Why Ethereum ETF Launch Didn’t Stop Its Price Crash: Inside Look

- Ethereum’s worth falls by 10% post-ETF launch, opposite to bullish predictions.

- Components like market corrections and exterior financial pressures contribute to the downturn

In latest developments, Ethereum [ETH] worth has witnessed a notable downturn, dipping by almost 10% inside the previous 24 hours, and at present standing at $3,164.

This decline strikes as notably vital given its timing—proper after the launch of the extremely anticipated spot Ethereum ETFs, which many had anticipated to catalyze a bullish development for ETH.

Though that is just the start of the stay buying and selling of those ETH monetary merchandise, 10x Analysis, a Digital Asset Analysis for Merchants and Establishments has given some notable elements on why Ethereum is plunging regardless of their launch.

Why the sudden drop?

Regardless of the optimism that surrounded the preliminary buying and selling of those ETFs, the response has not lived as much as expectations.

In keeping with insights from 10x Analysis, the fast dissipation of the preliminary pleasure across the Ethereum ETFs has led to a basic “sell-the-news” situation.

This phenomenon isn’t new to the cryptocurrency market; comparable tendencies have been noticed in previous vital occasions inside the digital property area, together with a number of cases all through 2017, 2021, and earlier in 2024.

10x Analysis factors out that the timing of the ETF launch could have exacerbated the scenario.

It coincided not solely with the distribution of Bitcoin from the long-standing Mt. Gox case but additionally with a broader market downturn influenced by poor performances within the U.S. tech sector.

Firms like Alphabet and Tesla have seen notable sell-offs, contributing to a cautious or bearish outlook throughout funding areas as a result of weakened client spending forecasts.

Moreover, the impression of those elements seems to be extra pronounced for Ethereum.

Forward of the ETF’s launch, 10x Analysis already marked Ethereum as overbought, suggesting that the market was ripe for a correction. This attitude appears to have been validated by the latest worth actions, which noticed Ethereum struggling whilst vital capital flowed into the brand new ETFs.

Ethereum ETF inflows and worth drop impression

Regardless of the downturn in spot costs, the Ethereum ETFs have attracted appreciable consideration from buyers. On their first day of buying and selling, these funds collectively garnered web inflows of round $106 million.

Main the cost was BlackRock’s iShares Ethereum Belief ETF, which alone pulled in $266.5 million. Shut on its heels was the Bitwise Ethereum ETF, with $204 million in inflows, and the Constancy Ethereum Fund, which attracted $71 million.

Nonetheless, not all funds skilled optimistic inflows. The Grayscale Ethereum Belief, transitioning into an ETF, noticed vital outflows totaling $484 million—markedly larger than the preliminary outflows skilled by its Bitcoin counterpart earlier within the 12 months.

In the meantime, because the market digests the brand new developments and adjusts to the inflow of ETF merchandise, Ethereum’s worth volatility has left many merchants going through substantial losses.

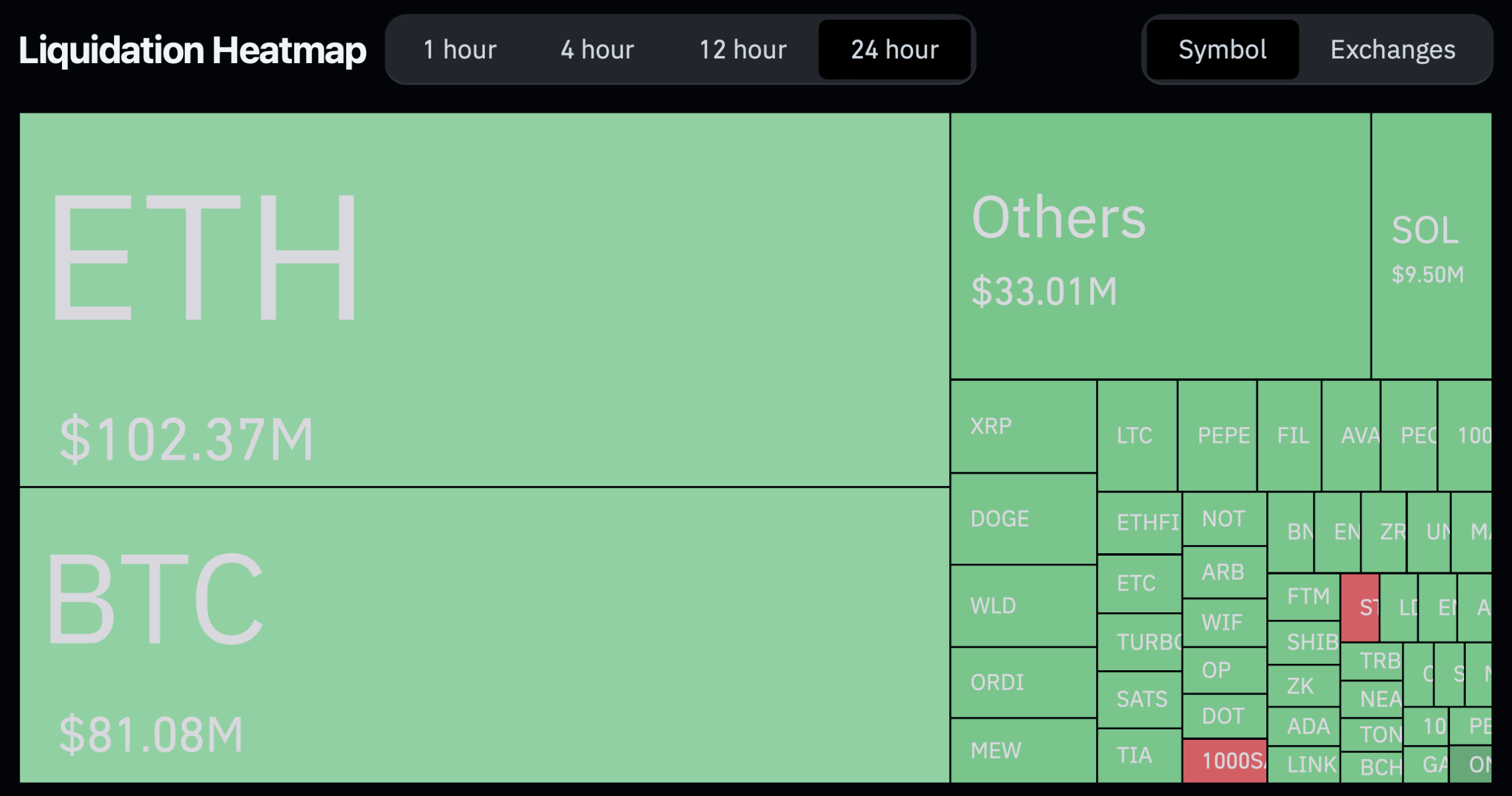

Supply: Coinglass

Over the previous day, a whopping 73,119 merchants have been liquidated, with Ethereum-related liquidations accounting for $102.37 million.

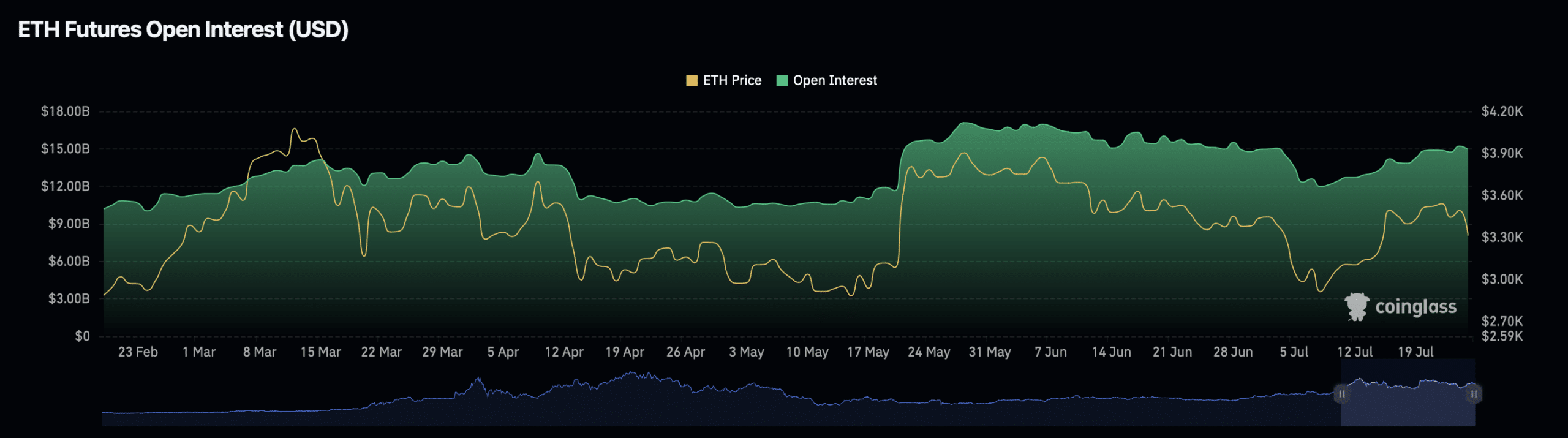

This has additionally influenced Ethereum’s open interest, which has seen a decline of almost 5%, standing at $14.32 billion, with the amount reducing by 3.92%.

Supply: Coinglass