).

Are AI tokens doing good?

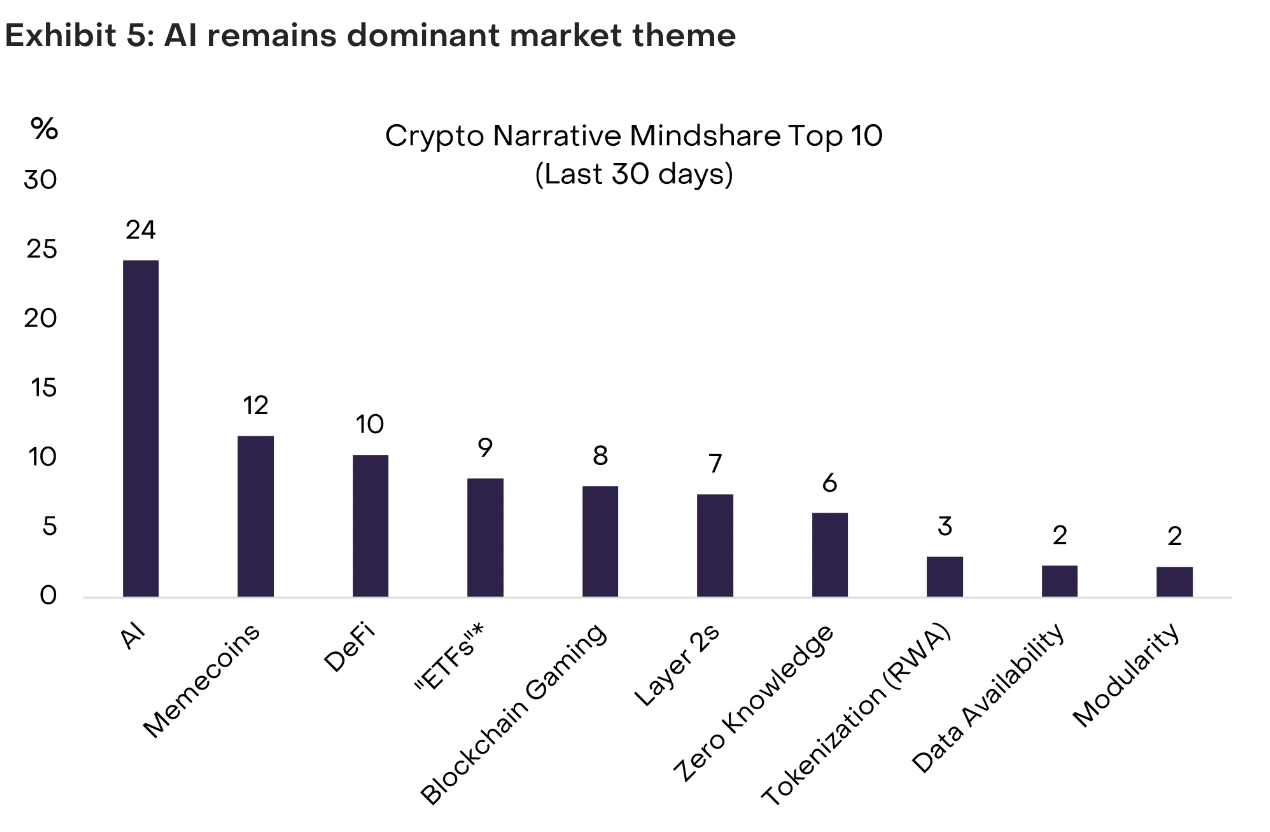

Based on current information, AI tokens had the most important quantity of dominance when it got here to the social media panorama.

Supply: Grayscale Analysis

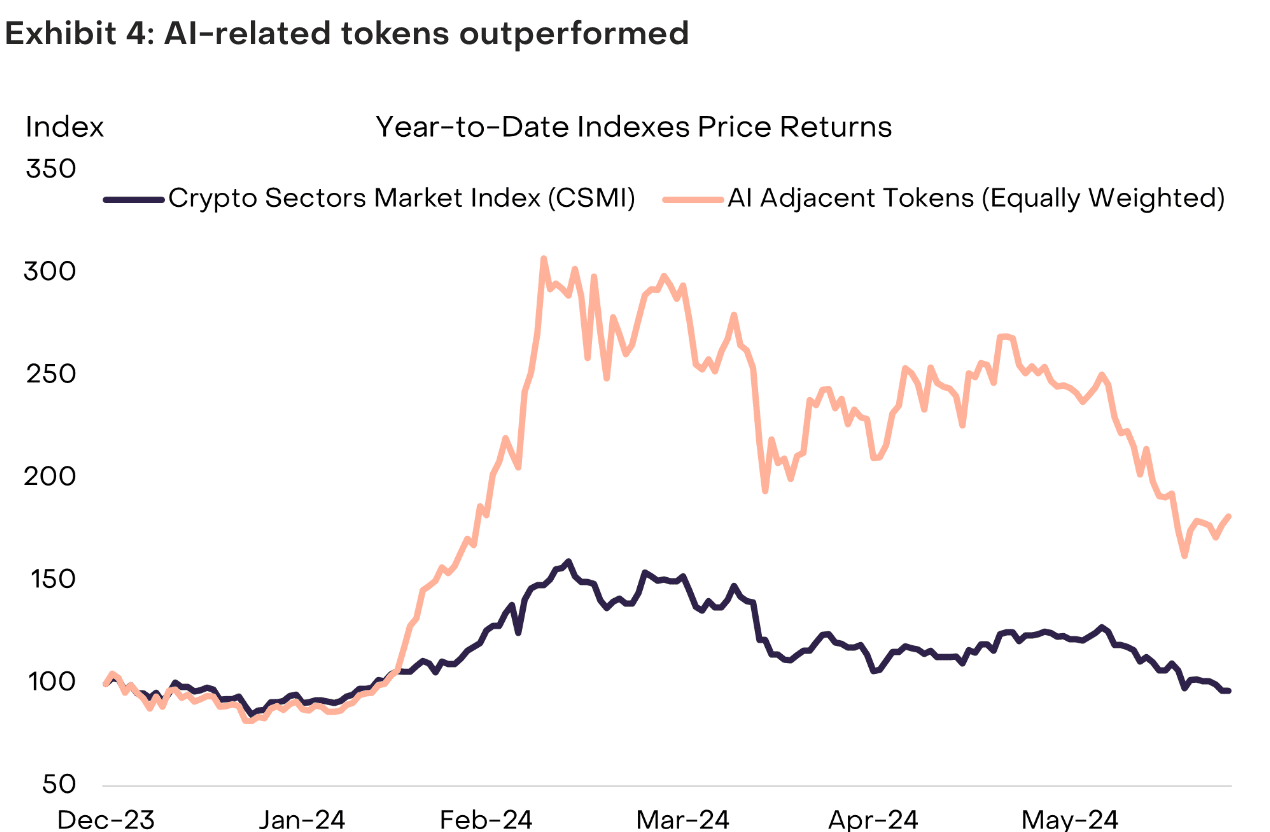

Furthermore, AI based mostly tokens corresponding to RNDR, TAO and FET, outperformed the general crypto sectors market index as effectively by way of 12 months so far value efficiency. If the hype round AI tokens continues, it might yield constructive outcomes for holders.

Supply: Grayscale