Why is Bitcoin’s price stuck near $52K?

- There was a pointy bounce within the variety of institutional traders.

- Charges collected by miners dropped 32% within the week.

In what was an indication of clear bullish sentiment, Bitcoin [BTC] value practically $540 million was pulled out of centralized exchanges during the last week. This, in line with on-chain analytics agency IntoTheBlock, was the biggest weekly internet outflow since June 2023.

Sometimes, spikes in alternate outflows indicate a short-term accumulation development, seemingly motivated by expectations of upper returns sooner or later.

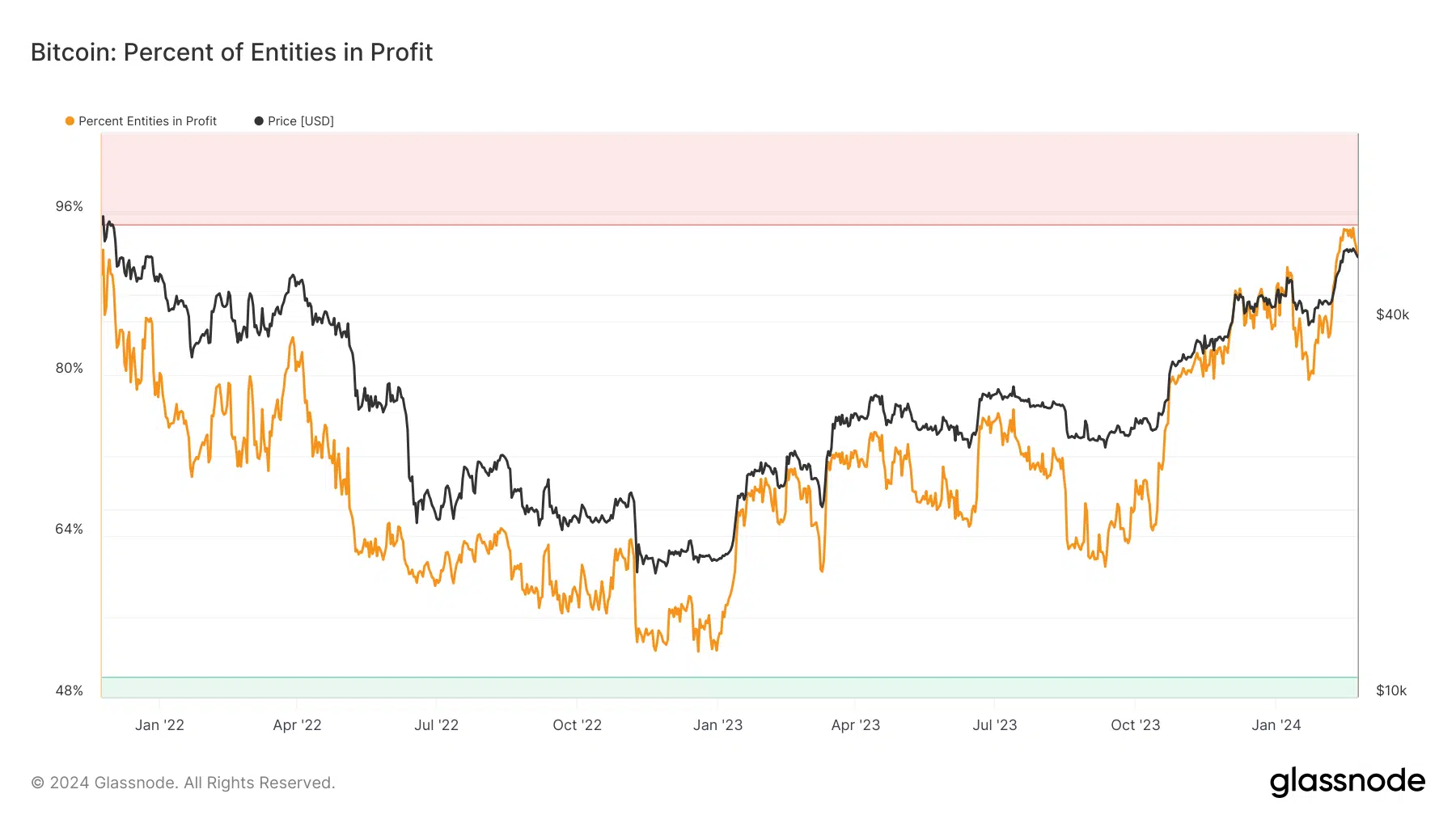

The development additionally mirrored traders’ choice to HODL reasonably than liquidate their holdings for features. This was attention-grabbing contemplating that greater than 94% of all Bitcoin entities have been in revenue as of this writing, in line with AMBCrypto’s evaluation of Glassnode’s knowledge.

What the merchants are as much as

One other telling indicator of a broader market accumulation was the bounce within the variety of institutional traders.

The variety of distinctive entities holding a minimum of 1k cash reached 1,670 at press time, a rise of 12% during the last month. This determine was additionally harking back to the early bull market interval of 2021.

As customers targeted on accumulation, transaction exercise on the community declined. Bitcoin miners collected slightly over $11 million in community utilization prices within the final week, marking a 32% plunge.

In reality, a more in-depth examination revealed a pointy decline in proportion of miner income derived from charges, dropping from 26% originally of the yr to three.23% at press time.

This may not be a cheerful studying for miners guarding the first-generation blockchain, who should cope with a drop in block rewards following subsequent month’s halving.

The king coin has been vary sure within the final week, oscillating in a slender zone between $51k and $52k, in line with CoinMarketCap. The sideways motion was one other signal that Bitcoin was getting gathered.

Learn BTC’s Worth Prediction 2024-25

The market was “extraordinarily grasping” at press time, as per AMBCrypto’s scrutiny of Hyblock Capital motion.

This advised that extra traders have been sure to enter the market, ultimately resulting in an upward breakout.