Why Ethereum’s rebound to $2.7K hinges more on memecoins, than on Bitcoin

- ETH stalled on the charts as memecoins gained momentum all through the week

- A robust catalyst could also be wanted to spark a brief squeeze

Because the crypto market rallied, propelled by Bitcoin [BTC] nearing its earlier ATH, Ethereum [ETH] loved weekly good points of almost 10%. On the time of writing, the altcoin was buying and selling at $2.6k.

This mirrored a typical buying and selling technique, one the place high-cap altcoins thrive when BTC hits a key resistance, prompting retail buyers to shift their capital in a bid to mitigate danger.

Nevertheless, in contrast to earlier cycles, ETH has continued to consolidate during the last three days. All whereas BTC posted every day good points exceeding 2% over the identical timeframe.

Merely put, there was an underlying shift out there dynamics.

Memecoins have reaped essentially the most advantages

Over the past seven days, memecoins have surged dramatically on the value charts, with three of the top 5 gainers being meme tokens.

Notably, DOGE led the pack with spectacular 30% weekly good points – An indication that buyers are exhibiting confidence in high-risk belongings that supply fast, outsized returns.

In keeping with AMBCrypto, as merchants more and more noticed upside potential in memecoins, curiosity in ETH waned, resulting in its consolidation on the charts.

Nevertheless, one other AMBCrypto report advised that DOGE’s uptick might be an indication of an overheated market. One which can quickly face a correction.

Therefore, the query – Might this potential pullback appeal to capital again into ETH, setting the stage for a brief squeeze?

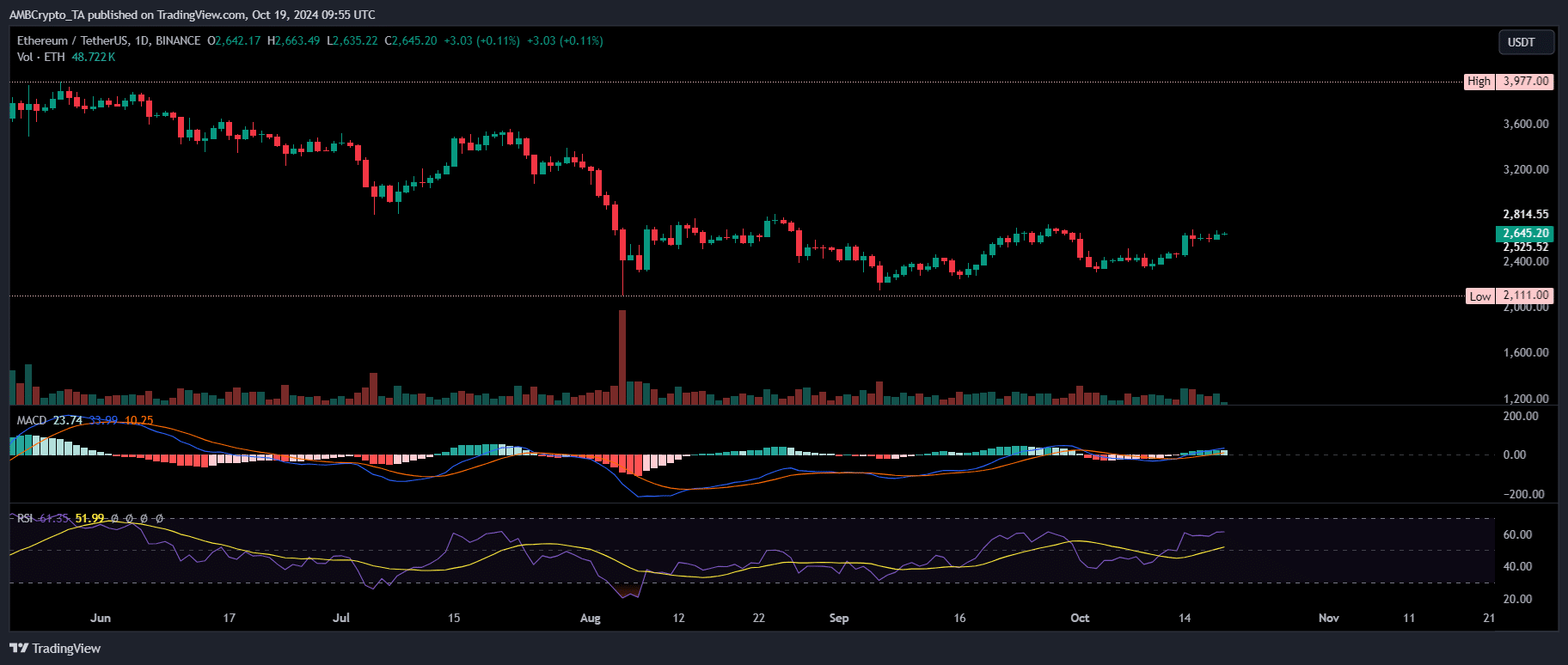

Supply: TradingView

On the time of writing, the MACD traces have been nearing a crossover. It it seems as deliberate, it may additional affirm ETH’s anticipated transfer over the weekend.

Quite the opposite, the RSI projected an overbought situation, with 74% of the value motion during the last two weeks trending upwards – Elevating the potential for a development reversal quickly.

Taken collectively, one can argue that ETH has been shedding floor throughout key metrics, with promoting stress growing as merchants proceed to journey the memecoin wave.

If this development persists and isn’t countered by a shift in momentum, it may set off a liquidation of lengthy positions, forcing holders to promote.

Such a state of affairs would restrict ETH’s capability to realize momentum when BTC peaks. That is usually an indicator of the onset of altcoin season.

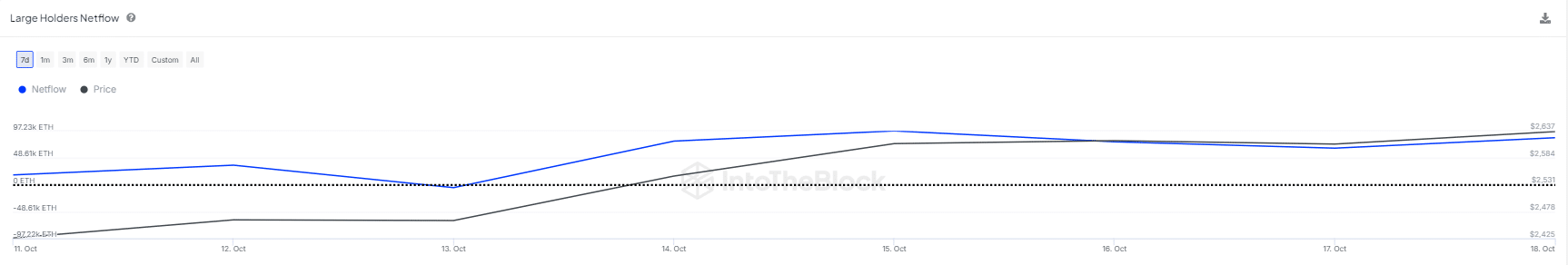

ETH holders are focusing on the dip

Sometimes, when retail buyers offload their holdings, it alerts a market high as they money in on their good points.

Quite the opposite, massive holders coming into an accumulation part at an area low can set up a market backside, viewing it as a possible dip to purchase.

Over the previous three days, as ETH’s rally stalled, massive holders strategically purchased ETH at discount costs. They anticipated that BTC’s rally would proceed, and extra buyers would search refuge in altcoins.

Supply: IntoTheBlock

Consequently, a major quantity of ETH tokens have been withdrawn from exchanges, catalyzing a ten% weekly surge regardless of the prevailing market worry.

Learn Ethereum [ETH] Value Prediction 2024-2025

Briefly, ETH is at a essential juncture, influenced by varied elements shaping its future trajectory.

If memecoins proceed to attract liquidity away from BTC merchants, the potential for a brief squeeze could hinge on massive holder exercise. This may make ETH extra weak to uneven focus and sudden value swings.