Why holding Ethereum long-term is a good idea for you

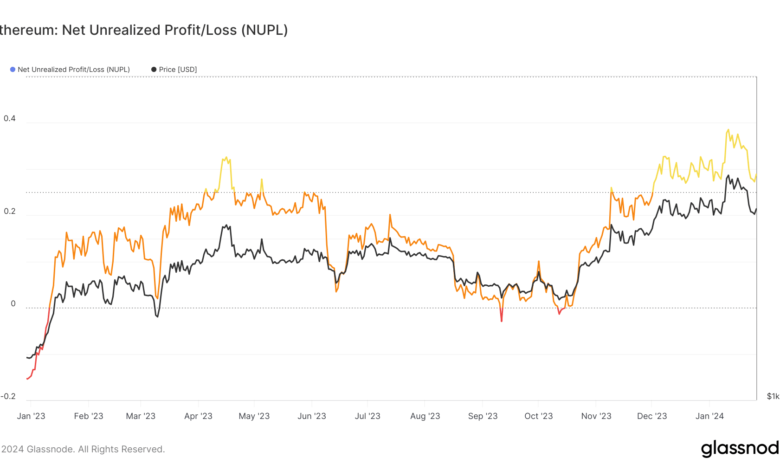

- The NUPL worth has not dropped a lot regardless of the current volatility.

- The short-term market sentiment was in favor of the sellers.

Ethereum [ETH] costs fell to the $2.2k help stage as soon as once more after the current slash in costs. The Bitcoin [BTC] promoting strain meant altcoins suffered too.

But, AMBCrypto famous that the NUPL metric confirmed optimism over the previous two months.

The Internet Unrealized Revenue/Loss is outlined because the distinction between Relative Unrealized Revenue and Relative Unrealized Loss. It has slowly climbed larger since October 2023.

Understanding the sentiment behind Ethereum

The NUPL reached 0.385 on the eleventh of January. The final time that the NUPL of ETH was larger was again in Could 2022, in line with knowledge from Glassnode.

Supply: Glassnode

The Unrealized Revenue or Unrealized Loss is calculated by weighting every circulating ETH by the distinction between its present value and realized value.

Realized value refers back to the value of the ETH when it was final moved.

Their distinction has been helpful in gauging the market cycle of Bitcoin and Ethereum prior to now. Proper now, the 0.385 worth is an indication that the sentiment was optimistic within the macrocycle.

A take a look at the short-term sentiment confirmed the other. The Weighted Sentiment knowledge from Santiment stood close to zero to indicate social media engagement didn’t favor the bears or the bulls.

Supply: Santiment

The Open Curiosity slid sharply on the twenty second and the twenty third of January, alongside the worth of Ethereum. The OI had not but recovered at press time.

The inference was that Futures contributors most popular to stay sidelined as ETH traded close to its $2.2k help zone.

The ETF approval caught many contributors offside

After the eleventh of January, ETH has trended downward on the decrease timeframe value charts (such because the 1-hour chart). But, from the twelfth to the twenty second of January, the estimated leverage ratio climbed larger.

Supply: CryptoQuant

Nevertheless, it fell quickly from twenty second to twenty fourth January as costs nosedived.

This urged that, whereas a very good portion of speculators selected to stay sidelined (OI was falling slowly at the moment) a big quantity additionally sought to extend leverage within the hopes of catching a breakout upward.

Supply: Hyblock

AMBCrypto analyzed the estimated liquidation ranges of ETH and located that the $2.3k mark was necessary but once more.

The Cumulative Liq Ranges Delta was detrimental, that means that brief liquidations outweighed the lengthy ones.

Therefore, there’s a higher probability of a bounce in costs to liquidate these brief sellers, than a bearish continuation over the following few days.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

To the north, the $2310 stage had near $100 million in estimated liquidations. Many smaller liquidation ranges have been clustered across the $2.3k mark.

Subsequently, a bounce to the $2310-$2350 space has a very good chance. Whether or not Ethereum will face a rejection from there or a bullish restoration stays to be seen.