Why Ethereum’s long-terms trends look bullish despite short-term sell-offs

- ETH noticed extra influx into exchanges within the final buying and selling session.

- The ETH steadiness on change has continued to say no.

A latest evaluation of Ethereum’s [ETH] market exercise revealed a sample of accumulation and sell-offs by totally different addresses over the previous couple of days.

Regardless of these blended developments, the general quantity of ETH on exchanges has decreased, which is usually a bullish sign.

Ethereum sees blended alerts

The latest Ethereum market exercise has produced blended alerts from key indicators. On one hand, there was notable accumulation by some giant holders, or “whales,” which is often a bullish signal.

Evaluation of holders’ knowledge reveals that these whale addresses have elevated their holdings by roughly 200,000 ETH, equal to round $540 million.

Alternatively, some institutional gamers have been promoting, which might point out a extra cautious or bearish outlook from sure market members.

Information from Lookonchain revealed that establishments like Amber Group and Cumberland have offered over 13,000 ETH, value greater than $35 million, within the final 24 hours.

This promoting strain from establishments contrasted with the buildup by whales, making a blended market sentiment.

Whereas the whale accumulation factors to a powerful perception in Ethereum’s future, the institutional sell-offs might replicate issues about short-term value actions or broader market uncertainties.

Ethereum circulation reveals the dominance of sellers

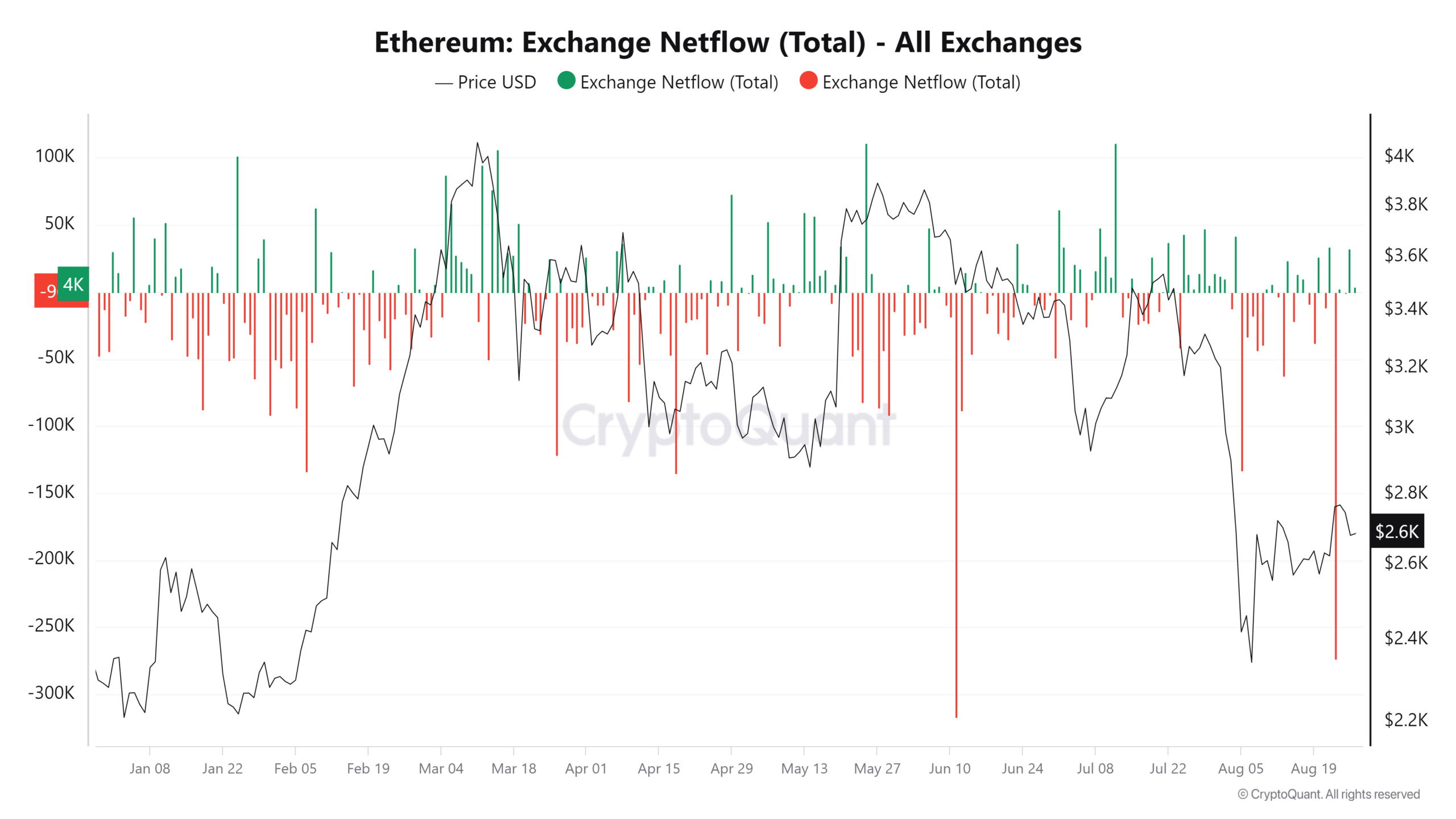

AMBCrypto’s evaluation of Ethereum’s change netflow knowledge from CryptoQuant on the twenty sixth of August revealed a constructive netflow.

This indicated that extra ETH was deposited into exchanges than was withdrawn on that day. Particularly, the netflow was over 32,000 ETH, suggesting that the quantity of sell-offs outpaced the buildup throughout this era.

Supply: CryptoQuant

A constructive netflow sometimes alerts that buyers are transferring ETH onto exchanges, presumably to promote or commerce, which may create short-term promoting strain.

This aligned with the latest knowledge exhibiting that some establishments, reminiscent of Amber Group and Cumberland, have been promoting vital quantities of ETH.

Nonetheless, regardless of this momentary enhance in change inflows, the broader pattern over the previous couple of weeks has seen extra outflow of ETH general.

Which means, on an extended timescale, extra ETH has been withdrawn from exchanges than deposited, typically interpreted as a bullish indicator.

ETH’s change flight

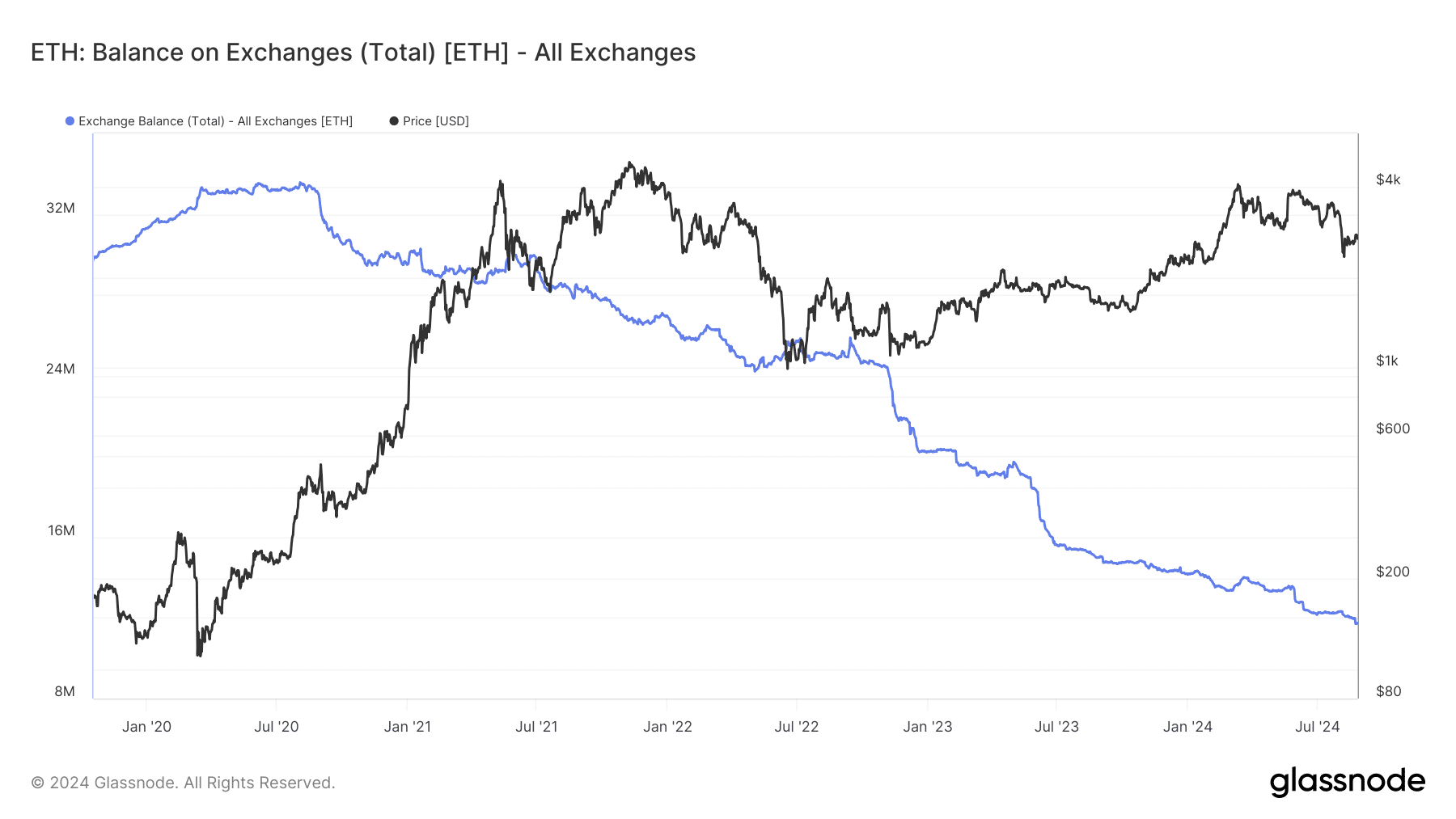

The continued decline in Ethereum’s steadiness on exchanges is a major pattern, indicating that extra buyers are withdrawing their holdings from exchanges.

This discount in change steadiness urged that buyers could also be transferring their ETH to chilly storage, staking, or different types of long-term holding, slightly than protecting it available for buying and selling.

Supply: Glassnode

A declining change steadiness can result in shortage within the obtainable provide of ETH on exchanges, which usually has a bullish implication for the asset’s worth.

When fewer cash can be found for buying and selling, and if demand stays robust or will increase, shortage can drive up costs as a result of fundamental financial precept of provide and demand.

This declining change steadiness provides to the record of bullish indicators for Ethereum, regardless of the blended alerts noticed in latest weeks.

ETH continues to pattern weakly

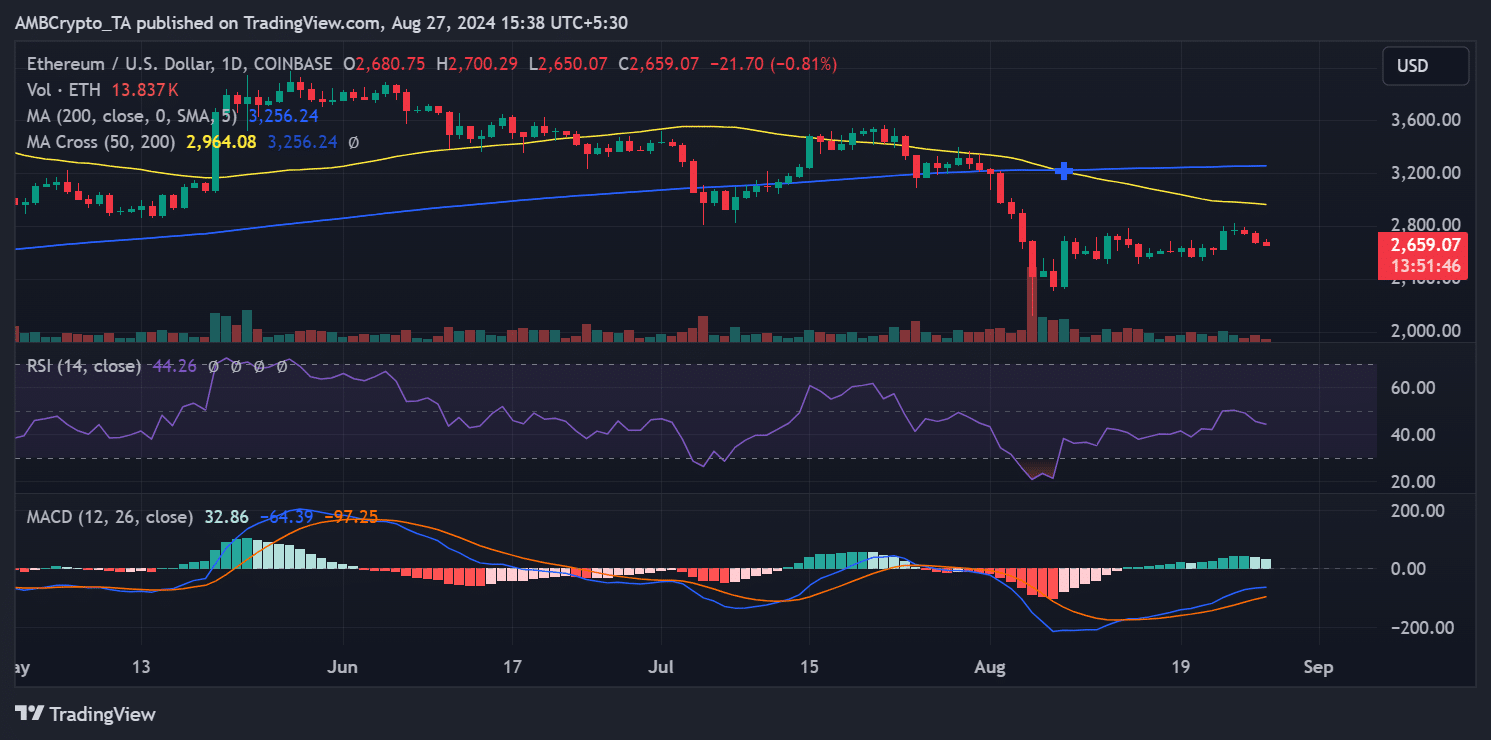

In response to AMBCrypto’s evaluation, Ethereum has just lately struggled to take care of constructive momentum.

Its each day value pattern evaluation reveals that Ethereum has skilled consecutive declines over the past three days. As of this writing, Ethereum traded at roughly $2,656, reflecting an extra decline of almost 1%.

Supply: TradingView

Its short-moving common (yellow line) continued to behave as a major resistance degree round $2,900.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

This resistance has repeatedly prevented Ethereum from breaking larger, contributing to the latest downward strain on its value.

The continued decline in value underscores the blended alerts which have characterised Ethereum’s market exercise in latest weeks, with short-term bearish developments contrasting with some longer-term bullish indicators, reminiscent of declining change balances.