Why Ethereum’s price can spiral towards $2500 over the next 7 days

- Ethereum flipped its 1-day market construction bearishly.

- The previous vary highs had been the subsequent assist area of curiosity.

Ethereum [ETH] noticed a wave of promoting exercise as profit-taking arose amidst concern. The downtrend was persistent in April and the promoting quantity was rising.

The symptoms had been bearish on the one-day timeframe.

The frustration from the Hong Kong ETFs’ quantity on the primary day outlined the sentiment towards ETH and crypto. The Open Curiosity additionally fell decrease to counsel speculators had been extra guarded.

The bullish order block above $2500 subsequent

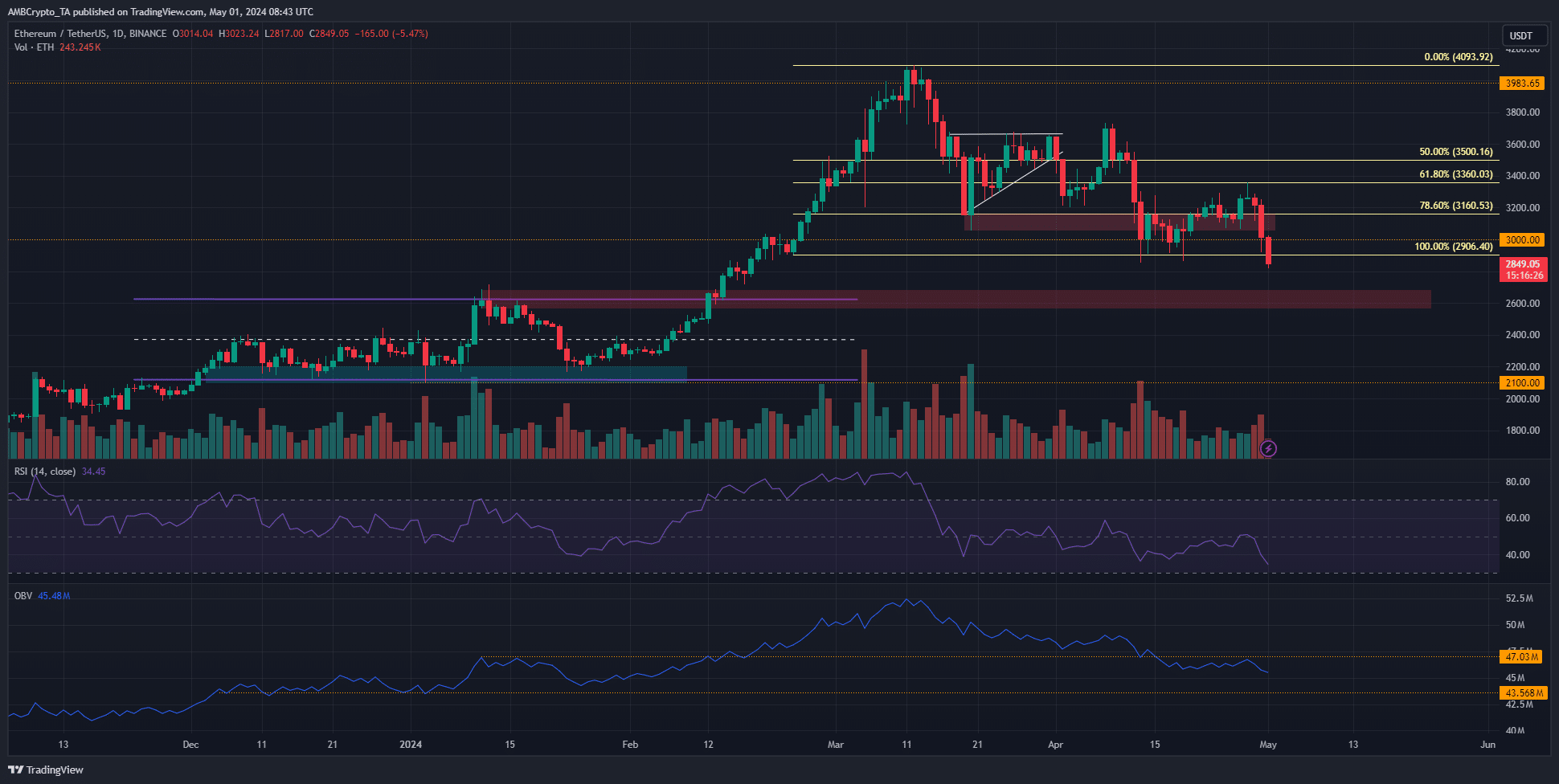

Supply: ETH/USDT on TradingView

The upper timeframe development of Ethereum flipped bearishly after it dropped beneath the $2906 swing low. If the every day session closes beneath this stage, the value would very possible head towards the subsequent assist zone at $2600.

This area additionally has confluence with the previous vary highs that ETH traded inside a couple of months in the past. The RSI on the 1-day timeframe has been beneath impartial 50 for many of April, highlighting constant downward momentum.

The OBV additionally slipped beneath a assist stage just lately and retested it as resistance. Ethereum is prone to register sizeable losses earlier than reaching the subsequent notable stage on the indicator.

The hunt for liquidity may see ETH go south

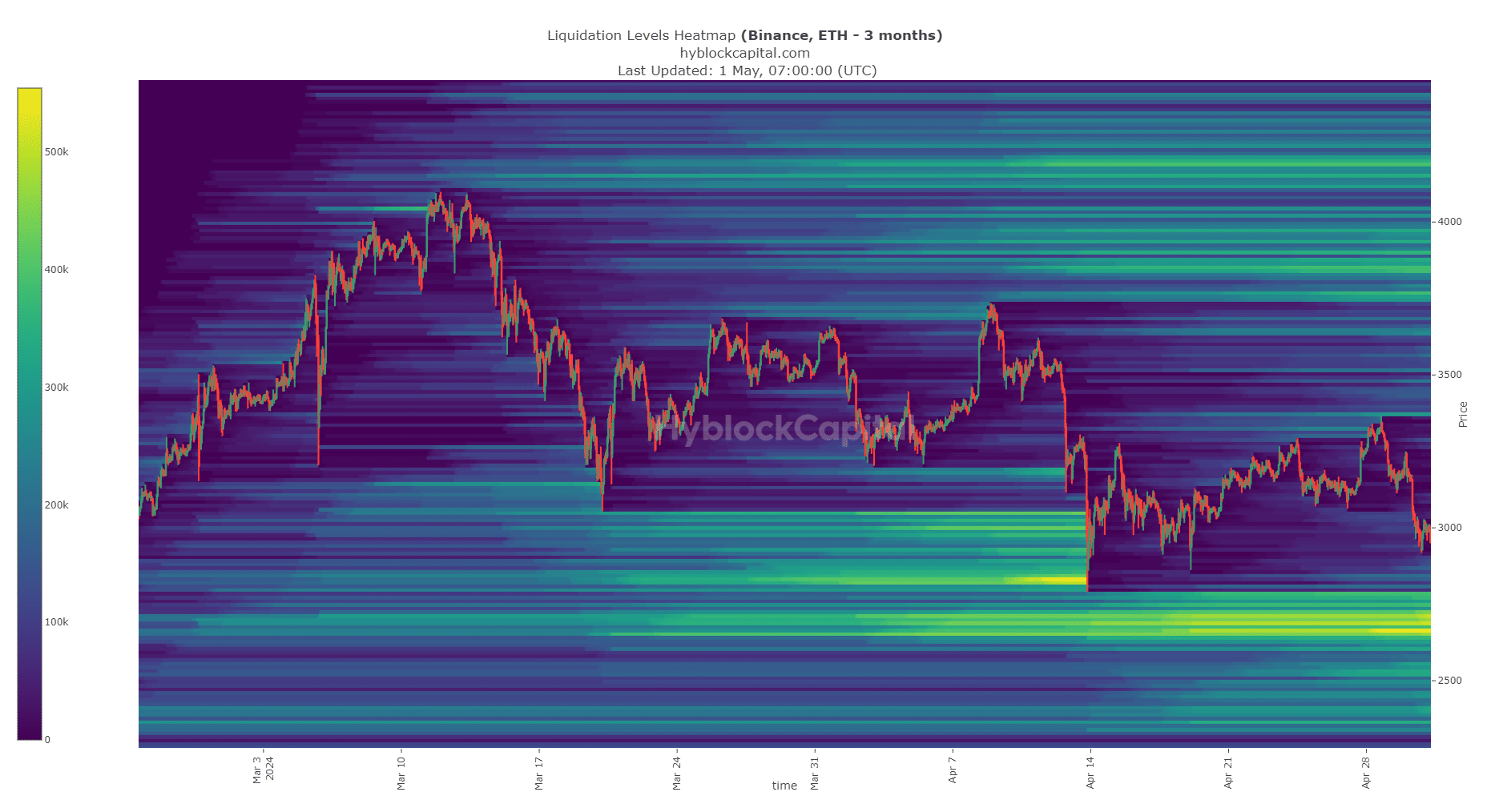

Supply: Hyblock

The closest cluster of liquidation ranges for ETH was downward. The $2640-$2750 area offered a horny pocket of liquidity.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

It additionally has confluence with the bullish order block highlighted on the vary highs.

It’s anticipated that ETH will descend to this liquidity pocket earlier than a reversal. Possibilities of a reversal earlier than that had been slim, since these liquidation ranges act as magnetic zones to the value.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.