Why Ethereum traders are starting to bet big against ETH’s price

- Quick positions enhance following Grayscale’s determination to tug its Ethereum futures ETF software.

- Market sentiment grows bearish with potential additional declines.

Ethereum [ETH], the second-largest cryptocurrency by market cap, has not too long ago proven a scarcity of serious upward momentum, contrasting with Bitcoin’s [BTC] current surge.

Though Ethereum reached over $4,000 in March, it didn’t set a brand new all-time excessive, not like Bitcoin, which soared to a brand new peak in the identical interval.

Within the final two weeks, Ethereum has seen practically a ten% decline, and this downward development has continued within the final 24 hours, with a 2.2% drop.

This bearish sentiment is mirrored within the actions of Ethereum merchants, who’ve been growing their brief positions, significantly after a major growth from Grayscale Investments.

Grayscale’s strategic withdrawal

Grayscale Investments not too long ago withdrew its application for an Ethereum futures exchange-traded fund (ETF), a transfer that has considerably impacted dealer sentiment.

This determination, made simply three weeks earlier than the U.S. Securities and Change Fee (SEC) was as a consequence of ship its verdict, has led to a rise in brief positions on Ethereum.

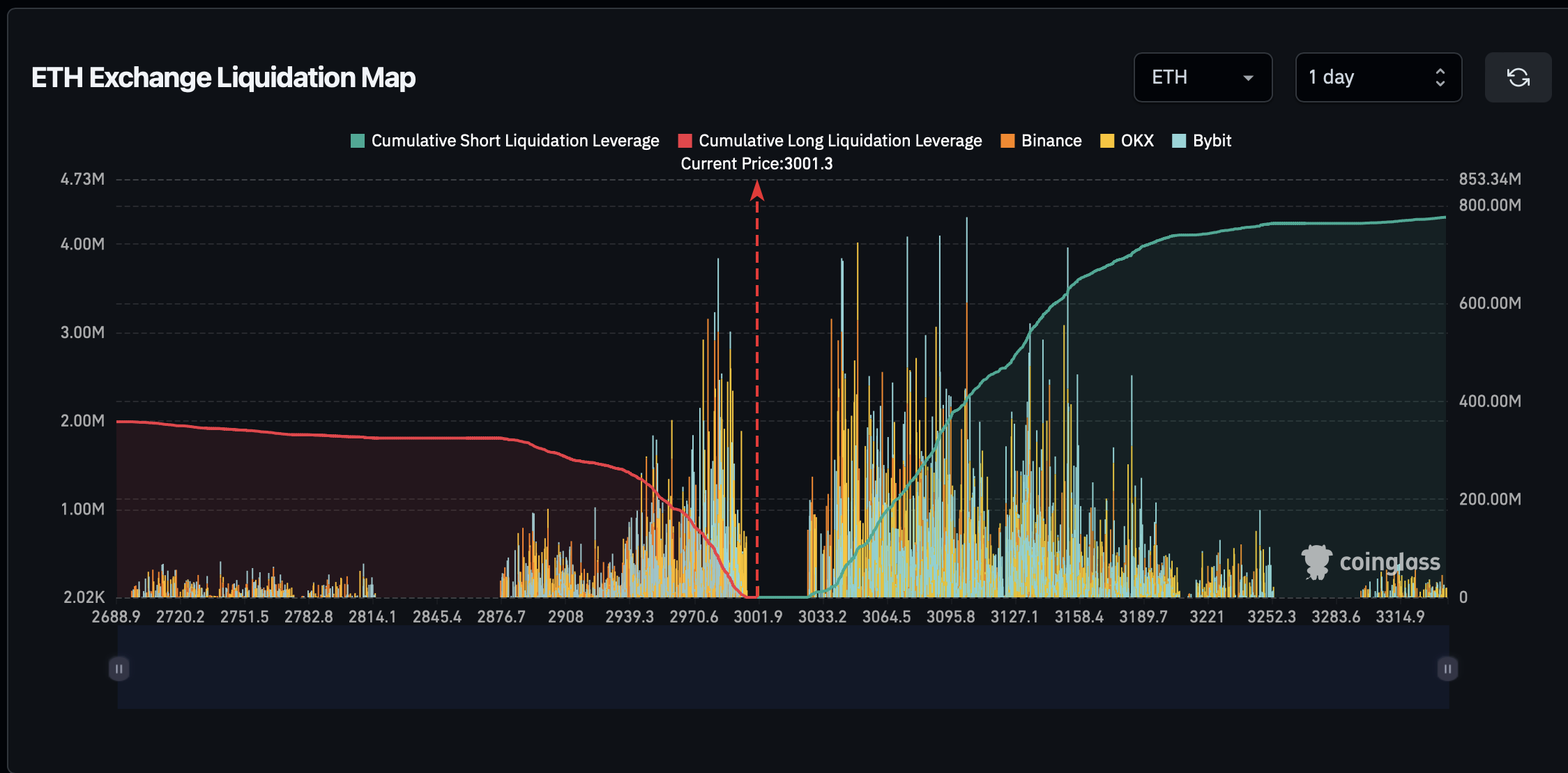

Merchants are presently betting heavily on additional declines, with $358 million in brief positions poised for liquidation if costs rise by simply 4%.

Conversely, a 4% drop would solely remove $237 million in lengthy positions.

Supply: Coinglass

This withdrawal aligns with broader issues about Ethereum’s regulatory standing, significantly concerning its classification as a safety and the destiny of spot Ethereum ETFs.

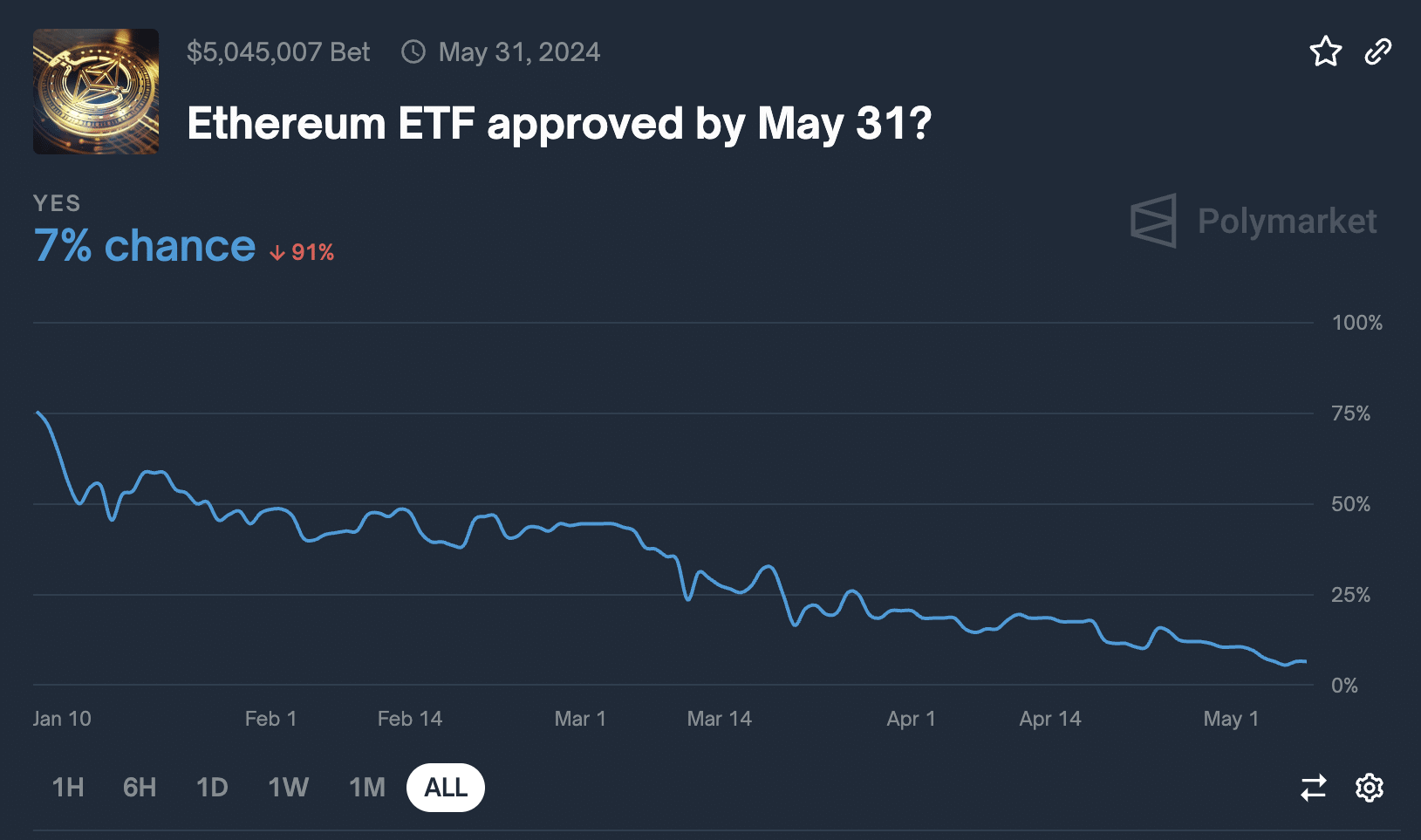

As the choice date — the twenty third of Might — approaches, analysts and market individuals are rising more and more skeptical concerning the approval of those ETFs.

In response to Polymarket, over 90% of individuals consider that the spot Ethereum ETF will likely be denied.

Supply: Polymarket

How is Ethereum doing?

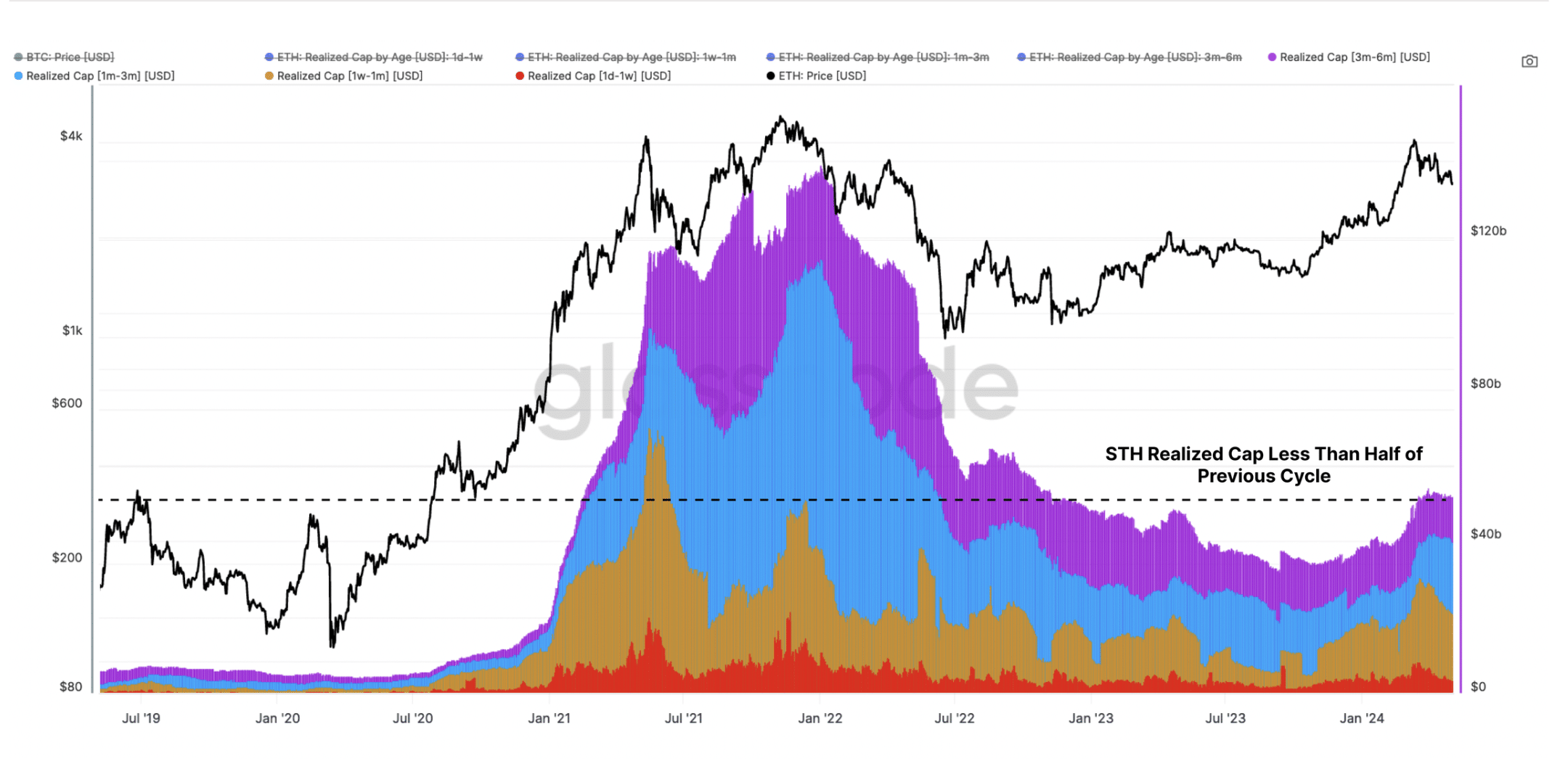

Past ETF issues, Ethereum faces points with its total utilization and a scarcity of speculative curiosity, particularly from short-term holders.

James Test, a famous crypto on-chain analyst, pointed out that Ethereum’s utilization is so low that its burn mechanism can’t sustain with issuance to validators.

This sentiment was echoed by Glassnode, which highlighted Ethereum’s underperformance relative to Bitcoin as a consequence of a lag in speculative curiosity from these short-term holders.

Supply: Glassnode

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

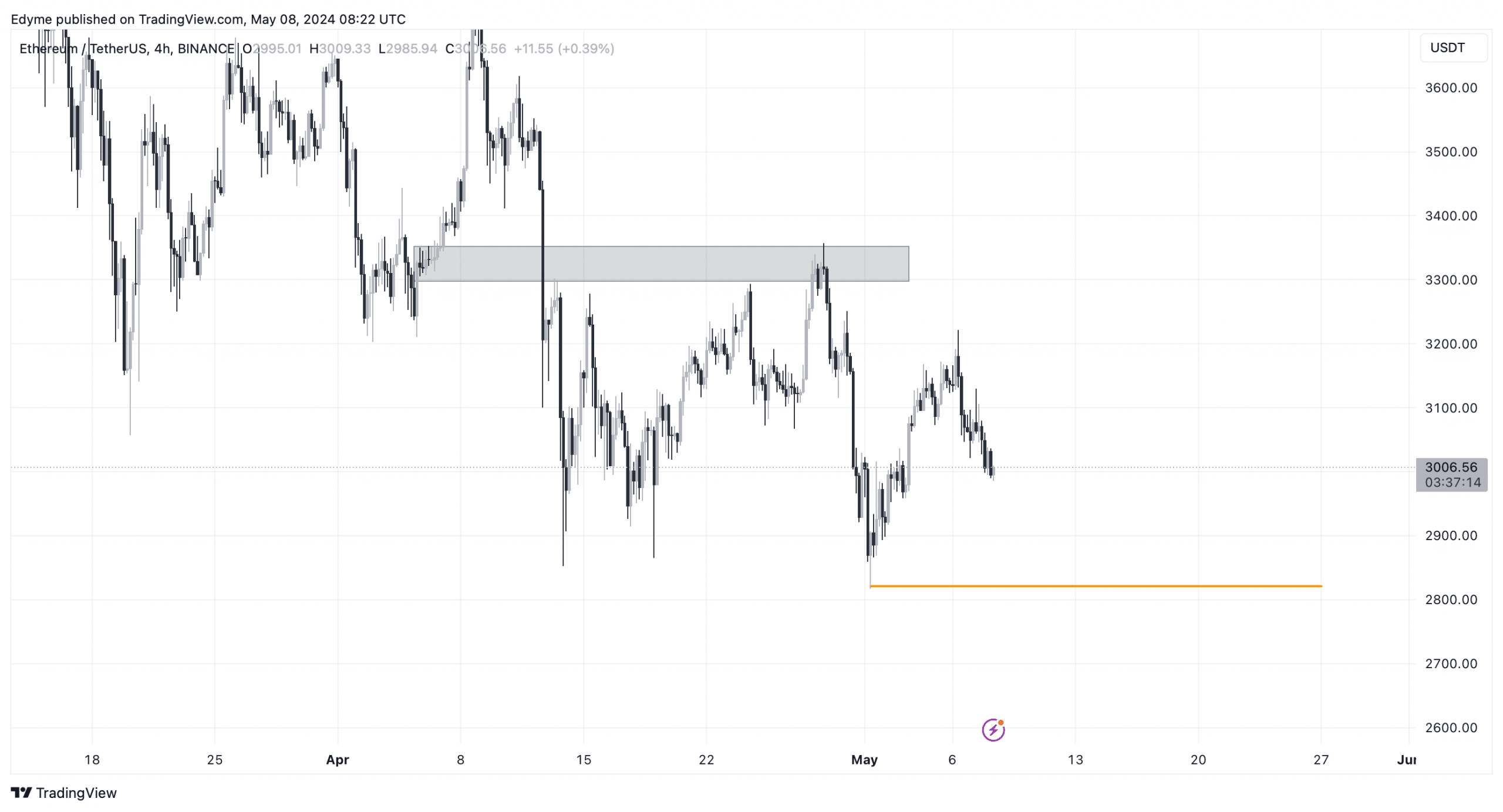

From a technical perspective, Ethereum’s worth is anticipated to proceed its downward trajectory till it reaches a swing low liquidity close to $2,800.

It is because Ethereum’s worth has not too long ago touched a breaker block, and the subsequent goal is to hit the most important swing low on the 4-hour chart.

Supply: TradingView