Why LINK decoupled despite alts following Bitcoin’s lead

- Fairly some quantity of LINK might be liquidated close to $20.3.

- Market indicators remained bearish on the token.

Your complete crypto market was in a bullish section, permitting most cash to register inexperienced, however Chainlink [LINK] has decoupled from the market.

So, AMBCrypto deliberate to take a more in-depth have a look at the token’s state to know what went unsuitable.

What induced the plummet?

The market gained bullish momentum due to Bitcoin’s [BTC] value motion. The king of cryptos reached a brand new ATH, and the altcoins joined the get together quickly. Nonetheless, the identical was not true for LINK.

In line with CoinMarketCap, Chainlink dropped by greater than 2.5% within the final 24 hours.

On the time of writing, LINK was buying and selling at $20.74 with a market capitalization of over $12.17 billion, making it the 14th-largest crypto.

AMBCrypto’s evaluation of CryptoQuant’s data revealed fairly a couple of components that performed their elements within the current value correction. Notably, we discovered that LINK’s alternate reserve was growing.

This meant that promoting strain on the token was excessive. Its variety of energetic addresses and whole transactions additionally declined throughout the identical interval.

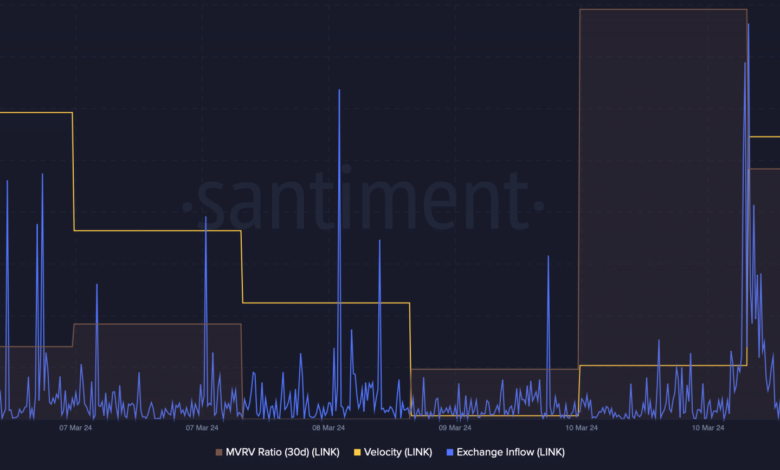

The truth that promoting strain was excessive was additionally confirmed by the spike in LINK’s Alternate Influx. Whereas the token’s value dropped, its MVRV ratio and Velocity adopted an identical declining pattern.

Supply: Santiment

Can Chainlink recuperate anytime quickly?

If the worth drop continues, a considerable quantity of LINK might get liquidated close to the $20.39 mark. Typically, when liquidation rises, it exerts extra strain on a token, leading to an extra value drop.

Subsequently, Chainlink should stay above that stage to showcase a fast restoration. Wanting northward, if LINK positive factors upward momentum, the primary goal needs to be $21.

A break above that may permit LINK to push its worth additional up within the coming days.

Supply: Hyblock Capital

To verify whether or not traders ought to anticipate a pattern reversal for Chainlink, AMBCrypto then checked the token’s day by day chart. As per our evaluation, the MACD displayed the opportunity of a bearish crossover.

Learn Chainlink’s [LINK] Worth Prediction 2024-24

LINK’s Relative Energy Index (RSI) registered a downtick and was headed in direction of the impartial mark. After an increase, the token’s Cash Movement Index (MFI) additionally went down barely.

These technical indicators instructed that LINK would possibly witness an extra drop in value within the days to come back.

Supply: TradingView