Why Ethereum’s new 2-year high should worry ETH holders like you

- Ethereum’s web flows into exchanges rose to a two-year excessive this week.

- Market sentiment stays considerably bearish.

Ethereum [ETH] web flows into crypto exchanges rallied to a two-year high this week amid the “authorized marketing campaign” to categorise the main altcoin as a safety.

AMBCrypto beforehand reported that the US Securities and Exchanges Fee (SEC) had despatched investigative subpoenas to U.S. corporations, amongst which is the Swiss-based Ethereum Basis, the non-profit entity that helps the community.

In keeping with the report, the regulatory watchdog launched its investigation into the Ethereum Basis after the Ethereum community transitioned from a Proof-of-Work consensus mechanism to a Proof-of-Stake (PoS) mannequin in September 2022.

Hike in coin sell-offs

IntoTheBlock’s knowledge confirmed that ETH web flows into exchanges this week totaled $720 million. In keeping with the information supplier, the final time the coin’s weekly movement into exchanges was this excessive was in September 2022.

When an asset witnesses a rally in its web movement into exchanges, it usually signifies that its holders are transferring their tokens onto buying and selling platforms to promote for revenue or hedge towards additional losses.

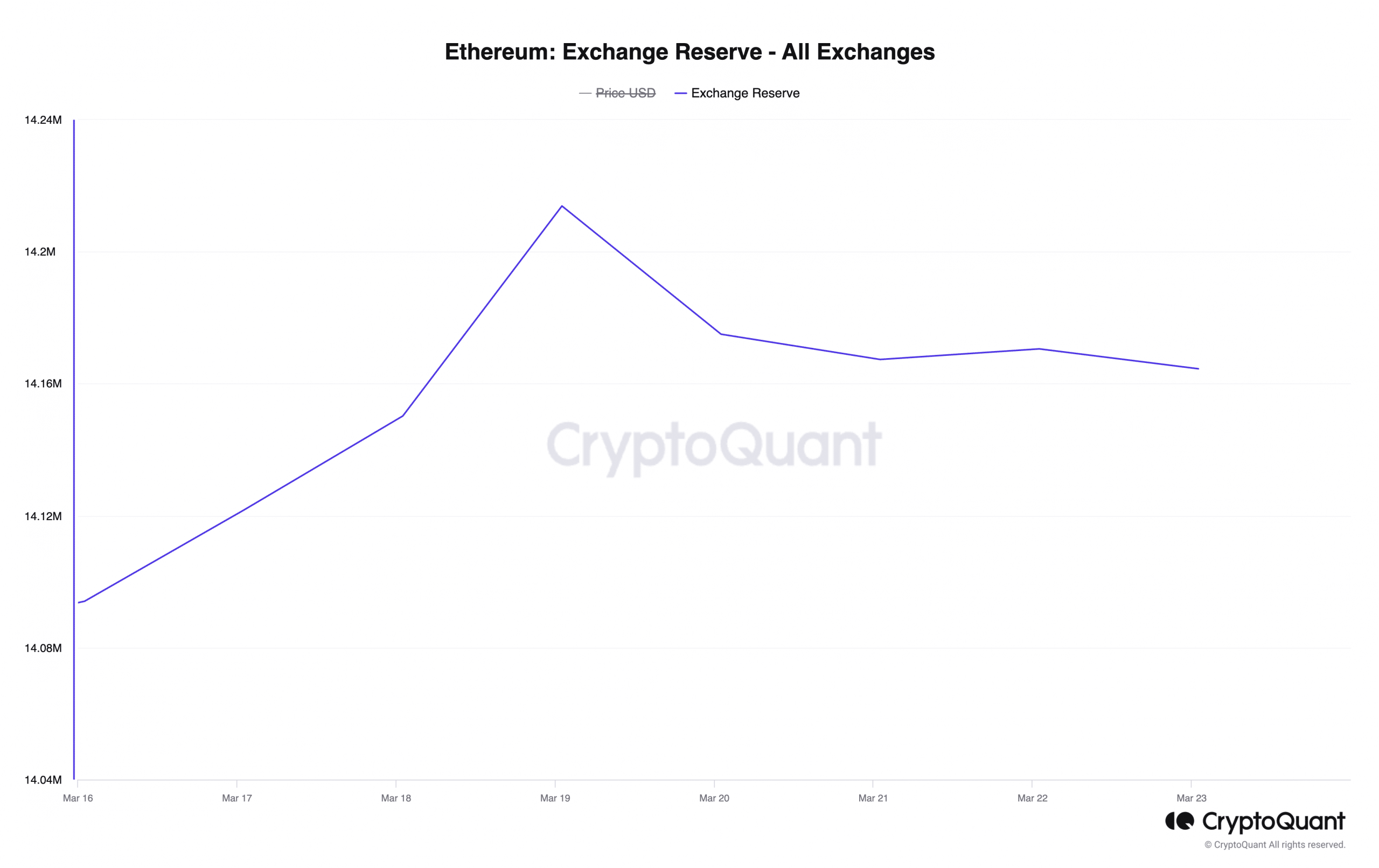

These inflows resulted in a minor uptick in ETH’s change reserve in the course of the interval beneath evaluate. In keeping with CryptoQuant’s knowledge, it elevated by 1%. At press time, 14.2 million ETH valued at round $47 million have been held throughout exchanges.

Supply: CryptoQuant

Whereas the spike in ETH’s influx into exchanges this week was partly because of the SEC’s transfer towards the Ethereum Basis, it was additionally attributable to the overall market decline recorded throughout that interval.

Per CoinGecko’s knowledge, the worldwide cryptocurrency market capitalization dropped by 4% previously seven days because of the surge in coin sell-offs.

ETH holders strategy with warning

This week’s evaluation of how worthwhile ETH transactions have been, revealed important bearish sentiments out there.

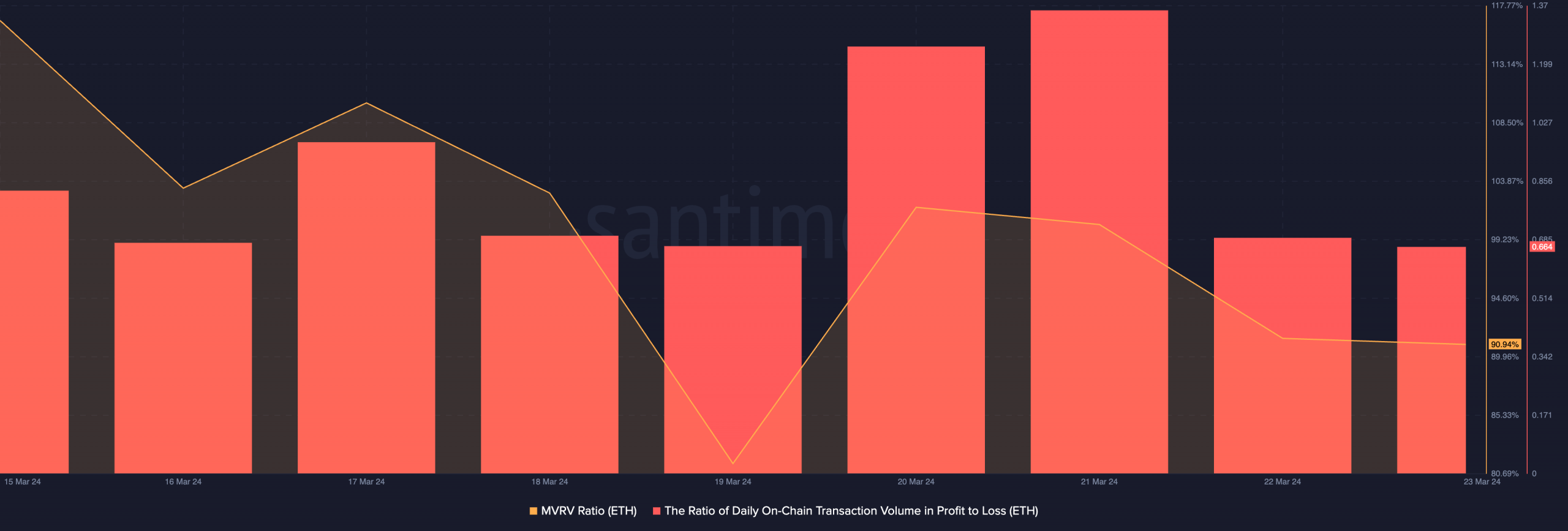

ETH’s Market Worth to Realized Worth (MVRV) ratio plummeted by 22%, to be noticed at 90% at press time. Likewise, the day by day ratio of ETH’s transaction quantity in revenue to loss plunged to a low of 0.664.

A holistic consideration of those two key on-chain metrics presents a divergence. ETH’s MVRV ratio of 90% suggests potential undervaluation, which may imply it’s a good time to purchase.

How a lot are 1,10,100 ETHs value as we speak?

However, the 0.664 day by day ratio of ETH’s transaction quantity in revenue to loss confirmed that there are extra traders who’re promoting their cash at a loss.

This divergence means that though ETH is at present undervalued, and now could also be a superb time to purchase. Quick-term sentiment amongst traders stays cautious or bearish. It is because traders are prepared to promote at a loss somewhat than maintain or purchase extra cash.

Supply: Santiment